Tag Archive: Speculative Positions

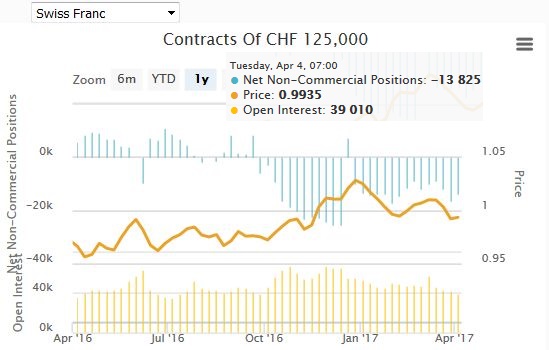

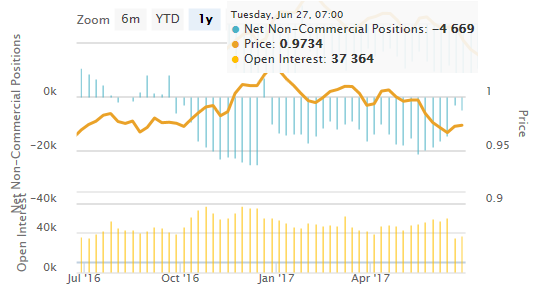

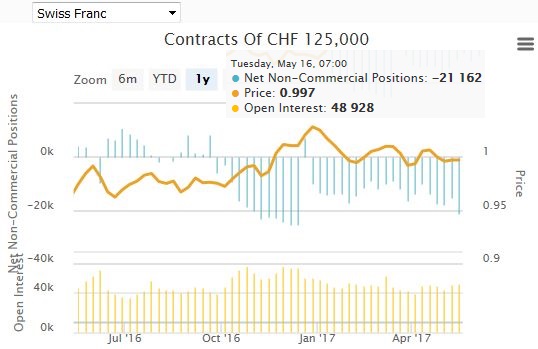

Weekly Speculative Positions (April 4 Data): Reduction in CHF Net Shorts

Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure. In the last week, finally they increased their Euro shorts again.... and reduced their CHF shorts.

Read More »

Read More »

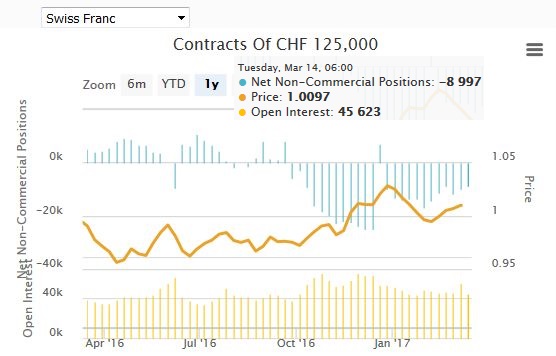

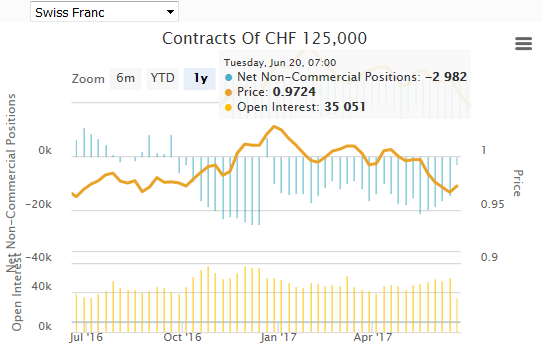

Weekly Speculative Positions: Last Reduction of Euro Short Positions?

Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure.

Read More »

Read More »

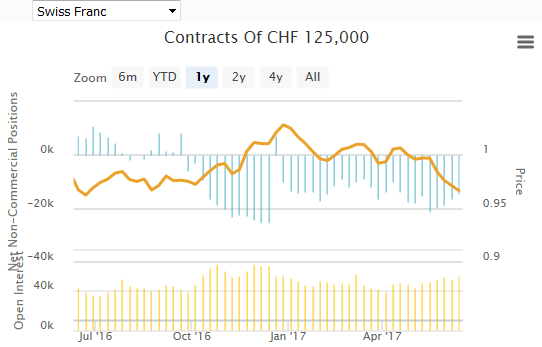

Weekly Speculative Positions: Continued reduction of Euro Shorts

Another time speculators reduced their net Euro shorts after the less dovish ECB. But the net short of CHF nearly remains stable. This resulted in an appreciation of EUR/CHF.

Read More »

Read More »

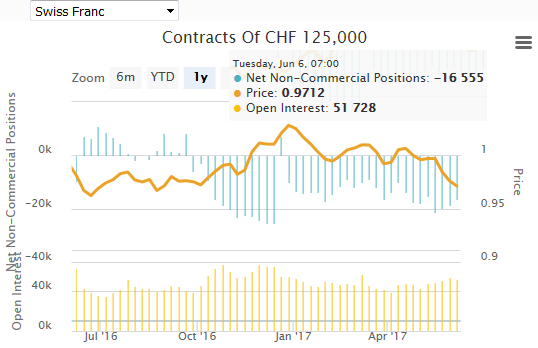

Weekly Speculative Position: After ECB, Reduction of Euro Shorts

Speculators reduced their net Euro shorts after the less dovish ECB. But the net short of CHF nearly remains stable. This resulted in an appreciation of EUR/CHF.

Read More »

Read More »

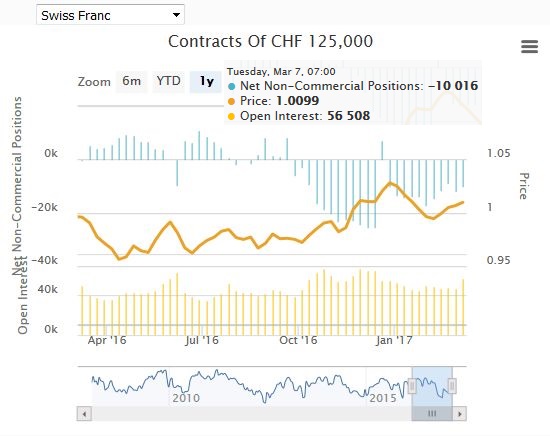

Weekly Speculative Position: Less dovish ECB not include yet

The commitments of traders were released on March 7 before the ECB meeting of March 9. We expect a considerable re-adjustment.

Read More »

Read More »

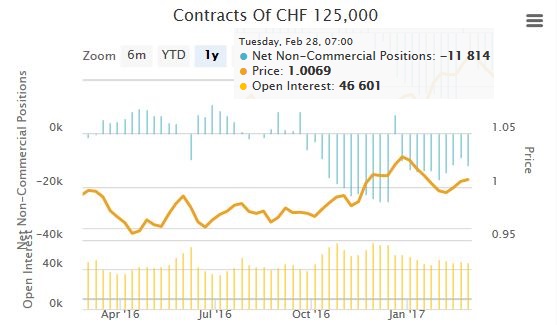

Weekly Speculative Position: More CHF Shorts, Less EUR Shorts this time

Speculators reduced their EUR net short positions, on a potential reduction of ECB quantitative easing. At the same time, they increased the CHF net shorts.

Read More »

Read More »

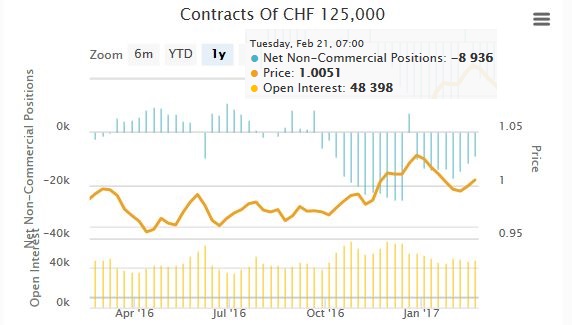

Weekly Speculative Position: More EUR Shorts, Less CHF Shorts .. Again

Speculators increased their EUR net short position against the dollar, but lowered their CHF net shorts (vs. USD). This tendency confirms our view that EUR/CHF will move towards parity.

Read More »

Read More »

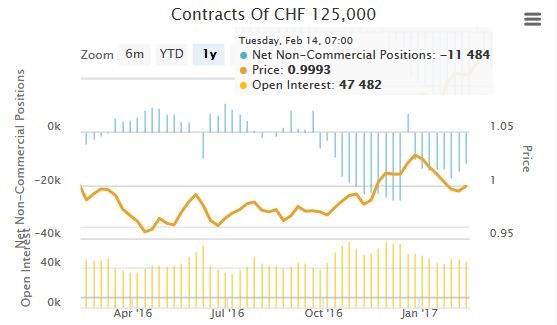

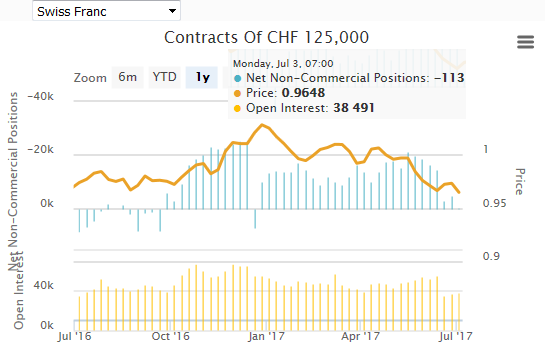

Weekly Speculative Position: Rising EUR shorts and falling CHF shorts point to weaker EUR/CHF

Speculators increased their EUR net short position against the dollar, but lowered their CHF net shorts (vs. USD). This tendency confirms our view that EUR/CHF will move towards parity.

Read More »

Read More »

Weekly Speculative Position: Speculators are long all currencies of the dollar bloc

Speculators are net short CHF with 14.6K contracts against USD. This is less than the 17K last week.

Read More »

Read More »

Weekly Speculative Position: Net Short Euro and Yen Are Falling. Short CHF Stable

Speculators are net short CHF with 13.6K contracts against USD. This is nearly unchanged. But net short of Euro and Yen are Diminishing.

Read More »

Read More »

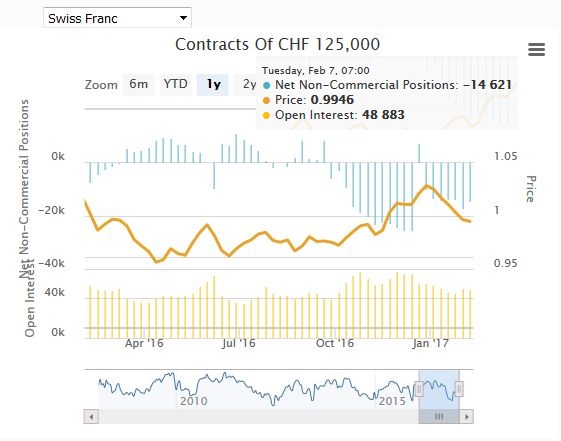

Weekly Speculative Position: CHF getting stronger, net shorts stable

Speculators are net short CHF with 13.7K contracts against USD. This is nearly unchanged. On the other side, the USD/CHF is falling.

Read More »

Read More »

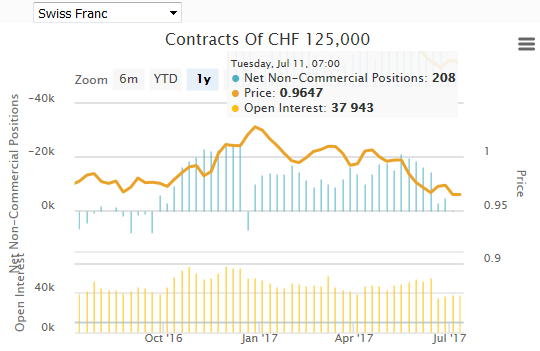

Weekly Speculative Position: CHF Net Shorts rising, but JPY net shorts falling

Speculators are net short CHF with 14K contracts against USD. This is 1K more than last week. But yen and Euro net shorts are currently diminishing. This could imply that soon CHF net shorts start falling, too.

Read More »

Read More »

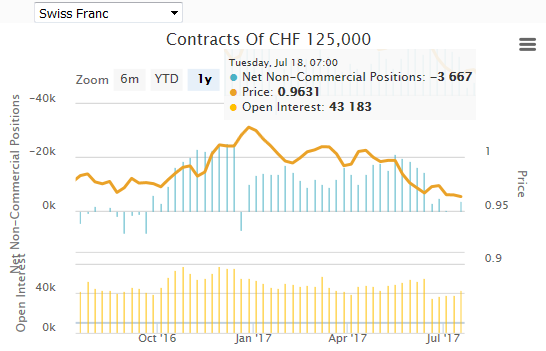

Weekly Speculative Positions: CHF and GBP net shorts are slowly rising again

Speculators are net short CHF with 13K contracts against USD, 3K more than last week. This is still far from the post financial crisis record of 26 K contracts. Moreover the net short GBP are increasing again.

Read More »

Read More »

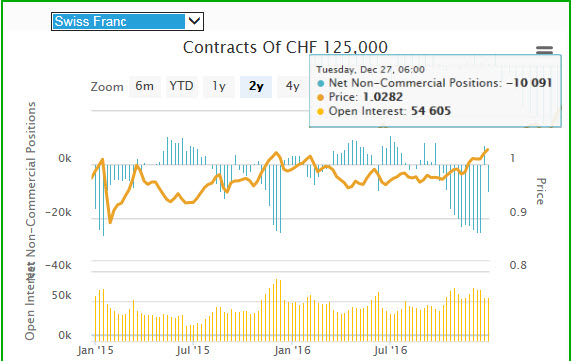

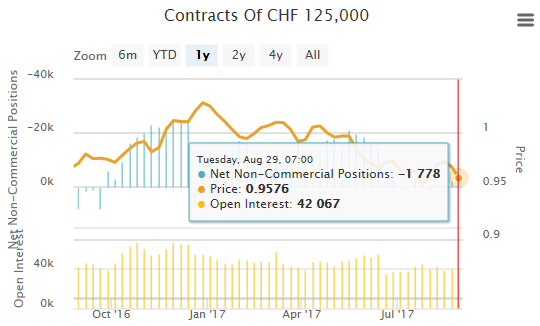

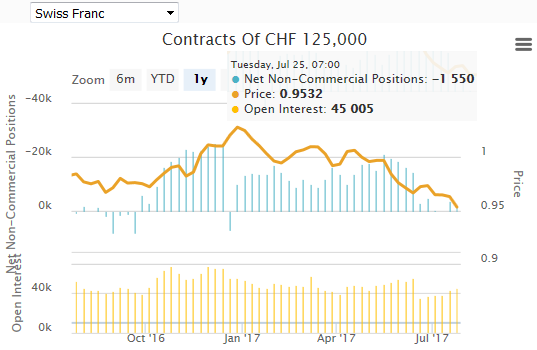

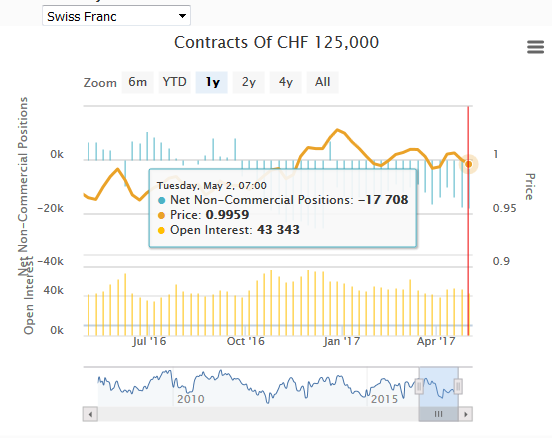

Weekly Speculative Positions: Speculators go short CHF again after a brief period of Long CHF

The sudden adjustment of CHF speculative positions ended (see last week's post) . Speculators went net short CHF USD with 10K contracts, this is still far from the 26.K contracts record. We should wait for another Fed rate hike, to reach these levels again.

Read More »

Read More »

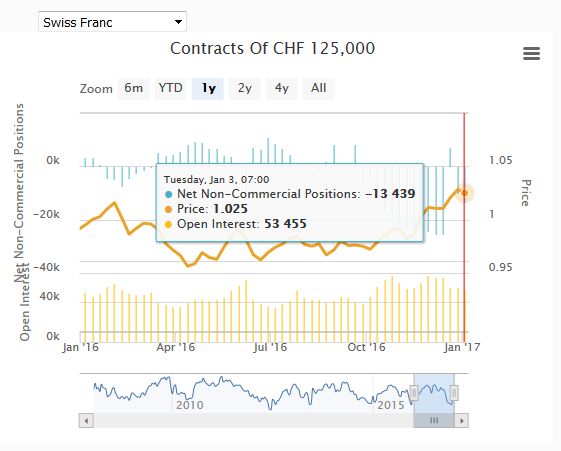

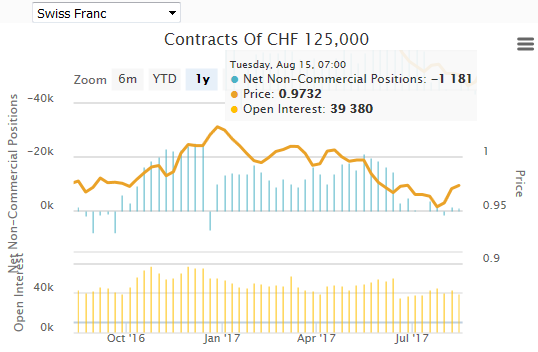

Weekly Speculative Positions: After Fed Rate Hike, Speculators Close their Short CHF and Open Long CHF

The expiry of the December currency futures may spurred more than normal speculative position adjusting. The out-sized 27.9k contract jump in the speculative gross long Swiss franc futures position is a prime example.

Read More »

Read More »

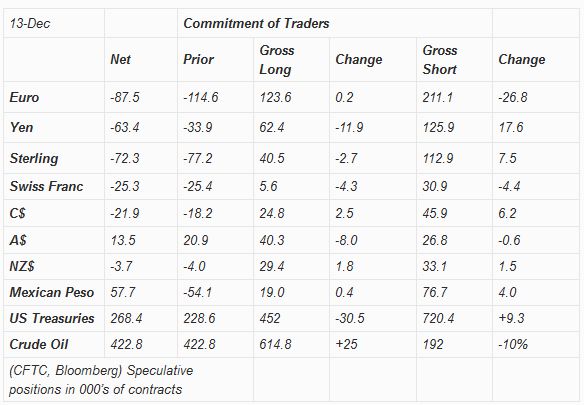

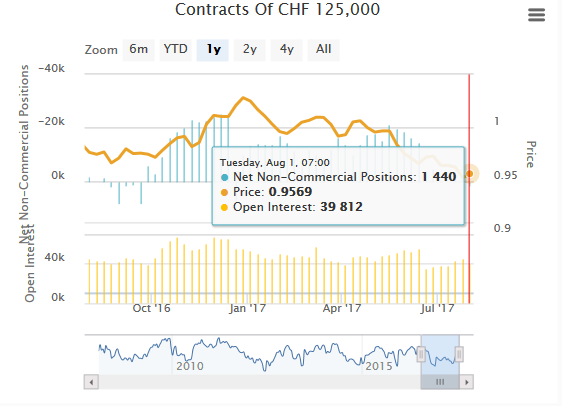

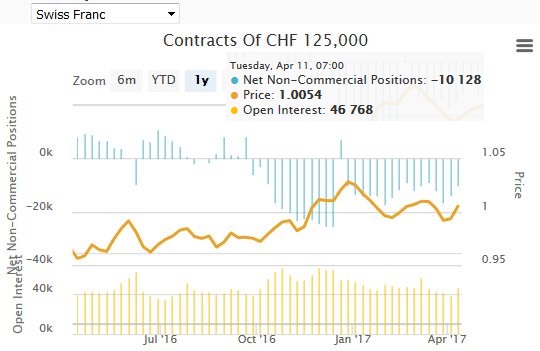

Weekly Speculative Positions: Short CHF Close to Records of 2015

The net short CHF speculative position is close to reaching new records. Shortly before the end of the peg, speculators were net short CHF by 26.4K contracts. Now we are at 25.4K.

Read More »

Read More »

Weekly Speculative Positions: Short CHF Close to Records of 2015

The net short CHF speculative position is close to reaching new records. Shortly before the end of the peg, speculators were net short CHF by 26.4K contracts. Now we are at 25.4K.

Read More »

Read More »

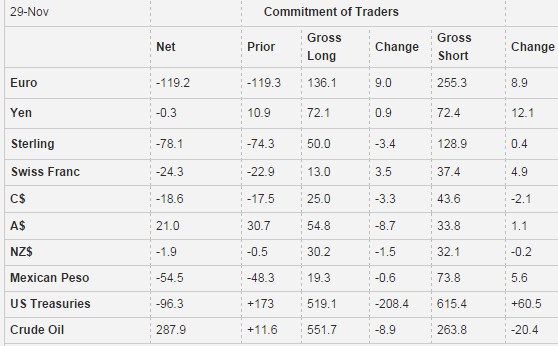

Weekly Speculative Positions: Short CHF Are Increasing

The net short CHF speculative position is close to reaching new records. Shortly before the end of the peg, speculators were net short CHF by 26K contracts. Now we are at 24.3K.

Read More »

Read More »

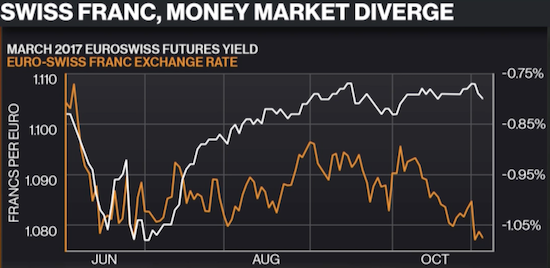

THIS Time A Swiss Franc Hedge Makes More Sense

Money markets and the Swiss franc have diverged despite a presumed increase in event risk from the U.S. Presidential election. Moreover, shorts against the Swiss franc have risen. This surprising divergence opens up a presumed opportunity use the franc as a hedge against a surprise outcome from the election. This time I agree with the strategy even as I suspect that, once again, any subsequent incremental strength in the Swiss franc will be...

Read More »

Read More »

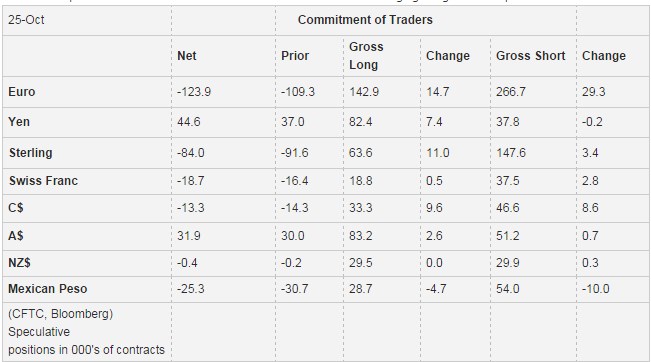

Weekly Speculative Positions: Bottom-Picking Sterling, Swiss Franc Even More Net Short

Speculators increased their Short Swiss Francs to Net 18K contracts. While they started to bottom-pick Sterling.

Not everyone is convinced that sterling will bounce. The bears extended their gross short sterling position by 3.4k contracts to 147.6k. On the eve of the UK referendum, the gross short position was around 94k contracts.

Again speculators, both bulls and bears have rapidly expanded their exposure in recent weeks. In the most...

Read More »

Read More »