Tag Archive: Speculative Positions

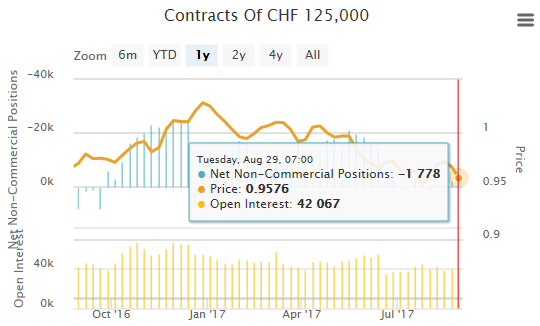

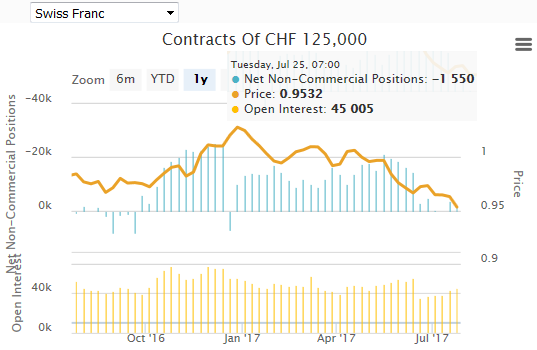

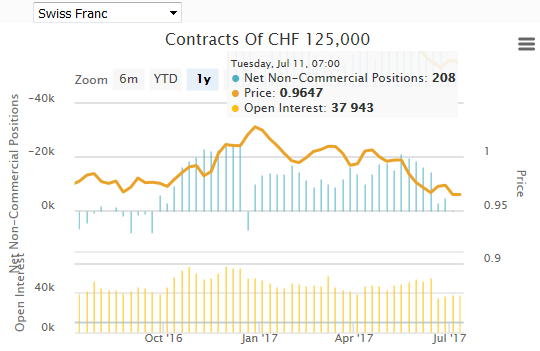

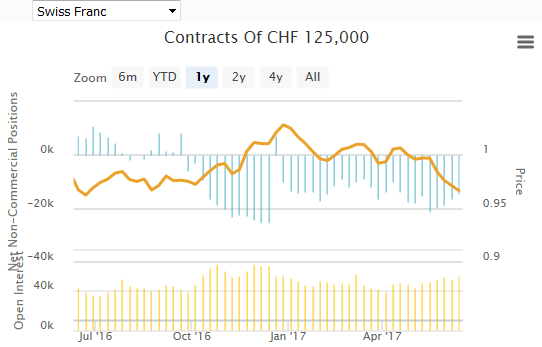

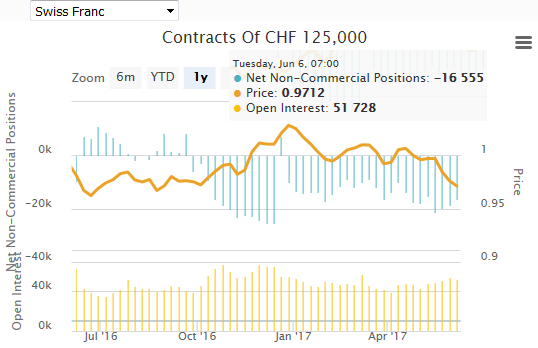

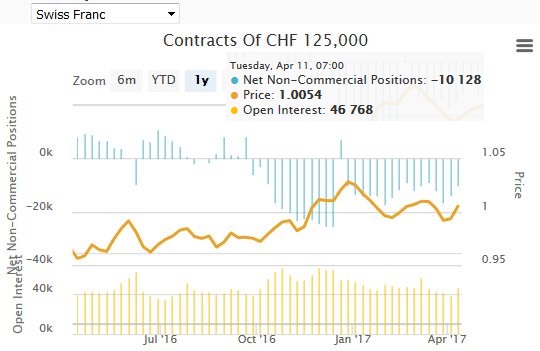

Weekly Speculative Positions: Net Short CHF Position is Increasing

The net short Swiss Franc position against the dollar has risen to the levels seen before the breakdown of the EUR/CHF floor.

It has increased from short 9.4 K contracts to 16.4 K contracts.

In the last week, speculators raised their short positions by 15% for both the euro and CHF. Euro longs against USD were up slightly, while CHF longs were reduced.

Read More »

Read More »

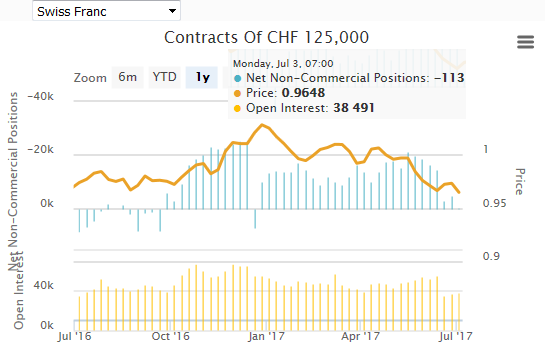

Weekly Speculative Positions: More Bearish Euros and CHF, Less Bullish the Yen

Speculators turned more bearish the euro and Swiss Franc and less bullish the Japanese yen in the Commitment of Traders week ending October 11.

Read More »

Read More »

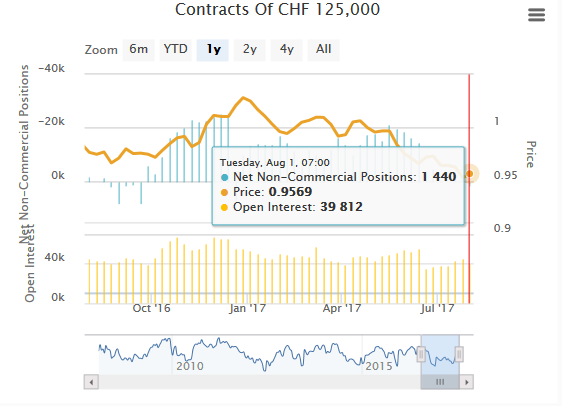

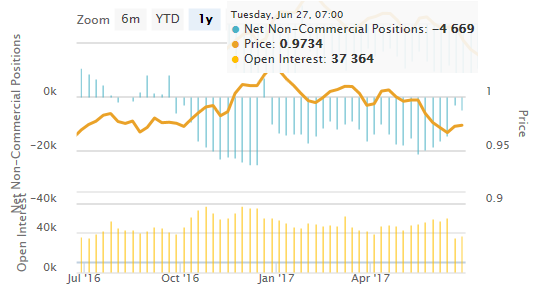

Weekly Speculative Positions: Speculators Closing their CHF Longs

Marc Chandler speaks of the volatility of the CHF speculative positioning. For us this was window dressing by the SNB that wants to improve the quarterly results. Traders react to the strong market movement caused by the SNB and they close their long CHF positions. If it was really the SNB, we will see on Monday

Read More »

Read More »

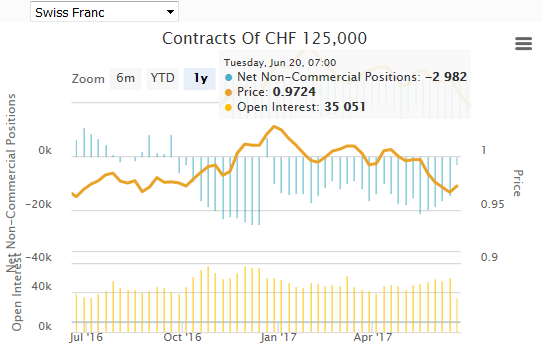

Speculators continue reducing Euro shorts

Speculators are reducing their net short Euro positions, since Draghi's comments on inflation. Apparently not only against the dollar but also against the Swiss Franc. This also means that the euro zone may be target real money (like purchases of stocks, real estate and bonds) instead of Switzerland.

Read More »

Read More »

Weekly Speculative Positions: Rising Swiss Franc Longs

Speculative activity remained light in the latest CFTC reporting period ending August 30. There were no gross position adjustments that we recognize as significant; 10k contracts or more. There were only three gross adjustments by speculators of more than 4k contracts. With the higher EUR/CHF FX rate and weaker U.S. jobs date, speculators went long CHF by 8.2K contracts.

Read More »

Read More »

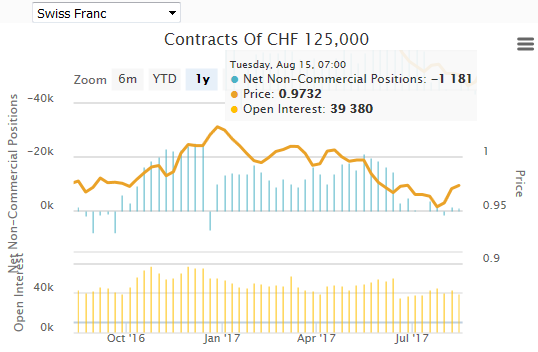

Weekly Speculative Positions: Switch to Small Net Long CHF

Speculators shifted to a 0.1 long Swiss Franc position in the week of August 9. Speculators reduced their exposure on Euro, CHF and Peso, increased it for NZD, CAD and GBP.

Read More »

Read More »

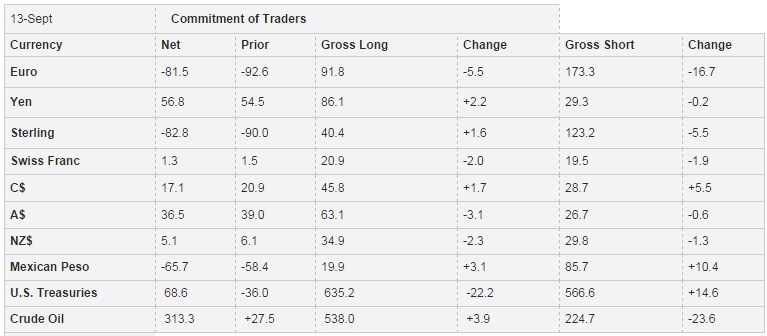

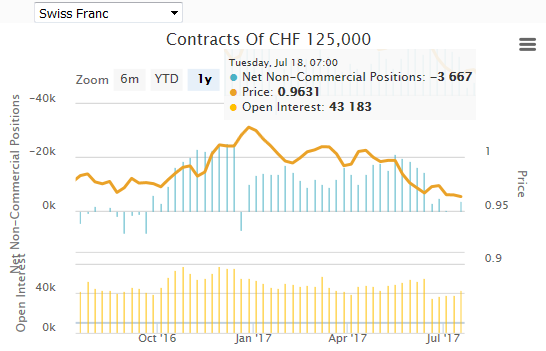

Weekly Speculative Positions: Record Sterling Shorts, Net Short in Swiss Francs

For a period that included a BOJ and FOMC meeting and the US GDP, speculators in the currency futures were unusually quiet. Summer holidays with family may be more important. Of the 16 gross currency futures speculative positions we track, 12 of them were less than 5k contracts. There was only one gross position adjustment more than 10k contracts. Euro bears covered …

Read More »

Read More »

Weekly Speculative Positions: Speculators Still Don’t Believe in the Greenback

Speculators reduced their Net long CHF position (against USD) from 10.9K contracts to 8.7K contracts. In five of the eight currency futures, we track, speculators covered their gross short exposure and added to their gross long exposure.

Read More »

Read More »

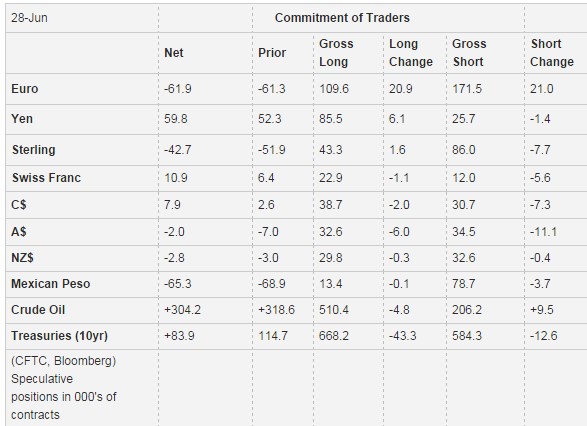

Weekly speculative Positions: Bulls and Bears Saw Speculative Opportunity in Euros

In the sessions before and after the UK referendum speculators in the currency futures did three things. First, they generally reduced exposure. This means gross longs and short positions were reduced. CHF long positions increased to 10K Speculators were divided about what to do with the euro.

Read More »

Read More »

Weekly Speculative Positions: Speculators Cut Currency Exposure ahead of FOMC, BOJ, and Brexit

The CFTC reporting week ending June 21 covers the day FOMC and BOJ meetings and ends two days before the UK referendum. The overarching theme was the reduction of exposure. This is not measured by net positions but by gross positions. Of the eight currencies we track, six saw a reduction of gross long positions and a six saw a reduction in the gross short positions.

Read More »

Read More »

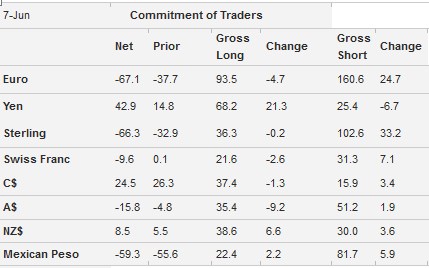

Weekly Speculative Positions after Uneventful ECB and Surprisingly Weak US Jobs

Price action shows a increase of the Swiss franc after the bad US payrolls report. Commitments of traders, however, indicate a move to a short CHF position of 9600 x 100k contracts against the dollar. We must separate speculative CHF positions from inflows into CHF cash, CHF stocks, bonds and real-estate, what we call "real financial flows". These will be revealed on Monday, with the SNB release of sight deposits, the counter-position of real...

Read More »

Read More »

Weekly Speculative Positions: Little Adjustment ahead of ECB and US Jobs

The Swiss Franc net position was reduced from 4.0 contracts long to 0.1 thousand contracts long. Apart from the yen., other speculative position barely changed. We are keen on next week's data that should reflect the dismal US jobs report.

Read More »

Read More »

Weekly Speculative Positions: Speculators Slash Yen and Aussie Longs, Net CHF nearly unchanged

Speculators remain Long CHF against USD. The figure is nearly unchanged at 4.0 k CHF contracts. For CHF, both shorts and longs increased.

This weeks major change was in the yen and in AUD. Speculators strongly reduced their longs.

Read More »

Read More »

Sentiment Shift Evident in Speculative Adjustment in Currency Futures

Speculative positioning in the currency futures began to adjust before the latest signals from the Federal Reserve about the prospects for a summer hike and the widening of interest rate differentials. In the CFTC reporting week ending May 17, the day before the FOMC minutes were released speculators mostly reduced gross long currency positions and added …

Read More »

Read More »

Weekly Speculative Positions: Significant Position Adjustments

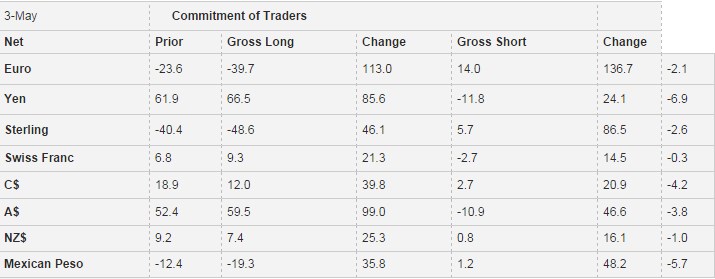

The US dollar staged an impressive reversal against many of the major foreign currencies on May 3. In the following week, speculators in the currency futures market made significant adjustment in their holdings. We identified a change in the gross position in the currency futures of 10k contracts or more to be significant. In the week …

Read More »

Read More »

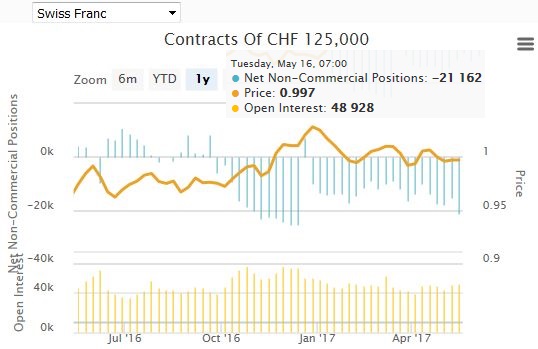

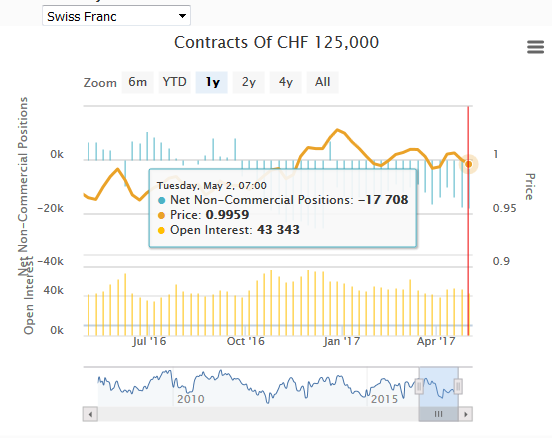

Weekly Speculative Positions: Cutting Longs in Yen and Swiss Franc

Speculators in the futures market continued to pare short foreign currency positions but were cautious about expanding long positions in the CFTC reporting week ending May 3. In fact, two of the three largest adjustments were the cutting of gross long Japanese yen and Australian dollar positions. Yen Speculators took profits on 11.8k contracts of …

Read More »

Read More »

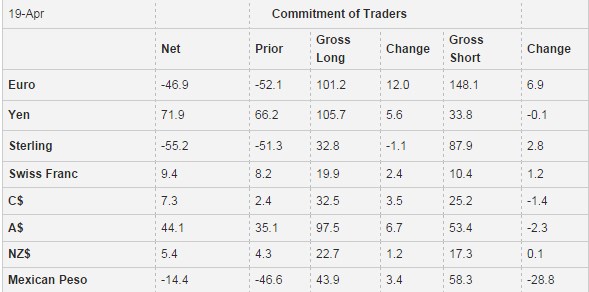

Weekly Speculative Postions: Euro and Yen Exposure Trimmed ahead of FOMC and BOJ

Speculators in the futures market made mostly small position adjustments in the sessions leading up to the FOMC and BOJ meetings. During the Commitment of Traders reporting week ending April 26, the largest adjustment of speculative position in the currency futures was the 12.5 k build of gross long Australian dollar contracts. The accumulation …

Read More »

Read More »

Weekly Speculative Positions: Reduction of US Dollar Exposure at What may be the Bottom

Speculators in the futures market continued to press a bearish view of the US dollar the CFTC reporting week ending April 19. For one and half month traders continue to increase their long CHF position against the dollar. It has risen to 7.3k contracts.

Read More »

Read More »