Trend Follower Ashraf Laidi Loses Against the Contrarian Investor SNB

The currency strategist Ashraf Laidi recently evoked a EUR/USD exchange rate of 1.35 thanks to the risk appetite after the easing operations of the Fed and the ECB. We show that he and the masses of his Forex rooters actually traded against a big central bank, that did not believe in the success of the easing operations and that bought masses of US dollars instead.

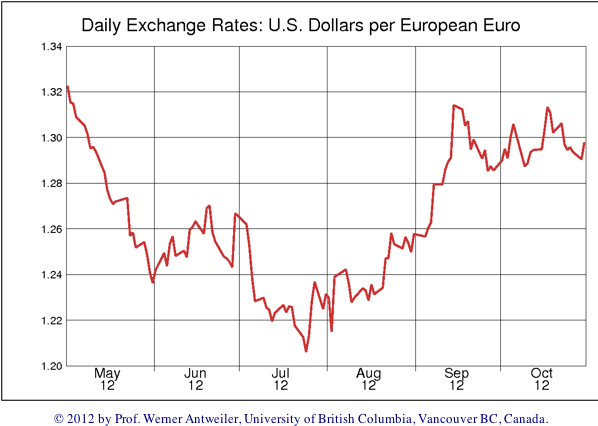

He thought that history repeats, namely the EUR/USD would move like it did after QE2. Between September and November 2010 the exchange rate rose from 1.30 to 1.40.

On September 18, 2012 he spoke of a bottoming out of the EUR/USD to above 1.30.

On September 24 he explained why the EUR/USD should rise to 1.35.

His last try to repeat his EUR/USD 1.35 target was on October 16.

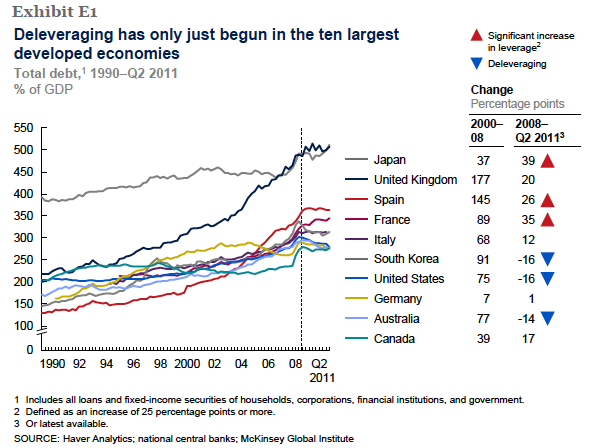

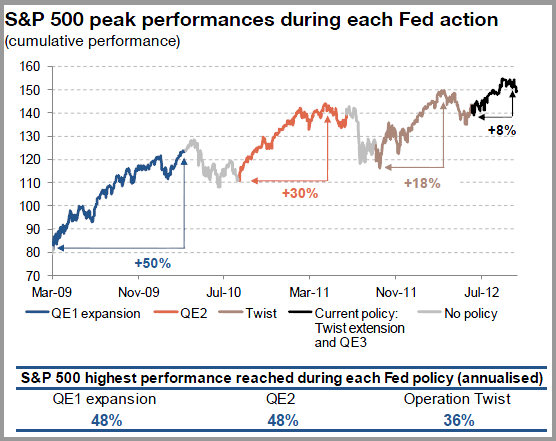

Opposed to Laidi’s view, we maintained our contrarian points, namely that the funds of QE3 would remain in the United States this time and would not pour into Asia and Europe. The reasons are for us that QE3 focused on mortgage-backed securities and not like QE2 on treasuries. Moreover, the euro crisis really started in 2011 and the US is already five years away from the start of its crisis. De-leveraging has really started in Spain and Portugal in 2011 and will affect other countries like France and Belgium, whereas in the US home prices show an uptrend.

(click to expand)

As opposed to 2010, when growth in Asia and Germany was accelerating already before QE2, it has slowed considerably now. The economists at the Swiss National Bank (SNB) were of our opinion and destroyed Laidis “1.35 party”. They bought masses of dollars and British pounds, probably when the monetary easing came and EUR/USD rose over 1.30.

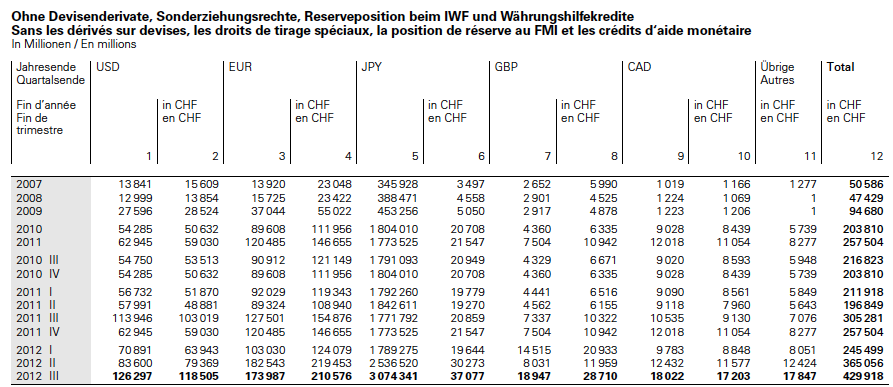

The central bank reduced the share of euros in the third quarter substantially from 60% in Q2 to 48% and increased dollar and pound positions. The SNB bought 80 billion euros when the common currency was trading around 1.24$, especially at the end of May and in June (see “2012 II” figures below). Given that the euro was even cheaper against the dollar in July and that the SNB was probably informed about the upcoming monetary easing of other central banks, we think that it added even more euros in July.

Therefore we reckon that a big part of the additional 50 billion CHF forex reserves in July went into the euro, possibly up to 31 billion €, a point that could be proven by the huge SNB Forex trading profit in Q3.

(click to expand)

But after the ECB and the Fed promised monetary easing, the SNB used the moment to exchange many euros into the dollar and the pound at prices of around 1.30 US$. It bought at least 43 billion dollars and 10 billion pounds in the third quarter (see “2012 III” above), but reduced euro holdings by 9 billion €. Considering more big SNB euro purchases in July, the real number might be far more elevated and could reach 40 billion euros sold and 70 billion dollars bought between the beginning of August and the end of September.

Based on the 5% difference between EUR/USD 1.24 and 1.30 and 40 billion euros exchanged into dollars and pounds, we judge that the SNB made trading gains of 2 billion €, a big part of the 5.2 billion CHF foreign exchange rate income in Q3/2012.

Decomposition into Currencies

The decomposition shows that the SNB underweights euro positions even against the Q1/2012, the 2011 percentage of 52% and the 2010 value of 55%. And the reason is not that the euro is currently extraordinarily cheap against the dollar, like in Q2/2012. In both year-end 2010 and year-end 2011 EUR/USD traded around 1.30.

It is clear that Mr Laidi and his followers did not have a chance to reach 1.35 against this masses of euros sold and dollars bought by a major central bank. In the meantime the europhoria had vanished and traders concentrate on fundamental data which has by far not improved so well like in the months after QE2. Or as Zerohedge puts it: The shrinking half-life of central bank’s interventions:

Are you the author? Previous post See more for Next post

Tags: Central Bank,currencies,decomposition,QE2,Reserves,results,Swiss National Bank