Tag Archive: newslettersent

Why An Ex-Credit Suisse Banker In Brazil Made More Money Than The CEO

Ever had to testify in a trial involving your father's dealings in corrupt activities, and as a result had your tax records leaked for all of the public to see? Sergio Machado, the ex-head of Credit Suisse's Brazil fixed-income business has, and now ...

Read More »

Read More »

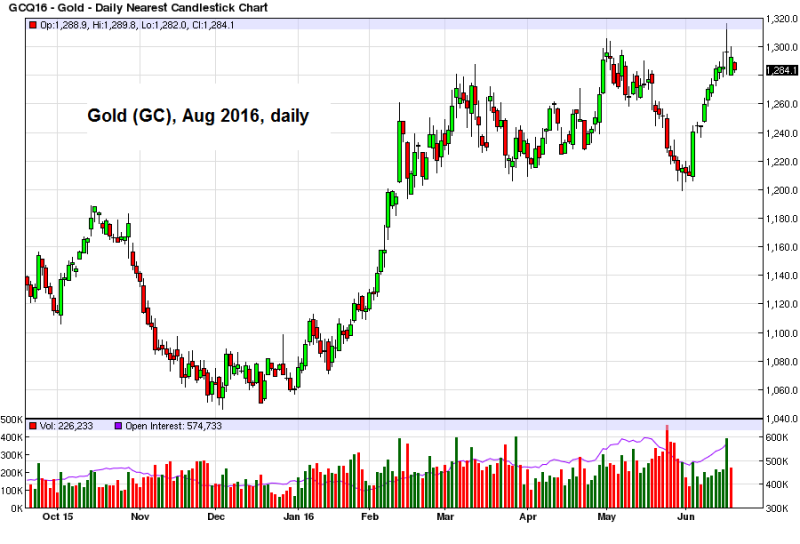

Janet Yellen’s $200-Trillion Debt Problem

More than $10 trillion of government bonds now trade at negative yields. And another $10 trillion or so worth of U.S. stocks trade well above their long-term average valuations.

And there’s more than $200 trillion of debt in the world. All of this sits on the Fed’s financial applecart. Does Janet Yellen dare upset it?

Read More »

Read More »

FX Daily, June 20: Brexit not the main Swiss Franc Driver

Recently I enumerated the different drivers for the continuing strength of the franc. Most commentators mentioned Brexit fears, but I insisted on the low rate and yield environment in the United States after the last Non-Farm Payroll report and the FOMC.

Today's jump in sterling confirmed my view. This anticipation of an Anti-Brexit vote was not followed by a franc decline against USD. This also implies that a Brexit will not entrench a huge...

Read More »

Read More »

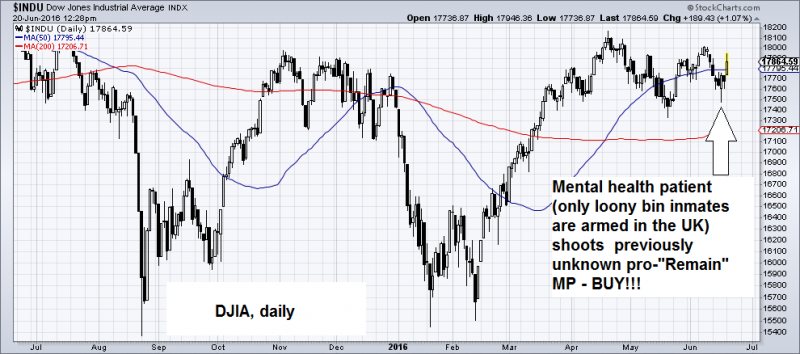

If Sterling has Not Peaked, It has Come Pretty Close

Today's sterling rally is the largest since 2008.

The rally began with the murder of UK MP Cox.

Risk-reward favors a near-term pullback.

Read More »

Read More »

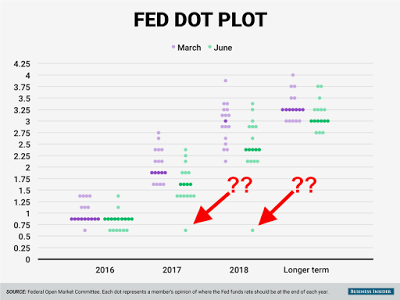

Bullard’s New Paradigm and the Federal Reserve

There is much to like in Bullard's new paradigm.

The problem is that it does not reflect the Federal Reserve's view or approach.

Policy emanates from the Fed's leadership, but be confused by the noise.

Read More »

Read More »

A Market Ready to Blow and the Flag of the Conquerors

The U.S. is too big, too varied, too much of everything. You can’t fix a single view of it, even in your mind.

But now our problems, challenges, and discontents are big. They are national and international. We cannot see them. We cannot understand them.

Instead, we draw their measure from the news media – based on a flag that flutters and sags, depending on which way the wind is blowing.

Read More »

Read More »

How the Welfare State Dies

People have become used to the idea that the State is their sugar daddy. Many apparently believe that it has some undisclosed, infinite stash of resources at its disposal which it can shower them with at will. The reality is unfortunately different.

Read More »

Read More »

Down Go the Hopes and Dreams of Three Generations

On Wednesday, Janet Yellen pressed on the broken buttons again. After the two day FOMC meeting, the Fed Chair announced they’d continue pressing the federal funds rate down to just a ¼ to ½ percent – effectively zero. What type of insanity is this?

If she keeps it up, and whole thing doesn’t implode, the yield on the 10-Year Treasury note could also slip below zero…along with the hopes and dreams of three generations of retirees.

Read More »

Read More »

FX Weekly Preview: It is All about Europe

Major data this week:

German Constitutional Court ruling on OMT.

UK referendum.

EMU flash PMI.

ECB TLTRO II launch.

Yellen testifies before Congress, RBI Rajan to step down in early Sept.

Read More »

Read More »

Weekly Speculative Postion: After Jo Cox Speculators Bought Sterling Futures with Both Hands

In the days ahead of the murder of Jo Cox, a UK member of parliament, apparently for her support for remaining in the EU, speculators in the futures market scooped up sterling. While last week, speculators took long dollar positions against CHF, this barometer shifted this week towards long CHF.

Read More »

Read More »

FX Review Week till June 17: Jo Cox’s death supports Sterling, negative for CHF

Two main events that drove the foreign exchange market. The first iare some post-FOMC meeting movements and the assassination of Jo Cox, that might be positive for the Anti-Brexit camp . The EUR/CHF has fallen down to 1.0774 and recovered.

Read More »

Read More »

Dumbest monetary experimental end game in history (including Havenstein and Gono’s)

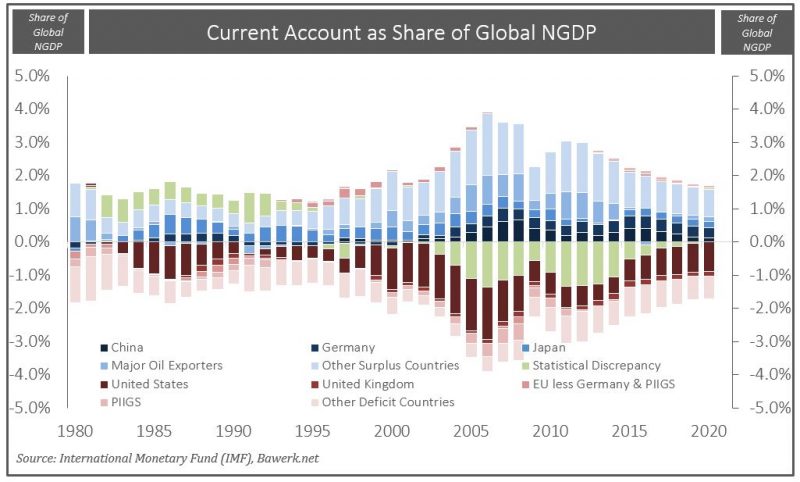

The Greatest Keynesian monetary experiment is not sustainable. It will not continue ad infinitum. Our money masters are just postponing the inevitable bust that will eventually correct these imbalances through worldwide capital re-allocation. Bawerk shows 3 graphs how investment growth gets slower and slower since the End of Bretton, how debt is increasing and how cheap dollar fuel debt-driven growth.

Read More »

Read More »

SNB’s Maechler on Negative Rates and our Critique

At the SNB news conference, Andréa Maechler discusses the current situation of financial markets and the negative interest environment. For us, negative rates make only holding money on accounts less attractive but not cash, real estate or stocks. Negative rates reduce the profit of banks and therewith GDP.

Read More »

Read More »

Switzerland Withdraws Application To Join EU: Only “Lunatics May Want To Join Now”

Resentment toward the EU hit a new high yesterday when the upper house of the Swiss parliament on Wednesday followed in the footsteps of Iceland, and voted to invalidate its 1992 application to join the European Union, backing an earlier decision by ...

Read More »

Read More »

FX Daily, June 17: Martyrdom of Cox Acts as Catharsis

The assassination of Jo Cox, a member of the UK parliament is a personal

and political tragedy. Her needless death provided an inflection

point. The suspension of the referendum campaigns and a steady stream of reports and speech...

Read More »

Read More »

How Germany Could Upset Europe before UK Referendum

The assassination of the Jo Cox has broken the powerful momentum in the markets. Investors recognize that the tragedy potentially injects a new element into consideration for the outcome of next week’s referendum. The campaigns will be resume over the weekend, and new polls will be available. Investors will place more weight on polls conducted …

Read More »

Read More »

News conference Swiss National Bank 2016, Fritz Zurbrügg

UBS and Credit Suisse: Capital Situation improved further: fully compliant. Domestically focused banks have capitalisation well above regulatory minimum requirements, but mortgage lending and risk exposure increased in 2015. In case of an interest rate shock, this could lead to problems.

Read More »

Read More »

News conference Swiss National Bank, Thomas Jordan

SNB rate remains –0.75%, SNB is ready to intervene in the FX market, Inflation will rise faster over the coming quarters, Swiss economy to grow 1% to 1.5% in 2016

Read More »

Read More »