In the third quarter of 2018, the hedge fund known as the Swiss National Bank did something it had not done in years: it sold stocks. As we showed in November, the overall value of the SNB's US listed long holdings rose by over $2 billion to $90 billion, but all of this was due to the price appreciation as the central bank sold around $7bn of equities in Q3. This compares to purchases during 1H18 of around $6bn.

Read More »

Tag Archive: SNB Holdings

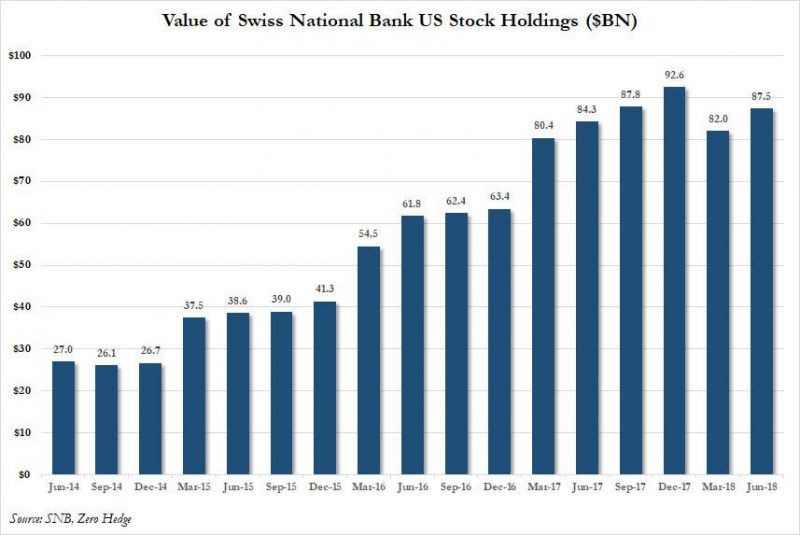

The Swiss National Bank Now Owns $87.5 Billion In US Stocks After Q2 Tech Buying Spree

In the second quarter of 2018, one in which the global economy was shaken by the rapid escalation of Trump's trade war, and in which central banks were one after another hinting at their own QE tapering and rate hiking intentions to follow in the Fed's footsteps, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using "money" that was freshly printed out of thin air, and...

Read More »

Read More »

In Unprecedented Intervention, Swiss Central Bank Bails Out Firm That Prints Swiss Banknotes

In the most ironic story of the day, the company that makes the paper that Swiss banknotes are printed on was just bailed out by the money-printing, stock-purchasing, plunge-protecting, savior-of-global equities…Swiss National Bank. While The SNB has a long and checkered history of buying shares in companies… as we have detailed numerous times.

Read More »

Read More »

SNB: It’s A Bonfire Of The Absurdities

This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my head now and then to “WTF” moments several times a week.

Read More »

Read More »

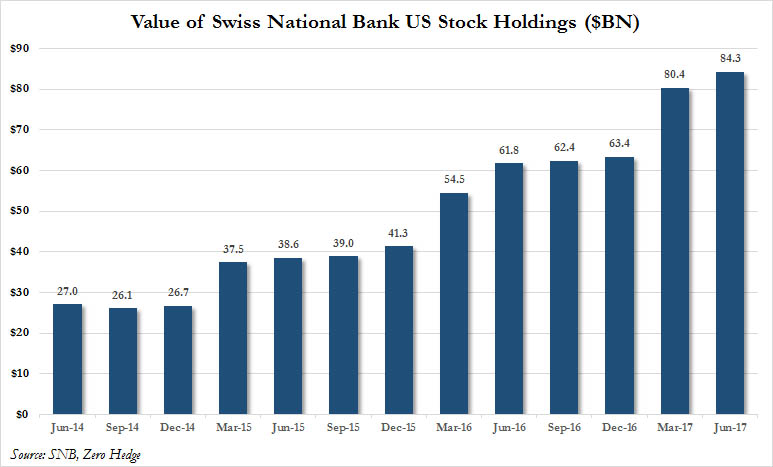

“Mystery” Central Bank Buyer Revealed: SNB Now Owns A Record $84 Billion In US Stocks

In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks and into European and Emerging Markets, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks.

Read More »

Read More »

The SNB’s Currency Interventions

On the FT’s Alphaville blog, Matthew Klein reviews Swiss monetary policy over the last years and its effect on the real economy. He concludes that - it seems the SNB’s relentless accumulation of foreign assets has been pointless — at best. More likely, the behaviour qualifies as predatory mercantilism at the expense of the rest of the world, especially Switzerland’s hard-hit neighbours.

Read More »

Read More »

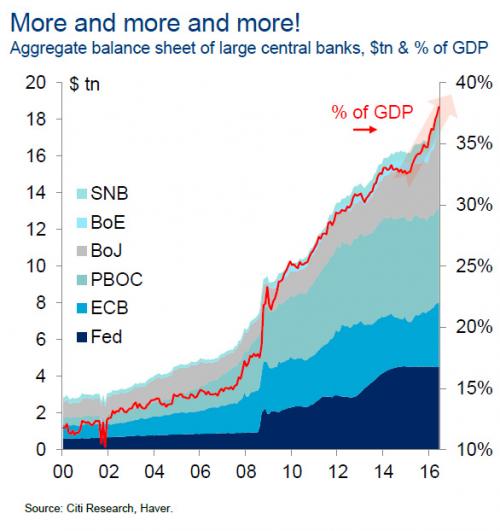

A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, "the largest CB buying on record."

Read More »

Read More »

Is Someone Trying To Buy The Swiss National Bank?

By now it is well-known that as we profiled previously, one of the most ravenous buyers of US stocks in recent years, has been a central bank: the Swiss National Bank... However, it is far less known that not only is the Swiss National Bank also a publicly traded stock, but is also one of the best performing stocks in the world this year.

Read More »

Read More »