Tag Archive: Post-Brexit

FX Daily, February 3: Inauspicious Start to the Year of the (Flying) Rat

Overview: The Year of the Rat is off to an inauspicious start as apparently a fly rat (a bat) virus has jumped to humans. China's markets re-opening amid much fanfare, and the Shanghai Composite dropped 7.7%, which is about what the futures in Singapore had anticipated. Several other markets in the region (Japan's Nikkei, Australia, Singapore, Taiwan, and Thailand) fell by more than 1%.

Read More »

Read More »

Carney Gets Ahead of Market Expectations; Sterling Slumps, Gilts Soar

BOE cuts rates and expands QE. Door is open to more easing. Sterling stabilizes after selling off 2 cents.

Read More »

Read More »

FX Daily, July 20: Sterling’s Jump Slows Dollar’s Ascent

It is a bizarre turn of events. Just like the Game of Throne's Westeros is a map of the UK put on top of an inverted Ireland, so too do UK events seem to be a strange permutation of the pre-referendum views. Although sterling and interest rates have not fully recovered from the Brexit decision, equity markets have, and fear of contagion has died down.

Read More »

Read More »

Squaring the Circle: Can Article 7 be Used to Force Article 50?

Article 7 would suspend the UK's EU voting rights on grounds it is not negotiating in good faith by delaying the triggering of Article 50. The U.S. debated what "is" means, now investors are trying to figure out what May means. Although sterling has stabilized, interest rate differentials have not.

Read More »

Read More »

FX Weekly Preview: Sources of Movement

Electoral politics remains significant. BOE is likely to cut rates, while BoC may tilt more dovishly. US Q2 earnings season formally begins.

Read More »

Read More »

Is Carney the Sole Adult in UK’s Political Morass?

Sterling has fallen to $1.3050. Two real estate funds have suspended trading (liquidation). Constitutional crisis over who has authority to trigger Article 50 may have begun.

Read More »

Read More »

FX Daily, July 04: Four Things that Happened on the Anniversary of the Original Brexit

Inflation expectations fall in Japan. UK construction PMI fell sharply before Brexit. The Australian dollar recovers from the dip as investors await more results. It is not clear that Brexit has sparked a wave of nationalism or anti-EU sentiment.

Read More »

Read More »

FX Weekly Preview: If No Article 50 Soon, What are the Fundamental Drivers?

Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act.

Read More »

Read More »

The Worst is Yet to Come–Don’t be Seduced by the Price Action

The two-day bounce in sterling seems technically driven rather than fundamental. The Brexit decision has set off a unfathomable chain of events whose impact and implications are far from clear. The economic hit on the UK may spur a BOE rate cut, even if not QE, as early as next month.

Read More »

Read More »

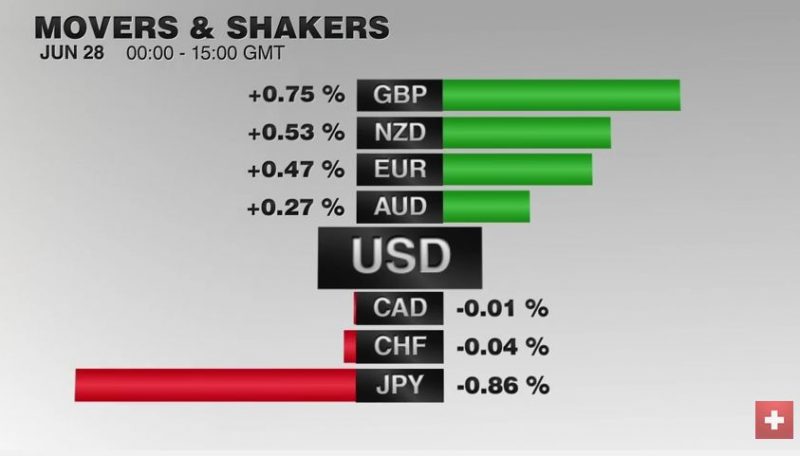

FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday's; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today.

Read More »

Read More »

Great Graphic: Sterling Monthly Chart and Outlook

Sterling's losses are not simply a product of thin liquidity or panic. Both main political parties are in disarray just when strong leadership is needed. The rough projection pre-vote of what could happen on Brexit suggests $1.20-$!.2750.

Read More »

Read More »

FX Weekly Preview: Post-Brexit: Week One

The EU response to Brexit is important. The EU summit and the talks with Turkey are very important. Brexit leaders seem as surprised and unprepared for the results as anyone. And a preview on economic data for the week.

Read More »

Read More »