Tag Archive: OIL

FX Daily, April 9: Three Deals Needed ahead of Holiday Weekend

Overview: Three deals need to be struck. First, the Eurogroup of finance ministers needs to reach an agreement of proposals for joint action to the heads of state. Second, oil producers need to cut output if prices are to stabilize. Third, the US Congress needs to strike a deal to provide more funding. Investor seems hopeful, and risk appetites are have lifted equities.

Read More »

Read More »

Cool Video: OIl, ECB, and Animal Spirits

I had the privilege to join Ben Lichtenstein at TD Ameritrade (from a remote location) this morning to talk about the global markets. I make four points. First, the reversal of the S&P 500 yesterday set the tone for Asia and Europe. Volatility throughout the capital markets remains elevated, even if off the peaks.

Read More »

Read More »

FX Daily, April 8: Flavor of the Day: Consolidation

Overview: Global equities are struggling after the S&P 500 staged a dramatic reversal yesterday. The early 3.5% gain was completely unwound and closed slightly lower. With few exceptions (e.g., Japan and the Philippines), most equity markets in the Asia Pacific region and Europe are lower.

Read More »

Read More »

FX Daily, April 6: Glimmer of Hope Lifts Markets

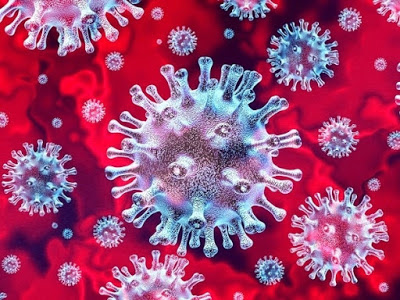

Overview: Reports suggesting that some of the hot spots for the virus contagion appear to be leveling off, and this is helping underpin risk appetites today. The curve seems to be flattening in Italy, Spain, and France. In the US, there are some early signs of leveling off in NY, and now, the number of states with infection rates above 20% is less than 10 from over 40 last week.

Read More »

Read More »

FX Daily, April 03: Oil Firm, Greenback Extends Gains

Overview: Global equities are finishing the week on a soggy tone despite the 2%+ gains seen in the US yesterday. The extension of shutdowns, rising contagion and fatality rate, and imploding economies weigh on prices. In Asia, Korea and Indonesia bucked the trend to most minor gains. Europe is giving back yesterday's gains, and the Dow Jones Stoxx 600 is nearly flat on the week.

Read More »

Read More »

FX Daily, April 2: Optimism on Oil Deal Steadies Risk Appetites…for the Moment

Overview: After US stocks dropped more than 4% yesterday, investor sentiment has improved, apparently sparked by ideas that the pain will force oil producers to find a way to reduce supply. Oil prices have surged, with the May WTI contract rallying around 7%. Asia Pacific equities were mostly higher, with Japan and Australia the notable exceptions.

Read More »

Read More »

FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today. Japan and Australia are exceptions to the generalization.

Read More »

Read More »

FX Daily, March 11: US Over-Promises and Under-Delivers, while BOE Steps Up with 50 bp Rate Cut

Overview: The S&P 500 and Dow Jones Industrials sold off after the higher open and briefly traded below yesterday's lows. Investors seemed disappointed that the Trump Administration was not ready with specific policies after Monday's tease that had initially helped lift Asia Pacific and European markets earlier on Tuesday. This sparked a sharp decline in Europe into the close.

Read More »

Read More »

FX Daily, March 9: Monday Meltdown

Overview: Equities plunged, and yields sank as the coronavirus threatens a global recession. The oil price war signaled by Saudi Arabia and Russia aggravates the desperate situation. Equities markets in the Asia Pacific region slumped 3-7%. The Shanghai Composite was fell 3%. The Nikkei was off by 5%, and Australia was hit among the hardest with a 7.3% loss.

Read More »

Read More »

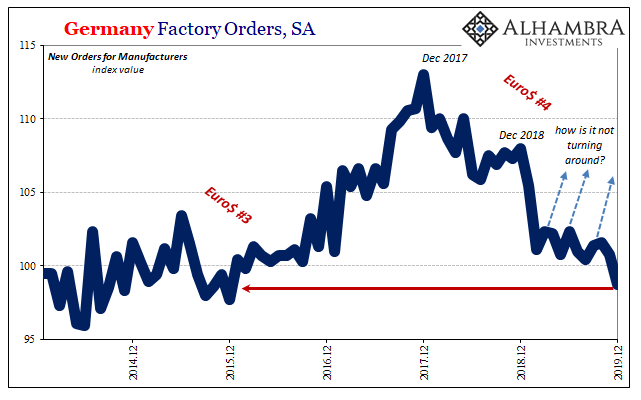

COT Black: German Factories, Oklahoma Tank Farms, And FRBNY

I wrote a few months ago that Germany’s factories have been the perfect example of the eurodollar squeeze. The disinflationary tendency that even central bankers can’t ignore once it shows up in the global economy as obvious headwinds. What made and still makes German industry noteworthy is the way it has unfolded and continues to unfold. The downtrend just won’t stop.

Read More »

Read More »

FX Daily, February 3: Inauspicious Start to the Year of the (Flying) Rat

Overview: The Year of the Rat is off to an inauspicious start as apparently a fly rat (a bat) virus has jumped to humans. China's markets re-opening amid much fanfare, and the Shanghai Composite dropped 7.7%, which is about what the futures in Singapore had anticipated. Several other markets in the region (Japan's Nikkei, Australia, Singapore, Taiwan, and Thailand) fell by more than 1%.

Read More »

Read More »

FX Daily, January 8: Hopes of De-Escalation Help Markets Stabilize

The Iranian retaliatory missile strike on Iraqi-bases housing US forces initially sparked a dramatic risk-off response throughout the capital markets. The muted response by the US coupled with signals from Tehran that it had "concluded" its proportionate measures saw the markets retrace the initial reaction. It was too late for equities in the Asia Pacific region, and several markets (Japan, China, Korea, Malaysia, and Thailand) fell more than 1%.

Read More »

Read More »

FX Daily, October 23: Markets Lack Much Conviction, Await Fresh Developments

Overview: UK Prime Minister Johnson is neither dead in a ditch as he said he would prefer to be than request an extension of Brexit, nor will the UK leave the EU at the end of the month. Yesterday's vote rejected the attempt to fast-track the legislation needed to support the divorce agreement. It all but ensures that such a delay will be forthcoming.

Read More »

Read More »

Tidbits Of Further Warnings: Houston, We (Still) Have A (Repo) Problem

Despite the name, the Fed doesn’t actually intervene in the US$ repo market. I know they called them overnight repo operations, but that’s only because they mimic repo transactions not because the central bank is conducting them in that specific place. What really happened was FRBNY allotting bank reserves (in exchange for UST, MBS, and agency collateral) only to the 24 primary dealers.

Read More »

Read More »

FX Daily, September 16: Oil Surge Pared, Markets Remain on Edge

Overview: Oil prices surged in the initial reaction to the unprecedented drone attack on Saudi Arabia facilities. Saudi Arabia may be able to restore around half of the lost production in a few days. Saudi Arabia and other countries, including the US, prepared to tap strategic reserves, oil prices have seen the initial gains halved. Brent is trading near $65 after finishing last week near $60.

Read More »

Read More »

FX Daily, September 11: Dollar is Firm as ECB is Awaited

Overview: Global equities are extending their recent gains while bonds remain on the defensive. The dollar is firm. There is a degree of optimism that is prevailing. There are some more overtures in terms of US-Chinese trade. In Hong Kong, developers and banks led an equity rally on ideas that the political tensions may ease. South Korea reported better trade data for the first ten days of September.

Read More »

Read More »

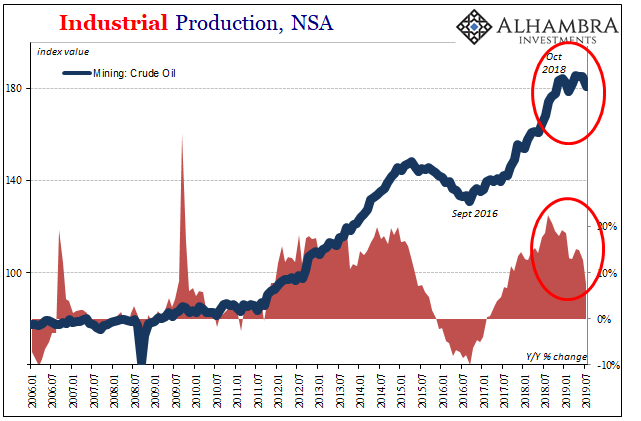

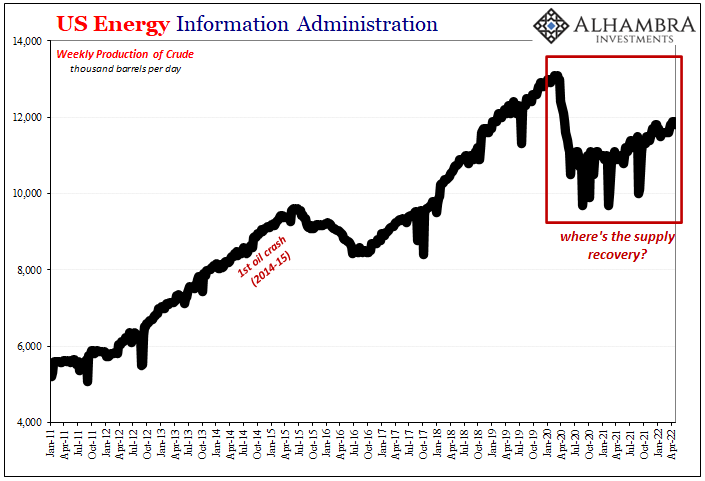

US Industrial Downturn: What If Oil and Inventory Join It?

Revised estimates from the Federal Reserve are beginning to suggest another area for concern in the US economy. There hadn’t really been all that much supply side capex activity taking place to begin with. Despite the idea of an economic boom in 2017, businesses across the whole economy just hadn’t been building like there was one nor in anticipation of one.

Read More »

Read More »

FX Daily, August 12: Yen Remains Bid, While Macri’s Loss in Argentina Weighs on Struggling Mexican Peso

Overview: China again tried to temper the downside pressure on the yuan, and this appears to be helping the risk-taking attitude. Many centers in Asia were closed today, including Japan and India, though most of the other equity markets advanced modestly, including China, Korea, and Australia. Europe's Dow Jones Stoxx 600 opened firmer but is staddling little changed levels unable to stain any upside momentum.

Read More »

Read More »

FX Daily, July 11: Powell Spurs Equity and Bond Market Rally, While the Greenback Falls Out of Favor

Overview: Fed's Powell confirmed a Fed rate cut at the end of this month by warning that uncertainties since the June FOMC had "dimmed the outlook" and that muted price pressures may be more persistent. It ignited an equity and bond market rally (bullish steepening) while the dollar was sold.

Read More »

Read More »

FX Daily, July 10: North American Focus: Poloz and Powell

Overview: The US Treasury market is retreating for the fourth consecutive session ahead of Fed Chairman Powell's testimony before Congress. It is the longest losing streak in six months, and the 10-year yield has risen 15 bp over the run. This is helping drag up global yields, and today Asia Pacific yields mostly rose 2-3 basis points while core European bond yields are 5-7 bp higher and peripheral yields up a little less.

Read More »

Read More »