Tag Archive: newslettersent

Working Hours increased in 2015

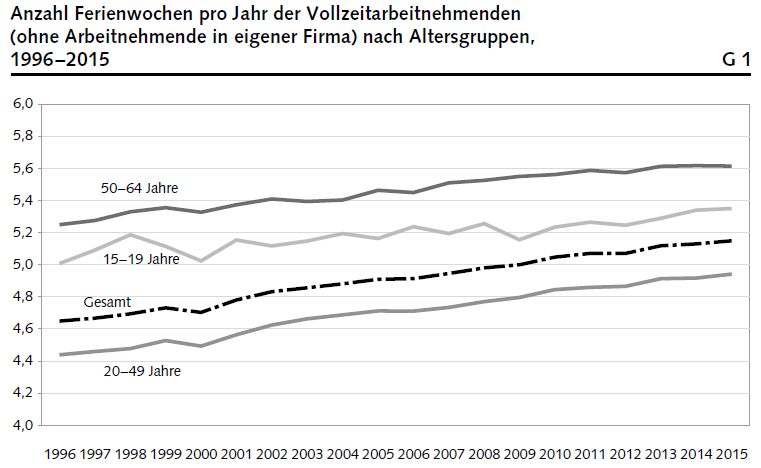

The total number of hours worked in Switzerland reached 7.889 billion in 2015, representing an increase of 2.3% compared with the previous year. Major reason were the increased number of employees and less bank holidays. Between 2011 and 2015, the actual weekly hours worked by full-time employees declined very slightly and stood at 41 hours and 17 minutes, whereas the number of weeks of annual holiday continued its gradual increase, reaching 5.15...

Read More »

Read More »

FX Daily May 23

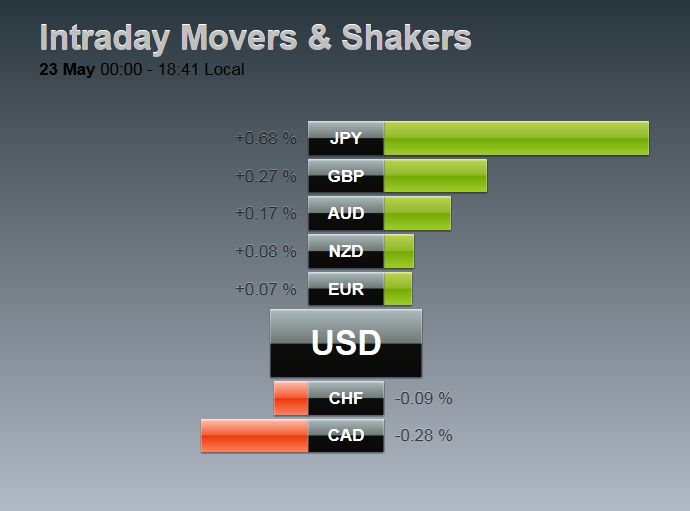

The capital markets are off to a mixed start to start the last week of the month. Asian shares were mostly higher, though the Nikkei shed 0.5%. European shares are also higher, extending the three-week high seen last week.

The US dollar is...

Read More »

Read More »

Introducing The Gotthard Train Tunnel, The World’s Longest and Deepest Train Tunnel

On June 1, Angela Merkel and Francois Hollande will take a break from their respective domestic crises and attend a ceremony to inaugurate the Gotthard Base Tunnel (GBT) in Switzerland.

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM had another rocky week, but managed to end on a slightly firmer note Friday. Market repricing of Fed tightening risk was the big driver last week, and that could carry over into this week. There are several Fed speakers in the days ahead, capped...

Read More »

Read More »

FX Week Ahead: Evolving Investment Climate

The US dollar’s weakness in recent months, despite negative interest rates in Europe and Japan likely had many contributing factors. These factors include shifting views of Fed policy, weaker US growth, the recovery in commodity prices, including oil, gold and iron ore, and market positioning.

Read More »

Read More »

Sentiment Shift Evident in Speculative Adjustment in Currency Futures

Speculative positioning in the currency futures began to adjust before the latest signals from the Federal Reserve about the prospects for a summer hike and the widening of interest rate differentials. In the CFTC reporting week ending May 17, the day before the FOMC minutes were released speculators mostly reduced gross long currency positions and added …

Read More »

Read More »

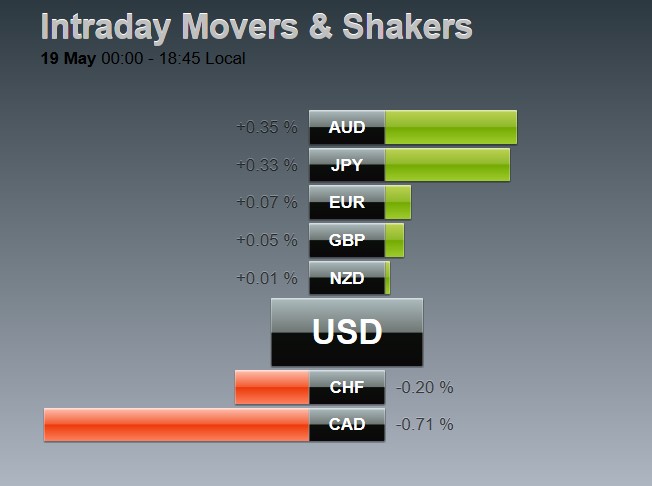

Daily FX, May 20: Divergence Reasserted, Extends Greenback’s Recovery

The combination of stronger US economic data and signals from the Federal Reserve that it is looking to continue the normalization process helped the dollar extended its recovery. The dollar posted a significant technical reversal against many of the major currencies on May 3. The Dollar Index rose for its third week, as the greenback climbed …

Read More »

Read More »

Emerging Markets: What has Changed

The Philippine central bank moved to an interest rate corridor Saudi Arabia is preparing to sell its first global bond ever Transport Minister Yildirim, a close ally of President Erdogan, will become Turkey’s new Prime Minister The new Brazil cabinet continues to take shape with a market-friendly bias In the EM equity space, South Africa …

Read More »

Read More »

How to Maximize Economic Potential

The fundamental problem facing today’s economy is the barefaced contempt governments the world over have for the free exchange of goods and services and private stewardship of property.

What it is government’s think they are doing with their destructive fiscal and monetary policies is unclear. But what is crystal clear is the scrambled disorder modern day economic policies have wrought.

Read More »

Read More »

How the Deep State’s Cronies Steal From You

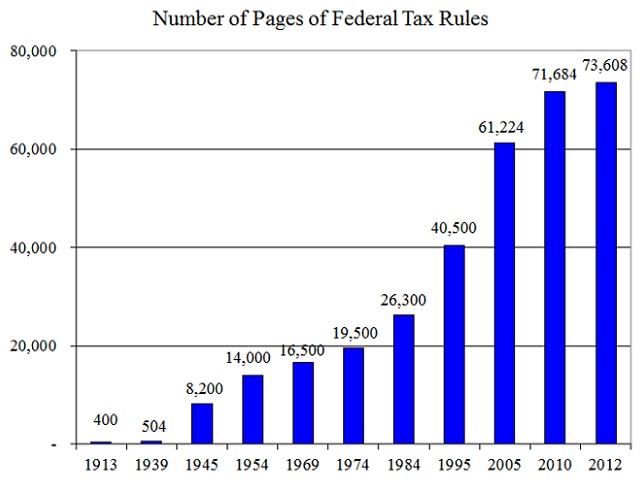

The relentless growth of Leviathan: Total Pages of Code of Federal Regulations from 10000 in 1950 to 170000 in 2014. Federal tax rules – from 400 in 1913 to 74,000 in 2012. Aggregate word count of Dodd-Frank regulations doubled.

Read More »

Read More »

The Japanese Popsicle Affair

Policy-Induced Contrition in Japan As we keep saying, there really is no point in trying to make people richer by making them poorer – which is what Shinzo Abe and Haruhiko Kuroda have been trying to do for the past several years. Not surprisingly,...

Read More »

Read More »

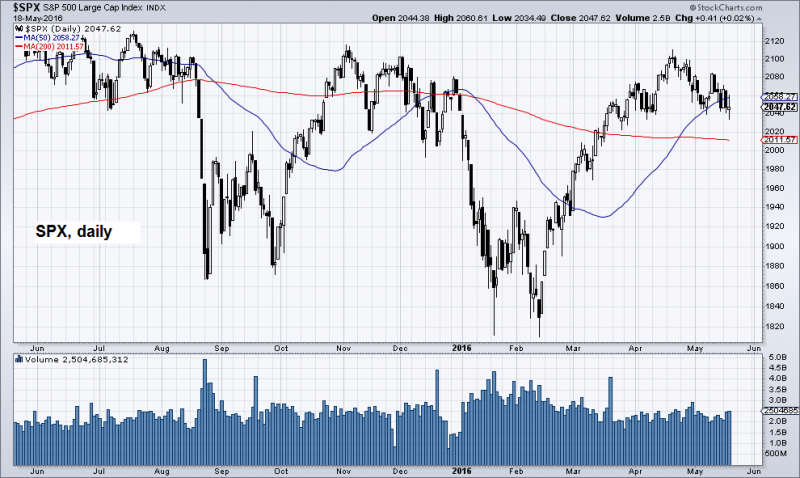

Pareto’s Wily Foxes

Smart Money Fleeing Stocks DUBLIN – The Dow dropped 180 points on Tuesday – or about 1%. And another clever billionaire says he is looking elsewhere for profits. Reuters: “Activist investor Carl Icahn on Monday said there was a chance the stock m...

Read More »

Read More »

Ten Most Expensive Countries for Healthcare in the World

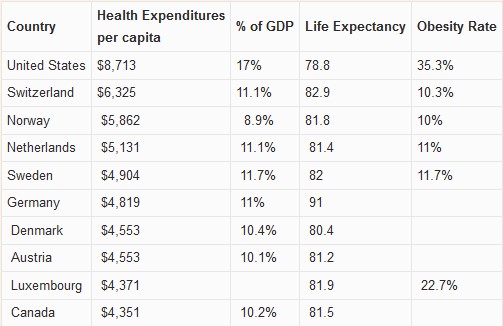

The United States spends 17% of GDP for health care, compared to around 10% in many other advanced economies. Thanks to rising health care costs, GDP growth was higher in the U.S. in recent years. The question is if this kind of GDP growth enriches the whole population or only the privileged.

Read More »

Read More »

Fed Suppression, Long Term Economic Repression

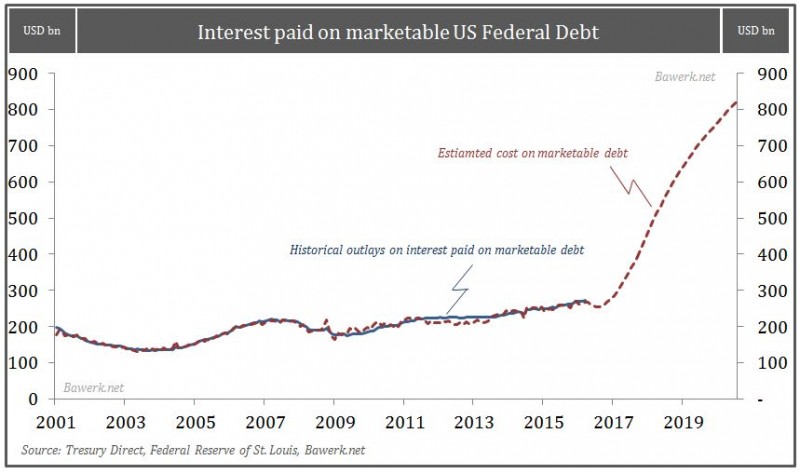

The Federal Reserve really wants to raise rates, but they do not dare as the consequence of interrupting an unprecedented level of capital misallocation is too grave to face head on. So our money masters continue their low interest rate policy; pulli...

Read More »

Read More »

FX Daily, May 19: FOMC Minutes Extend Dollar Gains

We felt strongly that the FOMC minutes would be more hawkish than the statement that followed the meeting, and we were not disappointed. However, our caveat remains: the minutes dilute the signal that emanates from the Fed’s leadership, Yellen, Fischer, and Dudley. The latter two speak in the NY morning. Fischer and Dudley’s comment will be scrutinized …

Read More »

Read More »

Drowning the Fir

Presidential Duties Our editor recently stumbled upon an image in one of the more obscure corners of the intertubes which we felt we had to share with our readers. It provides us with a nice metaphor for the meaningfulness of government activity. F...

Read More »

Read More »

The Long-Buried Secret of Napoleon Bonaparte

Family Secrets DUBLIN – The smart money is getting out while the gettin’ is still good. That’s the message we get from reading the recent headlines. Here’s the Financial Times: Redemptions from stock funds have hit nearly $90 billion this year ...

Read More »

Read More »

A Tale of Two Parliaments

Boisterous Debate vs. Non-Existence Readers may recall that we have previously reported on brawls breaking out in various parliaments, such as e.g. in Ukraine’s Rada, where we suspect representatives are actually engaging in a form of performance a...

Read More »

Read More »

Cool Video: CNBC Asia–Rare Double Feature

My two week trip to Asia is winding down. I had the privilege of being on CNBC in Asia earlier today and discussed the markets with Martin Soong from Singapore. There were two segments. The first segment (here) is about two minutes long and focuses on about Japan. The second segment (there) is 3.5 … Continue reading »

Read More »

Read More »