Tag Archive: Switzerland

Global Purchasing Manager Indices, Update December 17

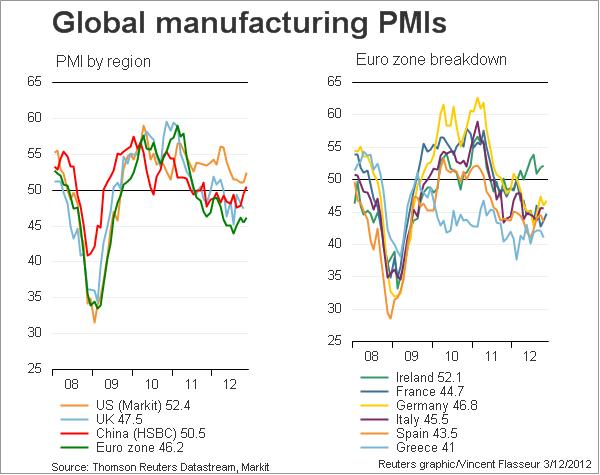

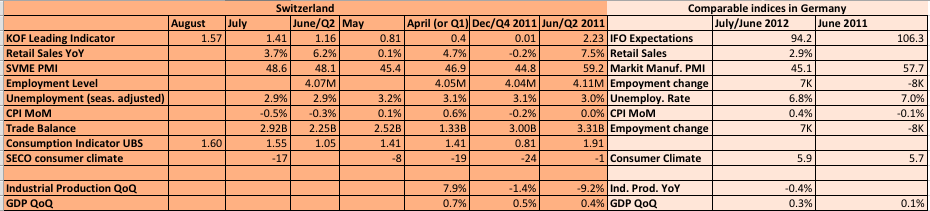

Manufacturing PMIs are considered to be the leading and most important economic indicators. Since the Fed’s QE3, this is the third month of improvements in global PMIs after a strong slowing in summer 2012. January 25th Expansion-contraction ratio: There are as many countries that show values above 50 as under 50. Positive-negative-change ratio: 18 countries …

Read More »

Read More »

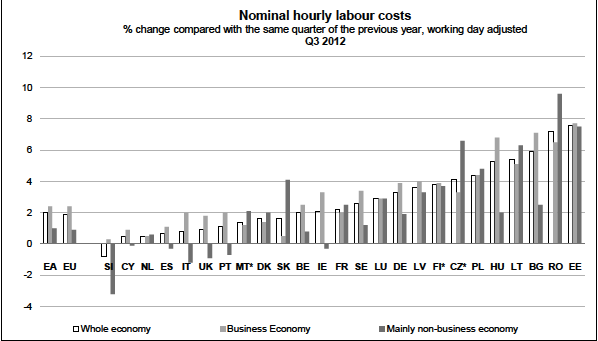

The Fairy Tale of Rising Competitiveness in the European Periphery

In our post we look on two questions concerning competitiveness for the European periphery: When will local production be cheaper than imported products? Do people have the money to buy these local products? It does not help reducing labor costs if local production costs still more than imported products. The second aspect is: even if …

Read More »

Read More »

4 Different Solutions for the Euro Crisis: Can it Be the Northern Euro? A Discussion

The discussion about the future of the Euro: Among a Post-Keynesian, a European Etatist, an Austrian economist and an advocate of a Northern Euro on the French website www.atlantico.fr. The French paper is asking: “Sommet européen : créer un euro du Nord est-il le seul moyen de sauver l’Europe de l’austérité ?” Is the creation of …

Read More »

Read More »

SNB Monetary Policy Assessment December 2012: (Nearly) Full Text

The SNB decided to maintain the floor at 1.20 and the Libor target between 0% and 0.25%. As we expected in our outlook on the assessment, there were still important downwards drivers of inflation after the strong appreciation of the franc. Therefore, the SNB has moved its inflation expectations downwards for 2013 to minus 0.1% …

Read More »

Read More »

Switzerland, the Paradise of Insider Trading and Intransparency

Switzerland is well known as the country, where even central bankers were allowed to do insider trading. Instead the whistle blowers get problems with the courts. Some new cases of insider trading include UBS, General Electric and Valiant, see the article on

Read More »

Read More »

How Currency Speculators Help the SNB to Fight against Ordinary Investors

A discussion in the investor forum made clear how currency speculators currently help the SNB to maintain the floor against normal investors. A situation that was different in August/September 2011, when the SNB had to fight against these speculators. A discussion in the investor forum Seeking Alpha: part one Based on our analysis of …

Read More »

Read More »

Credit Suisse and UBS Will Charge Negative Interests Above a Threshold

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such was worth 150 bps, this year on 28 bps. See the official news at FT Alphaville

Read More »

Read More »

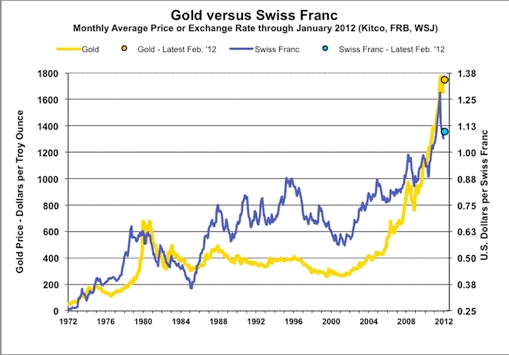

Gold, CHF, Brent Arbitrage Trading after Negative CS, UBS Interest Rates

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such news was worth 250 bps, on December 3 only 28 bips. One remembers August 26, 2011, when UBS only spoke of negative interests and consequently EUR/CHF rose from 1.1420 to 1.1688. At the time FX traders …

Read More »

Read More »

Global Purchasing Manager Indices, Update December 10

Manufacturing PMIs are considered to be the most leading and important economic indicators. Jim O’Neill, Chairman of Goldman Sachs Asset Management, believes the PMI numbers are among the most reliable economic indicators in the world. BlackRock’s Russ Koesterich thinks it’s one of the most underrated indicators. Global Purchasing Manager Indices for the manufacturing industry December 3, 2012 …

Read More »

Read More »

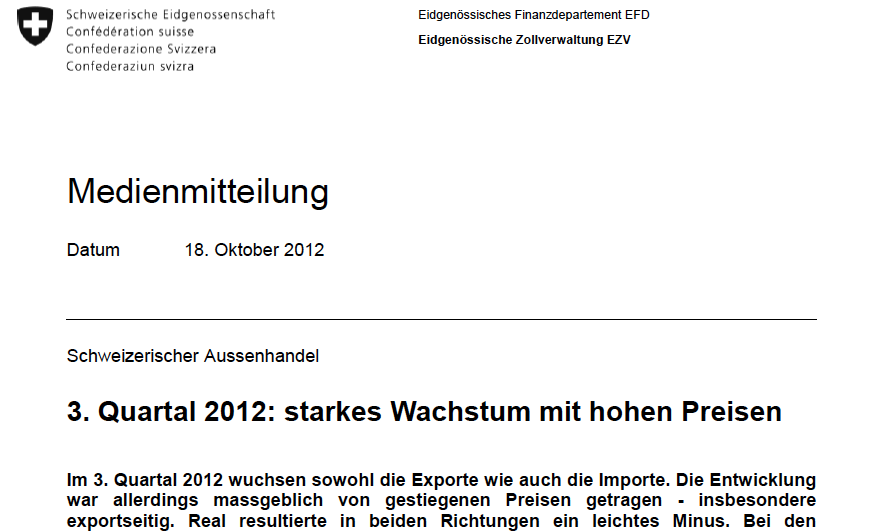

Swiss Exports Rise Thanks to Higher Export Prices. Sorry, What ????

Or how Swiss exporters are able to widen their margins thanks to the SNB currency manipulation Last week the Swiss export data for the third quarter was released. The news agency report was simple: Exports from Switzerland fell by a real 8.0 percent in September to 16.49 billion Swiss francs ($17.87 billion), the Federal …

Read More »

Read More »

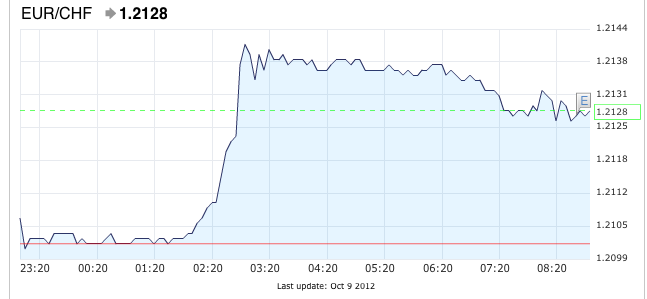

Strange movement in EUR/CHF in Asia session, a possible explanation

Strange movement in the EUR/CHF in the Asian session today The Asian session was a risk-on session, it recovered some of yesterday’s losses. After yesterday’s rather good HSBC services PMI, Shanghai Composite was up today by 1.97%. Therefore safe-havens like the yen and the Swissie were under pressure. At first, some Forex traders …

Read More »

Read More »

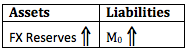

SNB Monetary Data Week of September 28

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger over the autumn months till …

Read More »

Read More »

Standard and Poor’s critique of the Swiss National Bank, part 1

Part 1: Swiss investments abroad [This paper includes some of the S&P critique, but also aims to clarify some of S&P’s misleading points] Last Thursday Thomas Moser, a member of the Swiss National Bank (SNB) governing council, said that one of the main reasons for the strong franc is the conversion of Swiss foreign incomes …

Read More »

Read More »

Can The SNB Make Profit On Currency Reserves ?

Abstract We determine the main criteria with which markets evaluate currency prices. We focus on explaining the differences between the carry trade era (or like Ben Barnanke called it “The Great Moderation”) and the period after the financial crisis. Our research shows that each one of the following three main preconditions must be fulfilled, …

Read More »

Read More »

Will the EUR/CHF fall like a stone? A perfect scalp ?

Recently we have observed the upward movement of all euro pairs. They have marked more or less continuously higher highs and higher lows thanks to massive support from the central banks ECB, Fed and SNB (ignore Sunday 16th) The first euro pair to finish this upwards trend is traditionally the EUR/CHF. … Continue...

Read More »

Read More »

Are German Bunds finally heading for the big slide ?

Citibank judges that the Swiss National Bank (SNB) does not need a peg anymore. The EUR/CHF exchange rate would be now over 1.20 even if exposed to the free market. Yesterday we showed that the upward move in the EUR/CHF is just the behavior of some euphoric Forex traders. In the meantime we see a completely … Continue reading »

Read More »

Read More »

The next SNB rumor: Wall Street Journal and our response

A bit breathlessly…. The next SNB rumor story comes from the so-well established Wall Street Journal, its columnist Nick Hastings. WSJ: The Swiss National Bank was bold before. And the central bank would be well advised to be just as bold again. When the SNB announced just over a year ago that it was setting a …

Read More »

Read More »