Tag Archive: SNB balance sheet

It Is Time To Short The Swiss National Bank!

The current Article will take a closer look to the incredible rise of the Swiss National Bank stock and suggest why taking a short position could be the right trade at this level. The Swiss Central Bank: Mandate and Monetary Policy. According to the Swiss Federal Constitution (Art. 99) the Swiss Central Bank is an independent institution with the mandate to conduct the monetary policy in Switzerland by ensuring price stability, while taking into...

Read More »

Read More »

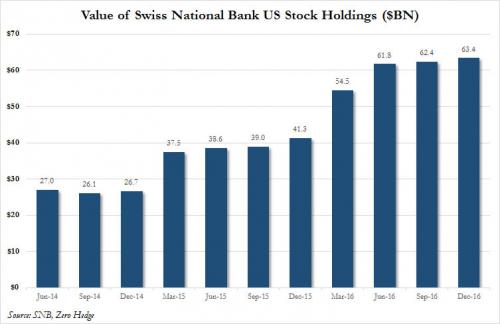

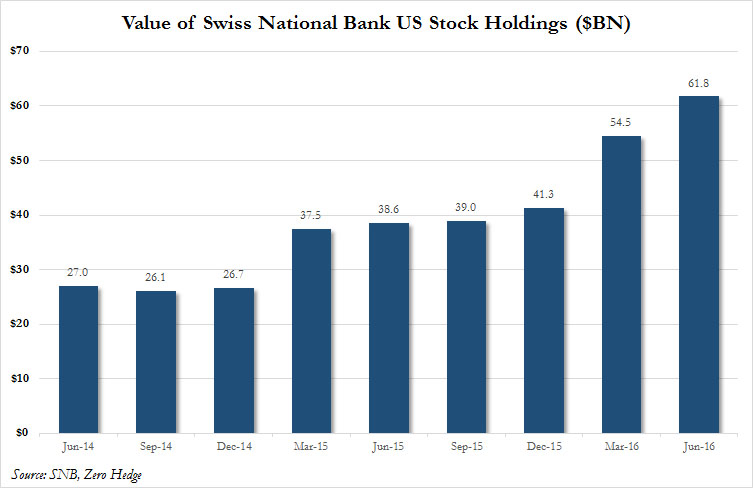

Swiss National Bank’s U.S. Stock Holdings Hit A Record $63.4 Billion

Being able to print your own money and buy stocks at any price sure can be fun. Just as the SNB which unlike many other (if ever fewer) central banks admits to doing just that. In its latest 13F filing, the Swiss National Bank reported that the value of its portfolio of US stocks rose again in the fourth quarter, increasing by 1.6% from $62.4 billion as of Sept. 30 to a record high $63.4 billion at the end of the year.

Read More »

Read More »

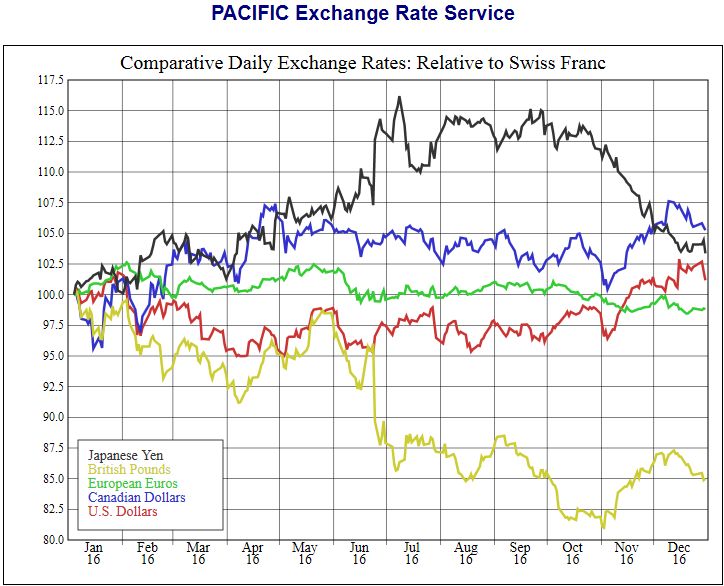

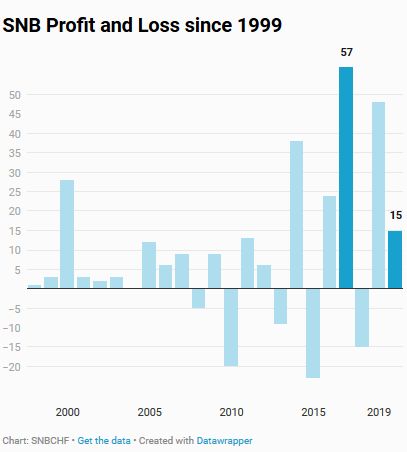

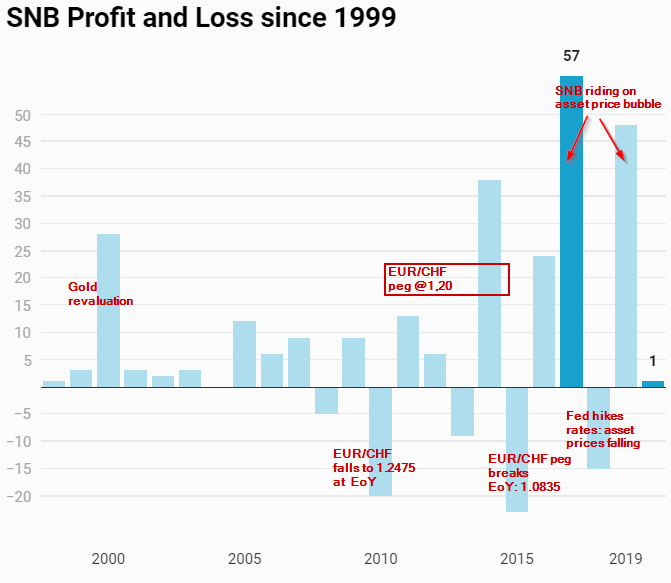

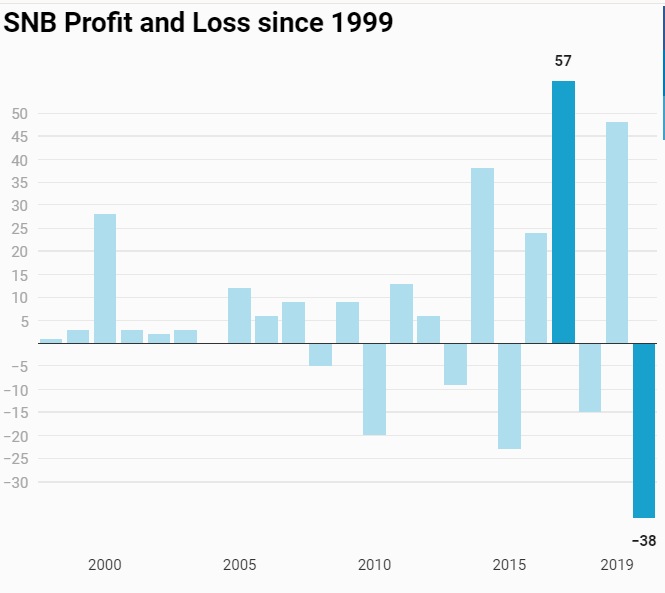

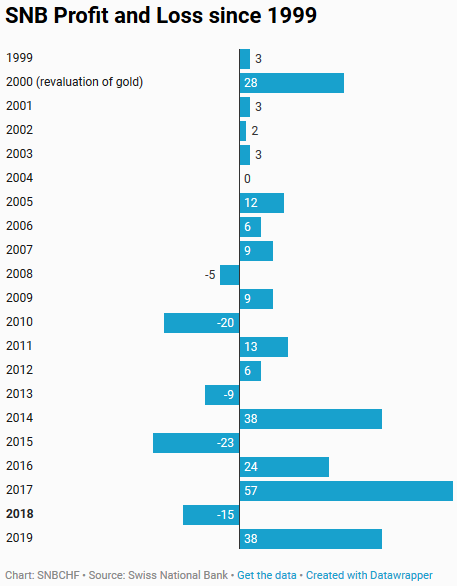

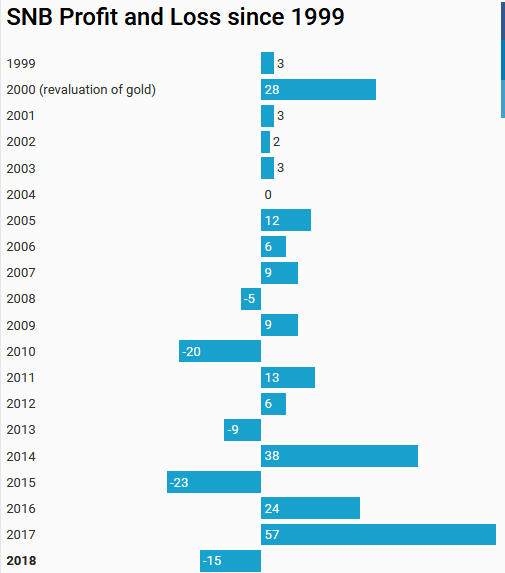

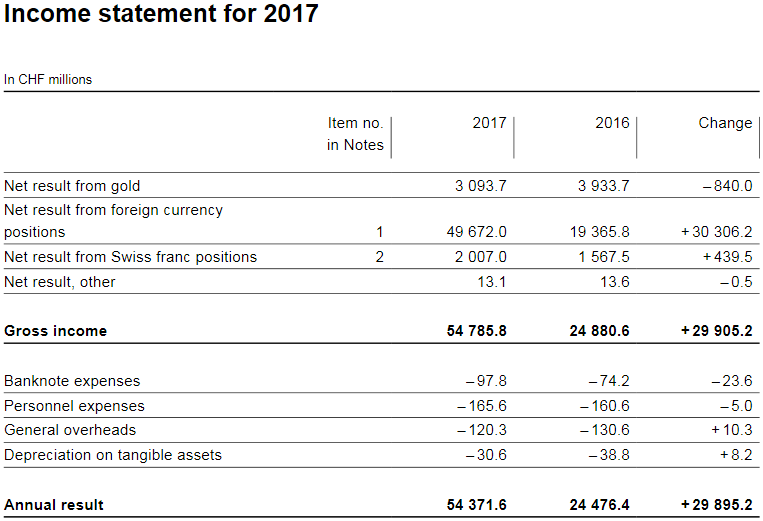

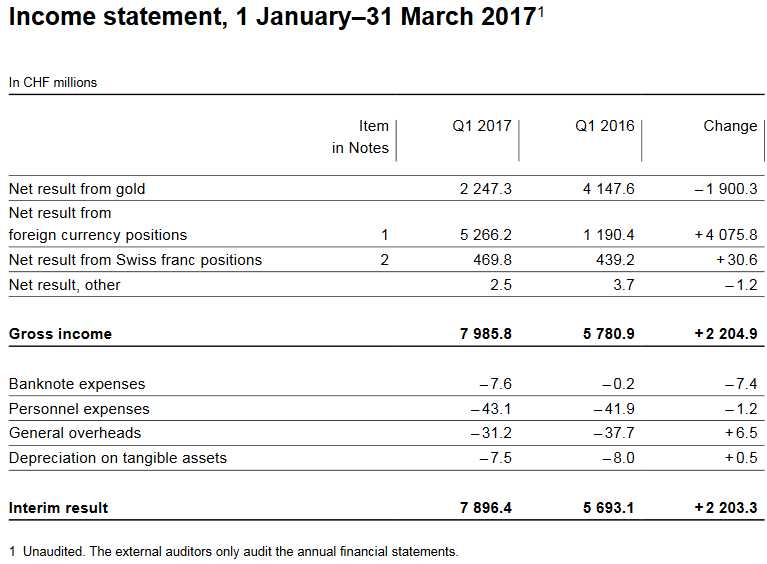

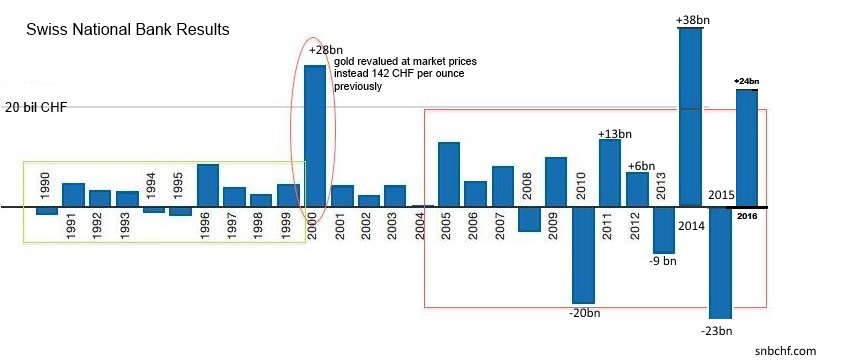

SNB announces 24 bn CHF profit for 2016 thanks to rising stock markets.

The Swiss National Bank has announced 24 bn profits from 2016. Profits came from the dollar, yen and Canadian dollar, while the pound retreated by 15%. The EUR/CHF is only slightly weaker, mostly because the SNB actively supported the euro.

Read More »

Read More »

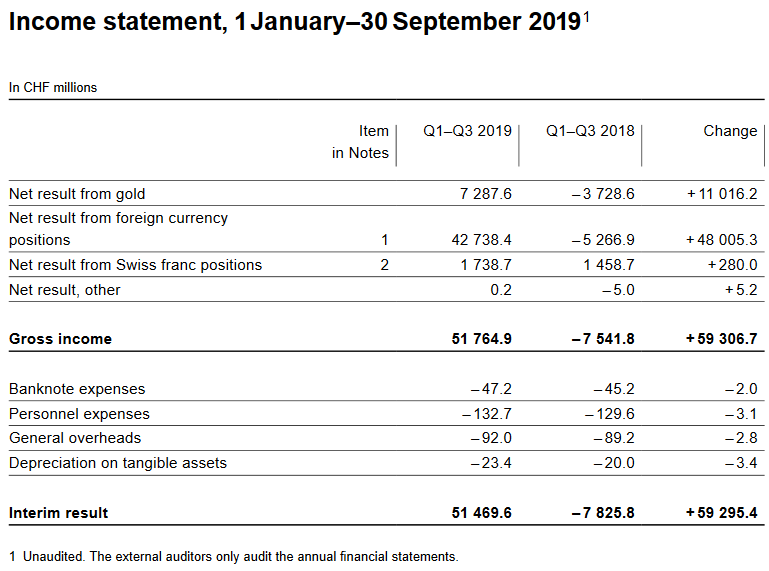

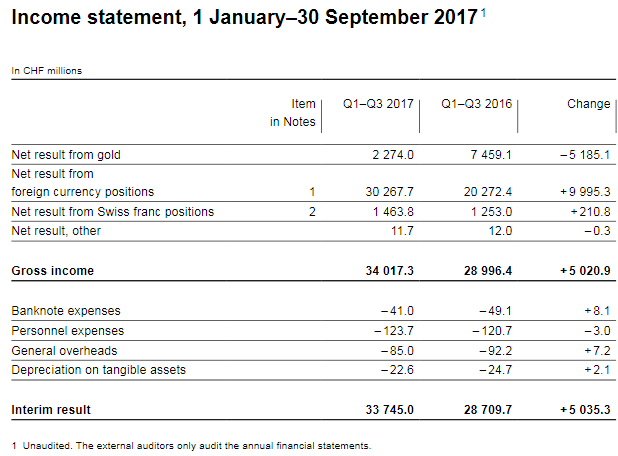

Swiss National Bank Results Q3 / 2016: Volatility of Results is Increasing

Interim results of the Swiss National Bank as at 30 September 2016 The Swiss National Bank (SNB) reports a profit of CHF 28.7 billion for the first three quarters of 2016. But the volatility is rising: The SNB may lose 50 billion in one year and win 60 billion in the next year or the opposite.

Read More »

Read More »

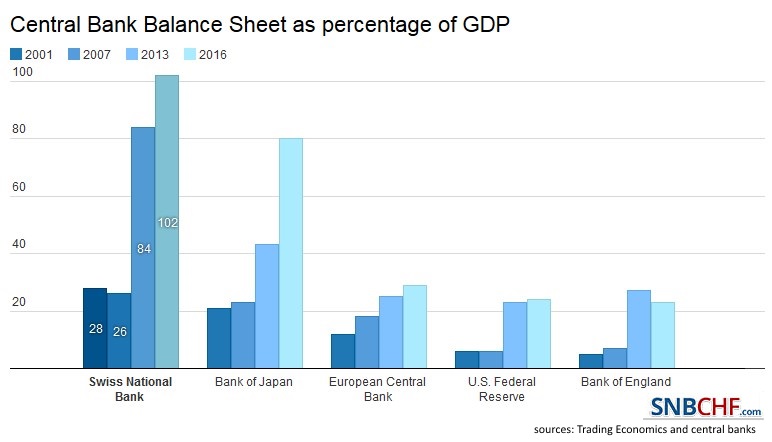

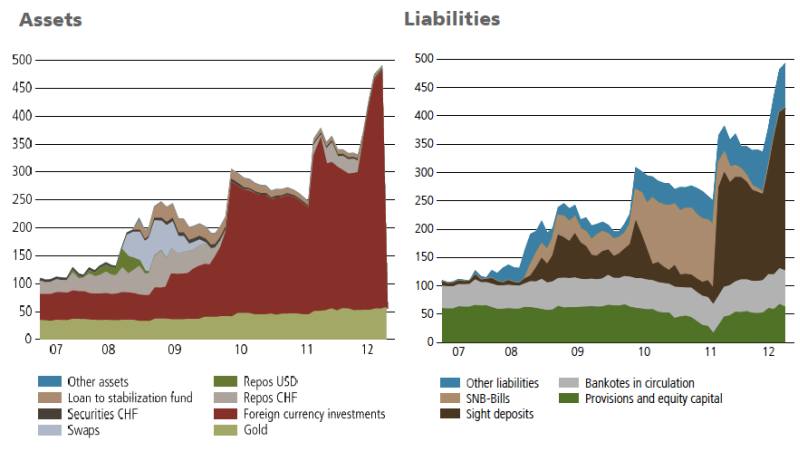

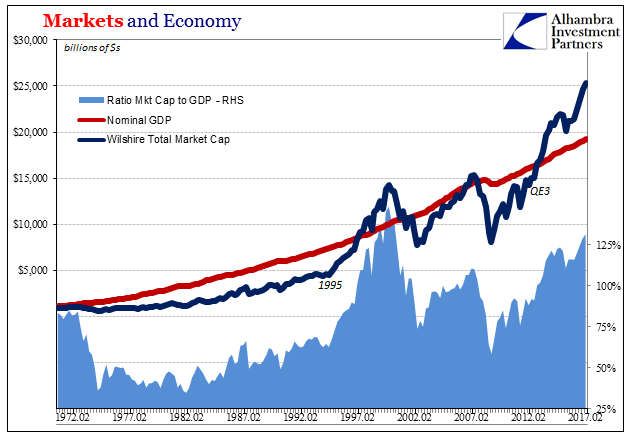

SNB Balance Sheet Now Over 100 percent GDP

Since 2008 the balance sheet of the Swiss National Bank has risen from 28% to 102% of Swiss GDP. Balance sheets of other central banks have strongly risen, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

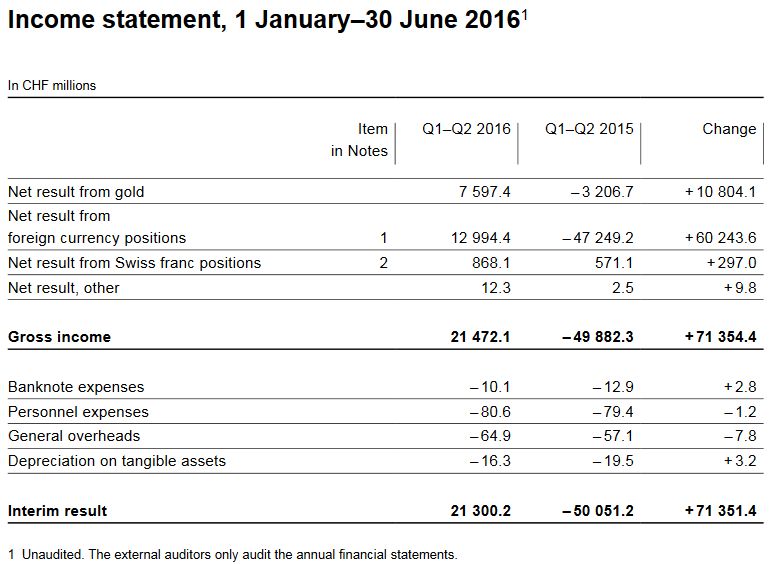

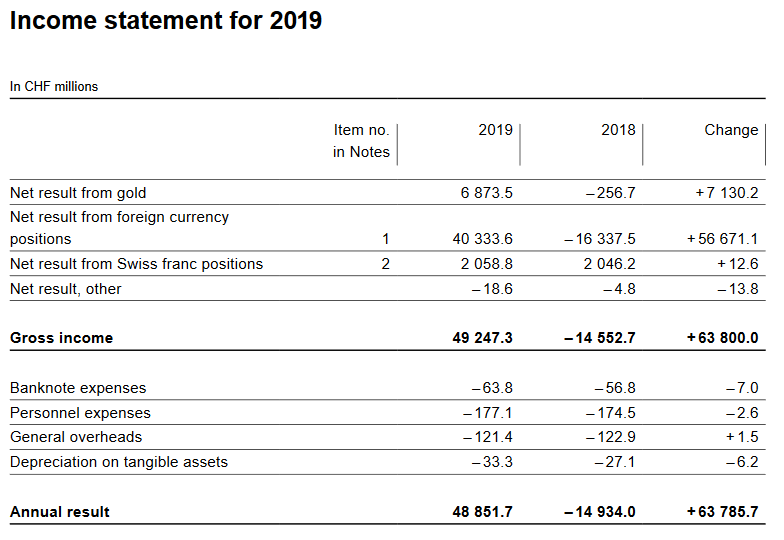

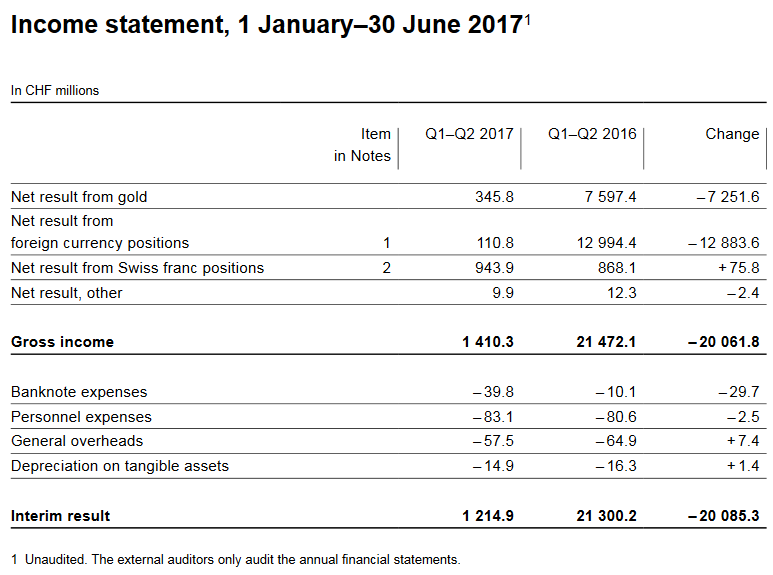

Interim results of the Swiss National Bank as at 30 June 2016

The Swiss National Bank (SNB) reports a profit of CHF 21.3 billion for the first half of 2016. A valuation gain of CHF 7.6 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 13.0 billion.

Read More »

Read More »

“Mystery” Buyer Revealed: Swiss National Bank’s US Stock Holdings Rose 50 percent In First Half, To Record $62BN

In a month, quarter and year, in which many have scratched their heads trying to answer just who is buying stocks, as both retail and smart money investors have been aggressively selling, yesterday we got the answer.

Read More »

Read More »

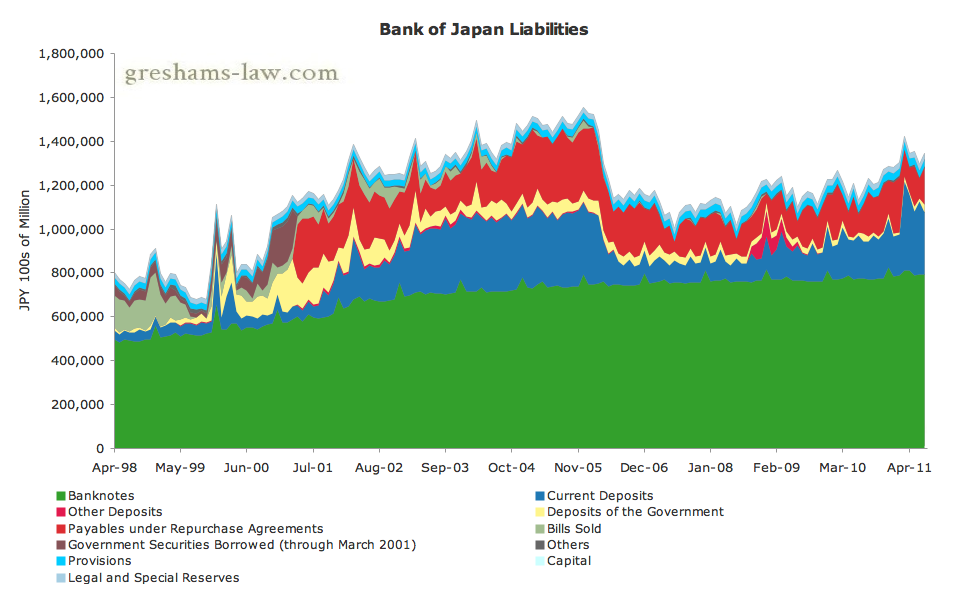

History of Bank of Japan Interventions

We show the history of Japanese FX interventions. The Japanese only intervened when the USD/JPY was under 80. Therefore the 2016 FX intervention threads at 108 are ridiculous.

As opposed to the Swiss National Bank, the Japanese only talk, they do not fight.

Read More »

Read More »

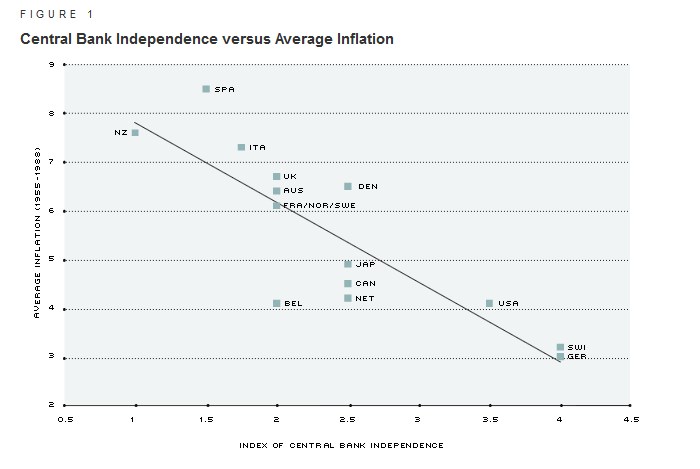

Central Bank Independence in Switzerland: A Farce

articles by Marc Meyer, one of the most critical voices against the SNB.

This post explains

--- That the SNB does not understand what assets and liabilities are - and therefore - it speculates with massive leverage.

--- The difference between good and bad deflation

--- Both the SNB and the Swiss government do what some Swiss exporters want. Therefore, the formerly admired central bank independence in Switzerland has become a farce.

Read More »

Read More »

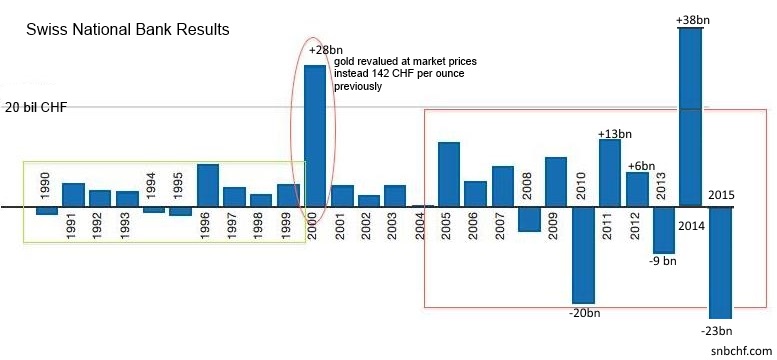

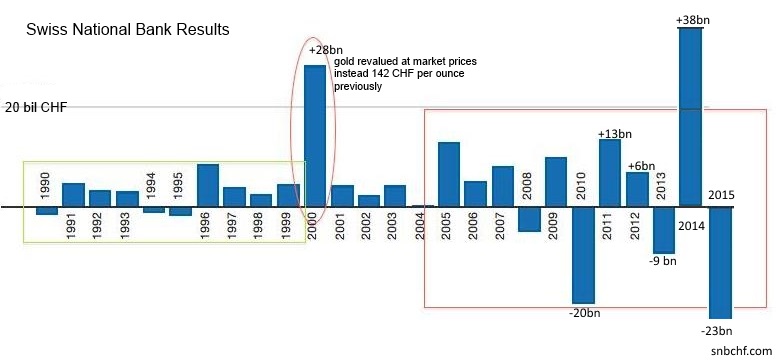

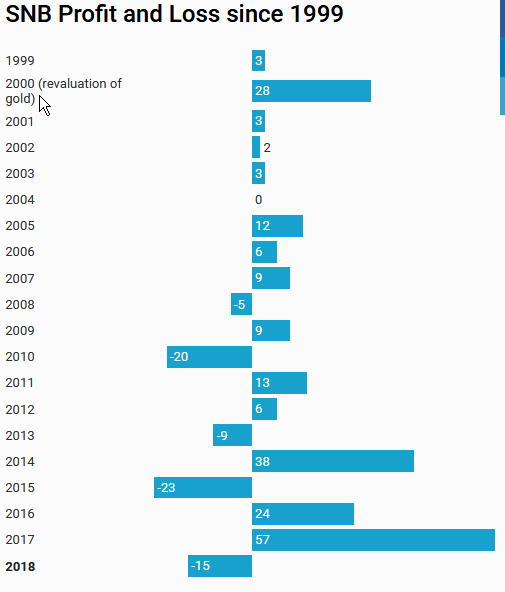

Swiss National Bank Results 2015 and Comments

The Swiss National Bank (SNB) is reporting a loss of CHF 23.3 billion for the year 2015 (2014: profit of CHF 38.3 billion). The loss on foreign currency positions amounted to CHF 19.9 billion. A valuation loss of CHF 4.2 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.2 billion.

Read More »

Read More »

SNB Reduced Loss from 50 Billion in June to 23 Billion

According to the latest news release, the Swiss National Bank expects an annual loss of 23 billion CHF, after reporting a loss of 50 billion at the end of June. Primarily thanks to the stronger dollar, the SNB was able to achieve unrealized gains of 27 billion CHF in the second half. This reduced her annual loss to 23 billion. With its rate hike, Fed is helping the SNB: the dollar has appreciated by 6% since July.

Read More »

Read More »

2014 Results: SNB expects profit of CHF 38 billion

The Swiss National Bank reported a profit of CHF 38 billion for the year 2014. They obtained price gains in all asset classes, in bonds, stocks and gold. Interest payments and dividends achieved a yield of 1.7%.

Read More »

Read More »

Gold Referendum, Parliamentary Speech Lukas Reimann

Swiss parliament member Lukas Reimann outlines the importance gold. In a future inflationary environment, prices of SNB holdings, the ones of German Bunds and US Treasuries will drop, while gold will appreciate.

Read More »

Read More »

Germany: Last European Country with Lots of Cash Under Matresses

In June 2014, the ECB decided to introduce negative rates on the excess reserves of banks. We explain that German banks had already removed most excess liquidity before the ECB meeting of June 2014, and they will continue to do so. Hence hardly any German bank will pay negative rates after the recent ECB decisions at that meeting.

Read More »

Read More »

SNB Balance Sheet Expansion

Since 2008 the balance sheet of the Swiss National Bank is 280% higher, this is the equivalent of 60% of Swiss GDP. So did most other central banks, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

When Will Hedge Funds and FX Traders Close their Short Yen Positions?

Hedge Funds have lost their power. This year has shown that their only remaining possibility to gain easy money is a concerted action with some of their friends manipulating currency markets, calling it “currency wars” and creating an unholy alliance with the dovish prime minister Abe. Some of the biggest U.S. hedge-fund investors have made …

Read More »

Read More »

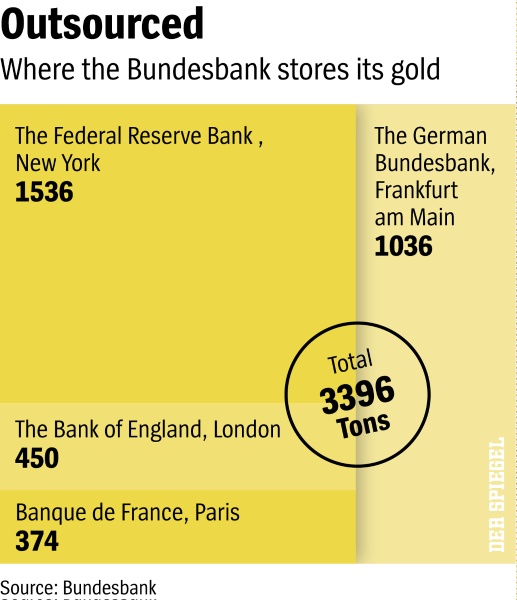

German Currency and Gold Reserves and the German Trade Surplus

During the Bretton Woods system, Germany managed to obtain current account surpluses. They converted these surpluses into gold. At the time they bought it at 35$ per ounce at a relatively cheap price – at the end of the 1960s the price was augmented to 42$. At the end of the 1960 and with …

Read More »

Read More »

Epic Shift in Monetary Policy: Japan goes SNB, Nuclear Option

According to Bloomberg, at least prime minister Abe is taking the nuclear option and is following the SNB in buying foreign assets. This is a huge change in global monetary policy.

Read More »

Read More »