Tag Archive: Swiss National Bank

SNB Balance Sheet Expansion

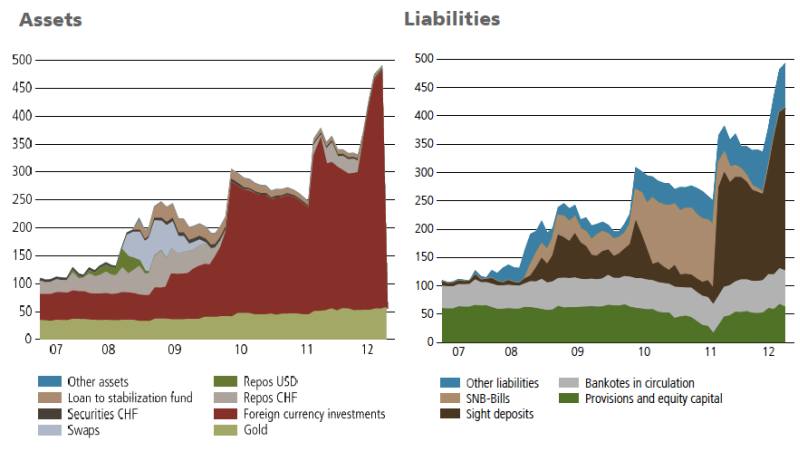

Since 2008 the balance sheet of the Swiss National Bank is 280% higher, this is the equivalent of 60% of Swiss GDP. So did most other central banks, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

Swiss National Bank Monetary Policy Mandate – 2007 version vs. today

The mandate of the Swiss National Bank is concentrated on price stability, i.e. less than 2% inflation and to avoid deflation.

Read More »

Read More »

ECB rate cut creates complex situation for SNB

Says Thomas Jordan.

Need to wait to assess impact of ECB rate cut

Wasn’t totally surprised by the cut

Interest rates will remain low in Switzerland

Low rates may lead to property bubble risk which SNB will respond to if necessary

SNB monitoring property market which is already in difficult situation

I did wonder about the lack of movement in EUR/CHF yesterday considering that nearly every other euro pair took a hit. It’s either become the...

Read More »

Read More »

Weekly Newspaper on Swiss National Bank and Swiss Franc

Feel free to click into the other categories “politics”, “business”, #chf, #snb in order to see more articles.

Read More »

Read More »

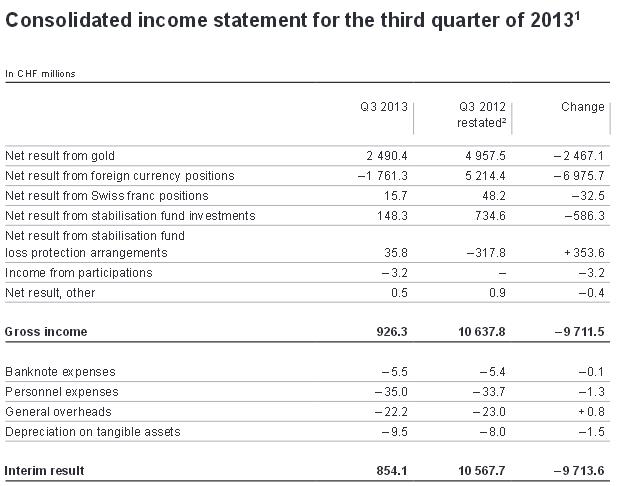

In Which Positions Does the SNB Win and Where Does it Lose Money: Details on the Q3 Results

UPDATE October 31, The official press release focused on the results for Q1 to Q3. The loss was 6.4 billion after a 7.3 bln. CHF loss in the first two quarters. Over all three quarters especially gold and the yen weakened the central bank’s positions. For the third quarter, it means that income was positive … Continue reading »

Read More »

Read More »

Weekly Newspaper on Swiss National Bank, Edition October 28

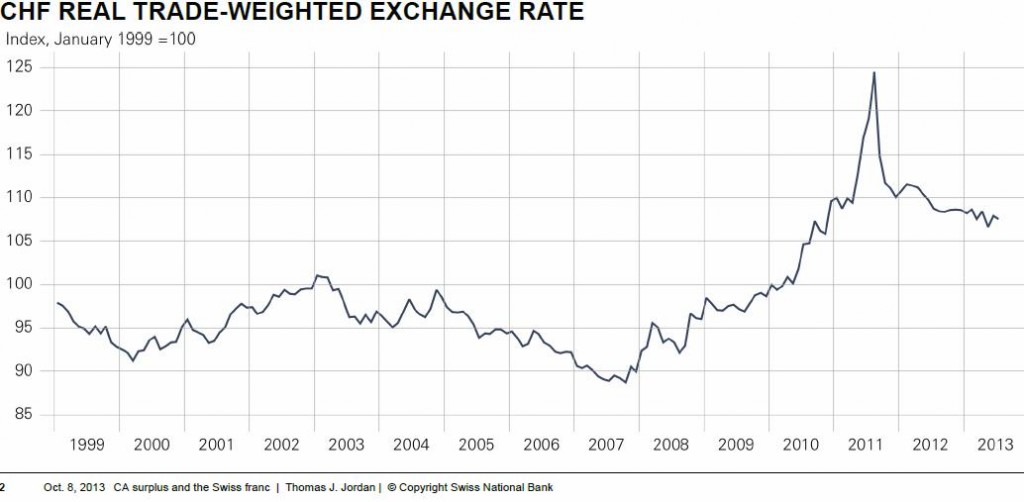

The SNB recently published the latest real effective exchange rate (REER). According to that the franc was only 7% overvalued against the base year 1999. Credit Suisse (CS) has taken some more factors than the REER under consideration: for them the fair value of the EUR/CHF is now 1.22, while the dollar was still undervalued. …

Read More »

Read More »

Danthine: SNB would end franc cap once it raises interest rates

It was obvious already at the latest SNB Monetary Policy Assessment, the SNB is becoming more and more hawkish. At the forefront is its ueber-hawk Jean-Pierre Danthine, the person responsible for the overheating Swiss housing market. He has now announced: SNB would end franc limit once it raises interest rates The Swiss National Bank will …

Read More »

Read More »

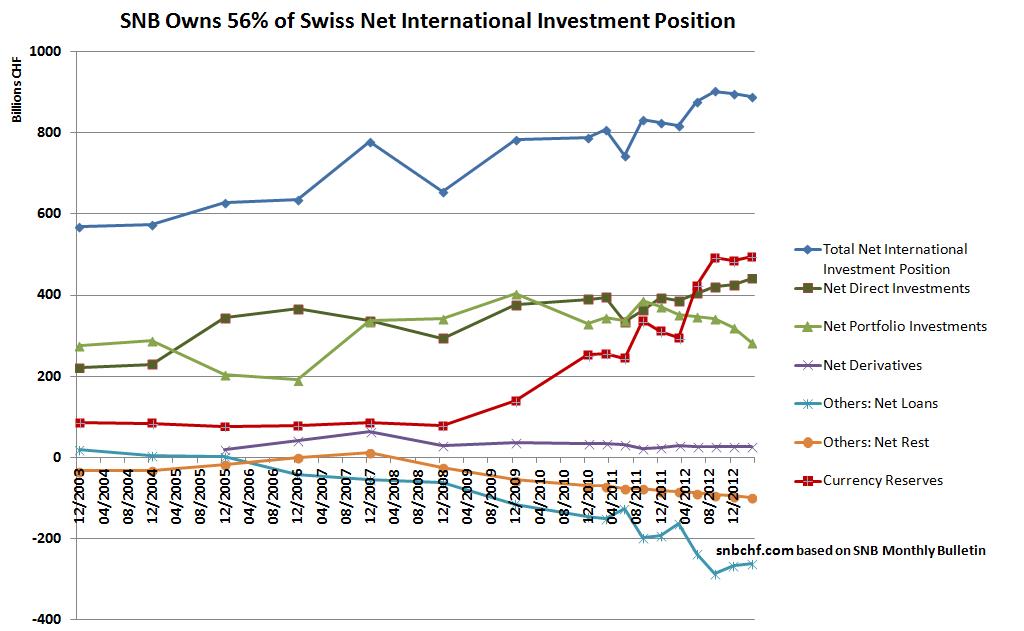

A Nationalization of Swiss Foreign Assets? SNB Owns 56% of Swiss Net International Investment Position

The SNB currently owns 56% of the Swiss net international investment position (“NIIP”). In the year 2007 this number was only 12%. Is the central bank implicitly nationalizing the Swiss international companies?

Read More »

Read More »

Our Detailed Estimate of SNB Q2 Results: 17 Billion Francs Loss, The Reality 18 Billion

UPDATE: July 30th, 2013: Our estimate for the quarterly loss missed the reality by 1 billion francs. The quarter results: 18.3 billion francs loss. The loss for H1 was 7.3 billion CHF. July 1st 2013: We estimate that the Swiss National Bank (SNB) obtained a loss of 17.3 billion francs in the second quarter 2013. … Continue reading »

Read More »

Read More »

Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years

The Swiss ZEW investor sentiment has risen to 4.8 by 2.6 points, news that do not influence markets. More interesting is the following: Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years * Majority see no change in euro/franc for next 6 months (Reuters) – The Swiss National Bank will most … Continue reading »

Read More »

Read More »

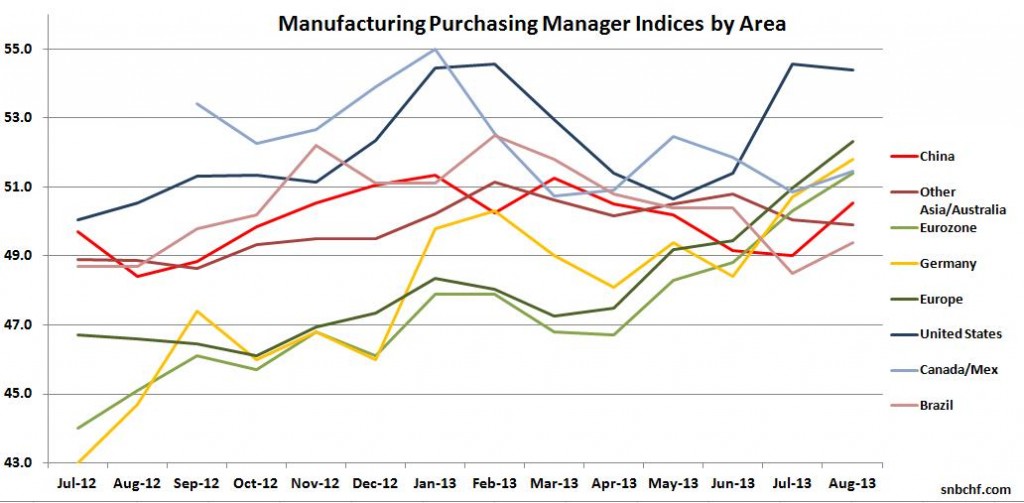

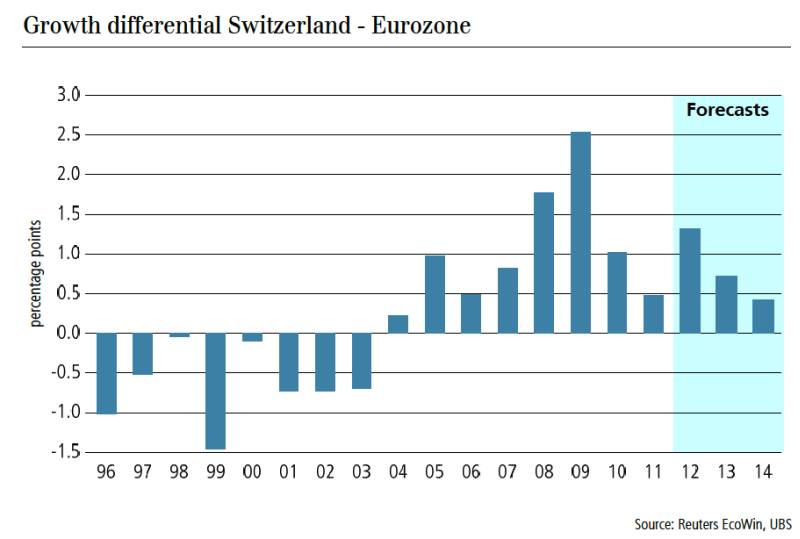

SNB Monetary Assessment June 2013: Very risk-averse, nearly hawkish tone

The Swiss National Bank (SNB) delivered a, for her standards, very hawkish monetary assessment with the focus on the risks in the financial sector. This does not come as a surprise for us. Each time, after the United States has recovered from a crisis – just like now – inflation and risks increased in Switzerland. …

Read More »

Read More »

Danthine’s Latest Statements Imply that SNB Might Remove Cap in 2014

SNB Vice Chairman Jean-Pierre Danthine is undoubtedly the most hawkish member of the governing board, an opposite personality to the rather interventionist and Keynesian hedge fund manager Philip Hildebrand. Danthine has perfectly understood that times for the SNB might get hard again in 2014. Jean-Pierre Danthine has made some comments recently: – Swiss franc stays …

Read More »

Read More »

SNB to Follow the Bank of Japan? Part1

Questions to George Dorgan Is there any chance that the SNB or other central banks could follow the BOJ and just depreciate the currency? George Dorgan: What did the BoJ do? Monetary easing and talk down the yen in a mercantilist style. A central bank is able to talk down a currency only if there … Continue reading »

Read More »

Read More »