Tag Archive: Precious Metals

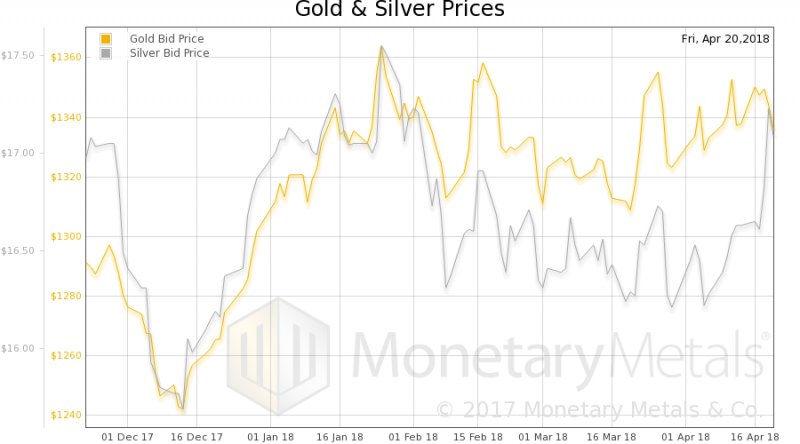

Russian Gold Rush – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

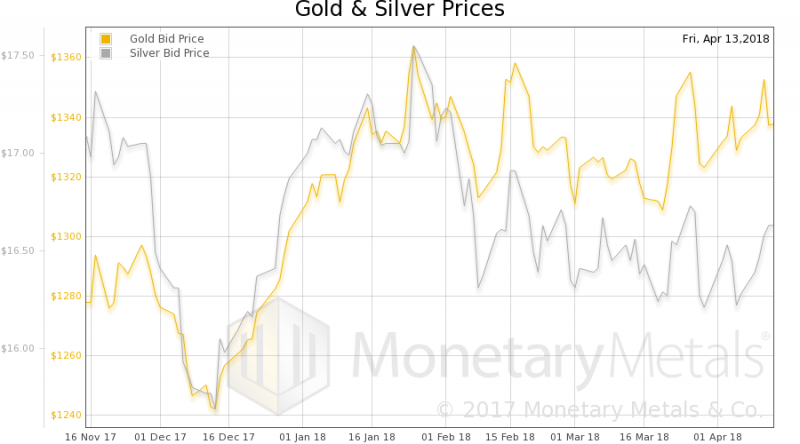

Flight of the Bricks – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Claudio Grass on Cryptocurrencies and Gold – An X22 Report Interview

The Global Community is Unhappy With the Monetary System, Change is Coming

Our friend Claudio Grass of Precious Metal Advisory Switzerland was recently interviewed by the X22 Report on cryptocurrencies and gold. He offers interesting perspectives on cryptocurrencies, bringing them into context with Hayek’s idea of the denationalization of money. The connection is that they have originated in the market and exist in a framework of free competition,...

Read More »

Read More »

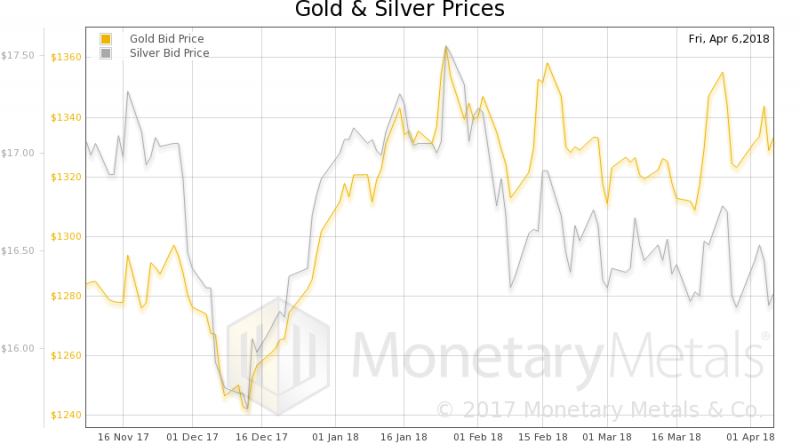

No Revolution Just Yet – Precious Metals Supply and Demand Report

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

The Dollar Cancer and the Gold Cure

The dollar is failing. Millions of people can see at least some of the major signs, such as the collapse of interest rates, record high number of people not counted in the workforce, and debt rising from already-unpayable levels at an accelerating rate.

Read More »

Read More »

Prices and Predictions – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Despondency in Silver-Land

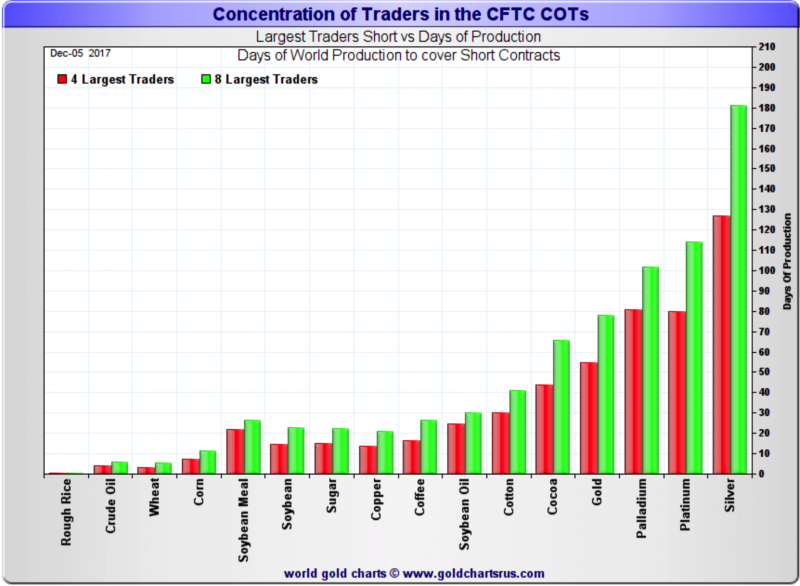

Over the past several years we have seen a few amazing moves in futures positioning in a number of commodities, such as e.g. in crude oil, where the by far largest speculative long positions in history have been amassed. Over the past year it was silver’s turn. In April 2017, large speculators had built up a record net long position of more than 103,000 contracts in silver futures with the metal trading at $18.30.

Read More »

Read More »

Return of the Market Criers – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

A Giant Ouija Board – Precious Metals Supply and Demand Report

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Why I Own Gold and Gold Mining Companies – An Interview With Jayant Bandari

Maurice Jackson of Proven and Probable has recently interviewed Jayant Bandari, the publisher of Capitalism and Morality and a frequent contributor to this site. The topics discussed include currencies, bitcoin, gold and above all junior gold stocks (i.e., small producers and explorers). Jayant shares some of his best ideas in the segment, including arbitrage opportunities currently offered by pending takeovers – which is an area that generally...

Read More »

Read More »

“Strong Dollar”, “Weak Dollar” – What About a Gold-Backed Dollar?

The recent hullabaloo among President Trump’s top monetary officials about the Administration’s “dollar policy” is just the start of what will likely be the first of many contradictory pronouncements and reversals which will take place in the coming months and years as the world’s reserve currency continues to be compromised. So far, the Greenback has had its worst start since 1987, the year of a major stock market reset.

Read More »

Read More »

Monetary Metals Brief 2018

Predicting the likely path of the prices of the metals in the near term is easy. Just look at the fundamentals. We have invested many man-years in developing the theory, model, and software to calculate it. Every week we publish charts and our calculated fundamental prices.

Read More »

Read More »

Quantum Change in Gold Demand Continues – Precious Metals Supply-Demand Report

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold and Gold Stocks – Patterns, Cycles and Insider Activity, Part 2

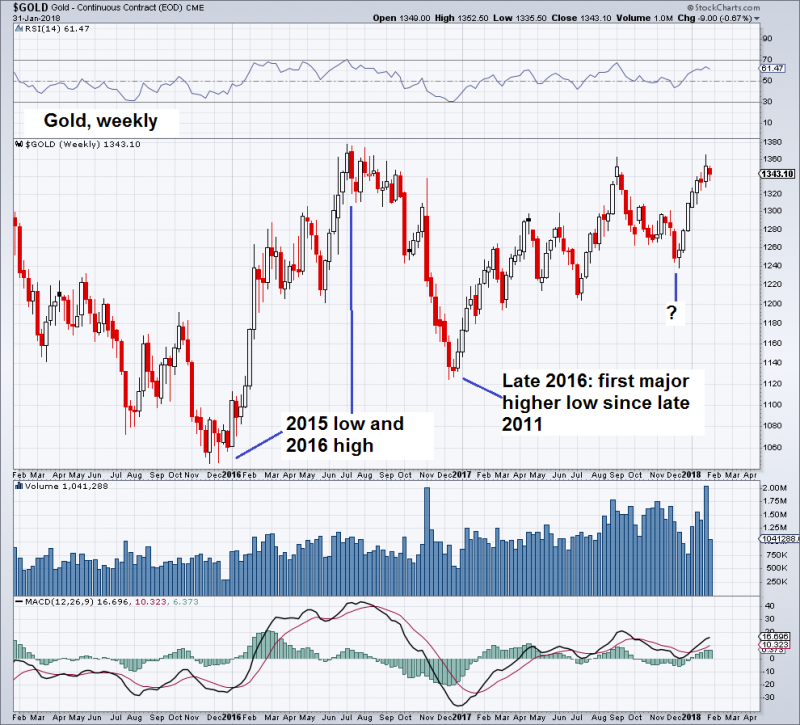

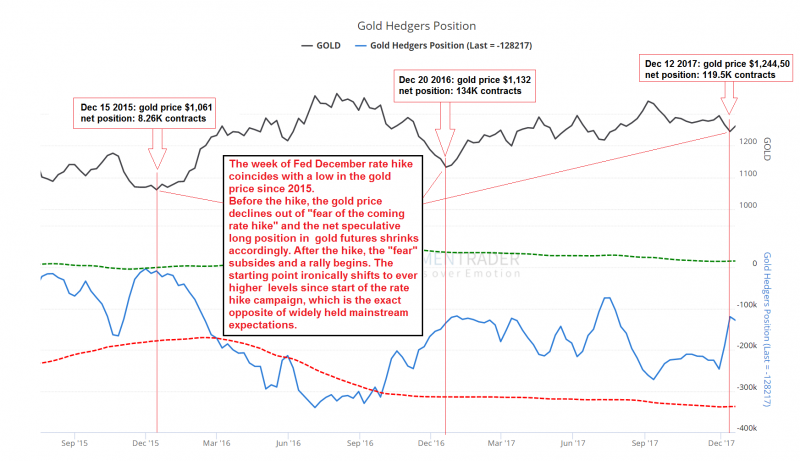

Another recurring pattern consists of the seasonally strong period in gold around the turn of the year, which is bisected by a mid to late December interim low in the gold price. An additional boost can be expected in January and Feburary from the strong seasonal uptrend in silver and platinum group metals as well (to see the seasonal PGM charts, scroll down to our addendum to this recent article by Dimitri Speck).

Read More »

Read More »

Gold and Gold Stocks – Patterns, Cycles and Insider Activity, Part 1

Repeating Patterns and Positioning A noteworthy confluence of patterns in gold and gold stocks is in evidence this year. At the close of trading on December 26, the HUI Index has given a (tentative) buy signal by completing a unique chart pattern, which is why we decided to briefly discuss the situation.

Read More »

Read More »

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

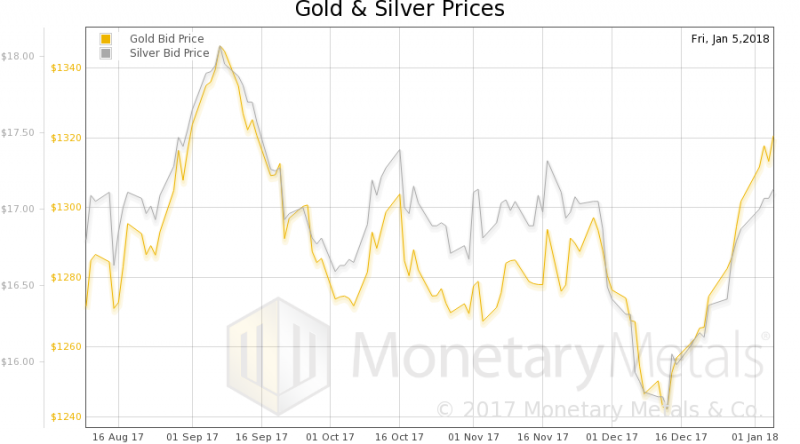

Gold and silver COT suggests bottoming and price rally coming. Speculators cut way back on long positions and added to short bets. Commercials/banks significantly reduced short positions. Commercial net short position saw biggest one-week decline in COMEX history. ‘Big 4’ commercial traders decreased their short positions by 28,800 contracts. Seasonally, January is generally a good month to own gold (see table). "If history is still reliable,...

Read More »

Read More »

What’s the Point? Precious Metals Supply and Demand Report

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Precious Metals Supply and Demand – Thanksgiving Week

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

The Precious Metals Bears’ Fear of Fridays

In the last issue of Seasonal Insights I have shown that the gold price behaves quite peculiarly in the course of the trading week. On average, prices rise almost exclusively on Friday. It is as though investors in this market were mired in deep sleep for most of the week.

Read More »

Read More »

New Gold-Backed Debit Card Launched In Partnership With MasterCard

In recent years, there has been a major debate about the respective merits of gold versus Bitcoin, even though many, not all, gold bulls are also supporters of the latter. Gold advocates generally view favourably Bitcoin’s inherent characteristics of decentralisation, finite supply and ability to operate (so far) outside of the usual interference by western central banks.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

13 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Bitcoin: Ich kaufe JETZT!

Bitcoin: Ich kaufe JETZT! -

Was kocht man einem Multimillionär?

-

15 Minuten Stadt wird Realität! Oxford Testlauf | Ernst Wolff Aktuell

15 Minuten Stadt wird Realität! Oxford Testlauf | Ernst Wolff Aktuell -

Paukenschlag in Budapest: Maja T. erwartet URTEIL schon Mittwoch!

Paukenschlag in Budapest: Maja T. erwartet URTEIL schon Mittwoch! -

2-2-26 Bears Are an Endangered Species

2-2-26 Bears Are an Endangered Species -

Vor 5 Minuten: ADAC Präsident tritt zurück! 60.000 Kündigungen!

Vor 5 Minuten: ADAC Präsident tritt zurück! 60.000 Kündigungen! -

UN 20% DE LOS INMIGRANTES NO TRABAJA

UN 20% DE LOS INMIGRANTES NO TRABAJA -

Berlin SCHOCK: “60% der Wärmepumpen zerstört”!!!

Berlin SCHOCK: “60% der Wärmepumpen zerstört”!!! -

Swiss bank Julius Bär posts lower profits

Swiss bank Julius Bär posts lower profits -

Michael Burry warnt, das ist passiert

Michael Burry warnt, das ist passiert

More from this category

A new era for silver?

A new era for silver?28 Aug 2024

A perfect storm in the making

A perfect storm in the making 15 Feb 2024

Gold Hits New All Time Highs

Gold Hits New All Time Highs2 Nov 2023

This Will Be The Biggest Theft of This Century

This Will Be The Biggest Theft of This Century10 Feb 2023

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton27 Oct 2022

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!16 Oct 2022

Rick Rule – Gold Helps Me Sleep at Night

Rick Rule – Gold Helps Me Sleep at Night14 Oct 2022

Were the UK pension funds just the canary in the gold mine?

Were the UK pension funds just the canary in the gold mine?9 Oct 2022

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!5 Oct 2022

Episode 5 of The M3 Report with Steve St. Angelo

Episode 5 of The M3 Report with Steve St. Angelo28 Sep 2022

US CPI Data Release Update

US CPI Data Release Update17 Sep 2022

What Problem Does Gold Solve?

What Problem Does Gold Solve?14 Sep 2022

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks10 Sep 2022

When markets forget that Central Banks cannot fix the world with interest rates

When markets forget that Central Banks cannot fix the world with interest rates4 Sep 2022

The Russian Gold Standard

The Russian Gold Standard28 Aug 2022

History Of Money and Evolution Suggests a Crash is Coming

History Of Money and Evolution Suggests a Crash is Coming27 Aug 2022

Why we couldn’t be happier that gold is boring

Why we couldn’t be happier that gold is boring23 Aug 2022

More energy blows are dealt to Europe, causing a cold chill to be even colder

More energy blows are dealt to Europe, causing a cold chill to be even colder13 Aug 2022

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300?11 Aug 2022

A muddled message from The Fed

A muddled message from The Fed29 Jul 2022