Tag Archive: Swiss National Bank

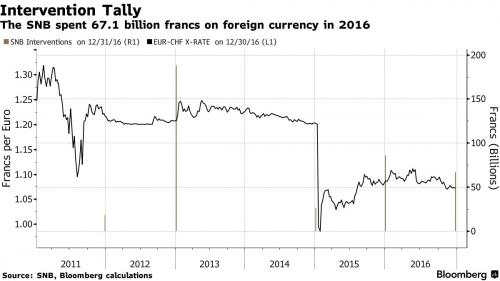

SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China.

Read More »

Read More »

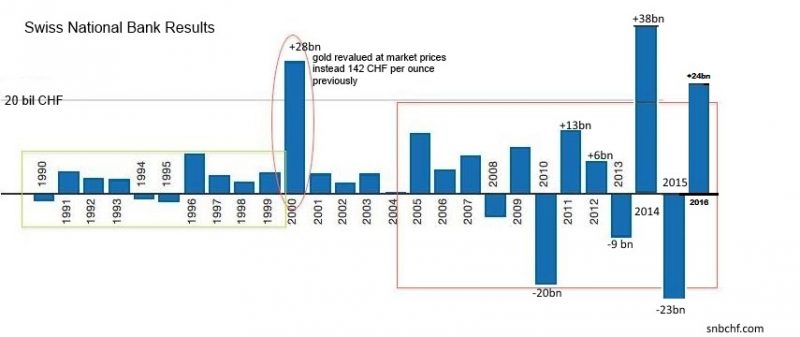

Swiss National Bank Results 2016 and Comments

The Swiss National Bank (SNB) reports a profit of CHF 24.5 billion for the year 2016 (2015: loss of CHF 23.3 billion). The profit on foreign currency positions amounted to CHF 19.4 billion. A valuation gain of CHF 3.9 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.6 billion.

Read More »

Read More »

It Is Time To Short The Swiss National Bank!

The current Article will take a closer look to the incredible rise of the Swiss National Bank stock and suggest why taking a short position could be the right trade at this level. The Swiss Central Bank: Mandate and Monetary Policy. According to the Swiss Federal Constitution (Art. 99) the Swiss Central Bank is an independent institution with the mandate to conduct the monetary policy in Switzerland by ensuring price stability, while taking into...

Read More »

Read More »

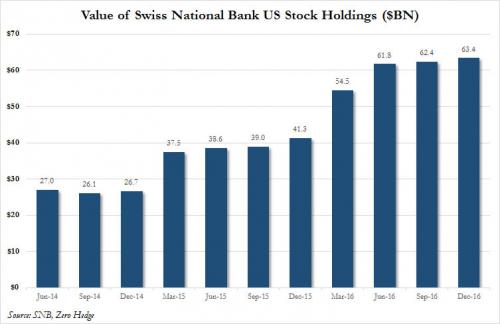

Video: The Swiss National Bank Is Acting Like A Hedge Fund

We discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy?

Read More »

Read More »

What Will Trump Do About The Central-Bank Cartel?

The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar.

Read More »

Read More »

Swiss National Bank’s U.S. Stock Holdings Hit A Record $63.4 Billion

Being able to print your own money and buy stocks at any price sure can be fun. Just as the SNB which unlike many other (if ever fewer) central banks admits to doing just that. In its latest 13F filing, the Swiss National Bank reported that the value of its portfolio of US stocks rose again in the fourth quarter, increasing by 1.6% from $62.4 billion as of Sept. 30 to a record high $63.4 billion at the end of the year.

Read More »

Read More »

Largest Retail FX Broker FXCM Banned By CFTC, Fined $7 Million For Taking Positions Against Clients

The CFTC on Monday fined Forex Capital Markets, parent FXCM Holdings LLC and founding partners Dror Niv and William Ahdout to pay $7 million to settle charges it defrauded retail foreign exchange customers and engaging in false and misleading solicitations. As part of the settlement, FXCM agreed to withdraw its registration and never seek to register with the CFTC again, effectively banning it from operating in the US.

Read More »

Read More »

The VIX Will Be Over 100 due to Central Bank Created Tail Risk

We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory!

Read More »

Read More »

Who Owns the Public Gold: States or Central Banks?

It’s a common misconception that the world’s major central banks and monetary authorities own large quantities of gold bars. Most of them do not. Instead, this gold is owned by the sovereign states that have entrusted it to the respective nation’s central bank, and the central banks are merely acting as guardians of the gold. Tracing the ownership question a step further, what are sovereign states?

Read More »

Read More »

80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded "fake news" by the established financial "kommentariat."

Read More »

Read More »

How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract.

Read More »

Read More »

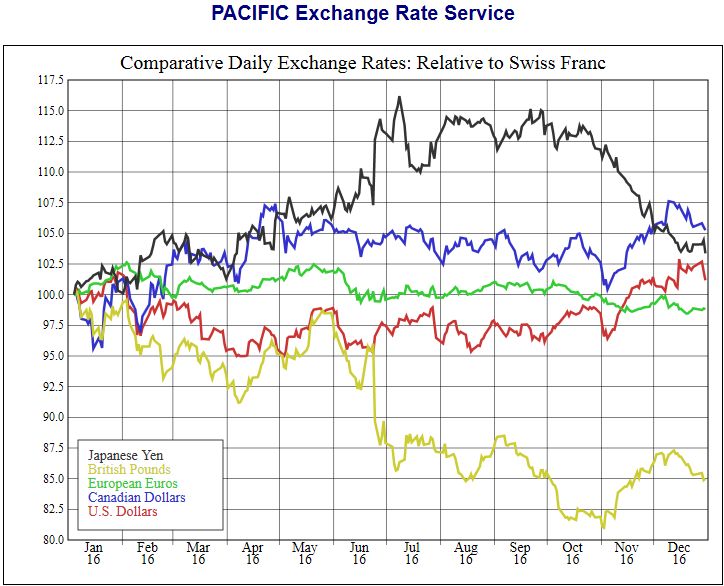

SNB announces 24 bn CHF profit for 2016 thanks to rising stock markets.

The Swiss National Bank has announced 24 bn profits from 2016. Profits came from the dollar, yen and Canadian dollar, while the pound retreated by 15%. The EUR/CHF is only slightly weaker, mostly because the SNB actively supported the euro.

Read More »

Read More »

Risk Reward Analysis for Financial Markets

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks...

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »

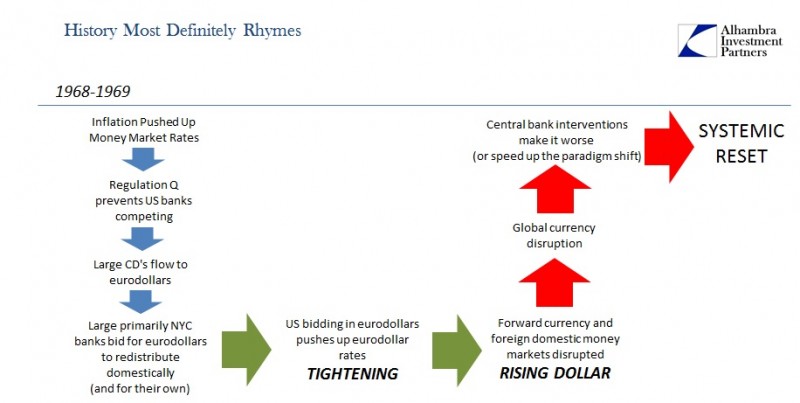

We Know How This Ends – Part 2

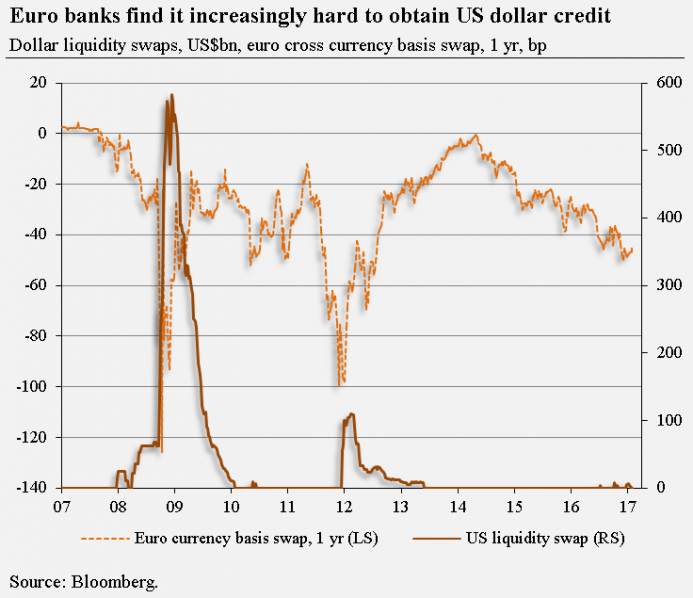

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Read More »

Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money)

Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle.

Read More »

Read More »

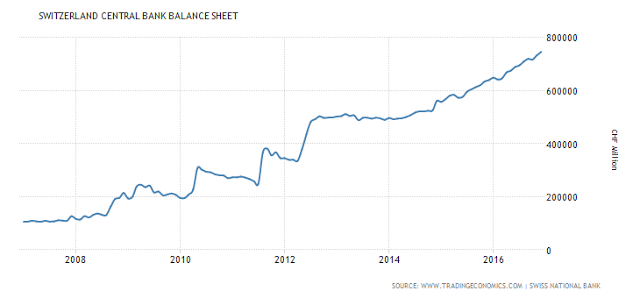

Swiss National Bank further strengthens provisions for currency reserves

The Swiss National Bank uses a strange formula on the basis of economic growth for the provisions for FX losses. It would be much easier to connect this number to the size of the balance sheet, e.g. 10% of the balance sheet.

Read More »

Read More »

Wie die SNB durch Kapitalsteuern die Schweizer Wirtschaft belastet

Vor dem Hintergrund eines angeblich „schwachen Wirtschaftswachstums“ rechtfertigte SNB-Chef Thomas Jordan neulich in einem Interview in der Tagespresse die SNB-Negativzinsen und bezeichnete diese als „expansiv“. Nur: Sind Negativzinsen wirklich „expansiv“? Sind diese nicht viel eher „restriktiv“ und bremsen unsere Wirtschaft – bewirken also genau das Gegenteil von dem, was die SNB behauptet?

Read More »

Read More »

Swiss banks taking more risks to compensate for record-low interest rates

Swiss banks focused on property lending are taking more risks to compensate for the impact of record-low interest rates, increasing the threat of a real-estate bubble, Swiss National Bank Vice President Fritz Zurbruegg said.

Read More »

Read More »

Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks...

Read More »

Read More »