Tag Archive: productivity

Dovish Hold Sends the Aussie Lower

Overview: The US dollar is little changed against most of the G10 currencies today. The antipodean currencies are the main exception. A modest change in tone from the Reserve Bank of Australia, boosting the chances of a rate cut early next year sent the Australian dollar back toward yesterday's lows, and the New Zealand dollar fell in sympathy. Most of the G10 currencies sporting softer profiles within the consolidative price action. The greenback...

Read More »

Read More »

Market Pulse: Mid-Year Update

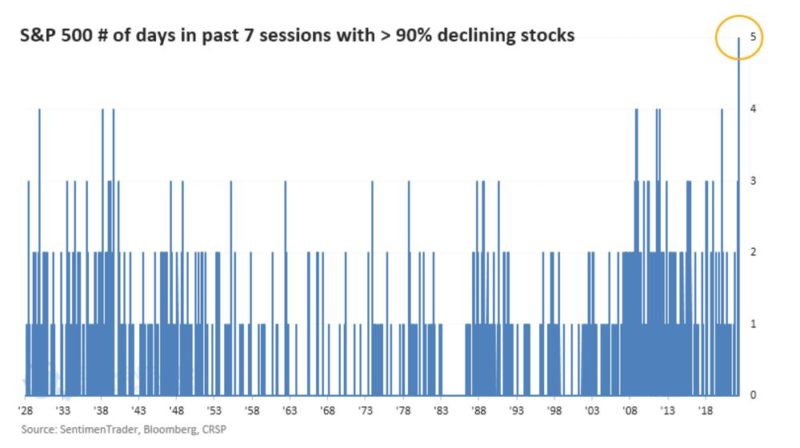

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

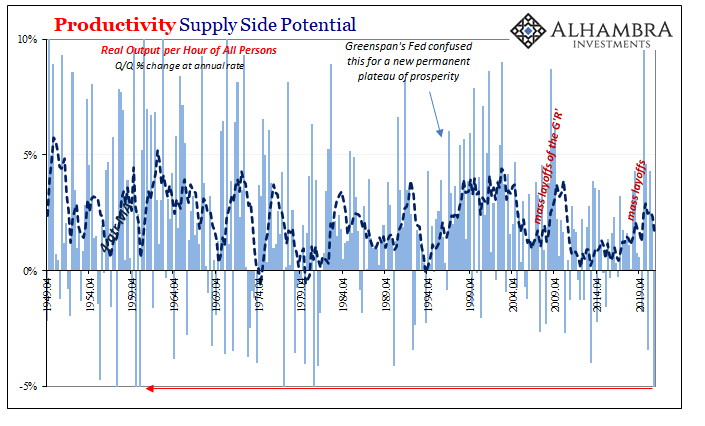

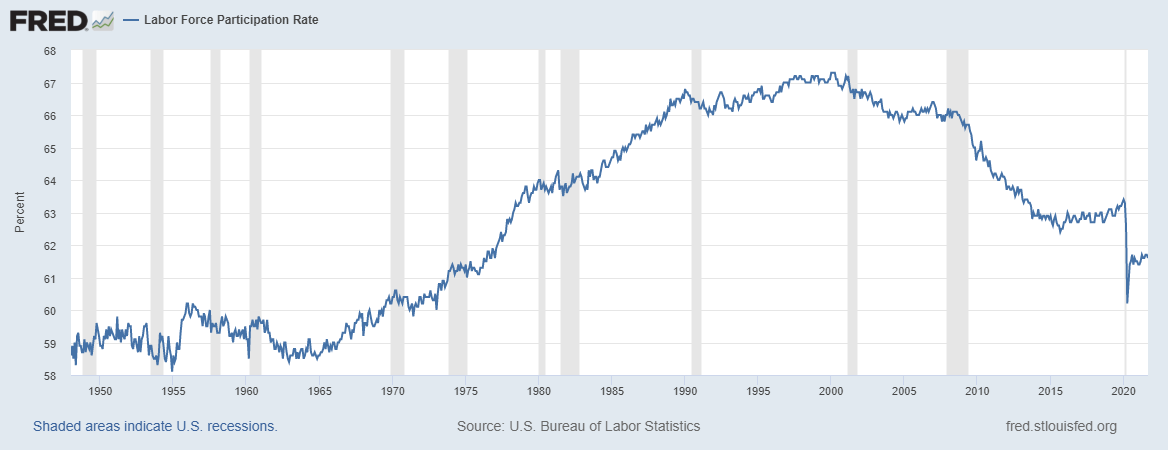

Neither Confusing Nor Surprising: Q1’s Worst Productivity Ever, April Decline In Employed

Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem.

Read More »

Read More »

The Productive Use Of Awful Q3 Productivity Estimates Highlights Even More ‘Growth Scare’ Potential

What was it that old Iowa cornfield movie said? If you build it, he will come. Well, this isn’t quite that, rather something more along the lines of: if you reopen it, some will come back to work. Not nearly as snappy, far less likely to sell anyone movie tickets, yet this other tagline might contribute much to our understanding of “growth scare” and its affect on the US labor market.

Read More »

Read More »

Weekly Market Pulse: Perception vs Reality

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large.

Read More »

Read More »

Weekly Market Pulse: The Market Did What??!!

One of the most common complaints I hear about the markets is that they are “divorced from reality”, that they aren’t acting as the current economic data would seem to dictate. I’ve been in this business for 30 years and I think I first heard that in year one. Or maybe even before I decided to lose my mind and start managing other people’s money. Because, of course, it has always been this way.

Read More »

Read More »

The Endangered Inflationary Species: Gazelles

Nevada is, by all accounts and accountants, in rough shape. Very rough shape. An economy overly dependent upon a single industry, tourism, in this case, is a disaster waiting to happen should anything happen to that industry. Pandemic restrictions, for instance.

Read More »

Read More »

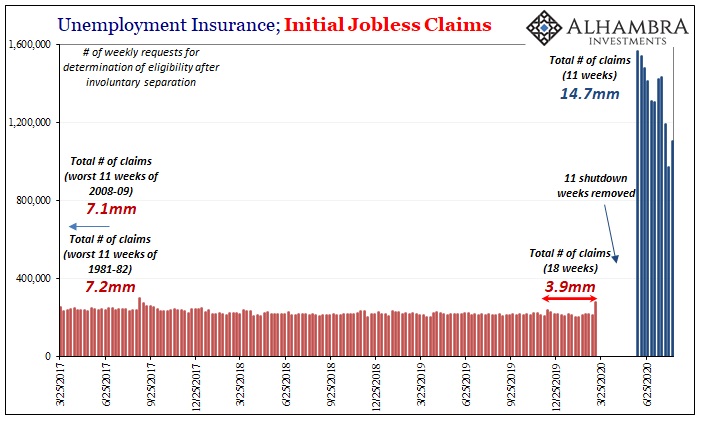

*These* Are The Real Huge Jobs Numbers, And They Will Make Your Blood Run Cold

There is simply no way to spin these figures as anything good. Not just the usual ones were talking about here, but more so some new data that you probably haven’t seen before. Beginning with the regular, it doesn’t matter that the level of initial jobless claims has declined substantially over the past few weeks

Read More »

Read More »

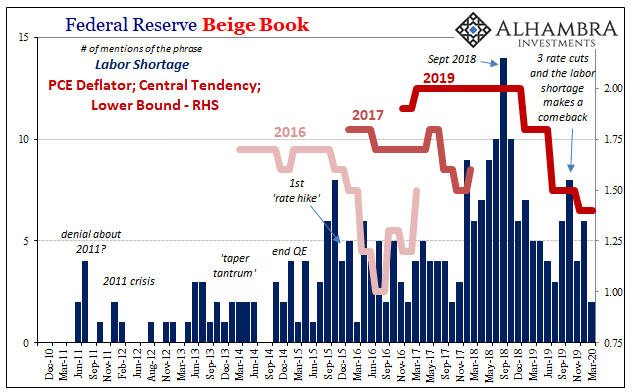

Like Repo, The Labor Lie

The Federal Reserve has been trying to propagate two big lies about the economy. Actually, it’s three but the third is really a combination of the first two. To start with, monetary authorities have been claiming that growing liquidity problems were the result of either “too many” Treasuries (haven’t heard that one in a while) or the combination of otherwise benign technical factors.

Read More »

Read More »

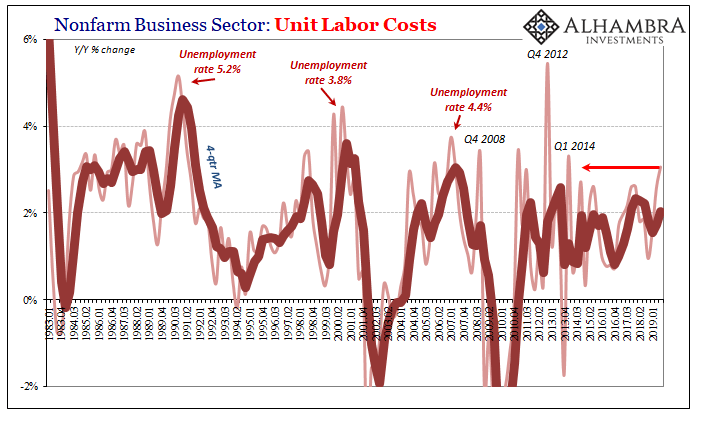

For Labor And Recession, The Bad One

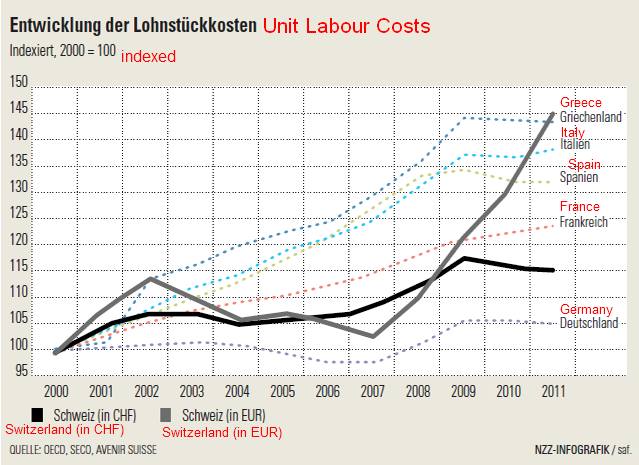

There’s a couple of different ways that Unit Labor Costs can rise. Or even surge. The first is the good way, the one we all want to see because it is consistent with the idea of an economy that is actually booming. If workers have become truly scarce as macro forces sustain actual growth such that all labor market slack is absorbed, then businesses have to compete for them bidding up the price of marginal labor.

Read More »

Read More »

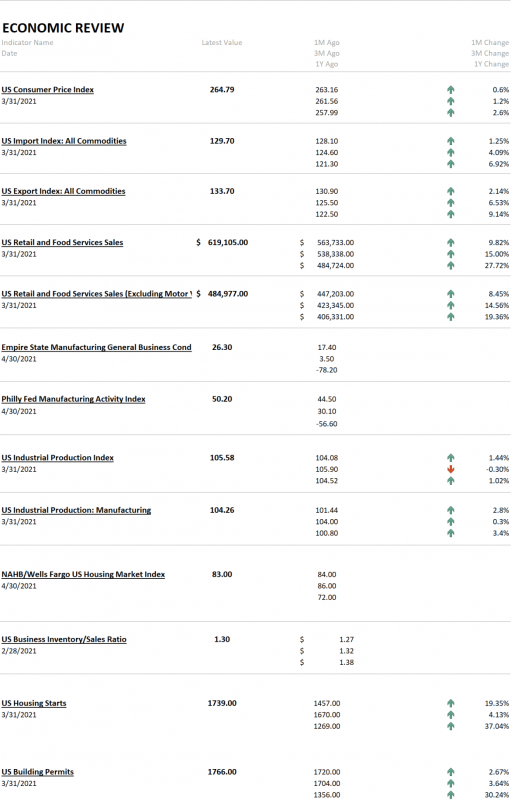

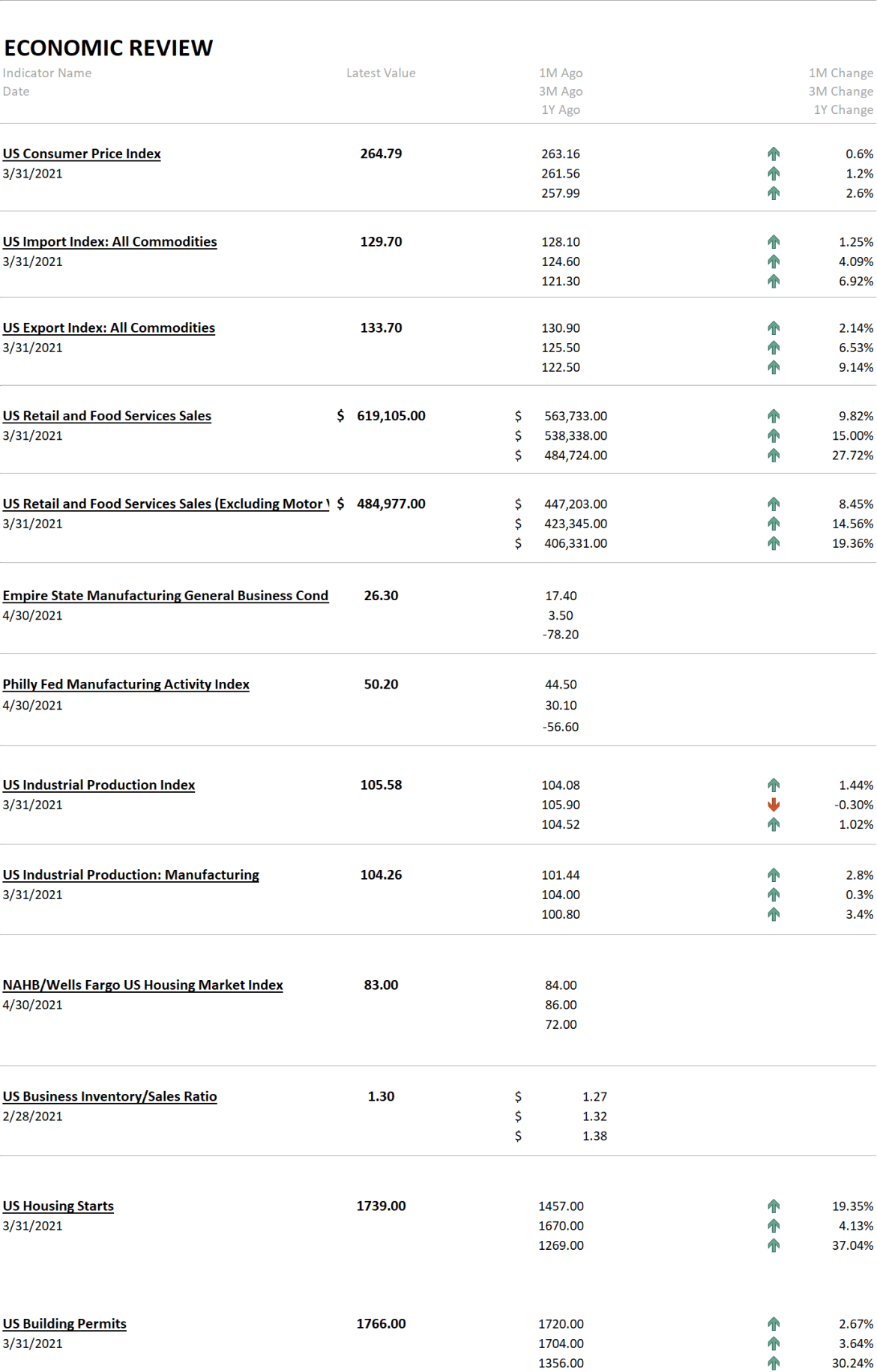

Monthly Macro Monitor: Economic Reports

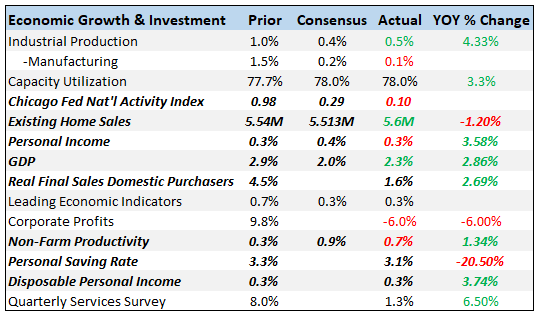

Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction.

Read More »

Read More »

Monthly Macro Chart Review: April 2019

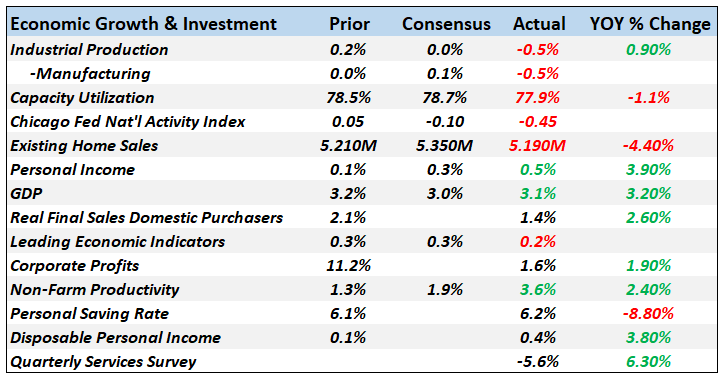

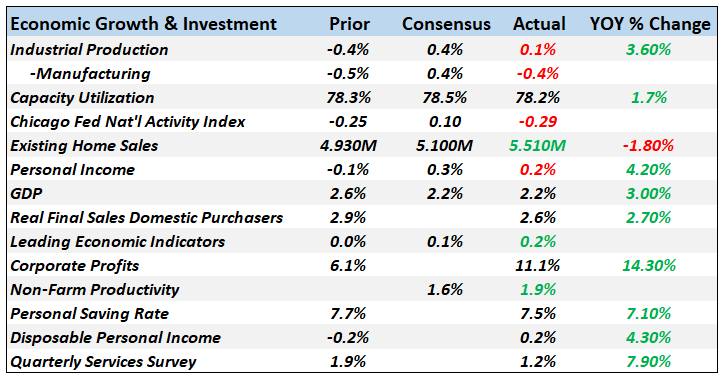

The economic data reported over the last month managed to confirm both that the economy is slowing and that there seems little reason to fear recession at this point. The slowdown is mostly a manufacturing affair – and some of that is actually a fracking slowdown – but consumption has also slowed.

Read More »

Read More »

Bi-Weekly Economic Review

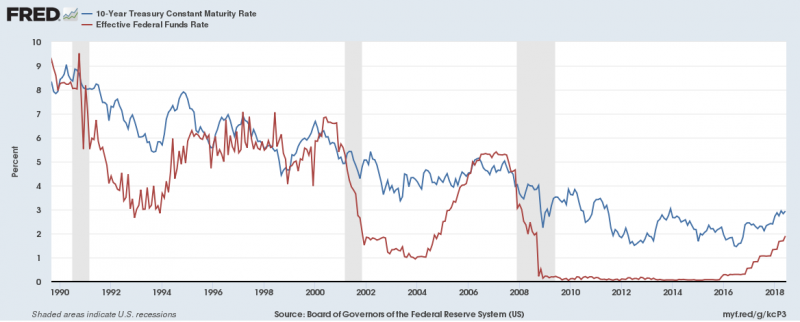

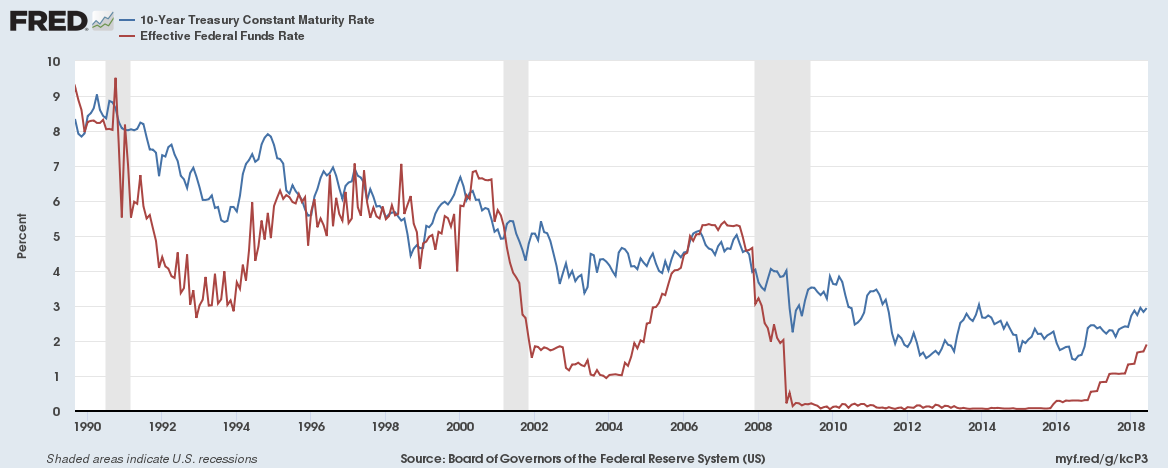

Is the rate hiking cycle almost done? Not the question on everyone’s minds right now so a good time to ask it, I think. A couple of items caught my attention recently that made me at least think about the possibility.

There has been for some time now a large short position held by speculators in the futures market for Treasuries.

Read More »

Read More »

Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth

The yield on the 10 year Treasury note briefly surpassed the supposedly important 3% barrier and then….nothing. So, maybe, contrary to all the commentary that placed such importance on that level, it was just another line on a chart and the bond bear market fear mongering told us a lot about the commentators and not a lot about the market or the economy.

Read More »

Read More »

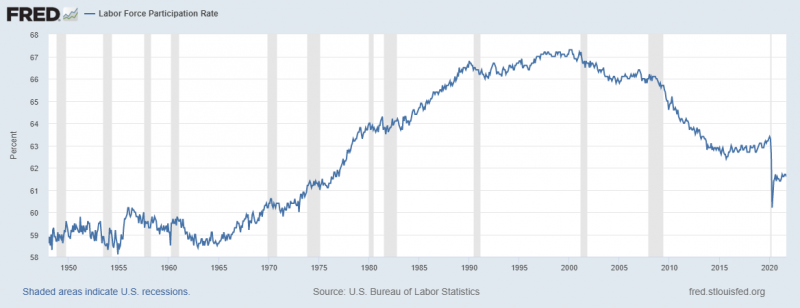

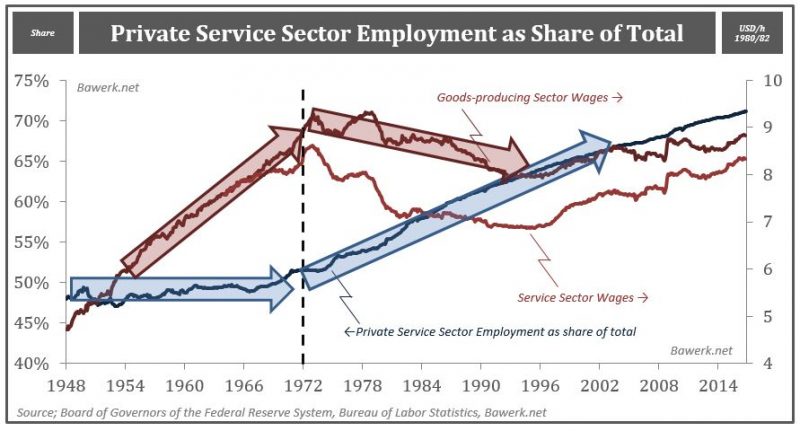

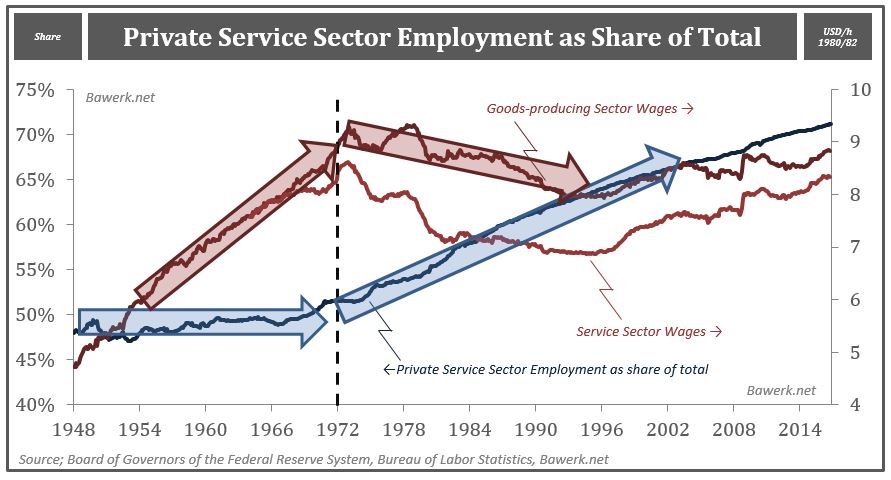

Great Graphic: US Wage Growth Exceeds Productivity Growth

One of the longstanding challenges to growth US aggregate demand has been that wages have not kept pace with inflation and productivity. The decoupling appears to have taken place in the late 1960s or early 1970s depending on exactly which metric one uses.In my book, the Political Economy of Tomorrow, I argue the decoupling of men's wages from productivity and inflation made it possible and necessary for women to enter the workforce in large...

Read More »

Read More »

Toward A New World Order, part III

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the new political class that we...

Read More »

Read More »

(5.3) FX Theory: Penn Effect and Balassa Samuelson Effect

George Dorgan extends the previous discussion on trade surplus countries. Now he explains the Penn and the Balassa-Samuelson Effect. He applies these principles to Germany, to Greece and to Switzerland.

Read More »

Read More »