Tag Archive: On Economy

Helping Robots Find Jobs…

When the cost of capital goes down to zero, a company with access to that cheap – or even free – money can afford to pay almost an infinite amount of money to get rid of its employees and hire robots.

“Zero-interest-rate policy is really a full robot employment program.”

Read More »

Read More »

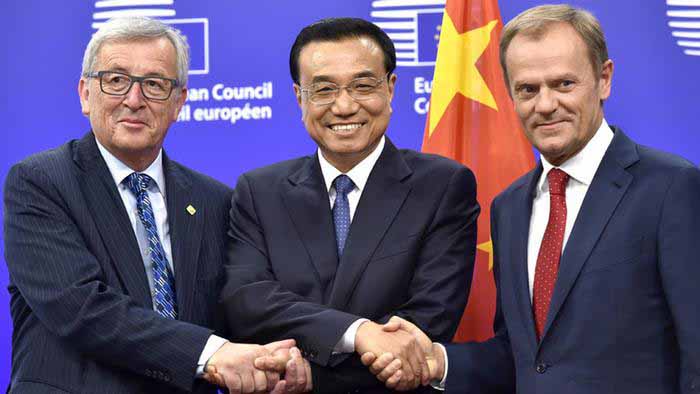

EU Sends Obsolete Industries Mission to China

The European press informs us that a delegation of EU Commission minions, including Mr. JC Juncker (who according to a euphemistically worded description by one of his critics at the Commission “seems often befuddled and tired, not really quite present”) and European Council president Donald Tusk, has made landfall in Beijing.

Read More »

Read More »

European Banks and Europe’s Never-Ending Crisis

Landfall of a “Told You So” Moment… Late last year and early this year, we wrote extensively about the problems we thought were coming down the pike for European banks. Very little attention was paid to the topic at the time, but we felt it was a typical example of a “gray swan” – a problem everybody knows about on some level, but naively thinks won’t erupt if only it is studiously ignored.

Read More »

Read More »

Planet Debt

She is a low-interest-rate person. She has always been a low-interest-rate person. And I must be honest. I am a low-interest-rate person. If we raise interest rates, and if the dollar starts getting too strong, we’re going to have some very major problems.

Read More »

Read More »

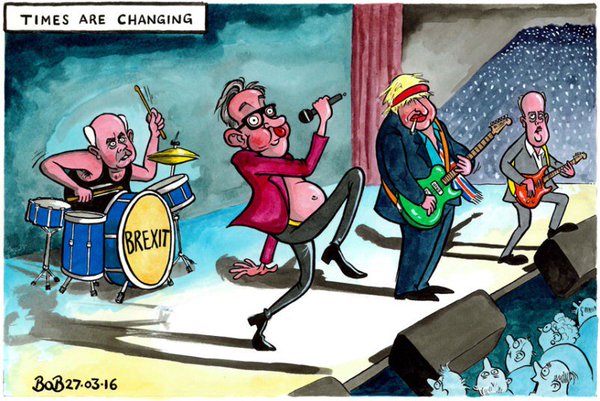

Mooning the Elite

Dow up 269 points. Was that all there was? Is the “Brexit” scare over? We don’t know… but we’re going to take a pause today. Instead of trying to connect the new dots, we’re going to take a look at the old dots we’ve already strung together

Read More »

Read More »

If the UK Economy Tanks, Don’t Blame Brexit

If the process of wealth generation is currently in good shape then Britain’s exit from the EU shouldn’t have any negative effect on real economic growth. This, however, might not be the case.

It is likely that the reckless monetary policy of central banks in the UK and the eurozone has inflicted a severe damage to the process of real wealth formation.

Read More »

Read More »

When the Deep State Controls All Wealth

The feds got out the knife in 1971. They changed the money system itself. They severed the link between gold and the dollar – and between value and price. It was so subtle almost no one objected… and so clever almost no one saw what it really meant. It took us more than 40 years to figure it out.

Read More »

Read More »

The Coming End of the “Third Way” System

We recently discussed the post-Brexit landscape with a friend (in fact, our editor), who bemoaned that “the EU is led by a drunkard”. Our immediate reaction to this was to exclaim: “That’s the best thing about the EU!”

Read More »

Read More »

Vive la Revolution! Brexit and a Dying Order

A Dying Order Last Thursday, the Brits said auf Wiedersehen and au revoir to the European Union. On Friday, the Dow sold off 611 points – a roughly 3.5% slump. What’s going on?

Read More »

Read More »

Rule Britannia

What a glorious day for Britain and anyone among you who continues to believe in the ideas of liberty, freedom, and sovereign democratic rule. Against all expectations, the leave camp somehow managed to push the referendum across the center line, with 51.9% of voters counted electing to leave the European Union.

Read More »

Read More »

The EU Begins to Splinter, a new Tsunami for Kuroda

Early this morning one might have been forgiven for thinking that Japan had probably just been hit by another tsunami. The Nikkei was down 1,300 points, the yen briefly soared above par.

Read More »

Read More »

Towards Freedom: Will The UK Write History?

Every freedom loving person on the planet has their eyes fixed on this referendum. A clear majority voting for Brexit and therefore for more decentralization, would show that the British realized they can break free from their self-imposed nonage, and reclaim individual liberty.

Read More »

Read More »

A Market Ready to Blow and the Flag of the Conquerors

The U.S. is too big, too varied, too much of everything. You can’t fix a single view of it, even in your mind.

But now our problems, challenges, and discontents are big. They are national and international. We cannot see them. We cannot understand them.

Instead, we draw their measure from the news media – based on a flag that flutters and sags, depending on which way the wind is blowing.

Read More »

Read More »

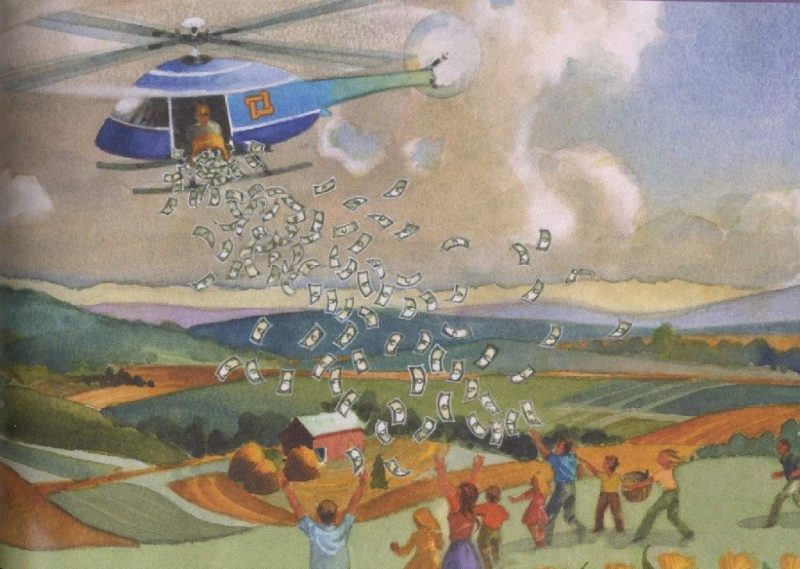

How the Welfare State Dies

People have become used to the idea that the State is their sugar daddy. Many apparently believe that it has some undisclosed, infinite stash of resources at its disposal which it can shower them with at will. The reality is unfortunately different.

Read More »

Read More »

Down Go the Hopes and Dreams of Three Generations

On Wednesday, Janet Yellen pressed on the broken buttons again. After the two day FOMC meeting, the Fed Chair announced they’d continue pressing the federal funds rate down to just a ¼ to ½ percent – effectively zero. What type of insanity is this?

If she keeps it up, and whole thing doesn’t implode, the yield on the 10-Year Treasury note could also slip below zero…along with the hopes and dreams of three generations of retirees.

Read More »

Read More »

The VIX Breaks Out – Market Risk Continues to Surge

The Sharp Move in the VIX Accelerates In Monday’s trading session, the upward move in the volatility index VIX (which measures the implied volatility of SPX options) continued unabated, vastly out of proportion with the move in the underlying stock...

Read More »

Read More »

Brexit Paranoia Creeps Into the Markets

European Stocks Look Really Bad… Late last week stock markets around the world weakened and it seemed as though recent “Brexit” polls showing that the “leave” campaign has obtained a slight lead provided the trigger. The idea was supported by a not...

Read More »

Read More »

A Darwin Award for Capital Allocation

Beyond Human Capacity Distilling down and projecting out the economy’s limitless spectrum of interrelationships is near impossible to do with any regular accuracy. The inputs are too vast. The relationships are too erratic. The economy – comple...

Read More »

Read More »