Tag Archive: newslettersent

Great Graphic: Small Caps and the Trump Trade

The Russell 2000, which tracks the 2000 smallest companies in the Russell 3000, is threatening to turn positive for the year. It had turned negative in the second half of last week. Many pundits saw its decline and the penetration of the 200-day moving average for the first time in over a year as a sign of an impending down move in the broader equity market.

Read More »

Read More »

A Swiss parliamentary commission wants to get rid of imputed rent

In Switzerland, home owners have to add a theoretical rent to their taxable income. This means home ownership can increase your annual tax bill, sometimes substantially.

Read More »

Read More »

The Truth About Bundesbank Repatriation of Gold From U.S.

Bundesbank has completed a transfer of gold worth €24B from France and U.S. Germany has completed domestic gold storage plan 3 years ahead of schedule. In the €7.7 million plan, 54,000 gold bars were shipped and audited.

Read More »

Read More »

Swisscom accused of huge roaming charge rip-off

The Swiss consumer protection agency says it will file criminal charges against Swisscom for an alleged roaming charge rip-off that is said to have netted the telecommunications giant millions of francs at customers’ expense.

Read More »

Read More »

Did the Economy Just Stumble Off a Cliff?

This is more intuitive than quantitative, but my gut feeling is that the economy just stumbled off a cliff. Neither the cliff edge nor the fatal misstep are visible yet; both remain in the shadows of the intangible foundation of the economy: trust, animal spirits, faith in authorities' management, etc.

Read More »

Read More »

Court Upholds Fines for Leaking ex-SNB Chairman’s Bank Details

Switzerland’s highest court has imposed suspended fines on a local politician and a former bank worker for leaking the personal bank transactions of former Swiss National Bank (SNB) chairman Philipp Hildebrand. The leak forced Hildebrand to resign in 2012.

Read More »

Read More »

FX Daily, August 25: Is the Janet and Mario Show a New Episode or Rerun?

The event that investors have been waiting for and the media frequently linked to whatever price action has taken place has arrived: Yellen and Draghi's speeches later today. Yellen is first. She will speak at 10:00 am ET. This is toward the end of the European trading week. Draghi speaks late in the North American session--3:00 pm ET.

Read More »

Read More »

Swiss gender pay gap only 2 percent, says study

The report says that while it is true that, as a group, women get paid less than men, it is not because they receive less for the same work. It is because they don’t get the highest-paying jobs in the highest-paid industries.

Read More »

Read More »

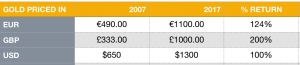

Global Financial Crisis 10 Years On: Gold Price Rises 124 percent From €490 to €1,100

Gold up over 100% in major currencies since financial crisis. Gold up 100% in USD, 124% in EUR and surged 200% in GBP. Gold has outperformed equity, bonds and most assets. Gold remains an important safe-haven in long term.

Read More »

Read More »

How will Yellen Address Fostering a Dynamic Global Economy?

Yellen has identified two challenges regarding the US labor market, the opioid epidemic and women participation in the labor force. The topic of the Jackson Hole gathering lends itself more to a discussion of these issues than the nuances of monetary policy. Dynamic world growth needs a dynamic US economy, and that requires more serious thinking about these socio-economic and political issues.

Read More »

Read More »

We Need a Social Revolution

In the conventional view, there are two kinds of revolutions: political and technological. Political revolutions may be peaceful or violent, and technological revolutions may transform civilizations gradually or rather abruptly—for example, revolutionary advances in the technology of warfare.

Read More »

Read More »

Que reste-t-il de la BNS? Liliane Held-Khawam

Nous alertons sur ce blog depuis des années sur le fait que la BNS, qui a récupéré grâce à la « réforme » de 2003 une levée des restrictions sur sa politique monétaire, mène une stratégie complaisante vis-à-vis du marché financier, et plus précisément américain.

Read More »

Read More »

FX Daily, August 24: Greenback Firmer in Becalmed Markets

The US dollar is enjoying a firmer tone in quiet. Sterling is stabilizing after grinding down to its lowest level since late June. The Mexican peso, which had dropped in thin trading in Asia and Europe yesterday following Trump's threat to exit NAFTA and force Congress to fund the Wall or face a government shutdown recovered fully and is now slightly higher on the week.

Read More »

Read More »

Small Swiss firms struggle to recruit qualified staff

One in four small and medium-sized Swiss firms (SMEs) suffers due to a serious lack of qualified staff, a new Credit Suisse survey reveals. The economic situation in Switzerland is generally favourable to most SMEs, which are slightly more optimistic about the future than they were last year, a Credit Suisse report published on Thursday stated. But difficulties recruiting qualified staff are worrying.

Read More »

Read More »

Euro Flirting with Near-Term Downtrend

North American traders began the week by selling dollars. Euro is testing a downtrend off the year's high. DXY is testing its uptrend.

Read More »

Read More »

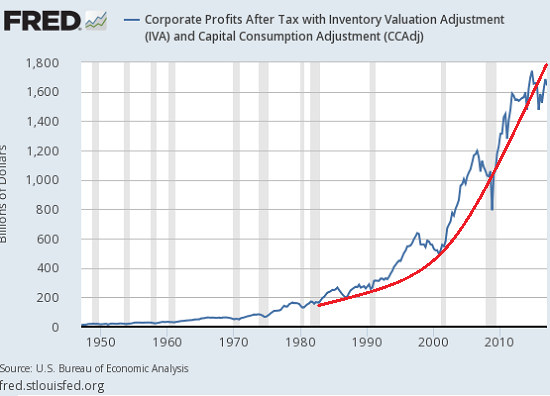

Questions

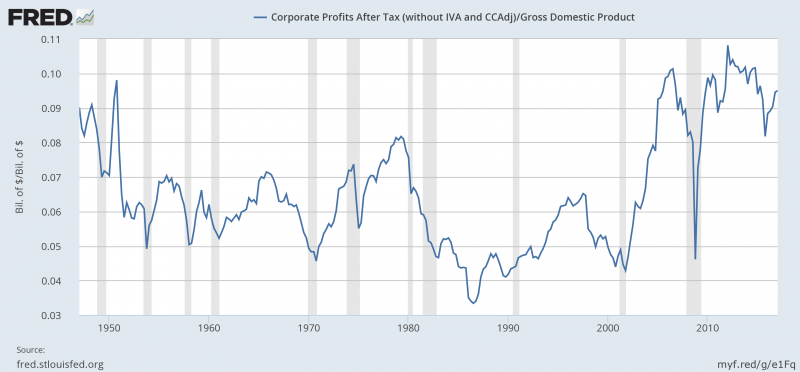

Why are profit margins persistently high? With decent earnings this quarter, corporate profits as a % of GDP will approach (maybe exceed) 10% again. That is abnormally high compared to the period 1960 to 2000. Margins actually started to rise in the mid-80s but really accelerated after 2000 and outside of the 2008 crisis have remained high. Why?

Read More »

Read More »

FX Daily, August 23: Consolidation in Capital Markets Conceals Coming Turbulence

A mixed US dollar will greet the North American participants today. It is softer against the euro and yen, but firmer against the dollar-bloc currencies. Among the emerging market currencies, the eastern and central European currencies are moving higher in the euro's draft.

Read More »

Read More »

U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There

US Treasury Secretary Steve Mnuchin visits Fort Knox Gold

Later tweeted ‘Glad gold is safe!’

Only the third Treasury Secretary to visit the fortified vault, last visit was 1948

Read More »

Read More »