Tag Archive: silver

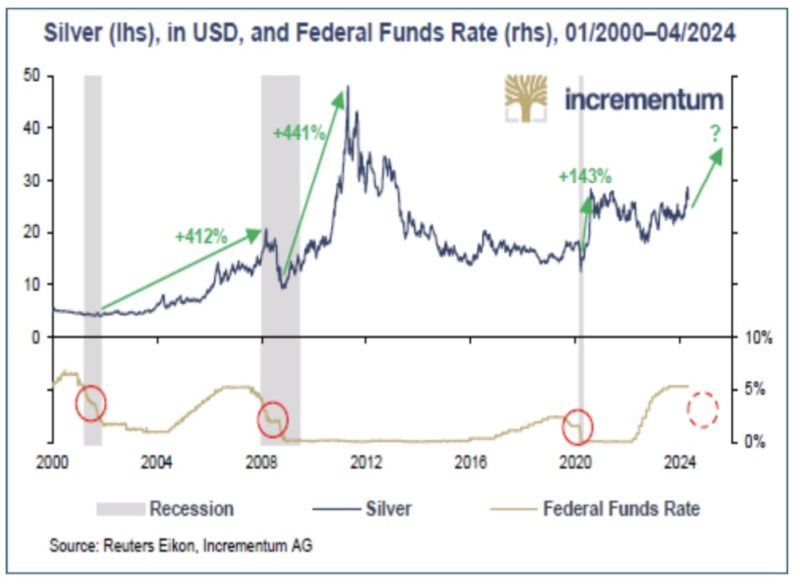

Silver: A rare buying opportunity

The gold price recently surged to unprecedented levels, surpassing the $3,000 per ounce milestone. This remarkable surge has been attributed to escalating geopolitical tensions, the revival of the trade wars, mounting inflation concerns, and of course, a very uncertain and very worrying outlook for the global economy and for the markets. As they always do, investors have once again flocked to the safe haven that gold unmistakably provides, pushing...

Read More »

Read More »

Monetary Metals Achieves SOC 2 Certification

Scottsdale, AZ – September 3, 2024 – Monetary Metals® is proud to announce that it has achieved SOC 2 certification. This significant milestone demonstrates the company’s unwavering commitment to maintaining a secure environment for its innovative Gold Yield Marketplace® platform.

Read More »

Read More »

A new era for silver?

Share this article

It’s been a fantastic year for physical precious metals owners and by many accounts, the best is yet to come. All the issues we’ve been warning against for years, including inflation, currency debasement and government suppression of individual financial liberty have started boiling over in a way that is so obvious, that even the most naive citizen can clearly comprehend.

Despite the efforts by politicians and institutional...

Read More »

Read More »

CEO Keith Weiner Quoted in Barron’s

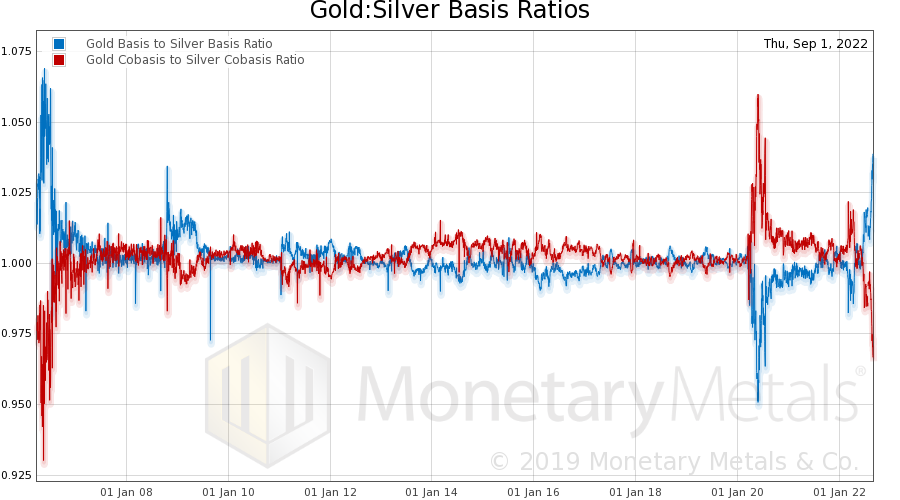

Published February 2nd, CEO Keith Weiner’s commentary was featured in a Barron’s article discussing “Why Silver is Outperforming Gold” written by Myra Saefong.

Read More »

Read More »

Is Central Banks’ License to Print Money About to Expire?

One of the biggest reasons for people deciding to buy gold bars or to own silver coins is because of the folly of central banks and government. It seems bizarre to most people that we are all aware that money doesn’t grow on trees and yet those responsible for financial stability have forgotten this basic life-lesson.

Read More »

Read More »

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

So Ben Bernanke has won a Nobel Prize for kicking a can down the road!Many will have heard the saying ‘those who do not learn from history, are doomed to repeat it’. It is often attributed to Churchill, but he was in fact quoting George Santanya. We prefer the Stephen Hawking quote, ‘“We spend a great deal of time studying history, which, let’s face it, is mostly the history of stupidity.” as this feels more apt in this day and age.

Read More »

Read More »

Rick Rule – Gold Helps Me Sleep at Night

“The US dollar’s strength isn’t so much a function of the strength of the US economy or US political leadership, but rather, the fact that we’re competing in a horse race against a bunch of other horses that are completely lame.” Rick Rule – Rule Investment Media

Read More »

Read More »

Were the UK pension funds just the canary in the gold mine?

This week we ask if the wobble experienced by UK pension funds, last week, was just the canary in the gold mine for the global economy. If not for other central banks then this was certainly a reminder for individuals, who were prompted to ask about the levels of counterparty risk their savings and pensions were exposed to, and how they might better protect themselves in the coming months and years.

Read More »

Read More »

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Our guest this week is Ed Steer, expert gold and market analyst and author of the Gold & Silver Digest. We invited Ed onto GoldCore TV to get his take on what is concerning him most in financial markets, movements in SLV and sanctions against Russia. He also draws our attention to central bank purchases of gold.

Read More »

Read More »

Episode 5 of The M3 Report with Steve St. Angelo

Is the energy crisis something that can be resolved? Was it always inevitable? Will renewable energy make it all OK? Are Western financial policies to blame?

Read More »

Read More »

US CPI Data Release Update

It is easy to get caught up in data releases. The media is keen to read a lot into them, hoping it will offer some sense of what is really going on, so often the news is about numbers just announced or expectations for what one economic measure will show from one month to the next.

Read More »

Read More »

Silver Fever, or Silver Fading?

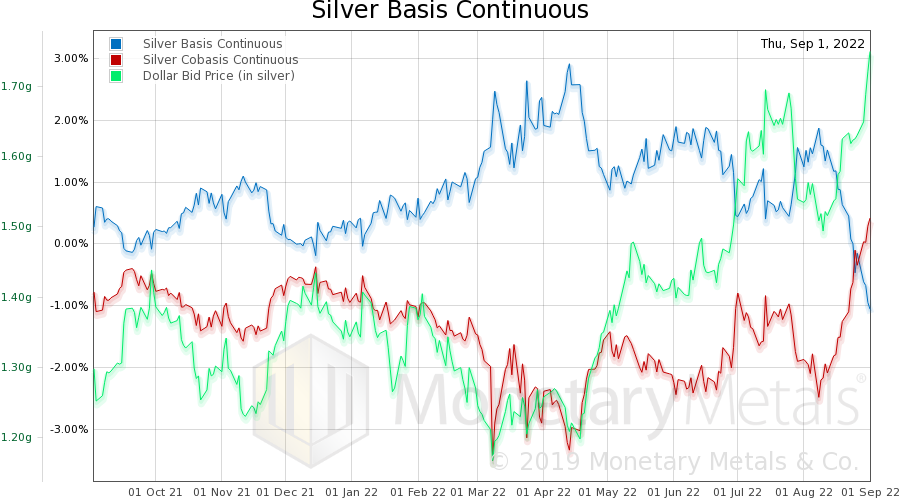

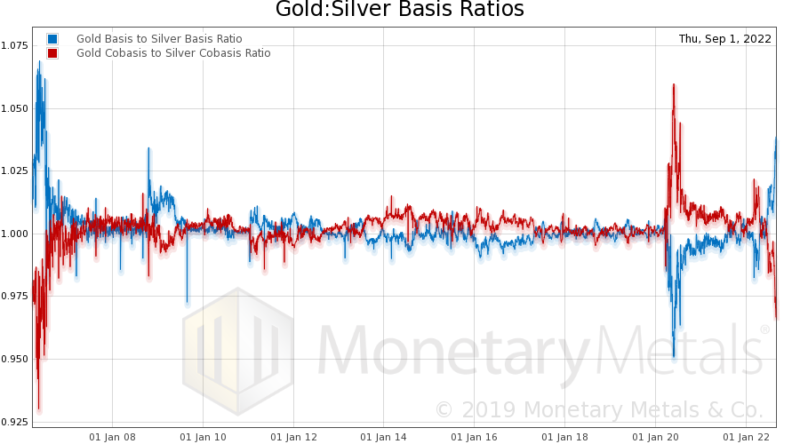

We finally had a resolution, of sorts, in silver. Since April 13, we have had a falling price of silver (indicated as a rising price of the dollar, as measured in silver). And along with this price trend, a growing scarcity of the metal to the market (i.e. the cobasis, the red line). Indeed, the price (of the dollar) and silver scarcity move with uncanny coordination. Almost as if they are linked.

Read More »

Read More »

What Problem Does Gold Solve?

Realising that you need to protect your portfolio from financial systemic risks is a tricky thing. Because, not only have you identified that all is not well in the economy but you now need to make a decision about how best to protect your investments.

Read More »

Read More »

Silver Update: Scarcity Gets More Extreme

Since our last silver article, the price of silver has dropped. With due respect to Frederic Bastiat, the price is the seen. The basis mostly goes unseen. We will take a look at the market data, revised for a few more days of trading.

Read More »

Read More »

When markets forget that Central Banks cannot fix the world with interest rates

It would be easy for those who have decided to buy gold and silver bullion to lose heart over the precious metals, had they seen how prices reacted to Chairman Powell’s comments, last week.

Read More »

Read More »

The Silver Phoenix Market

Listen to the audio version of this article here.

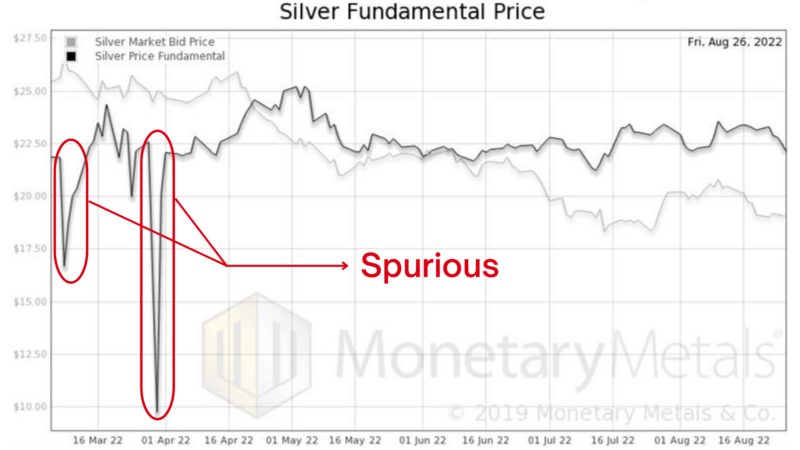

The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks.

Breaking Down Fundamental Silver Prices

However, the opposite has been happening to silver’s scarcity. First, let’s look at a chart of the silver market price and the silver fundamental price.

Read More »

Read More »

History Of Money and Evolution Suggests a Crash is Coming

Today’s guest is as much a historian and anthropologist as he is an expert on market events. Jon Forrest Little joins Dave Russell on GoldCore TV today and brings some fascinating insights into what we are currently seeing when it comes to political decisions, financial events and human reactions.

Read More »

Read More »

Why we couldn’t be happier that gold is boring

We’re the first to admit that investing in gold can be pretty boring. Don’t get us wrong, when you first decide to buy gold then the newness of it is exciting, as you choose which gold bullion dealer to use then it is interesting and when you actually see the gold bars or coins appear in your account then it’s really exciting.

Read More »

Read More »

Will Silver Prices Go Up to $300?

This week’s guest is so bullish on silver that he’s even written a best-selling book ‘The Great Silver Bull’ where he takes an in-depth look at why silver will outperform gold once again and even go as high as $300 an ounce.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet!

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet! -

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”!

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”! -

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan -

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!”

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!” -

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

Wie du 100 € skalierst und wirklich unabhängig wirst

Wie du 100 € skalierst und wirklich unabhängig wirst -

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

Galaktische Gewinne – die besten Ideen des Weltraum-Kapitalisten

Galaktische Gewinne – die besten Ideen des Weltraum-Kapitalisten

More from this category

- Silver: A rare buying opportunity

7 Apr 2025

- Monetary Metals Achieves SOC 2 Certification

2 Sep 2024

A new era for silver?

A new era for silver?28 Aug 2024

Gold Hits New All Time Highs

Gold Hits New All Time Highs2 Nov 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Is Central Banks’ License to Print Money About to Expire?

Is Central Banks’ License to Print Money About to Expire?29 Oct 2022

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!16 Oct 2022

Rick Rule – Gold Helps Me Sleep at Night

Rick Rule – Gold Helps Me Sleep at Night14 Oct 2022

Were the UK pension funds just the canary in the gold mine?

Were the UK pension funds just the canary in the gold mine?9 Oct 2022

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!5 Oct 2022

Episode 5 of The M3 Report with Steve St. Angelo

Episode 5 of The M3 Report with Steve St. Angelo28 Sep 2022

US CPI Data Release Update

US CPI Data Release Update17 Sep 2022

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022

What Problem Does Gold Solve?

What Problem Does Gold Solve?14 Sep 2022

Silver Update: Scarcity Gets More Extreme

Silver Update: Scarcity Gets More Extreme5 Sep 2022

When markets forget that Central Banks cannot fix the world with interest rates

When markets forget that Central Banks cannot fix the world with interest rates4 Sep 2022

The Silver Phoenix Market

The Silver Phoenix Market2 Sep 2022

History Of Money and Evolution Suggests a Crash is Coming

History Of Money and Evolution Suggests a Crash is Coming27 Aug 2022

Why we couldn’t be happier that gold is boring

Why we couldn’t be happier that gold is boring23 Aug 2022

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300?11 Aug 2022

Gold Hits New All Time Highs

2023-11-02

by Dave Russell

2023-11-02

Read More »