Tag Archive: Switzerland

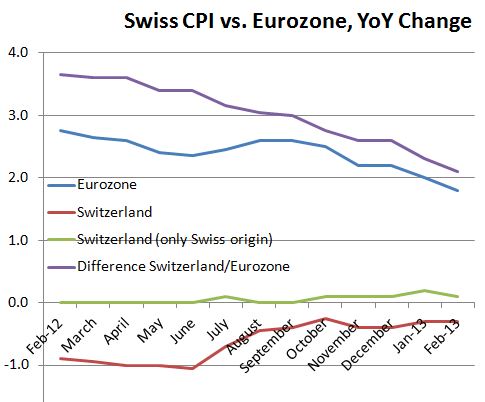

Difference between Eurozone and Swiss Inflation Rates Continues to Shrink

The gap has fallen from 3.7% in February 2012 to 2.1%. Swiss CPI is rising on monthly basis, but still negative with 0.3% YoY.

Read More »

Read More »

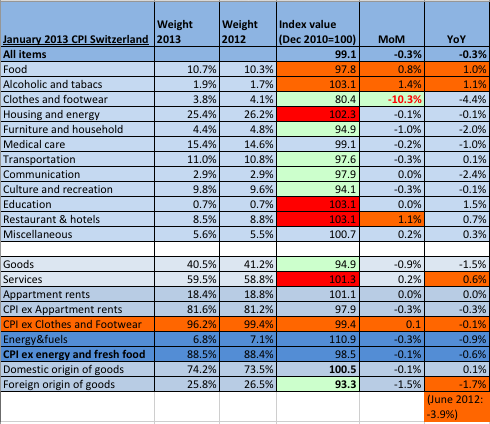

Switzerland’s Slow Way to Inflation

UPDATE February 2013 inflation data: The inflation figures for February showed the upwards movement we expected. On monthly basis inflation rose by 0.3%. The Swiss CPI is getting closer and closer to the one of the euro zone. We explain the January 2013 data on Swiss inflation and indicate which components drive the consumer …

Read More »

Read More »

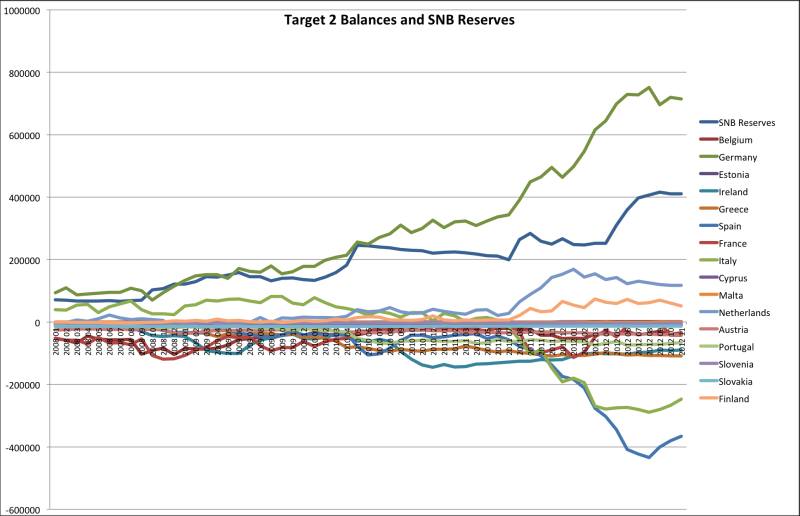

Target2 Balances and SNB Currency Reserves: Same Concept, Update February 2013

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

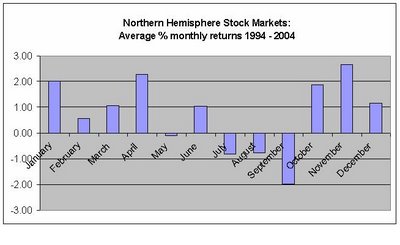

The “Get Stress in May and Relax in October Effect” for the SNB

The U.S. economy regularly improves between October and March. The SNB should use the moment to sell some currency reserves. From May on, the typical seasonal effects will push the SNB into a defense.

Read More »

Read More »

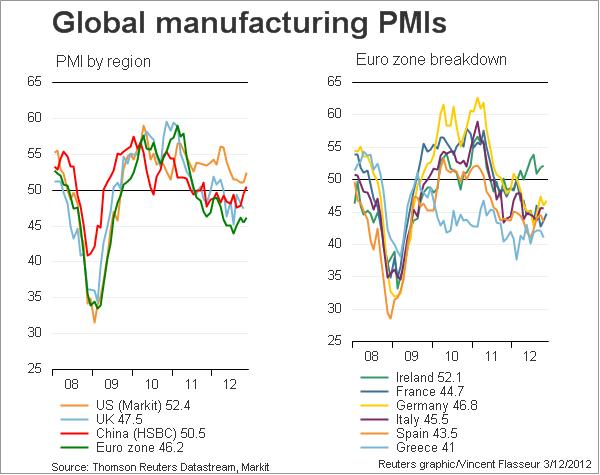

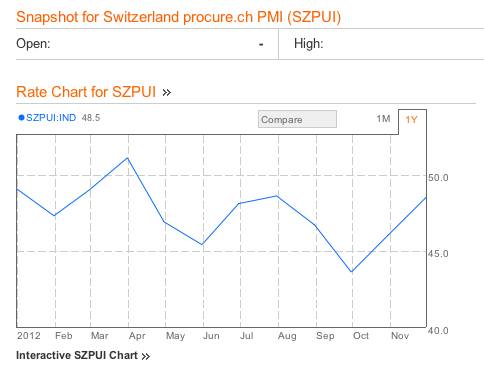

Global Purchasing Manager Indices, Update January 25

Manufacturing PMIs are considered to be the leading and most important economic indicators. After a strong slowing in summer 2012 and the Fed’s QE3, this is the fourth month of improvements in global PMIs January 25th Expansion-contraction ratio: There are 15 countries that show values above 50 and 14 with values under 50. Positive-negative-change ratio: …

Read More »

Read More »

Deflationary Risks? Comparing Swiss, Swedish and Norwegian Inflation and Exchange Rates

When the Swiss National Bank introduced the 1.20 lower limit, it wanted to eliminate the deflationary risks for Switzerland. For a certain period, namely when a global recession was looming in Autumn 2011, and the Swiss franc was hovering around 1.10, this risk was really present. In this post we would like to know if …

Read More »

Read More »

Target2 Balances and SNB Currency Reserves. They are Both the Same Concept

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

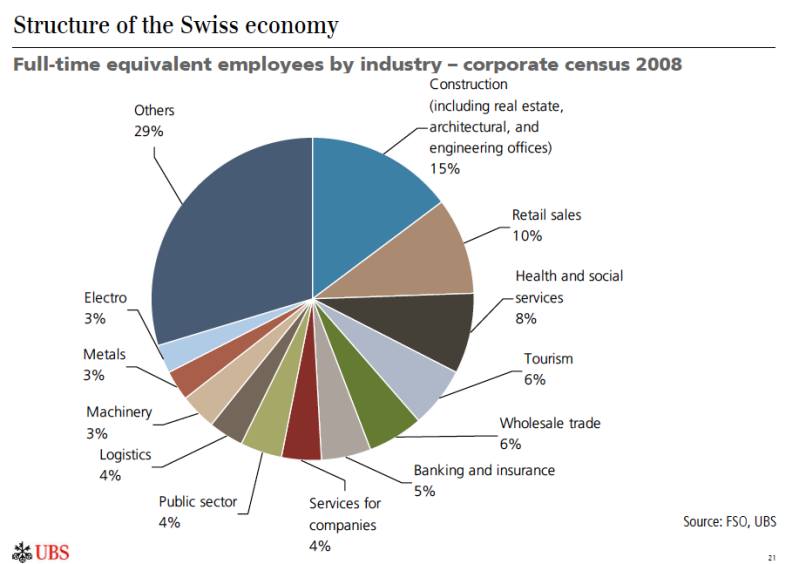

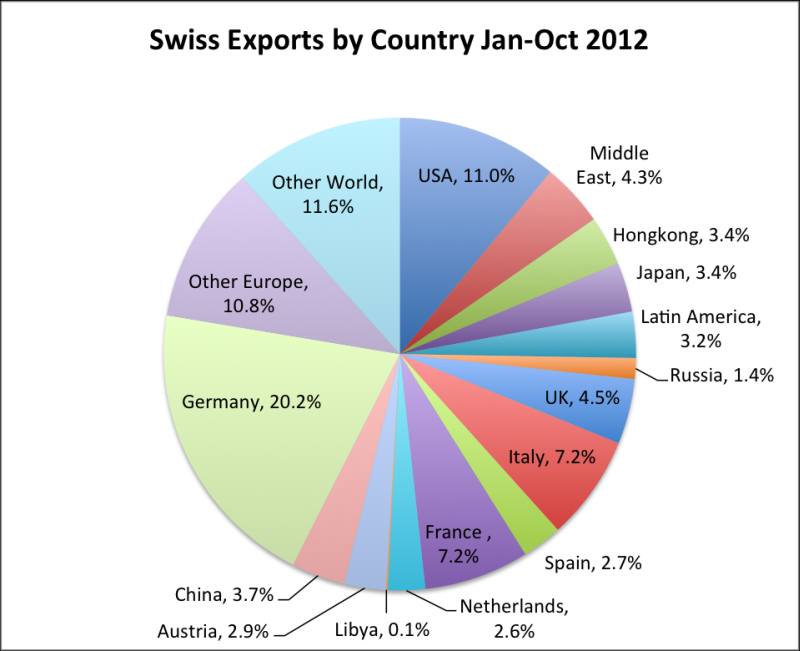

Yearly Swiss Doomsaying and Swissmem’s Control over the Swiss National Bank

The same as every year in December/January: Swiss media and economists are doomsaying. This time they claim that the banking industry and the UBS job losses will bring Switzerland into trouble. Once again they do not understand that the Great Recession was only to a small part a banking crisis, but it was mostly a … Continue reading »

Read More »

Read More »

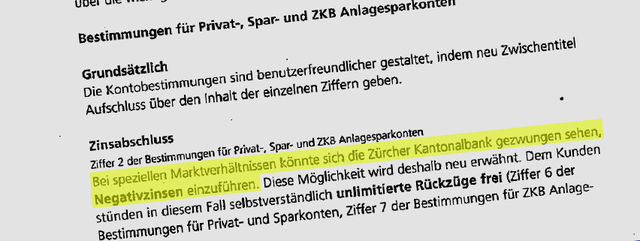

ZKB may introduce negative interest rates for ordinary savers

After UBS and CS introduced negative interest rates for big clearing accounts, ZKB changes general conditions for a potential introduction of negative rates even for ordinary savers. Time to get in contact with Geneva cash storing warehouses? More about the ZKB move on

Read More »

Read More »

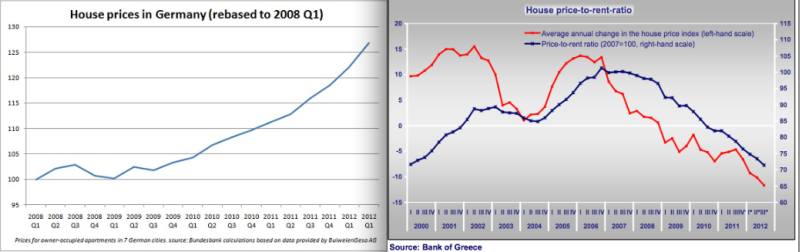

Swiss Public Discussion Switched from Floor to Housing Bubble

Why there is no real estate bubble in Switzerland yet and why the SNB will help to create one With the current recovery in the United States the discussion in Switzerland switched from a discussion about the EUR/CHF floor to the Swiss real estate boom, the so-called “housing bubble”. It seems that the Swiss …

Read More »

Read More »

FX Theory: The Balance of Payments Model Explained in 400 Words

The balance of payments leads to many confusions because definitions vary. For example, the IMF’s definition is different from the usual or historical definition. Secondly, the relationship between the balance of payments and reserve assets is difficult to grasp, especially in the IMF definition. Thirdly the origin of “errors and omissions” is often unclear. Therefore …

Read More »

Read More »

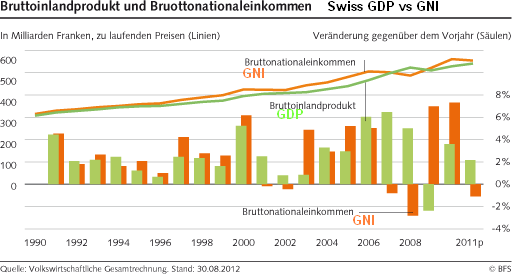

History of SNB monetary policy assessments vs. economic data

History of SNB monetary policy assessments vs. the Swiss gross national product (GDP) and gross national income (GNI).

Read More »

Read More »

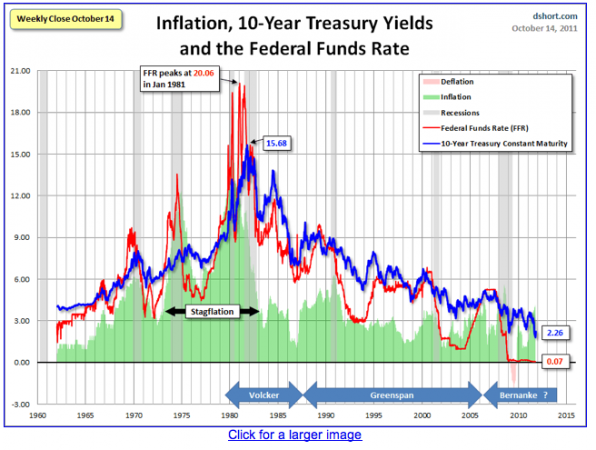

The Biggest Bubble of the Century is Ending: Government Bond Yields

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century? Update August 16, 2013: So, 10-year Treasury yields have ended the day closer to 3 per cent. But not as close as they … Continue reading »

Read More »

Read More »

Because They Knew What They Were Doing: The Parallels between European and SNB Leaders

Similarly as European leaders knew what they were doing with the euro, namely introducing a not feasible currency, Swiss National Bank did between 2005 and 2008, namely the absolutely wrong thing.

Read More »

Read More »