Tag Archive: newslettersent

EasyJet foresees Swiss market growth

In an interview given to the SonntagsZeitung on Sunday, EasyJet CEO Johan Lundgren described the company's strategy for increasing its already-growing share of passengers in the Swiss market. Lundgren told the German-language paper than in recent years, the low-cost British airline has counted about one million additional passengers in the Swiss market annually, and anticipates continued growth thanks to a combination of targeted advertising and...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mostly stronger last week, despite the dollar’s firm tone against the majors. Best EM performers on the week were MXN, KRW, and COP while the worst were ZAR, INR, and PEN. US jobs data poses the biggest risk to EM this week, as US yields have been falling ahead of the data. Indeed, the current US 10-year yield of 2.74% is the lowest since February 6.

Read More »

Read More »

What If All the Cheap Stuff Goes Away?

Nothing stays the same in dynamic systems, and it's inevitable that the current glut of low costs / cheap stuff will give way to scarcities that cannot be filled at current low prices. One of the books I just finished reading is The Fate of Rome: Climate, Disease, and the End of an Empire.

Read More »

Read More »

Tax and spend – canton of Geneva generates a surprise budget surplus

When Geneva’s finances make the news it is typically bad. At the end of 2016, the canton had debts of CHF 12.5 billion, equal to 153% of its income. In January 2018, the rating agency Standard and Poors gave Geneva a negative outlook citing risks related to the canton’s poorly funded public pension scheme.

Read More »

Read More »

Shell accuses former executive of hiding bribes in Switzerland

Royal Dutch Shell has filed a criminal complaint against a former employee it suspects of stashing kickbacks from the sale of a Nigerian oil field in Swiss bank accounts. The energy company is already being investigated over another deal there.

Read More »

Read More »

“Stars Are Slowly Aligning For Gold” – Frisby

“Stars Are Slowly Aligning For Gold” – Frisby. Gold ends March with a third-quarterly gain, a feat not seen since 2011. Impressive gains seen despite tightening of monetary policy from Federal Reserve. Frisby – gold is set to break through technical resistance of $1,360. Gold’s safe haven role back in focus with Trump trade wars and increasing geopolitical tensions. Now is opportune time for investors to buy gold, ahead of next quarter.

Read More »

Read More »

Short Term Market Signals

We reviewed the daily charts after yesterday’s close and noticed that the Russell 2000 Index, the NYA and transportation stocks all exhibited relative strength (the same holds actually for the DJIA), particularly vs. the FANG/NDX group. This is happening just as the SPX is battling with an extremely important trendline. As we pointed out before, relative strength in the RUT in particular served as a short term reversal signal ever since the...

Read More »

Read More »

Bankrupt Petroplus climate payments ‘non-refundable’

Climate fund payments made to now-bankrupt Swiss oil refiner Petroplus cannot be reclaimed by creditors as they constituted a business arrangement that brought benefits to contributors as opposed to a gift. This ruling from Zurich’s highest court has stopped a CH15 million ($16 million) claim in its tracks, barring an appeal to the federal courts.

Read More »

Read More »

Uncle Sam Issuing $300 Billion In New Debt This Week Alone

US needs to borrow almost $300 billion this week alone. This is the largest debt issuance since 2008 financial crisis. Trump threatens trade war with its biggest creditor – China. Bond auctions have seen weak demand due to large supply and trade war concerns. $20 trillion mark reached in early September 2017; $1 trillion added in just 6 months. US total national debt level now exceeds $21.05 trillion and is accelerating higher.

Read More »

Read More »

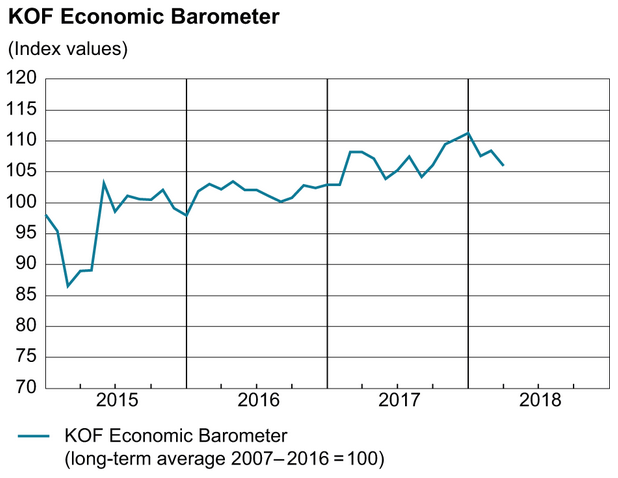

Eurozone Faces Many Threats Including Trade Wars and “Eurozone Time-Bomb” In Italy

Eurozone threatened by trade wars, Italy and major political and economic instability. Trade war holds a clear and present danger to stability and economic prospects. Italy represents major source of potential disruption for the currency union. Financial markets fail to reflect the “eurozone time-bomb” in Italy. Financial volatility concerns in Brussels & warning of ‘sharp correction’ on horizon.

Read More »

Read More »

Great Graphic: EMU Inflation Not Making it Easy for ECB

The Reserve Bank of New Zealand is credited with being the first central bank to adopt a formal inflation target. Following last year's election, the central bank's mandate has been modified to include full employment. To be sure this was a political decision, and one that initially saw the New Zealand dollar retreat.

Read More »

Read More »

GBEB Death Watch

As our friend Dimitri Speck noted in his recent update, the chart pattern of the SPX continues to follow famous crash antecedents quite closely, but obviously not precisely. In particular, the decisive trendline break was rejected for the moment. If the market were to follow the 1987 analog with precision, it would already have crashed this week.

Read More »

Read More »

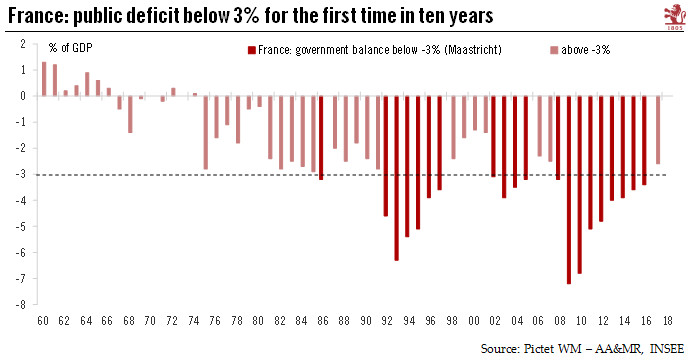

Larger-than-expected reduction in French public deficit

France’s public deficit fell to 2.6% of GDP in 2017 according to INSEE’s preliminary assessment, down from 3.4% in 2016 and below the 3% threshold for the first time since 2007. The outcome was better than the government’s estimate of a 2.9% deficit. If confirmed, France will exit the Excessive Deficit Procedure that the European Commission opened in 2009.

Read More »

Read More »

Central banks adding euros to their FX reserves

Central banks are looking beyond the dollar to grow their foreign exchange reserves for the first time in a decade. Rising trade tensions, and a recovering European economy bode well for the euro making a stronger case for central banks to diversify into the monetary union's currency.

Read More »

Read More »

Credit Suisse boss earned less last year

Credit Suisse Chief Executive Tidjane Thiam earned slightly less in 2017 during his third year on the job, the bank said on Friday. The news comes at a time of scrutiny over executive pay and bonuses. Thiam earned CHF9.7 million ($10.26 million) last year, a 5.3% drop on 2016, Switzerland’s second-biggest bank said.

Read More »

Read More »

Central Banks Care about the Gold Price – Enough to Manipulate it!

In early March, RT.com, the Russian based media network, asked me for comments and opinion on the subject of central bank manipulation of gold prices. The comments and opinion that I supplied to RT became the article that RT then exclusively published on its website on 18 March under the title “Central banks manipulating & suppressing gold prices – industry expert to RT“. This article is now transcribed below, here on the BullionStar website.

Read More »

Read More »

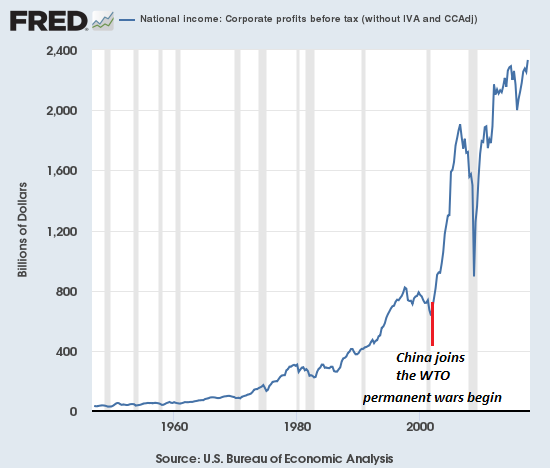

15 Years of War: To Whose Benefit?

As for Iraq, the implicit gain was supposed to be access to Iraqi oil. Setting aside the 12 years of "no fly zone" air combat operations above Iraq from 1991 to 2003, the U.S. has been at war for almost 17 years in Afghanistan and 15 years in Iraq. (If the word "war" is too upsetting, then substitute "continuing combat operations".)

Read More »

Read More »

Trendline Broken: Similarities to 1929, 1987 and the Nikkei in 1990 Continue

In an article published in these pages in early March, I have discussed the similarities between the current chart pattern in the S&P 500 Index compared to the patterns that formed ahead of the crashes of 1929 and 1987, as well as the crash-like plunge in the Nikkei 225 Index in 1990. The following five similarities were decisive features of these crash patterns.

Read More »

Read More »

Impact of recent tariffs on US and China’s GDP should be limited for now

The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD506bn of total Chinese merchandise imports). The list of products targeted, still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn.

Read More »

Read More »