Tag Archive: Swiss National Bank

Net Speculative Positions, Global Stock Markets, Week October 22

Submitted by Mark Chandler, from marctomarkets.com Our big picture view is that the US dollar is carving out an important bottom, after selling off in Q3 as policy makers moved to reduce the extreme tail risks. The position adjustment that inspired among investors appears to have largely run its course.This bottoming of the dollar is …

Read More »

Read More »

SNB Monetary Data Week October 12

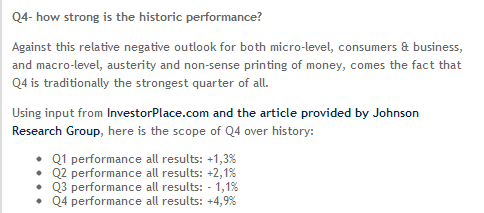

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks …

Read More »

Read More »

IMF Data: SNB Forex Reserves and Gold in September 2012

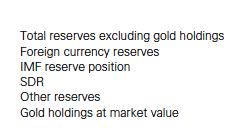

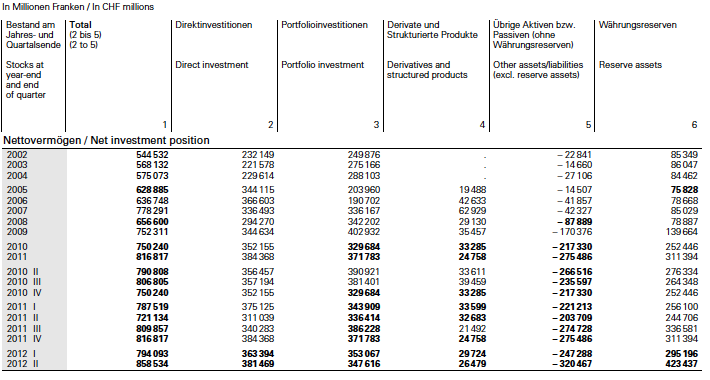

This link on the SNB website shows the data the central bank provides to the International Monetary Fund (IMF). It shows the SNB Forex and gold reserves in the last month. It is so-called “IMF Special Data Dissemination Standard (SNB Data)” It is released together with the international investment position, some monetary aggregates and the balance of payments two weeks after …

Read More »

Read More »

SNB Monetary Data Week October 5

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger and stocks rise over the autumn months …

Read More »

Read More »

SNB Monetary Data Week of September 28

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger over the autumn months till …

Read More »

Read More »

Standard and Poor’s critique of the Swiss National Bank, part 1

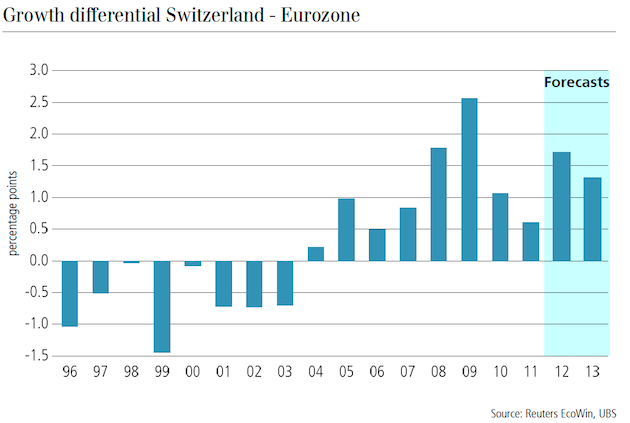

Part 1: Swiss investments abroad [This paper includes some of the S&P critique, but also aims to clarify some of S&P’s misleading points] Last Thursday Thomas Moser, a member of the Swiss National Bank (SNB) governing council, said that one of the main reasons for the strong franc is the conversion of Swiss foreign incomes …

Read More »

Read More »

Order the Full Report on the S&P Critique

In the full report we explain in detail how one can analyze the balance sheet of the Swiss National Bank (SNB) based on several sources of information, for example the monthly bulletin, which shows the changes of the SNB balance sheet and the quarterly distribution of the SNB assets including the information about FX … Continue reading...

Read More »

Read More »

Do Swiss companies prefer to hold cash at the SNB instead of local banks ?

The most recent SNB monetary data show that more and more companies are increasing their deposits at the central bank at a quicker speed than local banks. Might this be missing trust in the Swiss banking system ?

Read More »

Read More »

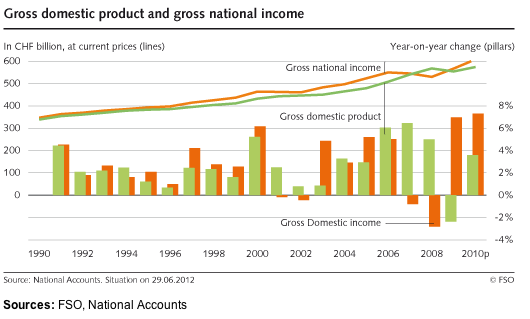

Swiss Net International Investment Position Increases by 64 Billion Francs

Swiss Gross National Income (GNI) rises by 1.8% in Q2, after Q1 +0.5% According to the latest SNB Monthly Bulletin, the Swiss net international investment position (NIIP) has improved by 64.5 billion francs. The Gross National Income (GNI) rises by 1.8% in Q2. The SNB currency reserves rose by 128 Bln. Francs in the …

Read More »

Read More »

Can The SNB Make Profit On Currency Reserves ?

Abstract We determine the main criteria with which markets evaluate currency prices. We focus on explaining the differences between the carry trade era (or like Ben Barnanke called it “The Great Moderation”) and the period after the financial crisis. Our research shows that each one of the following three main preconditions must be fulfilled, …

Read More »

Read More »

Are German Bunds finally heading for the big slide ?

Citibank judges that the Swiss National Bank (SNB) does not need a peg anymore. The EUR/CHF exchange rate would be now over 1.20 even if exposed to the free market. Yesterday we showed that the upward move in the EUR/CHF is just the behavior of some euphoric Forex traders. In the meantime we see a completely … Continue reading »

Read More »

Read More »

Isn’t it wonderful to trade with a strong central bank behind you?

Isn’t it wonderful to have a strong central bank like the SNB sitting behind you when trading Forex? Losses are limited to the floor of 1.20 and in the meantime you can gain forward swaps with the higher euro zone interest rates. Today the Swiss National Bank (SNB) decided in its monetary policy assessment …

Read More »

Read More »

The next SNB rumor: Wall Street Journal and our response

A bit breathlessly…. The next SNB rumor story comes from the so-well established Wall Street Journal, its columnist Nick Hastings. WSJ: The Swiss National Bank was bold before. And the central bank would be well advised to be just as bold again. When the SNB announced just over a year ago that it was setting a …

Read More »

Read More »

SNB prints nearly 5 billion francs in one week, FX traders poised to get ripped off

As we expected in our post “What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?“, long-time investors, global macro funds and US investment banks are moving into gold and the Swiss franc again. The SNB had to buy euros and print new Swiss francs of around 5 billion francs last week, as … Continue reading »

Read More »

Read More »

What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?

On Friday there was a big movement in the EUR/CHF. First it went up to 1.2154, fell later down to 1.2080 in the main American trading and rose again to 1.21 in the low-volume trading time. We repeat our entry from Friday, because we continuously updated the post after new developments, e.g. after the … Continue reading »

Read More »

Read More »

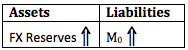

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

In this post we show that the risks the Fed, the ECB and the Bundesbank incur are far smaller than the one the Swiss SNB takes. The Fed has “just” an inflation risk, that could cost 200 billion US$, 1.2% of US GDP. The ECB and Bundesbank have the risk that the euro zone splits … Continue reading »

Read More »

Read More »

Net Speculative Positions, Technical Outlook, Global Markets Ahead of Eventful Week September 3rd

Submitted by Mark Chandler, from marctomarkets.com The week ahead kicks off what we expect to be a period of intense event risk. The combination of positioning, judging from the futures market and anecdotal reports, and the low implied volatility in currencies and equity markets warn of heightened risk in the period ahead. The week begins …

Read More »

Read More »

The Full English Translation of the Interview with Thomas Jordan

Here a translation of the interview with the president of the Swiss National Bank, Thomas Jordan, in the finance magazine ECO of the Swiss television SF1. Here the original German video. Question: Given that the SNB has reserves of over 200 bln. Euros, are you still able to sleep ? Jordan: We are in a … Continue reading...

Read More »

Read More »

The Swiss television interview with Thomas Jordan, or was it Leonid Brezhnev ?

Today Thomas Jordan gave a quick interview in the Swiss television. Everything was so well prepared and as sterilized. Thomas Jordan learned all answers by heart and was answered the questions about one second after the question was asked. It reminded me of an interview in Soviet television with former Soviet leader Leonid Brezhnev. Each …

Read More »

Read More »