EM FX was mostly firmer last week, but ended on a mixed note Friday. Best performers on the week for COP, MXN, and BRL while the worst were ARS, PHP, and CNY. We continue to warn investors against blindly buying into this broad-based EM rally, as we believe divergences will once again assert themselves in the coming weeks.

Read More »

Tag Archive: South Africa

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

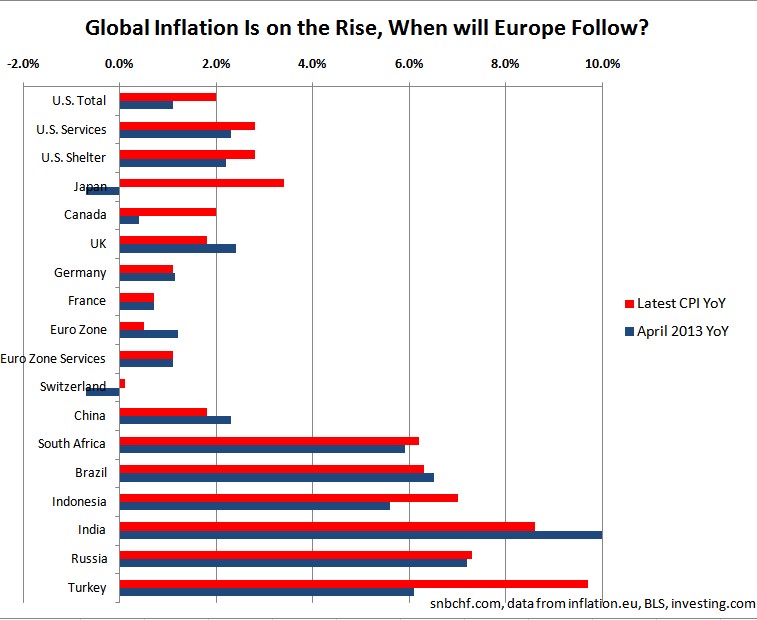

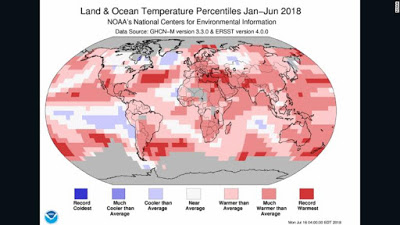

Global Inflation Spikes Up, Are You Sure About What You Are Doing Mr Draghi?

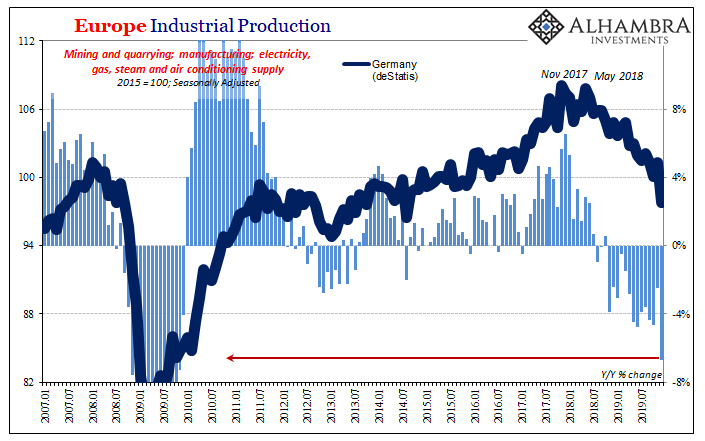

The European Central Bank (ECB) has the habit of reacting late. As seen in July 2008 and July 2011, the ECB is often the last major central bank to hike rates. They hike rates at the moment when others prepare for a recession or a significant slowing. Currently we are witnessing the opposite movement: The world is getting … Continue...

Read More »

Read More »

Jim O’Neill’s Bullish BRICS Outlook until 2020 and our Critics

Perfect charts by Goldman's Jim O'Neill that help to understand the former and future growth of different emerging, "growth markets", the BRICS. We criticise his partially over-optimistic views.

Read More »

Read More »

GDP Comparison BRICS Developed Markets

Beautiful charts by Goldman's Jim O'Neill that help to understand the former and future growth of different emerging, "growth markets", the BRICS. We criticise his partially over-optimistic views.

Read More »

Read More »

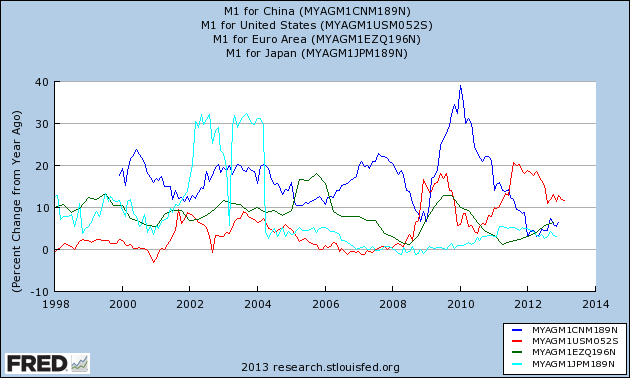

The Inflation Lie? Why and When Inflation Will Come Back

The so-called "inflation lie" : money printing does not create inflation. The cyclical slowing in emerging markets shows that it actually did cause inflation, just not in developed economies yet.

Read More »

Read More »

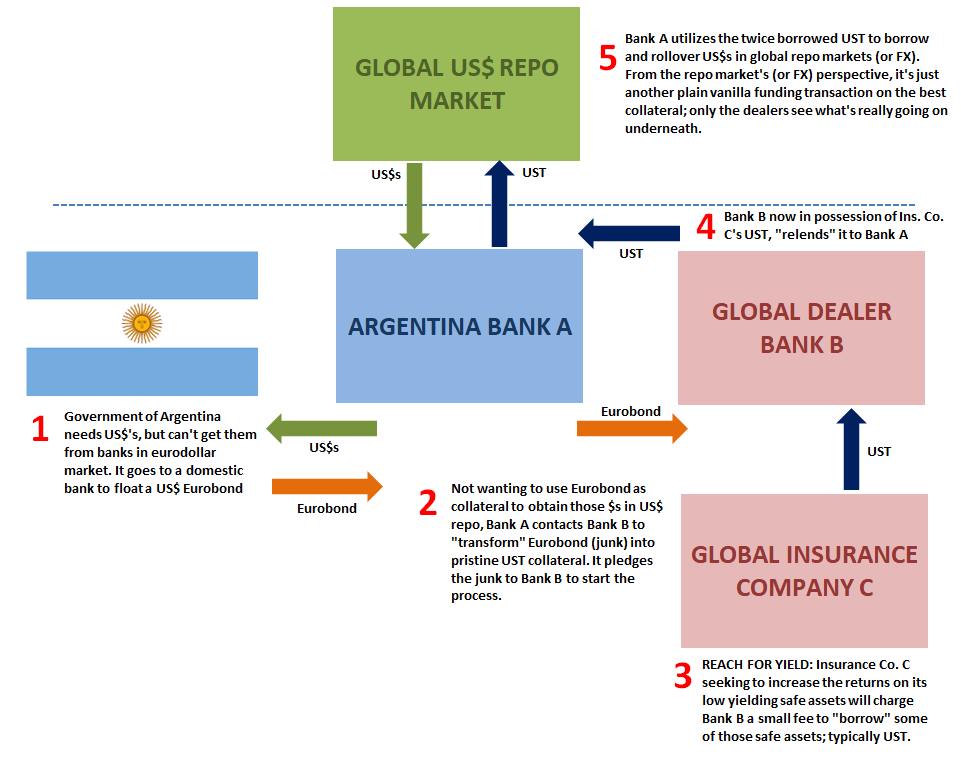

More About Overheating Emerging Markets: Retail Investors Should not Touch these Bonds

In our series about emerging markets, we name some that are overheating and could face increases of government bond yields due to higher inflation and weaker current accounts. At the same time, banks are aggressively selling emerging market bonds as possibility to achieve high yields. Tristan Hanson, head of asset allocation at Ashburton Asset …

Read More »

Read More »