Tag Archive: newslettersent

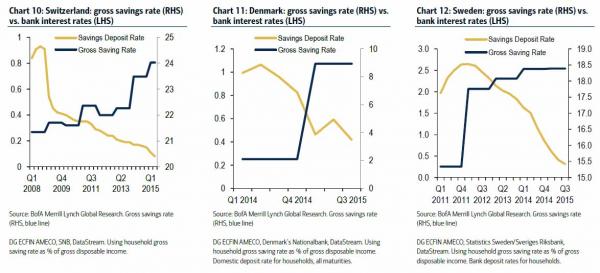

In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal.

Read More »

Read More »

FX Daily, June 23: R-Day is Here, but Can it Prove Anti-Climactic?

The UK's referendum is underway. The capital markets are

continuing the move that began last week with the murder of UK MP Cox.

The tragedy seemed to mark a shift in investor sentiment. Sterling

bottomed on June 17 just ahead...

Read More »

Read More »

The EU and Turkey: Unvarnished Truth and Stuffing

Turkey and the EU will begin negotiations over financial and budget reform.

It is one of 35 areas (chapters) of negotiations.

Turkey is no where close to joining the EU, for which it initially applied in 1987.

Read More »

Read More »

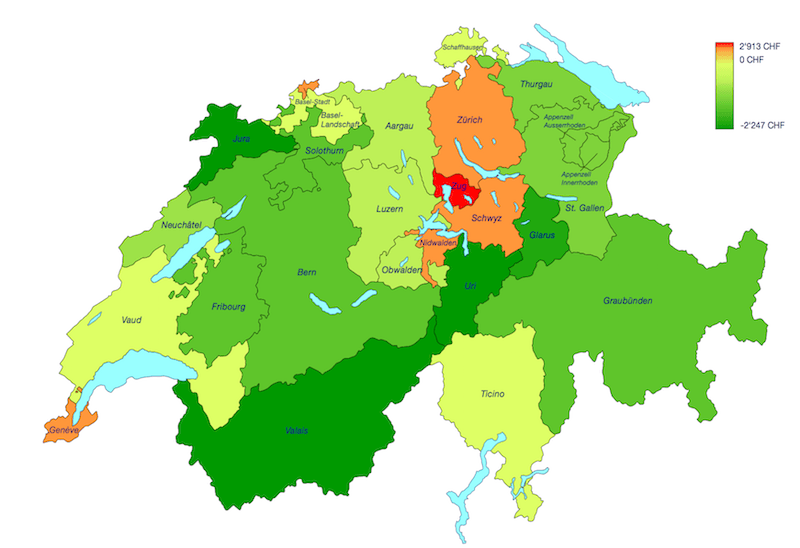

Swiss tax redistribution in 2017 – winners and losers

Switzerland has a system known as la péréquation financière nationale in French, or Finanzausgleich in German, which requires “rich” cantons to give money to “poor” cantons.

Yesterday, the Swiss federal government published the numbers for 2017.

Read More »

Read More »

Cool Video: Chandler at CNBC on Brexit

Chandler on CNBC's Trading Block show to discuss how the market is positioned for the UK referendum. The markets are strongly anticipating the UK to vote to stay in the EU, even though polls remain very tight. Given that leveraged participants and speculators have rallied sterling more than nine cents from last week's lows.

Read More »

Read More »

British Discontent About The EU: Only A Precursor To Unrest On The Continent

Britain leaves the EU and if the reaction to Brexit causes years of uncertainty, the EU will reap what it has sowed. British discontent is only a precursor to unrest on the Continent, where populists from across the political spectrum feel they have lost control over their fate, and are gaining popularity

Read More »

Read More »

FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The … Continue...

Read More »

Read More »

The British Referendum And The Long Arm Of The Lawless

Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law.

Read More »

Read More »

More Thoughts on the Democratic Deficit

It is not just that the polls indicate that the outcome of the UK referendum is too close to call, but the mere fact that the referendum is being held in the first place is significant. It was not Labour, but the Conservative Party that brought the UK into the EU in the first place … Continue reading »

Read More »

Read More »

World’s Central Bankers Gathering At BIS’ Basel Tower Ahead Of Brexit Results

What happens on the 18th floor of the main tower at Centralbahnplatz 2 in Basel, stays on the 18th floor of the main tower at Centralbahnplatz 2.

Read More »

Read More »

Great Graphic: UK Referendum–Turnout it Key

Younger age cohorts in the UK are more inclined to vote to stay in the EU than their elders. However, some suggested that this consideration is blunted by the fact that the younger people are less likely to vote.

Read More »

Read More »

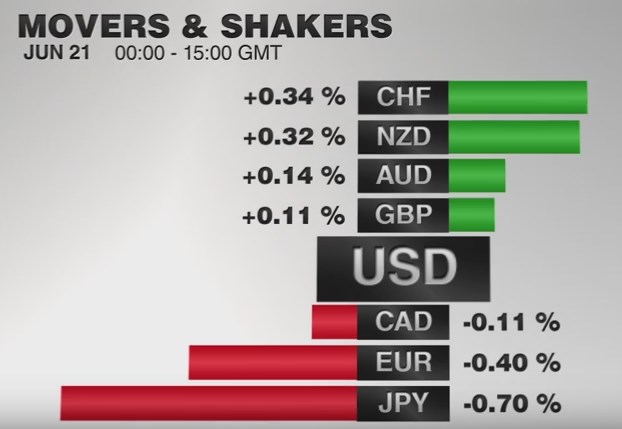

FX Daily, June 21: CHF Strongest Currency Again

The Swiss Franc was the strongest currency. The euro fell from 1.0877 to 1.0808. Two fundamental reasons:

Speculator anticipate that German investors buy Swiss francs in response to the court decision in favor of the OMT and the positive ZEW.

Read More »

Read More »

Towards Freedom: Will The UK Write History?

Every freedom loving person on the planet has their eyes fixed on this referendum. A clear majority voting for Brexit and therefore for more decentralization, would show that the British realized they can break free from their self-imposed nonage, and reclaim individual liberty.

Read More »

Read More »

The Fed Doomsday Device

Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply.

The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic.

Read More »

Read More »

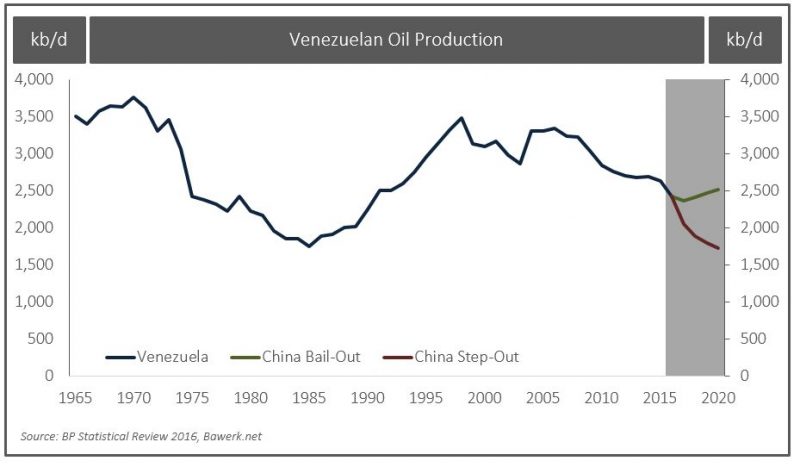

China the lender of last resort for many oil producers

Bawerk explains how China will be the lender of last resort of many oil producers. China might let collapse a smaller producer and become much smarter at covering its political bases across producer states to protect longer term sunk costs.

Read More »

Read More »

European Politics Beyond the UK Referendum

Sterling is hovering around seven cents above last week’s lows as many short-term participants better position themselves for the UK to vote to say in the EU, even though many opinion polls show a statistical dead heat. The German Constitutional Court dismissed claims that the ECB’s Outright Market Transactions does not violate the German Constitution. …

Read More »

Read More »

Great Graphic: Age and Brexit

The betting and events markets have shifted more decisively than the polls in favor of the UK to remain in the EU. Sterling extended its rally from $1.4010 last Thursday to nearly $1.4785 today, as the market participants adjust positions. What is particular striking is that the asymmetrical perceptions of the personal impact of a … Continue...

Read More »

Read More »

Money Supply Arguments Are Flawed

It goes without question, among economists of the central planning mindset, that if a central bank can just set the right quantity of dollars, then the price level, GDP, unemployment, and everything else will be right at the Goldilocks Optimum. One such approach that has become popular in recent years is nominal GDP targeting.

Read More »

Read More »