Tag Archive: Swiss National Bank

Negative and the War On Cash, Part 2: “Closing The Escape Routes”

History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966:

Read More »

Read More »

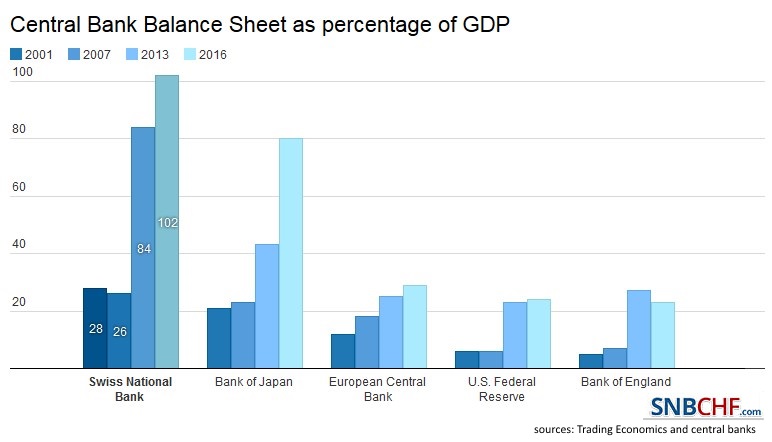

SNB Balance Sheet Now Over 100 percent GDP

Since 2008 the balance sheet of the Swiss National Bank has risen from 28% to 102% of Swiss GDP. Balance sheets of other central banks have strongly risen, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

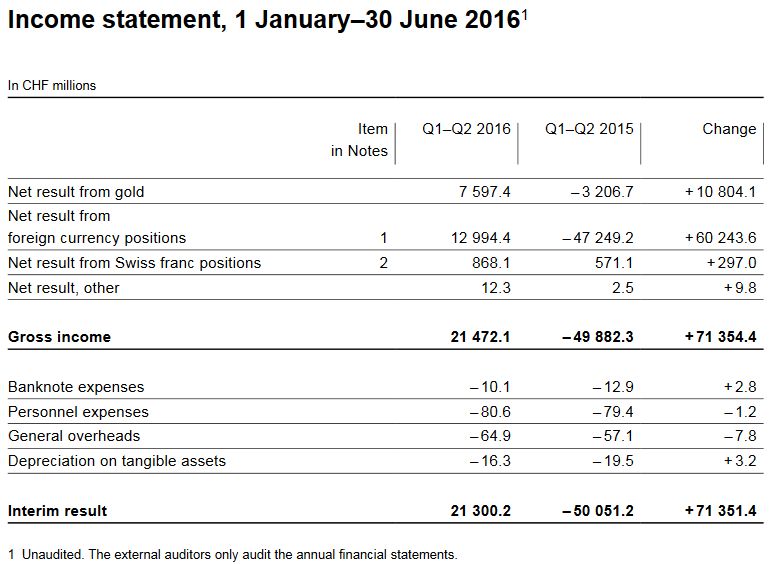

Interim results of the Swiss National Bank as at 30 June 2016

The Swiss National Bank (SNB) reports a profit of CHF 21.3 billion for the first half of 2016. A valuation gain of CHF 7.6 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 13.0 billion.

Read More »

Read More »

Swiss National Bank’s U.S. equity holdings hit record $61.8 billion last quarter

The value of the Swiss National Bank’s U.S. stock portfolio jumped to a record in June, helped by equity market gains. The holdings climbed to $61.8 billion from $54.5 billion at the end of March, according to calculations by Bloomberg based on the central bank’s regulatory filing to the U.S. Securities and Exchange Commission and published on Wednesday.

Read More »

Read More »

Spiritus rector des kranken Bonussystems ist Oswald Grübel

97 Franken – das war der Kurs der CS-Aktie im Mai 2007. Vergangene Woche notierte die Aktie noch bei einem Zehntel. Bei einem solch dramatischen Kurszerfall muss die CS sich nicht wundern, wenn kritische Fragen gestellt werden. Weshalb beträgt der aktuelle Wert der CS-Titel nur noch rund die Hälfte des in der Bilanz ausgewiesenen? Besteht die Gefahr eines Konkurses der CS? Wer wird dieses Too Big To Fail-Institut allenfalls retten? Die SNB, der...

Read More »

Read More »

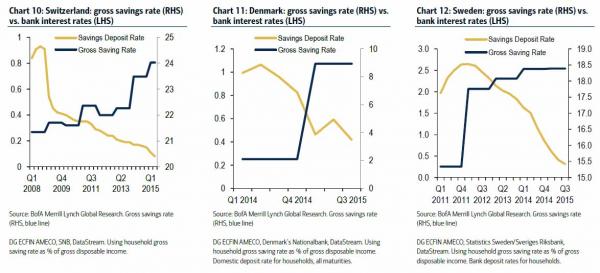

In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal.

Read More »

Read More »

Central Banks & Governments and their gold coin holdings

While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves.

Read More »

Read More »

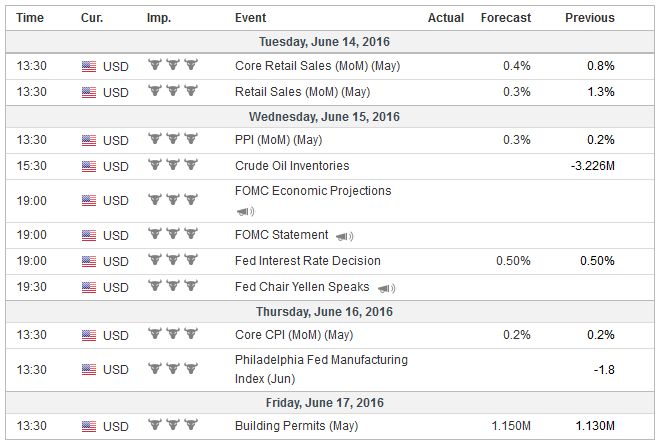

FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four

central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials

were preparing the market for a summer hike. Risks of a new downturn in

Japan spurred spe...

Read More »

Read More »

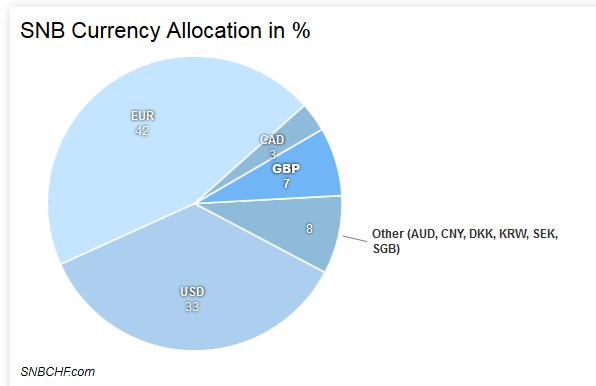

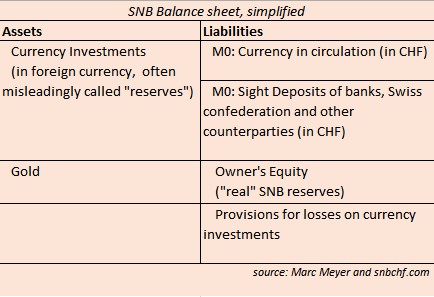

Swiss Reserves: Not what They Seem

This posts shows again the stupidity of the financial media, that mixes up assets and liabilities for central banks.

SNB FX reserves are assets. They are in different foreign currencies and subject to the valuation effect of these currencies.

Read More »

Read More »

Nigeria Currency Devaluation Looms As FX Forwards Crash To Record Lows

Despite US equity investors' exuberance over bouncing crude oil prices, the world's crude producers continue to suffer and while Venezuela is in the headlines every day (having already collapsed into chaos), Nigeria appears the nearest to that abyss ...

Read More »

Read More »

Three unintended consequences of NIRP

Central bankers use low or negative interest rates so that it leads to more investment. For them interest rates are a consequence of the currently very low inflation rates. Patrick Watson argues differently: Falling prices are a consequence of low interest rates.

Read More »

Read More »

Apple Jumps After Berkshire Reveals 9.8 Million Share Stake

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. Some hope for the Swiss National Bank or will Berkshire shares sink together with Apple and the SNB?

Read More »

Read More »

As Carl Icahn Was Selling Apple, This Central Bank Was Furiously Buying

We hope for the sake of Swiss residents that equity markets never suffer a dramatic drop. The SNB has “invested” 20% of Swiss GDP in stocks. When will the ivory tower economists ultimately lose control of the most manipulated, centrally-planned market in history?

Read More »

Read More »

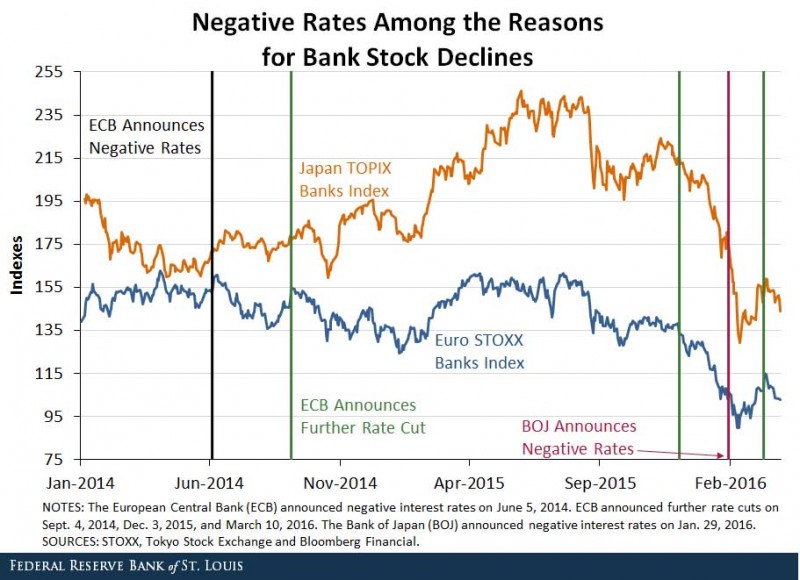

St. Louis Fed Slams Draghi, Kuroda – “Negative Rates Are Taxes In Sheep’s Clothing”

"At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?" Those are the shocking wor...

Read More »

Read More »

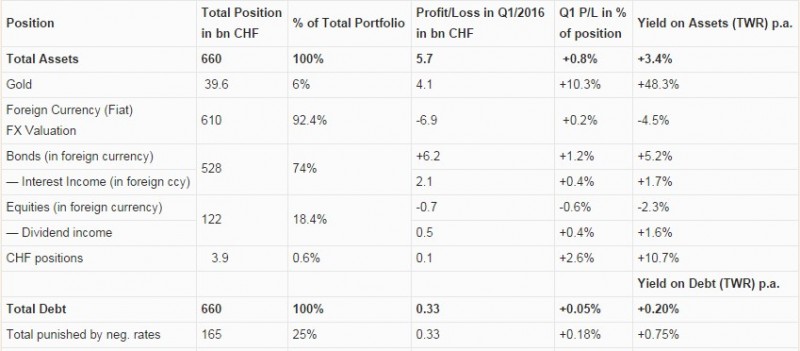

Gold, Bonds and Negative Interest Rates Give SNB a Q1 profit

SNB Results Q1 2016: Two thirds of SNB profit comes from Gold. Deflation helps with higher bonds prices and profit on negative interest rates.

Read More »

Read More »

With Tech Tanking, Can Anything Save The System?

Submitted by John Rubino via DollarCollapse.com,

First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing t...

Read More »

Read More »

Wall Street and SNB In Pain: 163 Hedge Funds Are Long AAPL Stock

First it was the blow up of hedge fund darling Valeant that crushed countless funds who were long the name.

Then, one month ago after the collapse of the Allergan-Pfizer deal, we showed (one of the reasons) why the hedge fund world continued to unde...

Read More »

Read More »

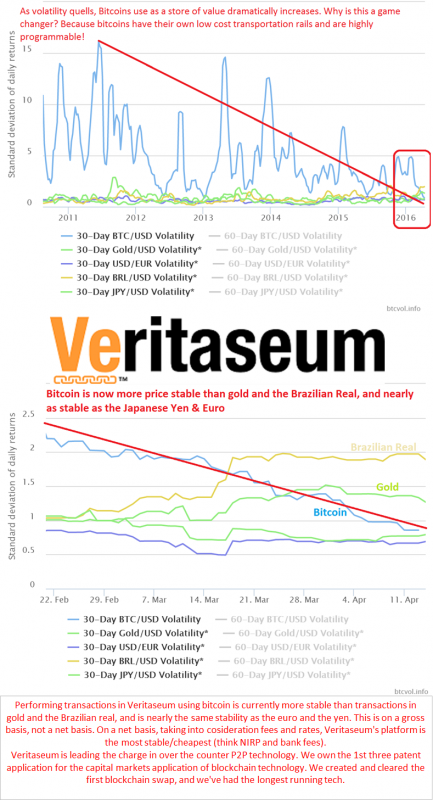

A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swis...

Read More »

Read More »