Tag Archive: Swiss National Bank

Warum die SNB nicht Hongkong, sondern Singapur imitieren wird

Im Gegensatz zu Hongkong mit dem USD/HKD-Peg kann die Schweiz ein Currency Board, einen fixen Kurs zum Euro nicht für Jahre durchhalten. Die Gründe auf snbchf.com

Read More »

Read More »

‘Negative’ has such unfairly negative connotations

Dear people, ATTENTION: HEAD OF FINANCIAL INSTITUTIONS/NETWORKMANAGEMENT/TREASURY AND/OR CASH MANAGEMENT FURTHER TO OUR SWIFT DATED 26 08 2011 PLEASE BE INFORMED THAT DUE TO THE CONTINUED PREVAILING MARKET SITUATION AFFECTING THE SWISS FRANC, WE HAVE...

Read More »

Read More »

The Euro Crisis: Details and chronology and the German Perspective on it

The history of EU reforms, bailouts during the euro crisis and the German perspective on them

Read More »

Read More »

SNB Losses in October and November: 8.4 Billion Francs, 1.5% of GDP

According to the SNB balance sheet and the SNB data delivery to the IMF, the central bank lost 8.4 billion francs of equity in the months of October and November, the equivalent of 1.5% of Swiss GDP. Details SNBCHF.COM

Read More »

Read More »

How Currency Speculators Help the SNB to Fight against Ordinary Investors

A discussion in the investor forum made clear how currency speculators currently help the SNB to maintain the floor against normal investors. A situation that was different in August/September 2011, when the SNB had to fight against these speculators. A discussion in the investor forum Seeking Alpha: part one Based on our analysis of …

Read More »

Read More »

Credit Suisse and UBS Will Charge Negative Interests Above a Threshold

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such was worth 150 bps, this year on 28 bps. See the official news at FT Alphaville

Read More »

Read More »

Gold, CHF, Brent Arbitrage Trading after Negative CS, UBS Interest Rates

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such news was worth 250 bps, on December 3 only 28 bips. One remembers August 26, 2011, when UBS only spoke of negative interests and consequently EUR/CHF rose from 1.1420 to 1.1688. At the time FX traders …

Read More »

Read More »

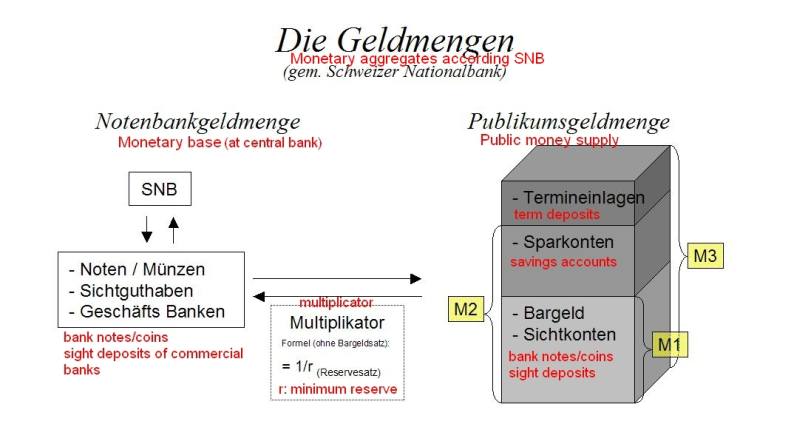

SNB Sight Deposits Week November 16

Total sight deposits at the SNB rose by 0.5 billion to a total of 373 bn. francs in the week ending on November 16th. "Other sight deposits", the ones of foreign banks and Swiss companies, fell by 600 million francs, but the ones of local institutes increased by more than 1 billion francs.

See full detail on our explanation, historical and our expected development of

Read More »

Read More »

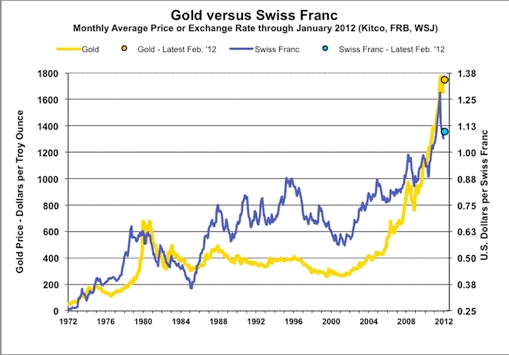

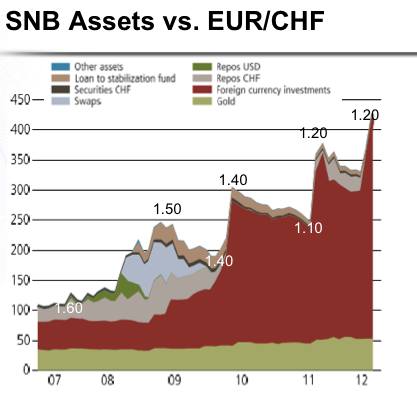

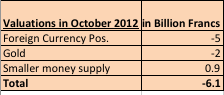

SNB Valuation Losses in October: Around 6 Billion Francs

The Swiss National Bank (SNB) had valuation losses of around 6 billion francs in October due to the weaker EUR/CHF exchange rate and a weaker gold price.

Read More »

Read More »

Die Wiederwahl Obamas bedeutet nichts Gutes für die Schweiz

Barack Obama war und ist der präferierte Kandidat vieler Schweizer. Obama scheint der Mann von Welt zu sein, während vom konservativen Mitt Romney eher feindselige Politik gegen Russland, China und Iran zu erwarten ist. Daher sind die Neutralität- und Frieden-liebenden Schweizer eher auf Obamas Seite. Aber auch wirtschaftspolitisch scheinen viele Eidgenossen Obama zu mögen. …

Read More »

Read More »

Jordan: Dropping Peg Is Premature

The Swiss National Bank's cap on the franc of 1.20 per euro remains the right policy tool for now and talk of dropping it is premature, Chairman Thomas Jordan said. See Reuters

Read More »

Read More »

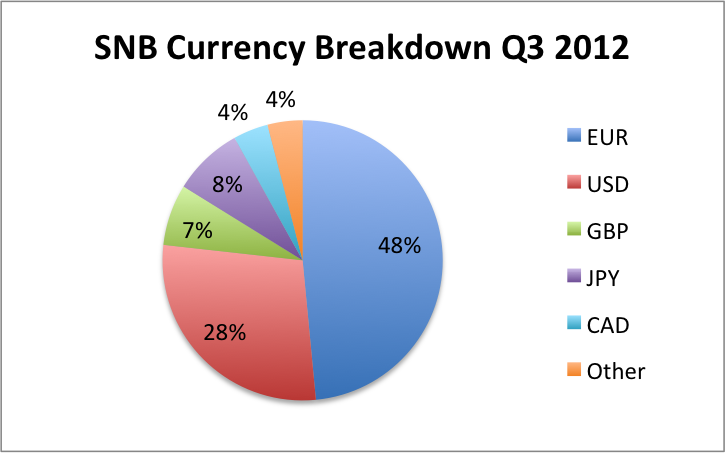

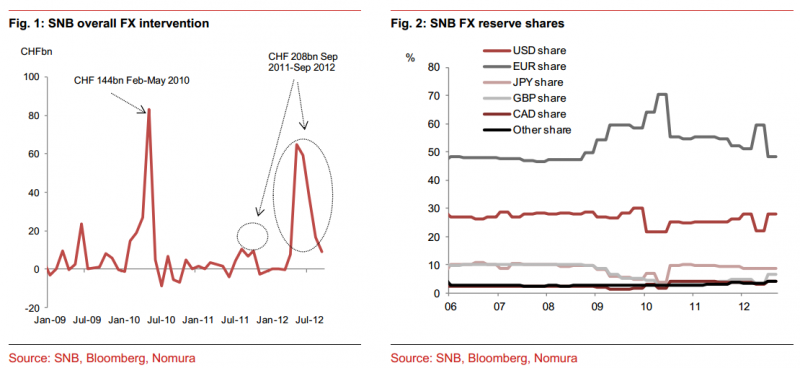

SNB Results Q3 2012: SNB Radically Reduces Euro Share from 60% to 48%

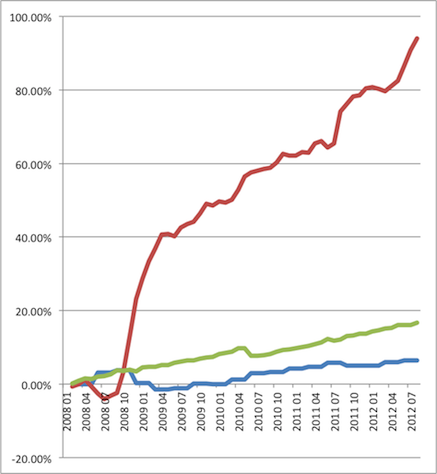

SNB Q3 Profits: 10 billion francs The Swiss National Bank (SNB) radically reduced its euro share, in the third quarter from 60% to 48%, and bought US dollars and sterling instead. In the second quarter, however, it increased the euro share from 51% to 60% and concentrated on buying euros. Given that the EUR/USD was … Continue reading...

Read More »

Read More »

The Swiss National Bank straddle

It’s Swiss National Bank reserve figures Wednesday! That glorious day when we get to see how exactly the ingredients of the SNB’s cake have changed. Or to put it more literally, how have they been dealing with the masses of euro assets they are colle...

Read More »

Read More »

How the SNB Destroyed Ashraf Laidi’s EUR/USD 1.35 Party

Trend Follower Ashraf Laidi Loses Against the Contrarian Investor SNB The currency strategist Ashraf Laidi recently evoked a EUR/USD exchange rate of 1.35 thanks to the risk appetite after the easing operations of the Fed and the ECB. We show that he and the masses of his Forex rooters actually traded against a big central …

Read More »

Read More »

SNB Monetary Data Week October 26

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Despite the seasonal effects between October and March, the SNB is not able to sell currency reserves consistently. Traditionally the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was possibly already anticipated …

Read More »

Read More »

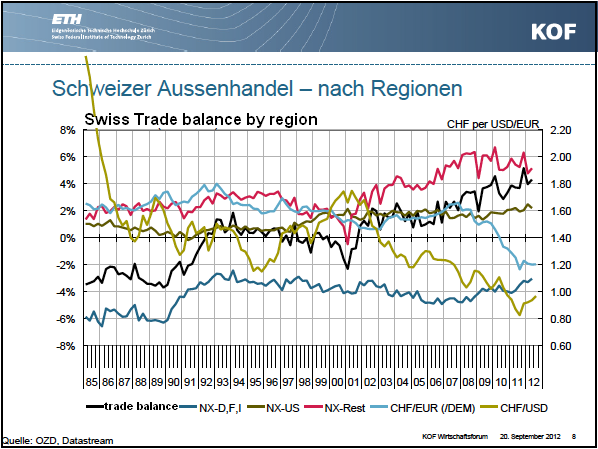

Swiss Exports Rise Thanks to Higher Export Prices. Sorry, What ????

Or how Swiss exporters are able to widen their margins thanks to the SNB currency manipulation Last week the Swiss export data for the third quarter was released. The news agency report was simple: Exports from Switzerland fell by a real 8.0 percent in September to 16.49 billion Swiss francs ($17.87 billion), the Federal …

Read More »

Read More »

SNB Monetary Data Week October 19

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was …

Read More »

Read More »