Tag Archive: Swiss National Bank

SNB only major central bank missing at Jackson Hole, are important SNB decisions looming ?

The Jackson Hole Symposium is traditionally a meeting of global central bankers, here the 2010 attendance list. This year it takes place between August 30 and September 1. Central bankers assemble The annual economic symposium for central bankers staged by the Federal Reserve Bank of Kansas City begins in Jackson Hole, Colorado (until September 1). …

Read More »

Read More »

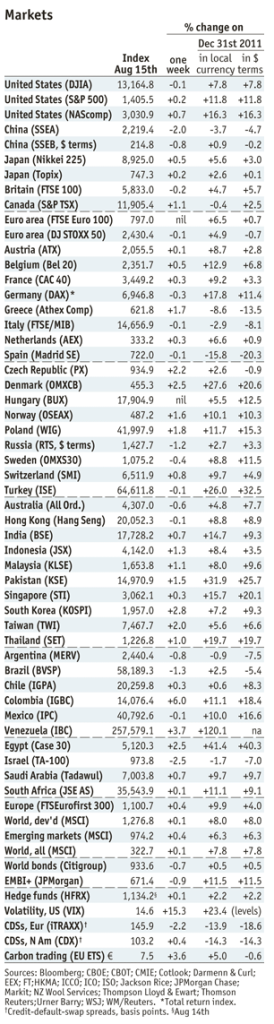

Net Speculative Positions , Global Markets and Outlook, week from August 20

Currency Positioning and Outlook, week from August 20 Submitted by Mark Chandler, from marctomarkets.com The market is like expectant parents who don’t know the gender of the fetus. They know something big is around the corner, but they don’t have enough information to make some important decisions. They can contemplate the future, but there …

Read More »

Read More »

How former central bankers stepped up against the central banks

There are already three former European central bankers who criticize more or less openly the European Central Bank (ECB).

Read More »

Read More »

EUR/CHF, A History of Interventions: What markets say, July 2012

More Chatter About The EUR/CHF Peg The FT reports that Switzerland is ‘new China’ in currencies Chatter that the SNB was buying 3 billion francs worth of euros per day. “The picture is one of a central bank that’s not coping with how much money is coming in,” said Kit Juckes, foreign currency analyst at Société … Continue reading »

Read More »

Read More »

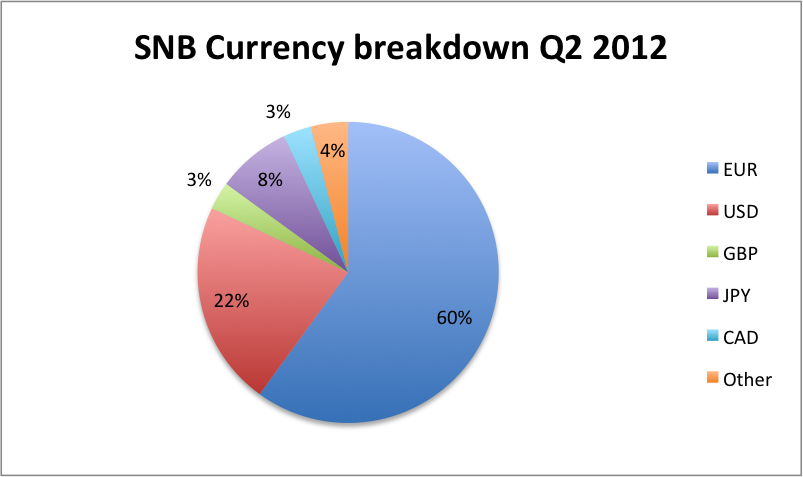

SNB zwingt jeden Schweizer implizit 73% seines Einkommens von 2012 in Euros anzulegen

Mit dem SNB Zwischenbericht heute wurde es klar, dass die Schweizerische Nationalbank 77% der im zweiten Quartal um 125 Milliarden Franken erhöhten Devisenreserven in Euro investiert hat. Die Abhängigkeit vom Euro ist so gross geworden, so dass die Schweiz gezwungen sein könnte, ein Teil der Eurozone zu werden, wenn sie einen riesigen Verlust vermeiden will. …

Read More »

Read More »

How Switzerland Implicitly Joins the Eurozone: SNB Obliges each Swiss to Invest 73% of 2012 income in Euros

The SNB forces each Swiss to invest 73% of each one's yearly income into Euros. Reason enough to join the Euro zone ?

Read More »

Read More »

SNB results: SNB invested 77% of the huge Q2 increase in reserves into Euros. Peg at risk ?

The Swiss National Bank (SNB) reported a profit of 6.5 billion Swiss Franc for the first half year (H1). After a loss of 1.7 bln. francs in the first quarter (Q1), it had a 8.2 billion profit for the second quarter (Q2). The Q2 SNB results of 8.2 bln. CHF were less than our … Continue reading »

Read More »

Read More »

SNB Results: SNB poised for 10 billion CHF quarterly profit

On July 31st the Swiss National Bank will publish interim results for the second quarter 2012. Already now we offer an estimate to our readers. Our estimate does not cover the central bank’s Forex trading results, they are difficult to estimate. A central bank is not a day trader, therefore the influence should be limited. …

Read More »

Read More »

SNB Zwischenbericht 2. Quartal 2012: Nationalbank möglicherweise mit mehr als 10 Milliarden Gewinn

Am 31. Juli um 7.30 Uhr wird die Schweizerische Nationalbank (SNB) den Zwischenbericht für das zweite Quartal 2012 herausgeben. Wir offerieren unseren Lesern schon jetzt eine Schätzung. Wir rechnen mit einem Gewinn von 10,65 Milliarden CHF dank der starken Erhöhung der Devisenreserven in den Monaten Mai und Juni und der Abschwächung des Franken gegenüber dem US-Dollar, …

Read More »

Read More »

Guest Post: Six Reasons Why Italy May Exit the Euro Before Spain; Ultimate Occupy Movement

Six Reasons Why Italy May Exit Before Spain

1) Rise of the Five Star Movement

2) 44% of Italians view the euro negatively, only 30% favorably. That is biggest negative spread in the eurozone. In Spain more view the euro positively than negative, albeit by a small 4 percentage point spread.

Read More »

Read More »

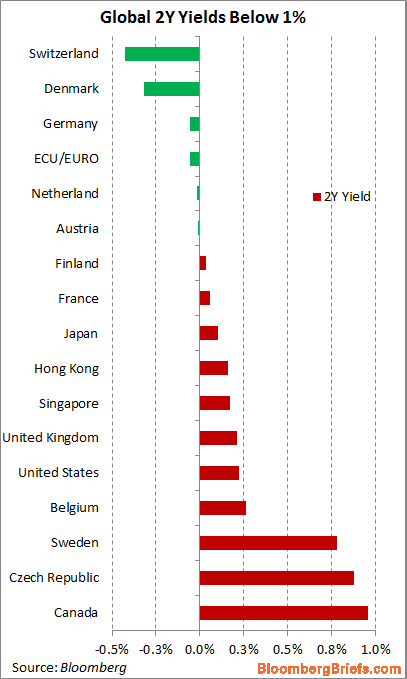

German Schatz turns negative again

After the first time End May, the German Schatz turns negative:

German June 2014 Schatz Average Yield -0.06% vs 0.10% on June 20

Swiss Eidgenossen 2yrs still at -0.4%

Read More »

Read More »

The End of Swiss and Japanese Deflation

At a time of speculations about global deflation, we show an interesting and very different aspect. Our CPI and wage data comparison among different developed countries, shows that Switzerland and Japan will see both inflation, whereas other countries like Australia will see disinflation.

Read More »

Read More »

German constitutional court needs 3 months to decide about the injunction

The German constitutional court will need up to 3 months for the injunction. Weidmann's critic on the ESM in detail. Estimations of German liability between 900 bln. and 2 trillion EUR.

Read More »

Read More »

German constitutional court injunction decision on ESM and the potential referendum

What is the injunction procedure of the German constitutional court exactly about. What are the arguments of the Anti-ESM and the Pro-ESM fractions ?

Read More »

Read More »

At EUR/CHF 1.10 SNB with 31 bln. loss, each Swiss losing 150 francs per week

The Swiss National Bank would realize a loss of 31 bln. francs, if it accepted a EUR/CHF exchange rate of 1.10 instead 1.20 and if we assume that the Swissie also appreciates against the dollar and other currencies

Read More »

Read More »

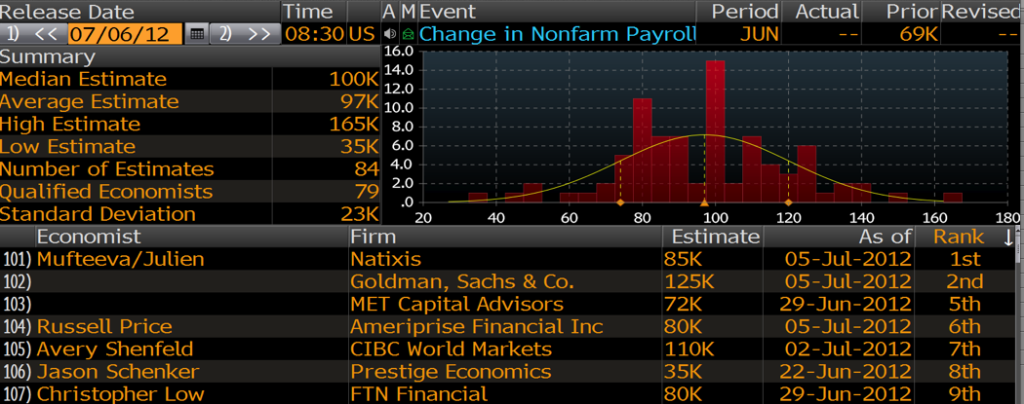

Non-Farm Payrolls: Today’s preview

A detailed comparison of Non-Farm Payroll estimators from six different sources, like Bloomberg, ISM, Department of Labor and ADP.

Read More »

Read More »

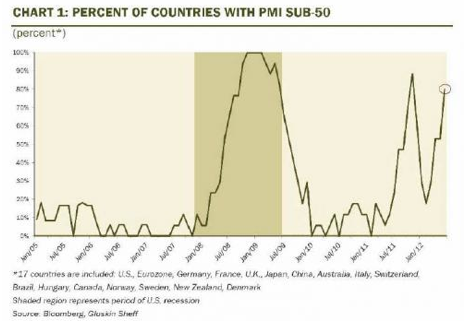

Global Macro with all Global PMIs July 4th

updated July 4,2012 This page inside our macro data menu contains global PMIs compared with the main risk indicators S&P500, Copper, Brent and AUD/USD as of the day after most PMIs came out. JP Morgan’s Global PMI: Click for details inside the table, History of composite PMI

Read More »

Read More »

Only 17% of German voters in favor of Eurobonds

Voters are strongly against many other European utopias The newest poll of the Forsa institute, here in the left-wing Stern and the conservative Welt, shows that Germans are strongly against Eurobonds and many more European “utopias”, as we called it. The German chancellor Angela Merkel recently connected her life with the fulfillment of the voters wish to …

Read More »

Read More »

EUR/CHF, A History of Interventions: What markets say, June 2012

SNB In A Bind With Euro Holdings Today’s reserve data showed skyrocketing reserves at the Swiss National Bank as they defend the EUR/CHF floor. Reserves were at 365B francs at the end of Q2 compared to 245B at the end of March, with all the growth coming in the final two months of the quarter … Continue reading »

Read More »

Read More »