Tag Archive: Trade

FX Daily, April 18: EMU Disappointment Lifts the Dollar

Overview: A bout of profit-taking in equities began in the US yesterday and has carried through Asia and Europe today. The MSCI Asia Pacific Index fell for the first time in five days, while the Dow Jones Stoxx 600 is snapping a six-day advance. The Nikkei gapped higher to start the week and a gap low tomorrow would undermine the technical outlook.

Read More »

Read More »

FX Daily, April 16: The Dollar and Stocks Catch a Bid

Amid light news, global equities are moving higher In Asia, the Nikkei rose to a new high since early December, while the Shanghai Composite rose 2.3% and posted its highest close since March 2018. European equities are solid, with the Dow Jones Stoxx 600 moving higher for the fifth consecutive session.

Read More »

Read More »

FX Daily, April 05: Trade Talk and German Industrial Output Lifts Sentiment

Overview: Comments by Chinese President Xi, recognizing substantial progress in trade, helped boost sentiment after the US-China negotiators failed to set a date for the meeting between the two presidents. Although we have argued that the German economy may be past the worst, the sharp drop in factory orders spooked investors.

Read More »

Read More »

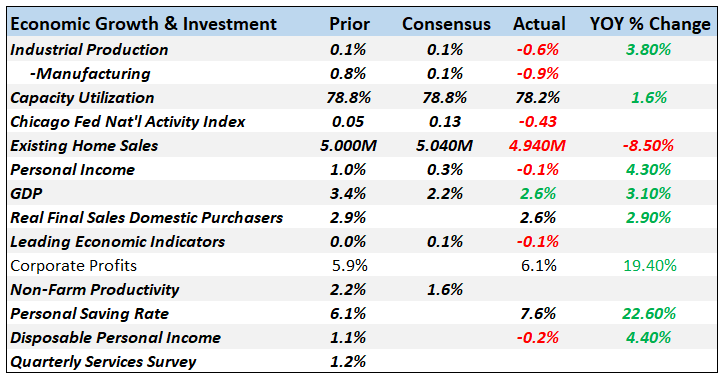

Monthly Macro Chart Review – March

We’re changing the format on our Macro updates, breaking the report into two parts. This is part one, a review of the data released the previous month with charts to highlight the ones we deem important. We’ll post another one next week that will be more commentary and the market based indicators we use to monitor recession risk.

Read More »

Read More »

FX Weekly Preview: Drivers, While Marking Time

The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive.

Read More »

Read More »

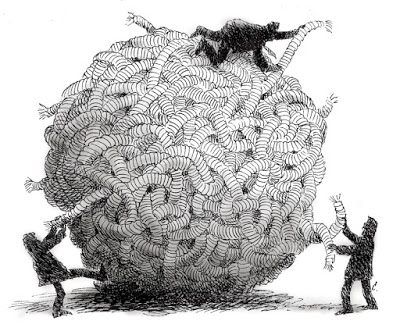

FX Weekly Preview: Little Resolution in the Week Ahead

According to legend, the person who unraveled the Gordian Knot would rule the world. No one succeeded until Alexandar the Great took his mighty sword and sliced the knot in half. A young boy saw him afterward, crying on the steps of the Temple of Apollo. "Why are you crying?" the boy asked, "you just conquered the world. "Yes'" Alexander wept, " now there is nothing else for me to do."

Read More »

Read More »

Two Brinkmanship Games and a Possible Third

Some historians give Adlai Stevenson credit for inventing the word "brinkmanship" as part of his criticism of US foreign policy under Dulles, who said that "if you are scared of going to the brink, you lost." But surely we can agree that the tactic is as old as civilization. The idea is you take the issue to the very edge, risking a significant confrontation, to force a deal, is the way it may seem.

Read More »

Read More »

FX Weekly Preview: Divergence Reinvigorated

Last week the focus was on Europe. Prospects of a delay in Brexit helped extend sterling's gains to 11-week highs. Disappointing flash PMI for the eurozone and a dovish Draghi pushed the euro below $1.13 for the first time since mid-December.

Read More »

Read More »

FX Weekly Preview: For the Millionth Time, Markets Exaggerate

The S&P 500 fell more than 12% in a few weeks. The 10-year Treasury yield fell nearly 40 bp. There were cries that the sky was falling. A recession is imminent, we are warned by prognosticators. The Fed went ahead and raised interest rates on March 21, 2018, and the S&P 500 proceeded to gap lower the next day and continued to sell-off the following day. Investors did not like the unanimous decision.

Read More »

Read More »

Some Thoughts on What is Happening

People do not just disagree on what should and will happen, but they disagree on what has happened. As William Faulkner instructed: "The past is not dead. Actually, it's not even past. This is clear in the narratives about the sharp drop in equity markets.

Read More »

Read More »

FX Weekly Preview: FOMC Dominates Week Ahead Calendar

The last FOMC meeting of 2018 is at hand. After hiking rates three times in 2017, the Fed signaled that four hikes were likely this year and with a widely expected move on December 20, it would have fully delivered, though many steps along the way, skeptical investors had to be led by the nose, as it were, to minimize the element of surprise.

Read More »

Read More »

Cool Video: Santa Claus Rally and Trade

I was on Fox Business today. Stuart Varney introduced me by asking me about my forecast for a Santa Claus rally--a year-end recovery in equities. From a technical perspective, I liked the fact that the S&P 500 successfully retested last month's lows last week. I liked that the price action made last Friday's price action into an island bottom, with a gap lower opening followed by Monday's gap higher opening.

Read More »

Read More »

FX Weekly Preview: Unfinished Business

Often, and apparently wrongly attributed to Mark Twain is the observation that it is not what we know that gets into trouble, but "what we know that just ain't so." Now though, investors suffer from a different problem. Several processes are in motion, and there is little confidence in their outcomes. Among these are Brexit, US-China trade, the trajectory of Fed policy, and the EC's efforts to enforce the agreed-upon budget rules.

Read More »

Read More »

FX Weekly Preview: Stocks, Trade, and the Fed in the Week Ahead

Last month's downdraft in equities spooked investors. The fear that is often expressed is that the end of the business cycle may coincide with the end of a credit cycle and a return to 2008-2009 crisis. It seems like an increasing number of economists agree with the sentiment expressed by President Trump that the Fed is too aggressive.

Read More »

Read More »

FX Daily, October 05: US Jobs Data will Test Dollar Bulls and Bond Bears

The US dollar is firmer against most of the major and emerging market currencies. The yen and sterling are resisting the pressure, while the South African rand and Russian rouble are paring some of this week's declines. US equity losses yesterday weighed on Asian and European trading today.

Read More »

Read More »

Three Things that may Disappoint Investors

There are three areas that we suspect that many investors are vulnerable to disappointment. NAFTA, trade talks with China, and Powell speech at Jackson Hole on Friday. With problems elsewhere, the Trump Administration has been playing up the likelihood of an agreement as early as today with Mexico, which would be used, apparently to deliver a fait accompli to Canada.

Read More »

Read More »

Monthly Macro Monitor – August 2018

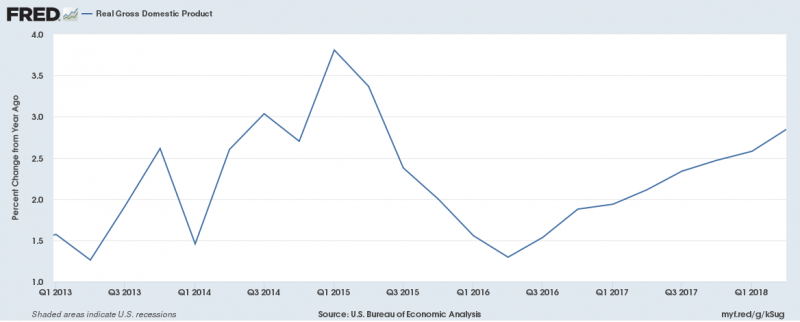

The Q2 GDP report (+4.1% from the previous quarter, annualized) was heralded by the administration as a great achievement and certainly putting a 4 handle on quarter to quarter growth has been rare this cycle, if not unheard of (Q4 ’09, Q4 ’11, Q2 & Q3 ’14). But looking at the GDP change year over year shows a little different picture (2.8%).

Read More »

Read More »

US-Japan Trade Talks

The withdrawal of the US from the Trans-Pacific Partnership trade agreement lift it exposed on two fronts. First, the TPP was going to modernize the NAFTA. Without, the US remains locked in protracted negotiations. A breakthrough in talks with Mexico has been reportedly imminent for weeks.

Read More »

Read More »

Some Initial Consequences of Trade Tensions

The Trump Administration argues that other countries have been taking unfair advantage of the US on trade for years, and what many are calling a trade war is really only the US finally saying enough. The US has taken many several countries, including China, to the WTO for trade violations and wins the vast majority of cases it has brought.

Read More »

Read More »

FX Daily, August 03: Greenback Remains Firm Ahead of Jobs, JGBs Stabilize, Italian Debt Moves into Spotlight

The US dollar is trading at the upper end of its recent ranges against the euro and sterling. The euro finished below $1.16 yesterday for the first time since the end of June and has not been able to resurface that level so far today.

Read More »

Read More »