Tag Archive: Swiss National Bank

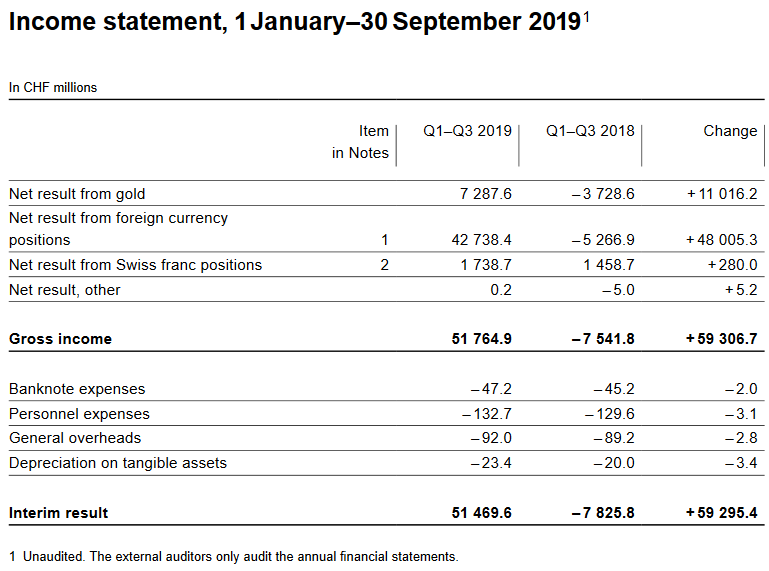

The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019

The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019. The profit on foreign currency positions amounted to CHF 42.7 billion. A valuation gain of CHF 7.3 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.7 billion.

Read More »

Read More »

BIS Innovation Hub Centre in Switzerland

From the SNB’s press release regarding the newly established BIS Innovation Hub Centre in Switzerland: The Swiss Centre will initially conduct research on two projects. The first of these will examine the integration of digital central bank money into a distributed ledger technology infrastructure. This new form of digital central bank money would be aimed at facilitating the settlement of tokenised assets between financial institutions.

Read More »

Read More »

FX Weekly Preview: Six Things to Watch in the Week Ahead

The prospect of a third trade truce between the US and China helped underpin the optimism that extended the rally in equities. Bond yields continued to back-up after dropping precipitously in August, led by a more than 30 bp increase in the US yield benchmark. The Dollar Index fell for the second consecutive week, something it had not done this quarter.

Read More »

Read More »

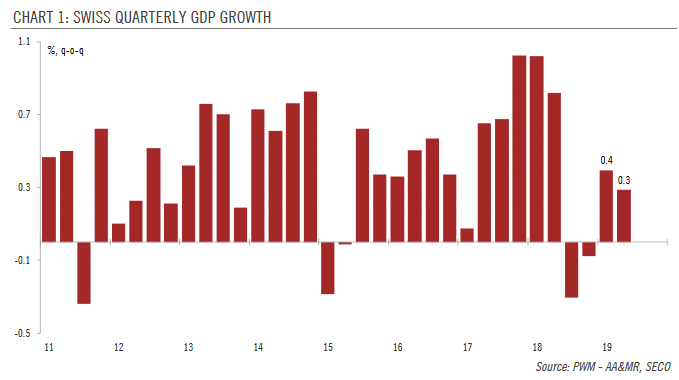

Swiss National Bank – Between a rock and a hard place

We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings.Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy.

Read More »

Read More »

SNB Jordan: Cannot say how long negative interest rates will last

SNBs Jordan on the wiresThe Swiss national banks Jordan is on the wires saying:He cannot say how long negative interest rates will lastNegative rates are necessary for nowInterest rate spreads like important role for exchange ratesThe USDCHF is trading higher today. It currently trades at 0.9861.

Read More »

Read More »

Nationalbank – SNB-Präsident Jordan: Libra könnte Geldpolitik gefährden

Die Schweizerische Nationalbank (SNB) misst Kryptowährungen wie Bitcoin wenig Potenzial zu. Die Chancen darauf, als Zahlungsmittel akzeptiert zu werden, sind aus Sicht der Zentralbank gering. Kryptowährungen hätten "eher den Charakter von spekulativen Anlageinstrumenten als von 'gutem' Geld", sagte der SNB-Präsident in einer Rede an der Universität Basel.

Read More »

Read More »

Swiss National Bank Presents New 100-Franc Note

The Swiss National Bank (SNB) will begin releasing the new 100-franc note on 12 September 2019, bringing the issuance of the ninth banknote series to a close. The first denomination in the new series, the 50-franc note, entered circulation on 13 April 2016. This was followed by the 20, 10, 200 and 1000-franc notes, which were released at six or twelve-month intervals.

Read More »

Read More »

SNB reports a profit of CHF 38.5 billion for the first half of 2019.

The Swiss National Bank reports a profit of CHF 38.5 billion for the first half of 2019. The profit on foreign currency positions amounted to CHF 33.8 billion. A valuation gain of CHF 3.8 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.1 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets.

Read More »

Read More »

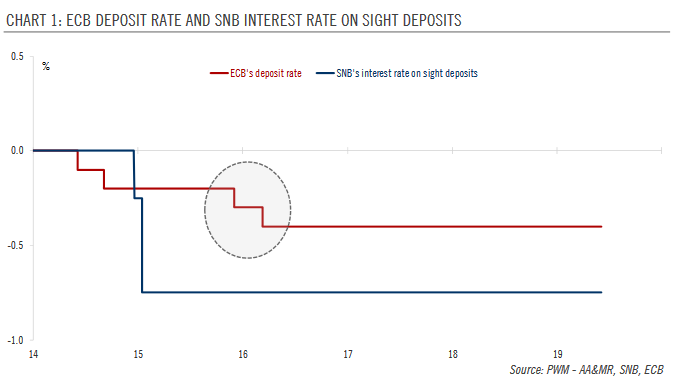

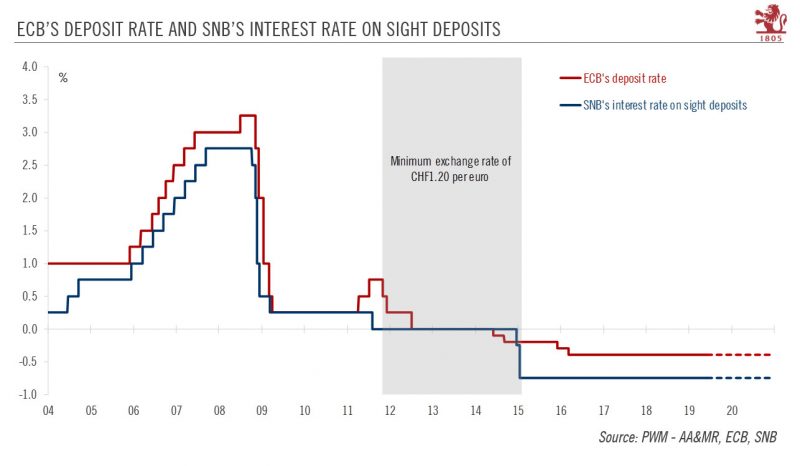

Swiss monetary policy – it’s (almost) all about the Swiss franc

With the ECB and the Fed both signalling their readiness to provide further stimulus, the Swiss National Bank is unlikely to have smooth sailing over the coming months.How the Swiss National Bank (SNB) reacts to further stimulus by its US and European counterparts will be the key focus of the coming months for investors.

Read More »

Read More »

Das Einmaleins des neuen Leitzinses

Die Schweizerische Nationalbank (SNB) führt neu einen Leitzins ein. Hatte sie denn bis jetzt gar keinen? Doch, hatte sie, aber der hiess anders. Nutzen wir doch die Gelegenheit, um zu klären, was eigentlich ein Leitzins ist. Und was sich nun geändert hat. Eine Notenbank benutzt einen Leitzins, um das gesamte Zinsniveau in einem Land zu beeinflussen – und damit indirekt den Gang der Wirtschaft.

Read More »

Read More »

How dovish can Swiss monetary policy go?

The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates.At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit, Italian budget disagreements…) have...

Read More »

Read More »

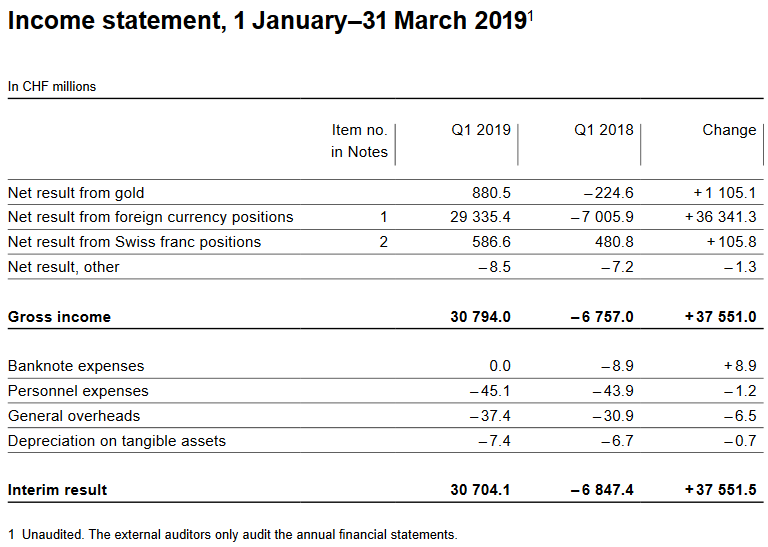

SNB Results: Big Win After Big Loss in Q4 2018

The Swiss National Bank reports a profit of CHF 30.7 billion for the first quarter of 2019. The profit on foreign currency positions amounted to CHF 29.3 billion. A valuation gain of CHF 0.9 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 0.6 billion.

Read More »

Read More »

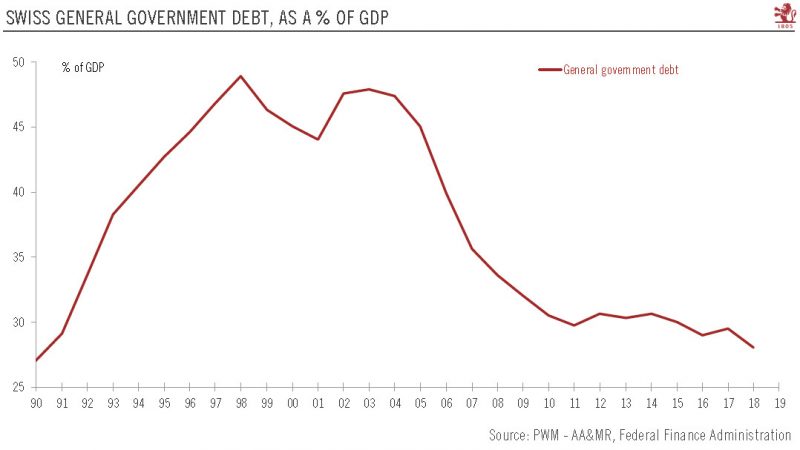

Swiss Policy Mix Review

The Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of CHF 2.9 billion, compared with budget projections for a surplus of CHF 295 million.

Read More »

Read More »

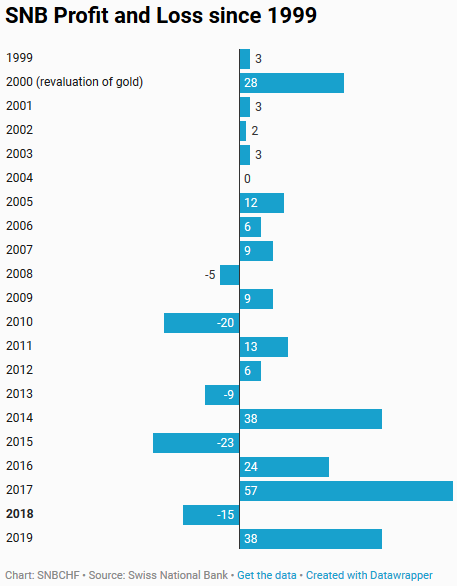

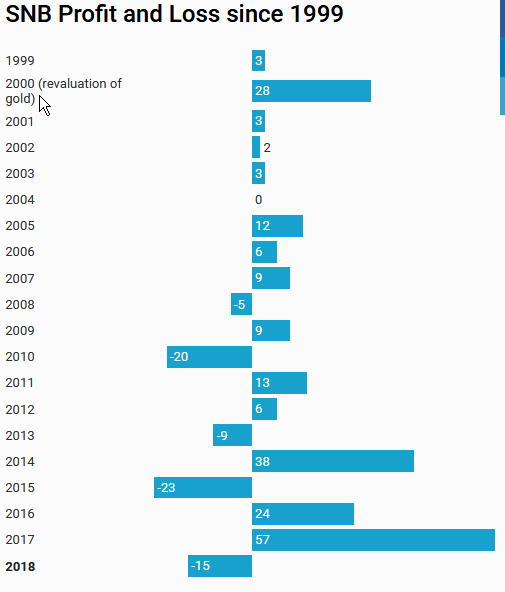

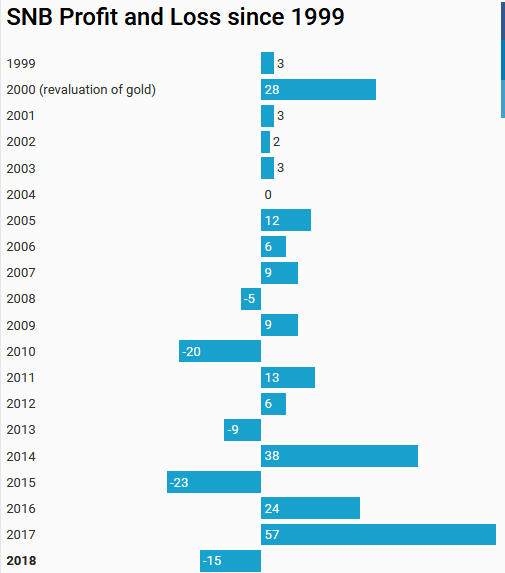

SNB loses 15 billion in 2018

The SNB earned 2 billion on negative interest rates (Swiss franc positions below), but lost nearly 17 billion CHF on FX investments, of which 5 bn on bonds and 12 bn on stocks. Gold was nearly unchanged.

Read More »

Read More »

Folgt nun der umgekehrte Frankenschock?

An ihrer ersten Sitzung im neuen Jahr hat die Europäische Zentralbank (EZB) ihren Kurs bestätigt. Das Wertschriftenkaufprogramm ist definitiv beendet. Fortan kauft sie netto keine zusätzlichen Anleihen mehr zu. Sondern sie ersetzt nur noch die bestehenden Papiere, die sie in ihrem Portefeuille hält.

Read More »

Read More »

SNB Grants Fintechs Access to SIC

In a press release the Swiss National Bank explains that it: "grants access to … [fintechs] that make a significant contribution to the fulfilment of the SNB’s statutory tasks, and whose admission does not pose any major risks.

Read More »

Read More »

Provisional Results 2018: Will the SNB ever make profits again?

15 Billion Francs Losses in 2018. Given that the good years have finished: Will the SNB will ever make profits again? And compensate for the ever rising Swiss franc?

Read More »

Read More »

Swiss National Bank Suffers $15 Billion Loss On 2018 Market Rout

In the third quarter of 2018, the hedge fund known as the Swiss National Bank did something it had not done in years: it sold stocks. As we showed in November, the overall value of the SNB's US listed long holdings rose by over $2 billion to $90 billion, but all of this was due to the price appreciation as the central bank sold around $7bn of equities in Q3. This compares to purchases during 1H18 of around $6bn.

Read More »

Read More »

SNB reports a loss of CHF 7.8 billion for third quarter of 2018

The Swiss National Bank (SNB) reports a loss of CHF 7.8 billion for the first three quarters of 2018. A valuation loss of CHF 3.7 billion was recorded on gold holdings. The loss on foreign currency positions amounted to CHF 5.3 billion. The profit on Swiss franc positions was CHF 1.5 billion.

Read More »

Read More »

Rückenwind für die SNB

Die Nationalbank hat die Schweizer Zahlungsbilanz für das zweite Quartal veröffentlicht. Damit bietet sich erstmals die Gelegenheit, nachzuprüfen, ob die viel zitierten Europaängste Fluchtkapital ins Land gespült haben. Zur Erinnerung: Im März wurde in Italien ein neues Parlament gewählt, die den beiden Europagegnern und Anti-Establishment-Formationen Movimento 5 Stelle und Lega eine Mehrheit bescherten.

Read More »

Read More »