Tag Archive: newslettersent

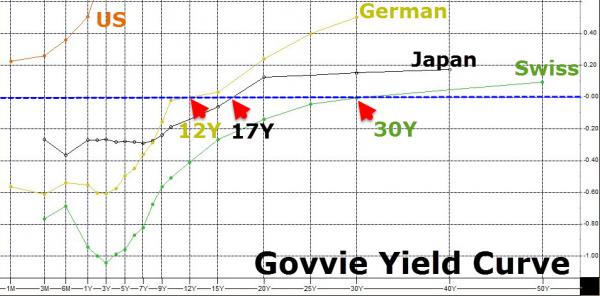

US Negative Interest Rate Bets Surge To Record Highs

As the "deflationary supernova" sweeps across the world, dragging bond yields to zero-and-beyond, even the almighty omniscent Federal Reserve has been forced to capitulate as the 'cheapness' of Treasury bonds lures the world's yield-hunters dragging ...

Read More »

Read More »

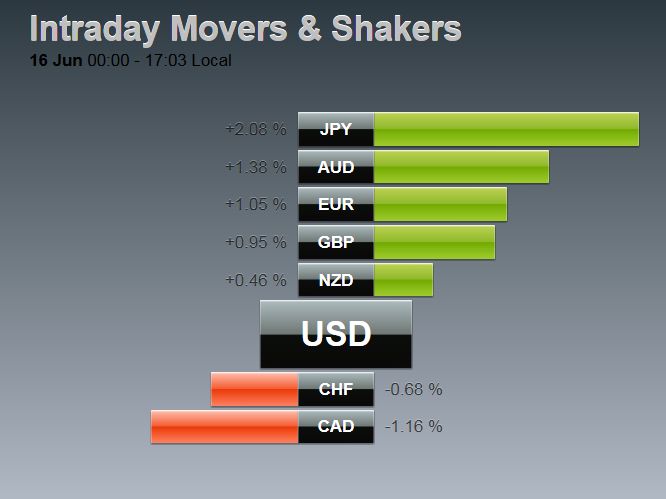

FX Daily, June 16: Markets are Anxious, Yen Soars

The US dollar is higher against the major currencies but the Japanese yen and the New Zealand dollar. The dollar fell to new two-year lows against the yen to JPY103.55 before bouncing in the European morning back to JPY104.40. The...

Read More »

Read More »

Macro Thinking: FOMC, USD, and EU

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate. The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely …

Read More »

Read More »

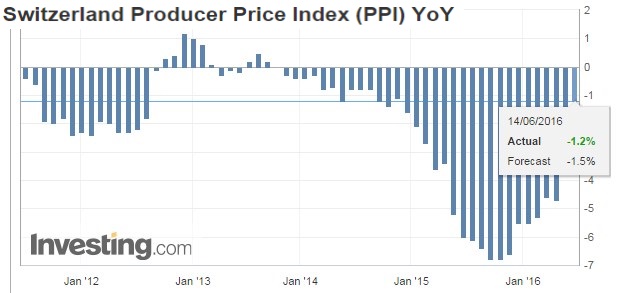

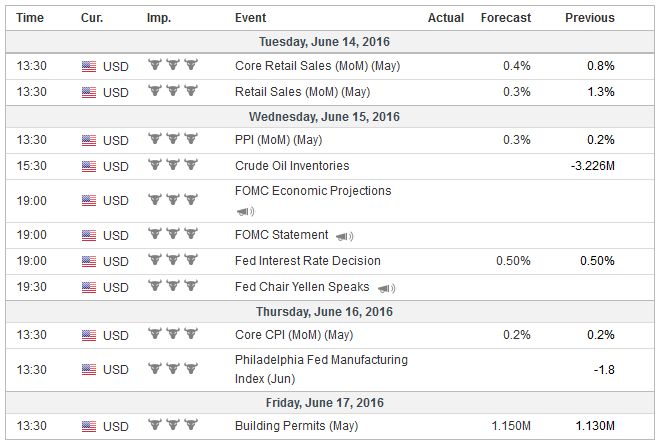

FX Daily, June 15: Key Data and FOMC

The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar.

Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduce the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again.

Read More »

Read More »

Fed Softens Stance Slightly

The immediate reaction was driven by the Fed's dot plots. Although the median continues to expect two hikes this year, six officials now see only one hike. Only one official anticipated one hike this year in the last forecasts made in March. The m...

Read More »

Read More »

Kuroda and the BOJ

Following today's FOMC meeting, the central banks of Japan, Switzerland, and the UK meet tomorrow.

The SNB will keep its powder dry to be able to respond to the results of the UK

referendum if needed. The Bank of England is als...

Read More »

Read More »

IIF Chief Warns “Brexit Bigger Threat To Global Economy Than Lehman”

As Brexit appears to gathering pace among British voters, Bloomberg Briefs interviews Hung Tan, executive managing director at the Institute of International Finance in Washington, DC., to understand the global impact of a decision by Britain to leav...

Read More »

Read More »

Claudio Grass Talks to Godfrey Bloom

Introductory Remarks – About Godfrey Bloom [ed note by PT: Readers may recall our previous presentation of “Godfrey Bloom the Anti-Politician”, which inter alia contains a selection of videos of speeches he gave in the European parliament. Both eru...

Read More »

Read More »

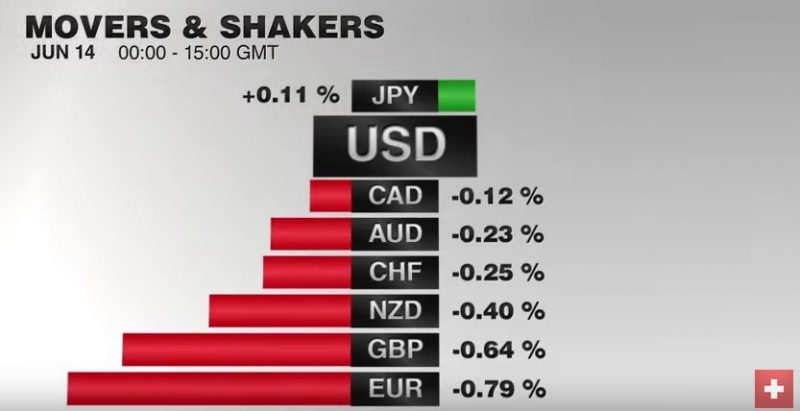

FX Daily, June 14: Capital Markets Remain at UK Referendum’s Mercy

"The Swiss Franc was the strongest performer, EUR/CHF has fallen to 1.08 by 0.8%". A spate of opinion polls showing a tilt toward Brexit, and the leading UK newspaper urging the Leave vote on the front page, keep the global capital markets on edge. Equities are lower, though of note ahead of the MSCI decision first thing Wednesday in Asia, Chinese shares eked out a small gain.

Read More »

Read More »

The VIX Breaks Out – Market Risk Continues to Surge

The Sharp Move in the VIX Accelerates In Monday’s trading session, the upward move in the volatility index VIX (which measures the implied volatility of SPX options) continued unabated, vastly out of proportion with the move in the underlying stock...

Read More »

Read More »

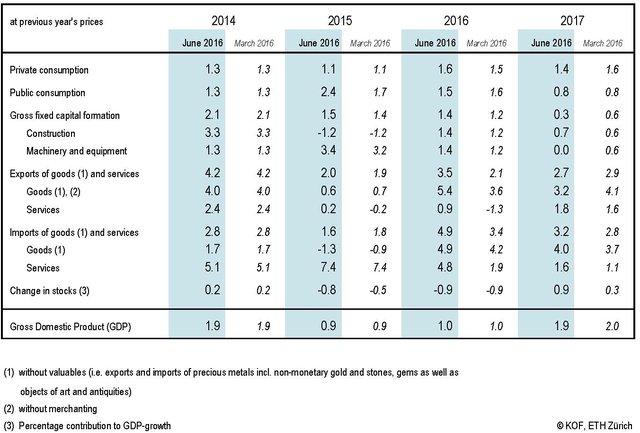

Swiss Producer and Import Price Index, May 2016: 0.4 percent MoM, -1.2 YoY

The strongly negative change in producer prices in 2015 reduced the Swiss franc overvaluation in terms of the Real Effective Exchange. Now, however, producer prices are approaching the zero change again.

It must also be noted that producer prices had fallen by 6% in 2015, while consumer prices went down only by 1.5%. Large margins are remaining for the Swiss retail sector.

Read More »

Read More »

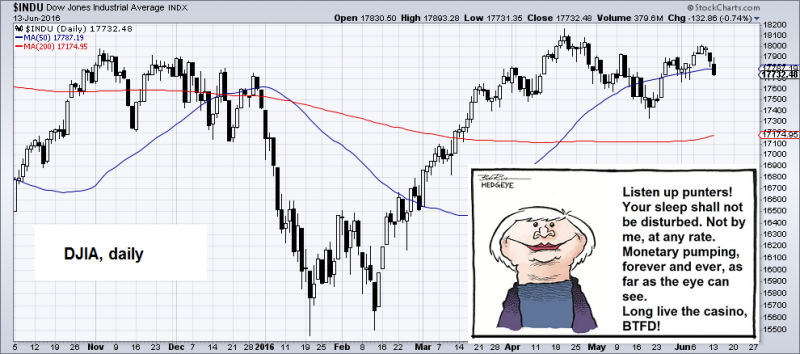

Stocks Set Another Valuation Record

Believe It Or Not… There Actually Is Some Downside Risk BALTIMORE – Not much action in the stock market last week. A few little steps ahead to over the 18,000 line for the Dow. Then a few little steps back. Currently the index sits at 17,732. Th...

Read More »

Read More »

Great Graphic: Oil Flirts with Four-Month Uptrend

The broader technical tone has weakened. The RSI has turned lower. The MACDs are also turning lower with a bearish divergence. The five-day moving average may move below the 20-day moving average for the first time since mid-April later this week....

Read More »

Read More »

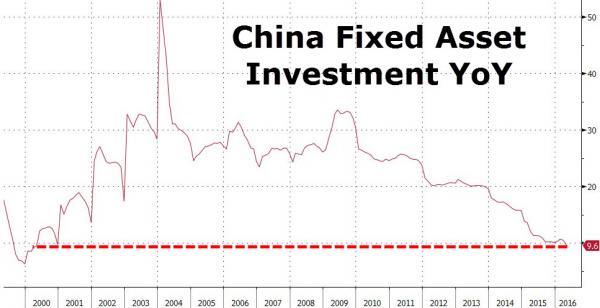

China and Japan Chart Update

A chart-up from China and Japan. Growth of Chinese industrial production, retail sales, fixed asset investment is at lows not seen since the Asian financial crisis. The Yuan is falling. Economic data from Japan is not a lot better.

Read More »

Read More »

Central Banks & Governments and their gold coin holdings

While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week under pressure. With two potentially disruptive events (FOMC meeting and Brexit vote) still in play, we think that EM softness should carry over into this week.

Read More »

Read More »

FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four

central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials

were preparing the market for a summer hike. Risks of a new downturn in

Japan spurred spe...

Read More »

Read More »

FX Weekly Review: June 06 – June 10: EUR/CHF Down 2 percent

Two main events that will drive the foreign exchange market. The first is the FOMC meeting.

The shockingly weak job growth dashed whatever lingering odds of a move next week. The EUR/CHF has fallen by 2%.

Read More »

Read More »