Tag Archive: newslettersent

Zurich Airport to Limit Night-Time Flight Traffic

Federal aviation authorities have decided to limit the number of time slots for planes at Switzerland’s main airport in Zurich. The Federal Office of Civil Aviationexternal link said it has ordered a freeze on landings after 9pm and for take-offs after 10:20pm to reduce the noise for residents living near the airport.

Read More »

Read More »

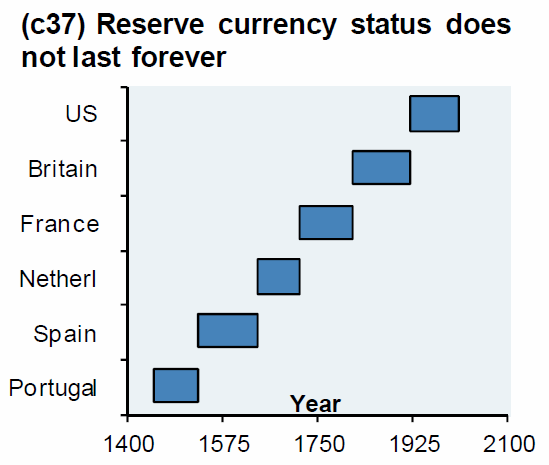

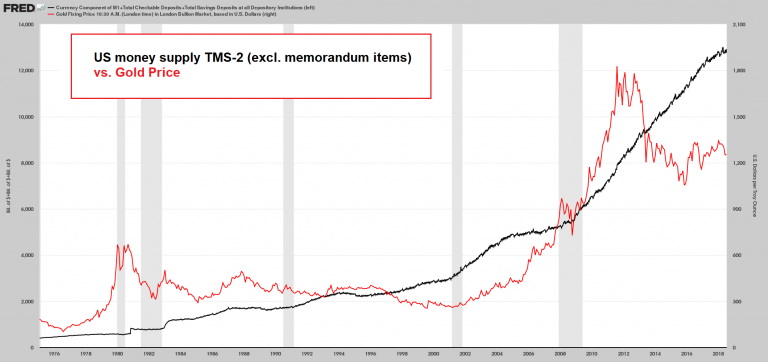

Physical Gold Is The “Best Defence” Against “Escalating Currency Wars”

Physical Gold Is The “Best Defence” Against “Escalating Currency Wars”. As governments around the world debase their currencies, you need an asset that can ride out the hard times. And nothing fits the bill like gold writes John Stepek of Money Week

Read More »

Read More »

Great Graphic: Is the Euro’s Consolidation a Base?

Speculators in the futures market are still net long the euro. They have not been net short since May 2017. In the spot market, the euro approached $1.15 in late-May and again in mid-June. Last week's it dipped below $1.16 for the first time in July and Trump's criticism of Fed policy saw it recover. Yesterday it reached $1.1750 before retreating. On the pullback, it held the 61.8% retracement of the recovery (~$1.1640).

Read More »

Read More »

FX Daily, July 24: China Turns To Domestic Stimulus, Weighs on Yuan but Lifts Stocks

Following a record injection via the medium-term lending facility yesterday, China's officials unveiled a set of policies designed to support the weakening economy that soon could face a substantial drag from US tariffs. The effort focuses on boosting domestic demand. Measures include targetted tax cuts and accelerating new infrastructure.

Read More »

Read More »

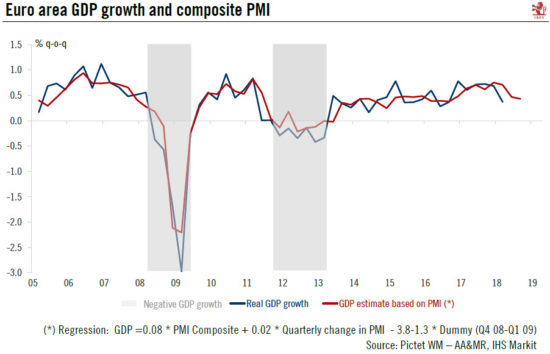

Euro area PMIs on the soft side

Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of decline.

Read More »

Read More »

Cool Video: Bloomberg Television–Dollar Outlook

The issue is the dollar's outlook. The greenback had looked to be on the verge of breaking out higher before the US President expressed disapproval with the Fed rate hikes and, then the following day, aggressively accused the EU and China of manipulating their currencies.

Read More »

Read More »

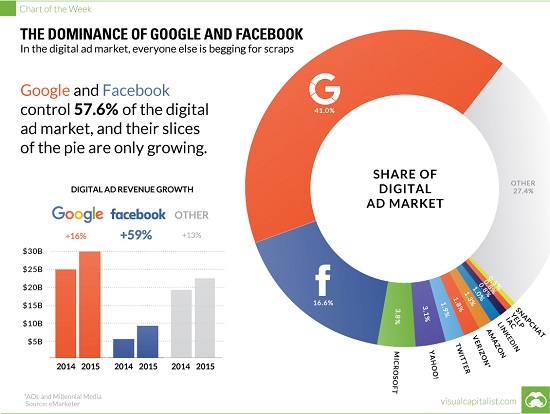

The Imperial Naivete of the American Public

The nation's premier corporate profit engines / social media giants are the ideal platforms for undermining the U.S. via the sowing of disintegration. Whether it's stated or not, one source of the inchoate outrage triggered by Russian-sourced purchases of adverts on Facebook in 2016 (i.e. "meddling in our election") is the sense that the U.S. is sacrosanct due to our innate moral goodness and our Imperial Project.

Read More »

Read More »

FX Daily, July 23: Dollar Consolidates Trump-Inspired Losses, BOJ Resolve Tested

US Treasury Secretary Mnuchin told G20 finance ministers and central bankers that President Trump was not trying to interfere in the foreign exchange market or encroach upon the Federal Reserve's independence. Trump's comments and tweets last Thursday and Friday effectively capped the dollar as it was looking to break out to the upside.

Read More »

Read More »

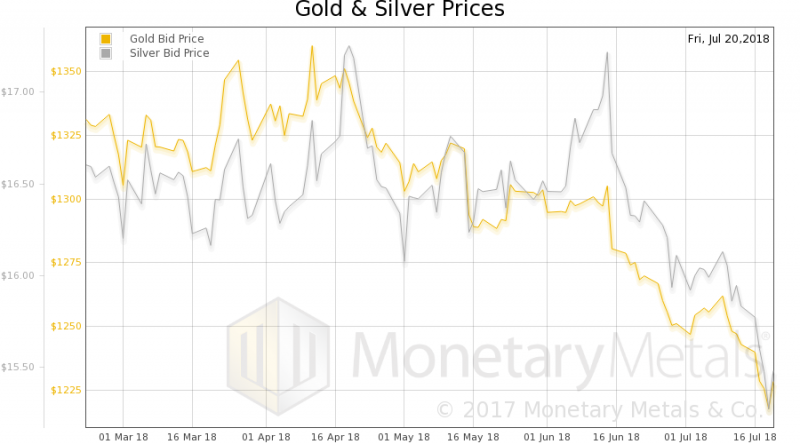

Crying Wolf, Report 22 July 2018

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Swiss slap nearly 20,000 fines over labour violations

Swiss authorities sanction on average ten companies per day for violating wage protection rules, according to official figures. That corresponds to 19,200 fines in the span of five years. NZZ am Sonntag published these figures on Sunday on the basis of a list compiled by the State Secretariat for Economic Affairs (SECO).

Read More »

Read More »

FX Weekly Preview: It was Supposed to be a Quiet Week

It was supposed to be a quiet week. The economic data and event calendar was light. There were three features, and none would likely disrupt the markets much. The first two are in Europe. The eurozone flash PMI for July, the first insight into how Q3 has begun. The PMI is expected to paint a mostly steady economic activity.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX saw some violent swings last week, due in large part to some unhelpful official comments Friday. BRL and TRY were the best performers last week, while RUB and CLP were the worst. When all is said and done, however, we think Fed policy remains unaffected and so we remain negative on EM FX. Also, global trade tensions remain high after Trump threatened tariffs on all Chinese imports entering the US.

Read More »

Read More »

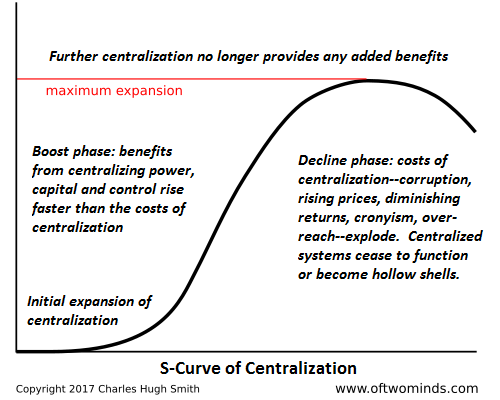

Solutions without Historical Templates: Cryptocurrencies and Blockchains

Crypto-blockchain technologies are leveraging the potential of computers and the web for direct political-social innovation. We're accustomed to three basic templates for system-wide solutions or improvements: 1. an individual "builds a better mousetrap" and starts a company to exploit this competitive advantage;

Read More »

Read More »

Rothschild bank sanctioned for role in 1MDB scandal

The Swiss financial regulator has concluded its investigations into the Malaysian 1MDB scandal by finding Rothschild Bank AG and one of its subsidiaries in serious breach of anti-money laundering regulations. The Swiss Financial Market Supervisory Authority (FINMA) said on Friday that it has appointed an auditor to make sure the bank and its Rothschild Trust vehicle properly implement an internal overhaul of its practices.

Read More »

Read More »

Euro, Yen, and Equities: Reviewed

US equities and the dollar appear to be moving higher together. The greenback is near its best level this year against most of the major and emerging market currencies. The Chinese yuan is not an exception to this generalization. At the same time, the S&P 500 is at its best levels since the downdraft February, and the NASDAQ set a new record high earlier in the week.

Read More »

Read More »

FX Daily, July 20: Dollar Consolidates after Trump Wades In

The US dollar is little changed but mostly softer as the week draws to a close. The market is digesting the implications of yesterday's comments by President Trump about interest rates and foreign exchange, and without fresh economic data, are content to go into the weekend. Since Trump's comments yesterday, the euro has not been below $1.1625 nor above $1.1680.

Read More »

Read More »

Swiss franc’s defensive features likely to come back into fashion

Despite heightened trade tensions, the Swiss franc has been relatively weak against the US dollar of late. The defensive features of the franc seem to be outweighed by an unsupportive interest rate differential. But the continuing threat of escalation in trade disputes and extreme short speculative positioning on the franc mean the latter has upside potential.

Read More »

Read More »