Tag Archive: oil prices

I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

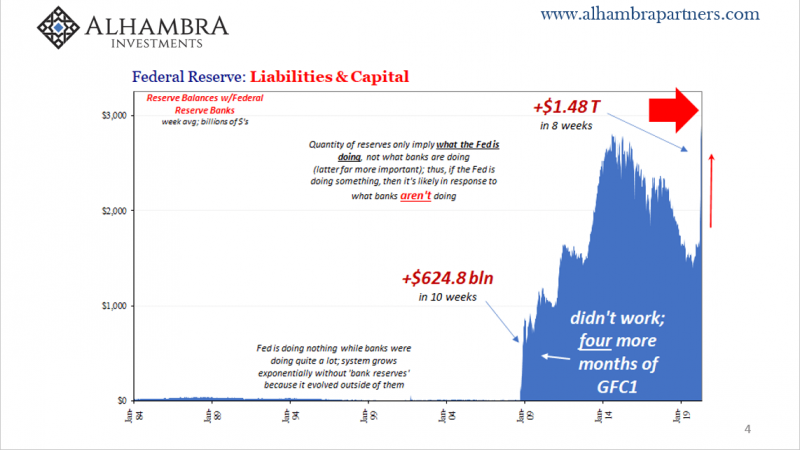

Trust the Fed. Ha! It’s one thing for money dealers to look upon Jay Powell’s stash of bank reserves with remarkable disdain, more immediately damning when effects of the same liquidity premiums in the real economy create serious frictions leaving the entire world exposed to the consequences. When all is said and done, the Federal Reserve has created its own doom-loop from which it won’t likely escape.

Read More »

Read More »

Weekly Market Pulse: Oil Shock

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week.

Read More »

Read More »

Houston, We Have An Oil (and inventory) Problem

If only, like in the aftermath of the Apollo 13 explosion, we could just radio Houston to get started in figuring out just the way out of our fix. Mission Control would certainly buzz all the right people with the right stuff, summoning the best engineers and scientists from their quiet divans to the frenzied and dangerous work ahead.

Read More »

Read More »

Short Run TIPS, LT Flat, Basically Awful Real(ity)

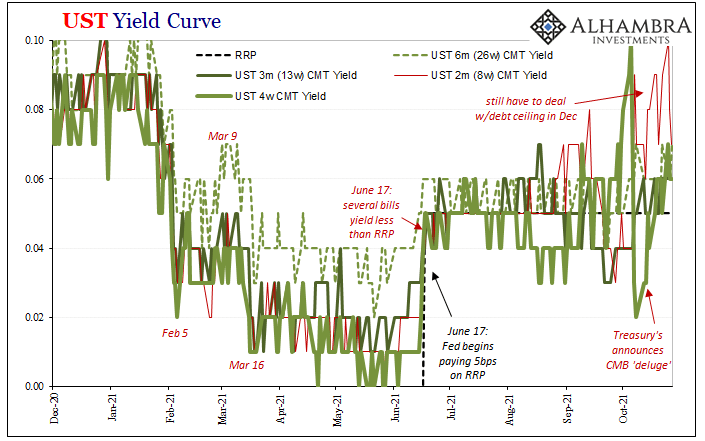

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday.

Read More »

Read More »

Perfect Time To Review What Is, And What Is Not, Inflation (and why it matters so much)

It is costing more to live and be, so naturally people are looking for who it is they need to blame. Maybe figure out some way to stop it. You know and feel for the basics since everyone’s perceptions begin with costs of just living. This is what makes the subject of inflation so difficult, even more so in the era of QE.

Read More »

Read More »

Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion.

Read More »

Read More »

Inflation Hysteria #2 (WTI)

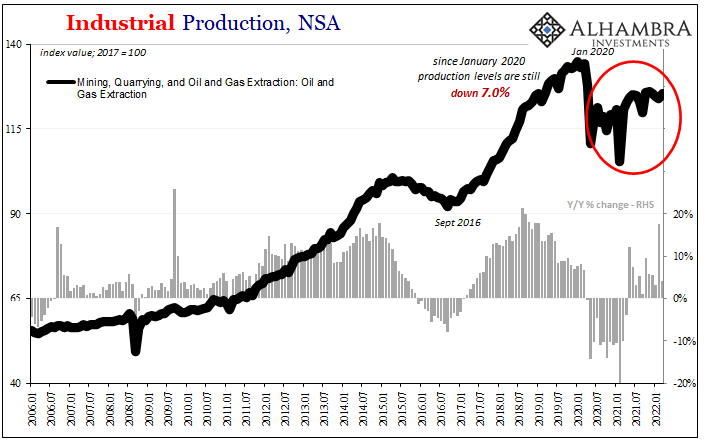

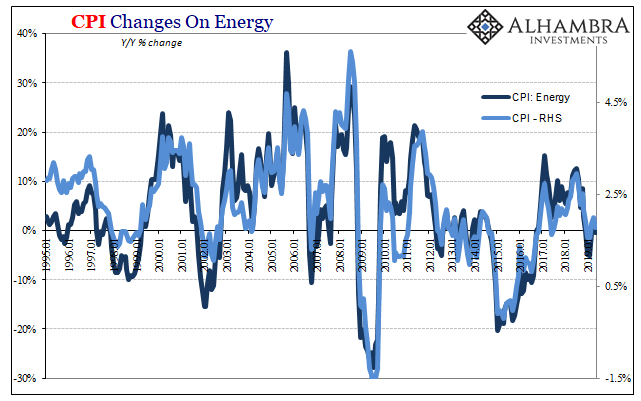

Sticking with our recent theme, a big part of what Inflation Hysteria #1 (2017-18) also had going for it was loosened restrictions for US oil producers. Seriously.

Read More »

Read More »

What’s Going On, And Why Late August?

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here?

Read More »

Read More »

Inflation Karma

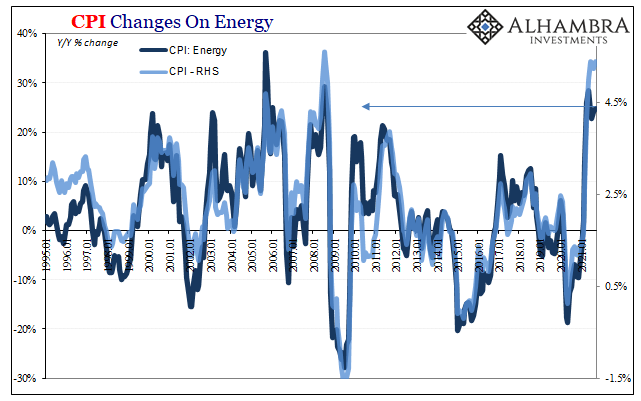

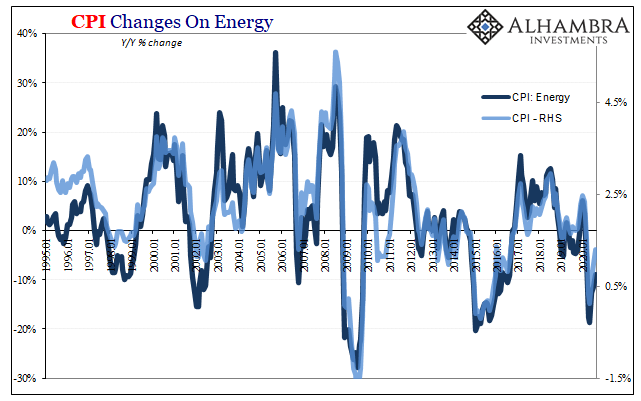

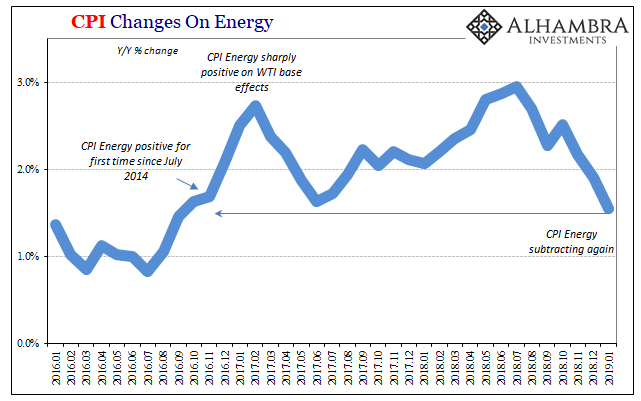

There is no oil in the CPI’s consumer basket, yet oil prices largely determine the rate by which overall consumer prices are increasing (or not). WTI sets the baseline which then becomes the price of motor fuel (gasoline) becoming the energy segment. As energy goes, so do headline CPI measurements.

Read More »

Read More »

A Big One For The Big “D”

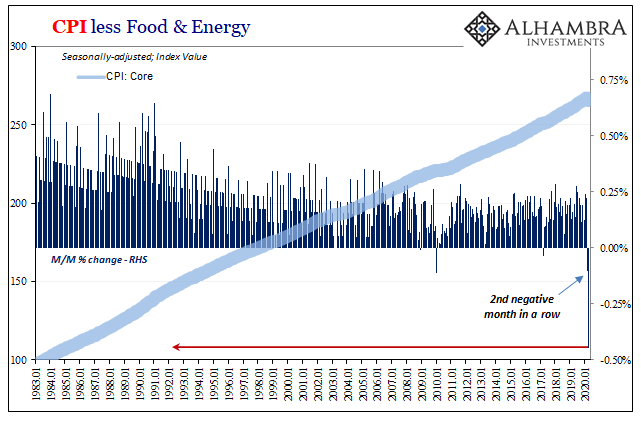

From a monetary policy perspective, smooth is what you are aiming for. What central bankers want in this age of expectations management is for a little bit of steady inflation. Why not zero? Because, they decided, policymakers need some margin of error. Since there is no money in monetary policy, it takes time for oblique “stimulus” signals to feed into the psychology of markets and the economy.

Read More »

Read More »

COT Black: No Love For Super-Secret Models

As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust.

Read More »

Read More »

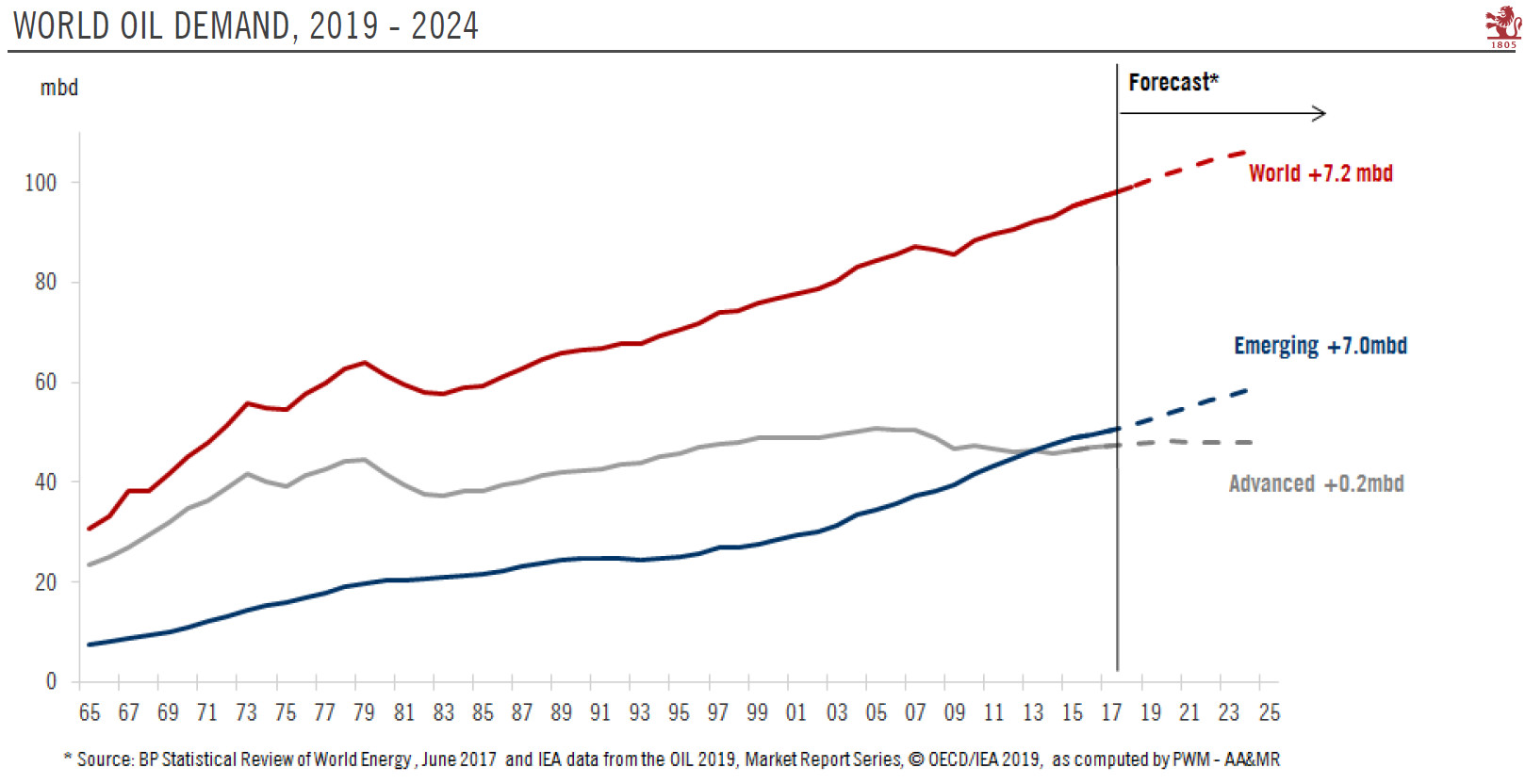

The Path Clear For More Rate Cuts, If You Like That Sort of Thing

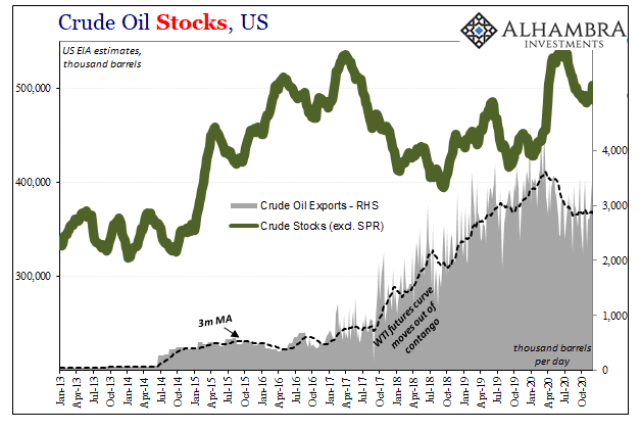

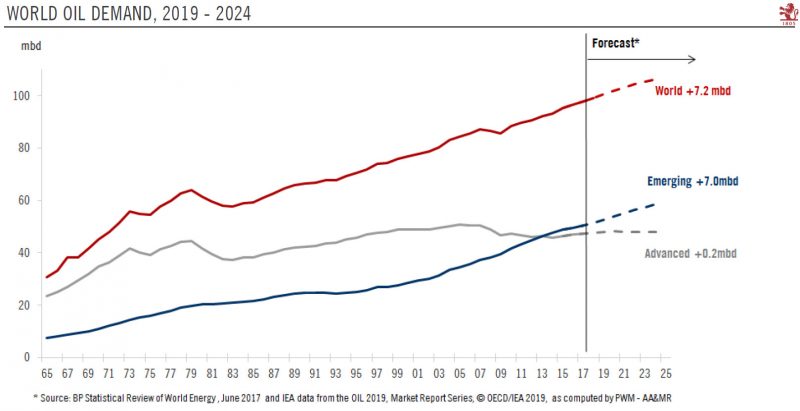

If you like rate cuts and think they are powerful tools to help manage a soft patch, then there was good news in two international oil reports over the last week. The US Energy Information Administration (EIA) cut its forecast for global demand growth for the seventh straight month. On Friday, the International Energy Agency (IEA) downgraded its estimates for the third time in four months.

Read More »

Read More »

When Verizons Multiply, Macro In Inflation

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were).

Read More »

Read More »

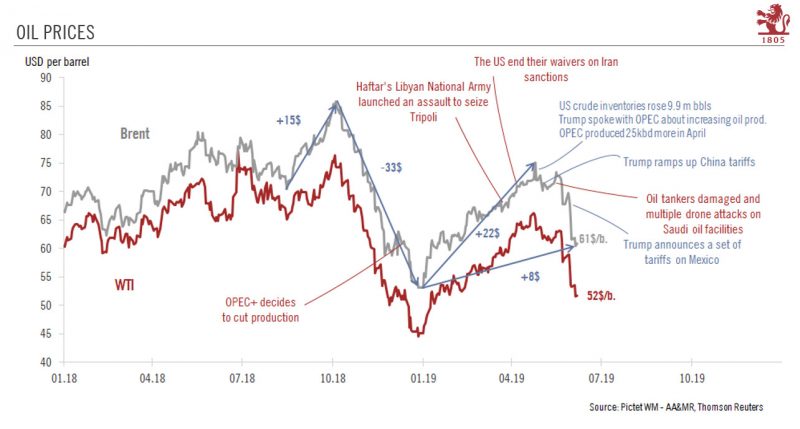

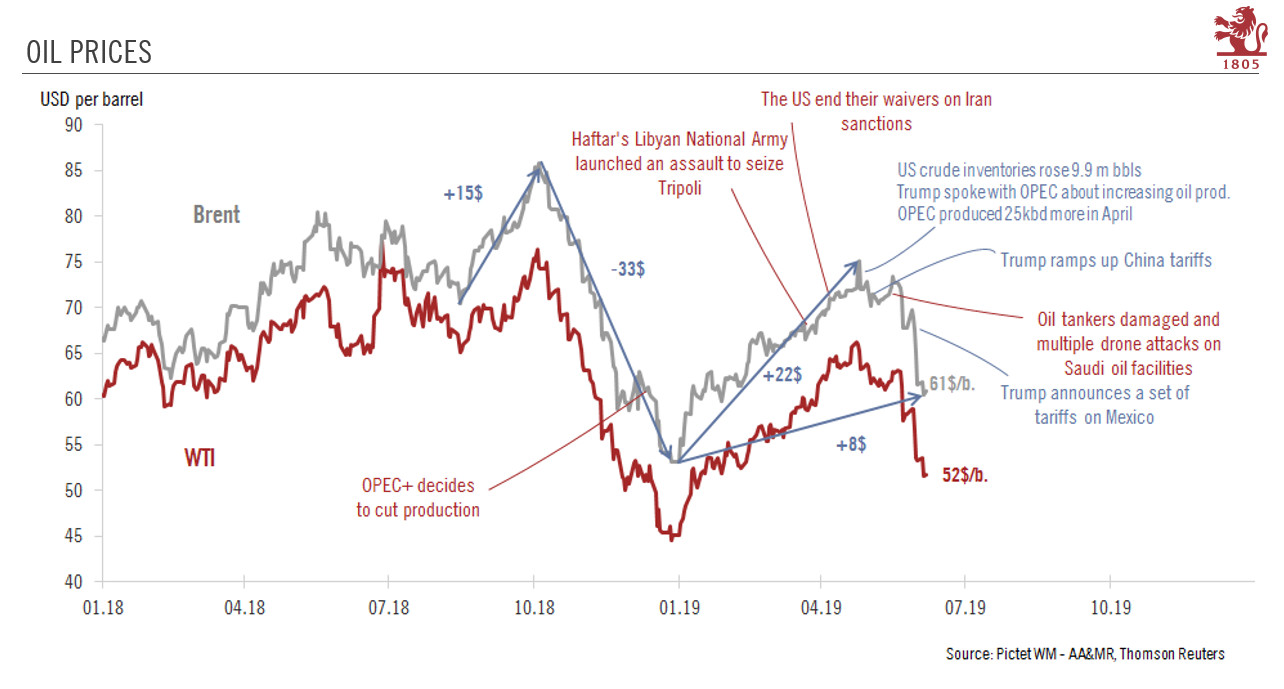

Oil prices are reeling

The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts.The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession.

Read More »

Read More »

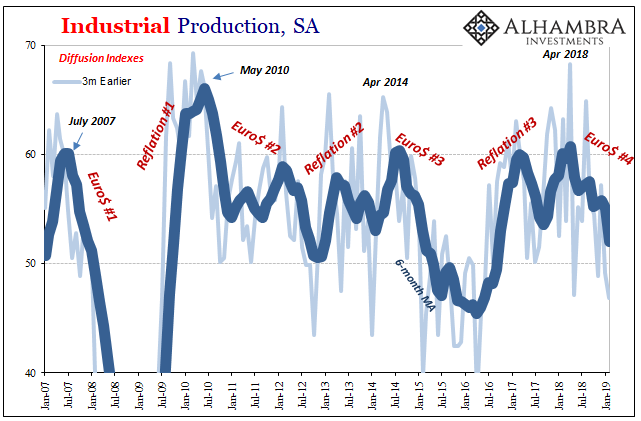

Green Shoot or Domestic Stall?

According to revised figures, things were really looking up for US industry. For the month of April 2018, the Federal Reserve’s Diffusion Index (3-month) for Industrial Production hit 68.2. Like a lot of other sentiment indicators, this was the highest in so long it had to be something. For this particular index, it hadn’t seen better than 68 since way back in March 2010, back when the economy looked briefly like it might actually recover.

Read More »

Read More »

Oil prices supported by OPEC+ cuts…before market risks being flooded again

Increased US export capacity would probably force OPEC+ to change its current tactics.After last year’s collapse, oil prices have found support since the beginning of this year for several reasons. At this stage, the main question is whether the recent surge in prices is sustainable or whether we will see renewed oil price volatility, with the possibility of a repeat of 2018.

Read More »

Read More »

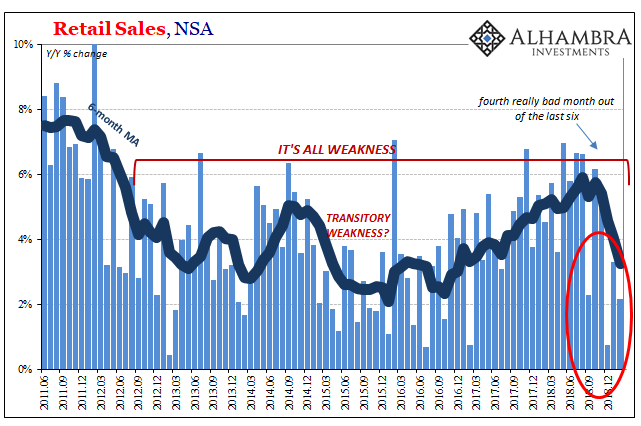

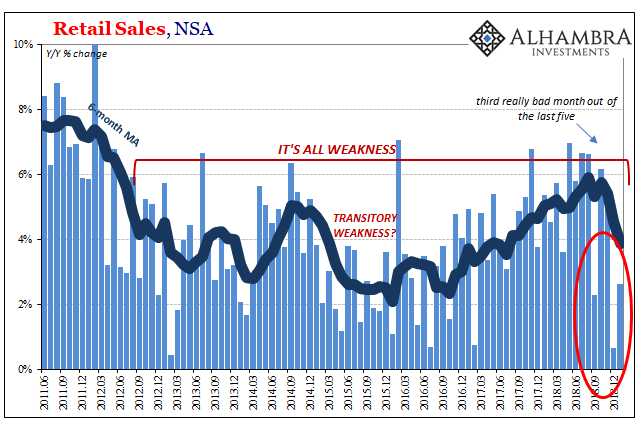

Retail Sales In Bad Company, Decouple from Decoupling

In a way, the government shutdown couldn’t have come at a more opportune moment. As workers all throughout the sprawling bureaucracy were furloughed, markets had run into chaos. Even the seemingly invincible stock market was pummeled, a technical bear market emerged on Wall Street as people began to really consider increasingly loud economic risks.

Read More »

Read More »

Downturn Rising, No ‘Glitch’ In Retail Sales

You just don’t see $4 billion monthly retail sales revisions, in either direction. Advance estimates are changed all the time, each monthly figure will be recalculated twice after its initial release. Typically, though, the subsequent revisions are minor rarely amounting to a billion. Four times that?

Read More »

Read More »

Inflation Falls Again, Dot-com-like

US inflation in January 2019 was, according to the CPI, the lowest in years. At just 1.55% year-over-year, the index hadn’t suggested this level since September 2016 right at the outset of what would become Reflation #3. Having hyped expectations over that interim, US policymakers now have to face the repercussions of unwinding the hysteria.

Read More »

Read More »

Wasting the Middle: Obsessing Over Exits

What was the difference between Bear Stearns and Lehman Brothers? Well, for one thing Lehman’s failure wasn’t a singular event. In the heady days of September 2008, authorities working for any number of initialism agencies were busy trying to put out fires seemingly everywhere. Lehman had to compete with an AIG as well as a Wachovia, already preceded by a Fannie and a Freddie.

Read More »

Read More »