Tag Archive: Precious Metals

A Note on Gold and India – What is Driving the Gold Price?

It is well-known that India’s government wants to coerce its population into “modernizing” its financial behavior and abandoning its traditions. The recent ban on large-denomination banknotes was not only meant to fight corruption. In fact, as our friend Jayant Bhandari has pointed out, fresh avenues for corruption immediately opened up upon enactment of the ban (see “Gold Price Skyrockets in India After Currency Ban” – Part 1, Part 2 and Part...

Read More »

Read More »

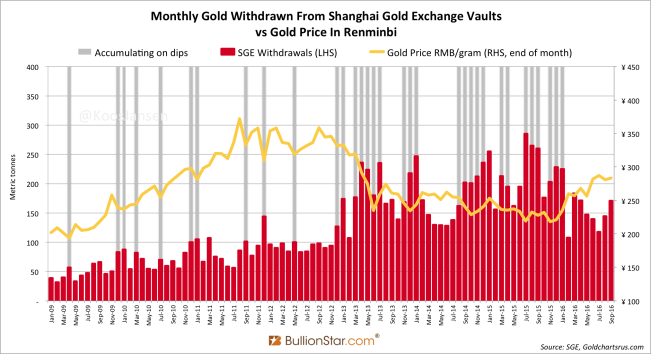

Q1 – Q3 2016 China Net Gold Import Hits 905 Tonnes

Withdrawals from the vaults of the Shanghai Gold Exchange, which can be used as a proxy for Chinese wholesale gold demand, reached 1,406 tonnes in the first three quarters of 2016. Supply that went through the central bourse consisted of at least 905 tonnes imported gold, roughly 335 tonnes of domestic mine output, and 166 tonnes in scrap supply and other flows recycled through the exchange.

Read More »

Read More »

Gold Bull Market Remains Intact – Long Term Fundamentals Outweigh Short Term Market Gyrations

In early 2016 gold had a big bull run. The precious metal rose close to 25% this year, pushed higher in a summer rally that peaked on July 10th. Gold experienced a bumpy ride over the remainder of the summer though, as investors became increasingly concerned about a potential rate hike by the Federal Reserve. Uncertainty returned to gold market and has intensified further since then.

Read More »

Read More »

The Dollar Is Rising – Precious Metals Supply-Demand Report

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold – Eerie Pattern Repetition Revisited

Ask and ye shall receive… we promised we would update the comparison chart we last showed in late November in an article that kind of insinuated that it might be a good time to buy gold and gold stocks (see: “Gold and Gold Stocks – It Gets Even More Interesting” for the details). We are hereby delivering on that promise.

Read More »

Read More »

Gold Price Skyrockets in India after Currency Ban – Part II

Here is a link to Part 1, about what happened in the first two days after India’s government made Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes illegal. They can now only be converted to Rs 100 (~$1.50) or lower denomination notes, at bank branches or post offices. Banks were closed the first day after the decision. What follows is the crux of what has happened over the subsequent four days.

Read More »

Read More »

Precious Metals – Backwardation Profit Taking

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold Price Skyrockets in India after Currency Ban

As I write this in the morning of 9th November 2016, there are huge lines forming outside gold shops in India — and gold traded heavily until late into the night yesterday. Depending on who you ask, the retail price of gold has gone up between 15% and 20% within the last 10 hours.

Read More »

Read More »

Gold Surges Post-Trump, Nears Heaviest Volume Day Ever

Gold futures had their heaviest day of trading during April 2013 when a mysterious flash crash sent the precious metal collapsing with no clear fundamental/news catalyst. In June, Brexit sparked massive volume buying in the barbarous relic, but overnight, as a Trump victory became more and more of a reality, gold futures are approaching their busiest day ever.

Read More »

Read More »

Gold Always Wins

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Incrementum Advisory Board Meeting Q3 2016

Is Stagflation a Potential Threat? The Incrementum Fund held its quarterly advisory board meeting on October 3 (the transcript can be downloaded below). Our regular participants – the two fund managers Ronald Stoeferle and Mark Valek, advisory board members Jim Rickards, Frank Shostak and yours truly – were joined by special guest Grant Williams this time.

Read More »

Read More »

Argor-Heraeus: Another giant Swiss gold refinery goes on the Sales Lot

News has just emerged in the gold market that the giant Swiss precious metals refiner Argor-Heraeus has held discussions to be acquired, and that the likely outcome is an acquisition by a private equity group. This private equity group is believed to be London-based WRM CapInvest, part of Zurich headquartered WRM Capital.

Read More »

Read More »

The Clinton-Comey Effect

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

50 Slides for Gold Bulls – The New Incrementum Chart Book Introduction

Our good friends Ronnie Stoeferle and Mark Valek of Incrementum AG have just published a new chart book, which recaps and updates charts originally shown in this year’s 10th anniversary edition of the “In Gold We Trust” report and provides an overview of recent developments relevant to the gold market. The chart book can be downloaded in PDF form via the link at the end of this post.

Read More »

Read More »

If You Can’t Touch It, You Don’t Own It

The pending Brexit has, not surprisingly, caused a shakeup in the investment world, particularly in the UK. Of particular note is that, recently, asset management firms in Britain began refusing their clients the right to cash out of their mutual funds. Of the 35 billion invested in such funds, just under £20 billion has been affected.

Read More »

Read More »

Wile E. Coyote Gravity Lessons

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

The Great Physical Gold Supply & Demand Illusion

Numerous consultancy firms around the world, for example Thomson Reuters GFMS, Metals Focus, the World Gold Council and CPM Group, provide physical gold supply and demand statistics, accompanied by an analysis of these statistics in relation to the price of gold. As part of their analysis the firms present supply and demand balances that show how much gold is sold and bought globally, subdivided in several categories. It’s widely assumed these...

Read More »

Read More »

Is the Gold Bull Market Over?

ABN Amro, Natixis and Wells Fargo have issued bearish calls on gold. Natixis even expects three Fed rate hikes next year. Pater Tanebrarum discusses these opinions critically.

Read More »

Read More »

Sideways Silver Market

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold Sector Correction – Where Do Things Stand?

When we last discussed the gold sector correction (which had only just begun at the time), we mentioned we would update sentiment and positioning data on occasion. For a while, not much changed in these indicators, but as one would expect, last week’s sharp sell-off did in fact move the needle a bit.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

13 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Bitcoin: Ich kaufe JETZT!

Bitcoin: Ich kaufe JETZT! -

Was kocht man einem Multimillionär?

-

15 Minuten Stadt wird Realität! Oxford Testlauf | Ernst Wolff Aktuell

15 Minuten Stadt wird Realität! Oxford Testlauf | Ernst Wolff Aktuell -

Paukenschlag in Budapest: Maja T. erwartet URTEIL schon Mittwoch!

Paukenschlag in Budapest: Maja T. erwartet URTEIL schon Mittwoch! -

2-2-26 Bears Are an Endangered Species

2-2-26 Bears Are an Endangered Species -

Vor 5 Minuten: ADAC Präsident tritt zurück! 60.000 Kündigungen!

Vor 5 Minuten: ADAC Präsident tritt zurück! 60.000 Kündigungen! -

UN 20% DE LOS INMIGRANTES NO TRABAJA

UN 20% DE LOS INMIGRANTES NO TRABAJA -

Berlin SCHOCK: “60% der Wärmepumpen zerstört”!!!

Berlin SCHOCK: “60% der Wärmepumpen zerstört”!!! -

Swiss bank Julius Bär posts lower profits

Swiss bank Julius Bär posts lower profits -

Michael Burry warnt, das ist passiert

Michael Burry warnt, das ist passiert

More from this category

A new era for silver?

A new era for silver?28 Aug 2024

A perfect storm in the making

A perfect storm in the making 15 Feb 2024

Gold Hits New All Time Highs

Gold Hits New All Time Highs2 Nov 2023

This Will Be The Biggest Theft of This Century

This Will Be The Biggest Theft of This Century10 Feb 2023

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton27 Oct 2022

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!16 Oct 2022

Rick Rule – Gold Helps Me Sleep at Night

Rick Rule – Gold Helps Me Sleep at Night14 Oct 2022

Were the UK pension funds just the canary in the gold mine?

Were the UK pension funds just the canary in the gold mine?9 Oct 2022

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!5 Oct 2022

Episode 5 of The M3 Report with Steve St. Angelo

Episode 5 of The M3 Report with Steve St. Angelo28 Sep 2022

US CPI Data Release Update

US CPI Data Release Update17 Sep 2022

What Problem Does Gold Solve?

What Problem Does Gold Solve?14 Sep 2022

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks10 Sep 2022

When markets forget that Central Banks cannot fix the world with interest rates

When markets forget that Central Banks cannot fix the world with interest rates4 Sep 2022

The Russian Gold Standard

The Russian Gold Standard28 Aug 2022

History Of Money and Evolution Suggests a Crash is Coming

History Of Money and Evolution Suggests a Crash is Coming27 Aug 2022

Why we couldn’t be happier that gold is boring

Why we couldn’t be happier that gold is boring23 Aug 2022

More energy blows are dealt to Europe, causing a cold chill to be even colder

More energy blows are dealt to Europe, causing a cold chill to be even colder13 Aug 2022

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300?11 Aug 2022

A muddled message from The Fed

A muddled message from The Fed29 Jul 2022