Tag Archive: Reality

We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable.

Read More »

Read More »

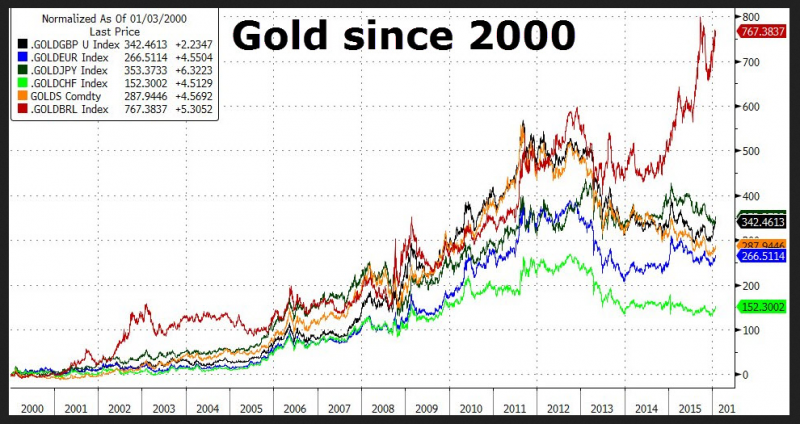

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

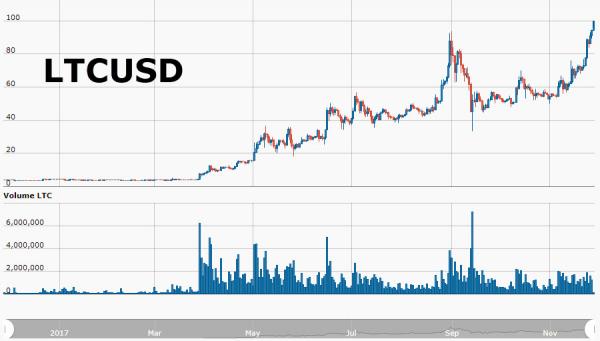

Is The US Dollar Set To Soar?

Hating the U.S. dollar offers the same rewards as hating a dominant sports team: it feels righteous to root for the underdogs, but it's generally unwise to let that enthusiasm become the basis of one's bets. Personally, I favor the emergence of non-state reserve currencies, for example, blockchain crypto-currencies or precious-metal-backed private currencies--currencies which can't be devalued by self-serving central banks or the private elites...

Read More »

Read More »

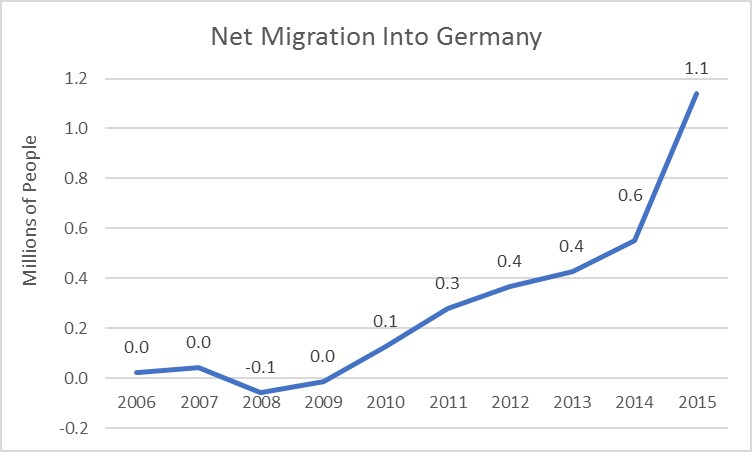

Negative Consumer Financing Rates in Germany, Soon More Negative in Switzerland?

Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one's means.

Read More »

Read More »

“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that - as we predicted last week - Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual...

Read More »

Read More »

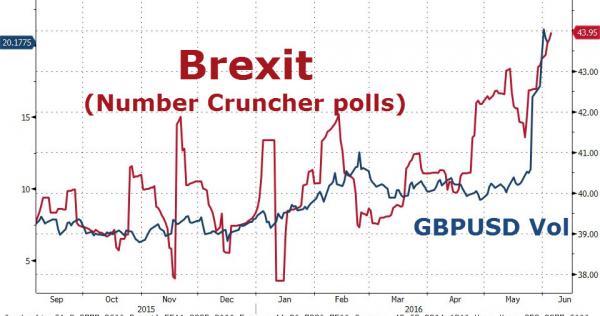

BofA: To Save Markets Central Banks Just Made Inequality And Populism Even Worse

There is a large dose of irony to the post-Brexit market response: while on one hand stocks have soared and as of today the S&P500 has already recouped more than half its post-Brexit losses (the SPX sank 5.7% peak-to-trough since the referendum and has since bounced 3.5%) an even sharper reaction has been observed in bonds.

Read More »

Read More »

The British Referendum And The Long Arm Of The Lawless

Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law.

Read More »

Read More »

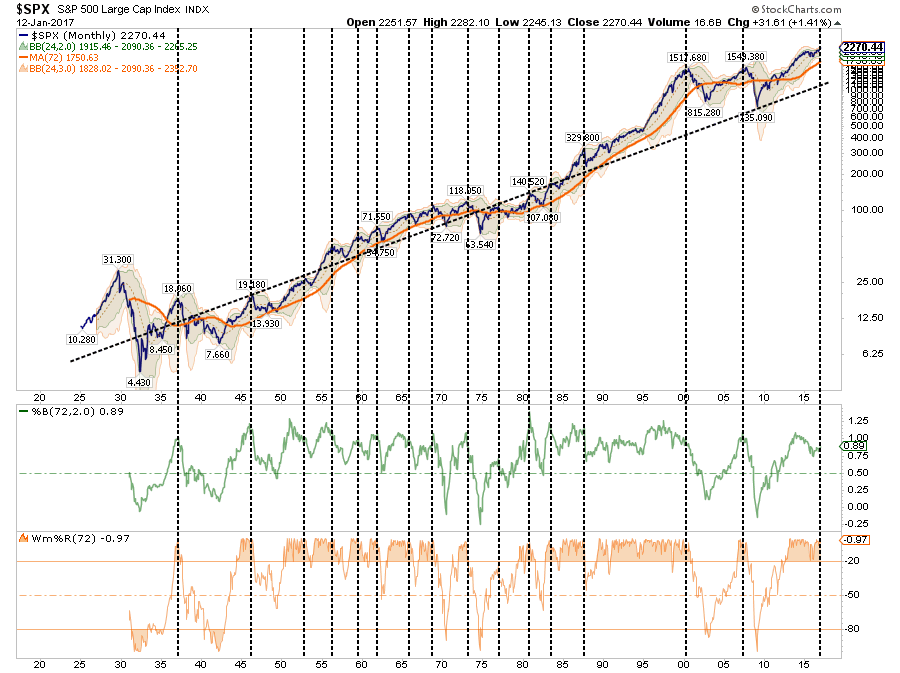

Chart up-date: Stocks, Bonds, Copper, Gold

Well that escalated quickly...All-time highs within reach... everything is awesome...wait what...

Quite a week:

Gold +5.25% in last 2 weeks - best run in 4 months

Silver +5.65% this week - best week since May 2015

Copper -4% this week to lowest week...

Read More »

Read More »

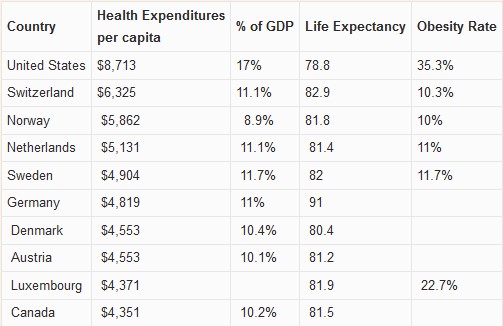

Ten Most Expensive Countries for Healthcare in the World

The United States spends 17% of GDP for health care, compared to around 10% in many other advanced economies. Thanks to rising health care costs, GDP growth was higher in the U.S. in recent years. The question is if this kind of GDP growth enriches the whole population or only the privileged.

Read More »

Read More »

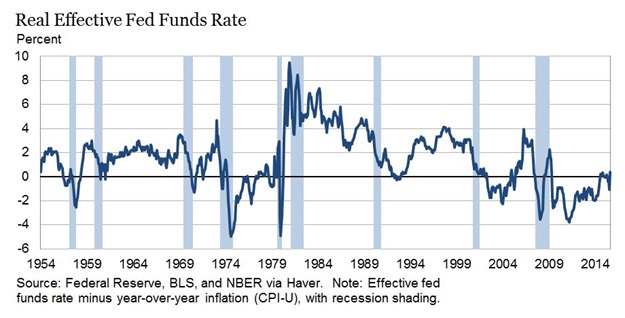

Gold And Negative Interest Rates

Submitted by Dan Popescu via Acting-Man.com,

The Inflation Illusion

We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed h...

Read More »

Read More »

The Shocking Reason For FATCA… And What Comes Next

Submitted by Nick Giambruno via InterntionalMan.com,

If you’ve never heard of the Foreign Account Tax Compliance Act (FATCA), you’re not alone.

Few people have, and even fewer fully grasp the terrible things it foreshadows.

FATCA is a U.S. ...

Read More »

Read More »

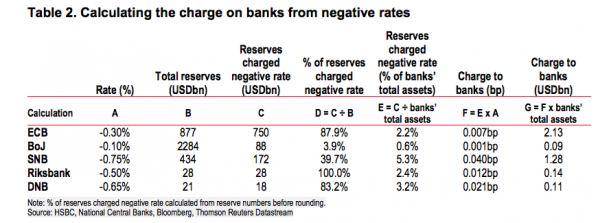

HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth.

For whatever reason, Haruhiko Kuroda’s move into NI...

Read More »

Read More »

BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is...

Read More »

Read More »