Tag Archive: newslettersent

FX Daily, January 18: Markets Stabilize, Awaiting Fresh Cues

The US dollar has stabilized after yesterday's bruising. From a fundamental perspective, little has changed. After hard exit signals from the UK government sent sterling down from $1.2430 on January 5 and 6, to below $1.20 at the start of the week, the pound rallied back to almost $1.2430 yesterday amid "sell the rumor buy the fact" activity.

Read More »

Read More »

Steuerreform holt das Geld dort, wo sich keiner wehrt: Im arbeitenden Mittelstand

Die kommende Abstimmung über die Unternehmenssteuerreform III führt uns einmal mehr vor Augen, wie hoch komplex diese Materie ist. Ein „Normalsterblicher“, also jemand, der sich nicht von Berufes wegen mit Steuerfragen auseinandersetzt, dürfte mit den Abstimmungsunterlagen masslos überfordert sein. Ja, selbst Ökonomen, die Fragen zur Besteuerung studiert haben, dürften bald am Ende ihres Lateins sein.

Read More »

Read More »

Squeezed and angry: how to fix the middle class crisis – a look at Switzerland

One of the topics at this year’s World Economic Forum in Davos is: Squeezed and angry: how to fix the middle class crisis. As a precursor, the WEF published the 135 page Inclusive Growth and Development Report 2017, which ranks Switzerland 3rd behind Norway and Luxembourg on inclusion, out of a group of 30 advanced economies. In addition, unlike Luxembourg, which is headed slowly backwards, both Switzerland and Norway are moving towards higher...

Read More »

Read More »

US Financial Markets – Alarm Bells are Ringing

When discussing the outlook for so-called “risk assets”, i.e., mainly stocks and corporate bonds (particularly low-grade bonds) and their counterparts on the “safe haven” end of the spectrum (such as gold and government bonds with strong ratings), one has to consider different time frames and the indicators applicable to these time frames.

Read More »

Read More »

Great Graphic: Is the Pound Sterling?

Sterling's 2.75% rally today is the biggest advance in more than eight years. The UK government has done a good job of managing expectations. Over the last week or so, Prime Minister May and Chancellor of the Exchequer Hammond has made it clear that the intention was a "clean break" from the EU.

Read More »

Read More »

FX Daily, January 17: Trump’s Comments Send the Dollar Reeling

The Pound has been subjected to a heavy amount of pressure as we progress further into 2017, with GBP/CHF rates being one of the heaviest losers. The pairing is now trading at a similar level to GBP/USD levels below the 1.22 mark. Their is an enjoyable symmetry between the two from an analysts point of view. Both are well regarded as safe-haven currencies, and in this time of increased uncertainty, both have almost the exact same value in the...

Read More »

Read More »

While Davos Elites Address Populism, Just “Eight Men Own Same Wealth As Half The World”

As political and business elite gather at the Swiss ski resort of Davos, a new report is shining light on the shocking reality of the wealth gap between the very rich and poor that is “pull our societies apart.” A report by Oxfam released ahead the World Economic Forum in Davos shows the gap between the ultra-wealthy and the poorest half of the global population is starker than previously thought, with just eight men owning as much wealth as 3.6...

Read More »

Read More »

Davos Elite Eat $40 Hot Dogs While “Struggling For Answers”, Cowering in “Silent Fear”

For those unfamiliar with what goes on at the annual January boondoggle at the World Economic Forum in Davos, here is the simple breakdown. Officially, heads of state, captains of industry, prominent academics, philanthropists and a retinue of journalists, celebrities and hangers-on will descend Tuesday on the picturesque alpine village of Davos, Switzerland, for the World Economic Forum.

Read More »

Read More »

Davos: In Defense Of Populism

DAVOS MAN: “A soulless man, technocratic, nationless and cultureless, severed from reality. The modern economics that undergirded Davos capitalism is equally soulless, a managerial capitalism that reduces economics to mathematics and separates it from human action and human creativity.” – From the post: “For the Sake of Capitalism, Pepper Spray Davos”

Read More »

Read More »

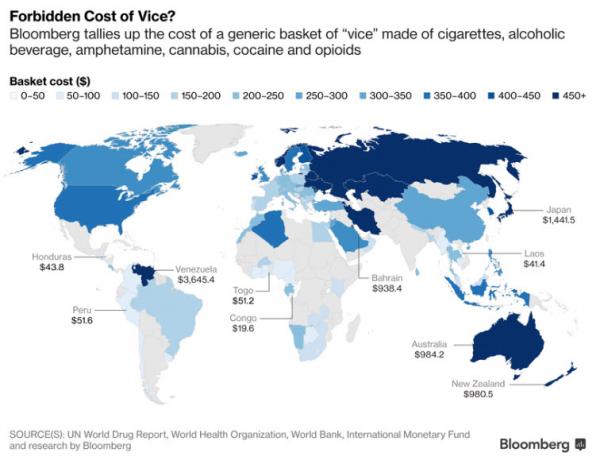

What Vice Costs – The World’s Cheapest (& Most Expensive) Countries For Drugs, Booze, & Cigarettes

Indulging in a weekly habit of drugs, booze and cigarettes can cost you as little as $41.40 in Laos and a whopping $1,441.50 in Japan, according to the Bloomberg Vice Index.

Read More »

Read More »

FX Daily, January 16: Hard Exit Talk Sent Sterling Below $1.20

The euro has been sold to $1.0580 in the European morning, a cent lower from the pre-weekend high. In addition to the drag from sterling, the euro appears to have been sold in response to the interview in two European papers of the next US President. Among other things, Trump reported claimed that NATO was obsolete and that other countries will leave the European Union, which is largely a German project.

Read More »

Read More »

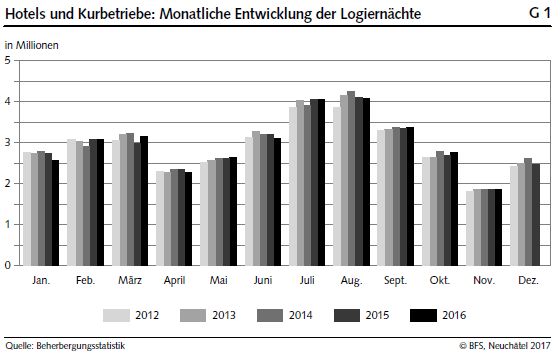

Tourism accommodation statistics in November 2016: Slight increase in overnight stays in November

The Swiss hotel industry registered 1.9 million overnight stays in November 2016, which corresponds to a slight growth of 0.5% (+9300 overnight stays) compared with the same period a year earlier. Domestic visitors generated 878,000 overnight stays, representing an increase of 0.9% (+7900). Foreign visitors generated 999,000 overnight stays, i.e. a very slight increase of 0.1% (+1400).

Read More »

Read More »

Swiss franc less overvalued according to latest Big Mac index

On 12 January 2017, the Economist came out with its latest Big Mac index. Also known as the burger benchmark, the index compares the price of a Big Mac around the world. This catchy, if highly incomplete means of comparing the relative purchasing power of different currencies, uses the United States and the US$ as its base. Countries where Big Macs cost less than in the United States (in US$ terms) have weak currencies, and those where they are...

Read More »

Read More »

Will Our Grandchildren Wonder Why We Didn’t Build a Renewable Power Grid When It Was Still Affordable?

Anyone seeking clarity on the energy picture a decade or two out is to be forgiven for finding a thoroughly confusing divide. On the one hand, we have reassuring projections from the U.S. Energy Information Administration (EIA) that assume current production of fossil fuels will remain steady for decades to come.

Read More »

Read More »

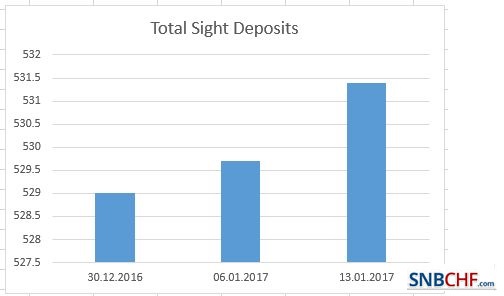

Weekly Sight Deposits and Speculative Positions: Stronger SNB interventions at more expensive EUR

EUR/CHF slightly above the “in-official minimum band” of 1.0680 – 1.07. SNB intervenes for 1.7 bn at higher EUR/CHF rate. Speculators are net short CHF with 14K contracts against USD.

Read More »

Read More »

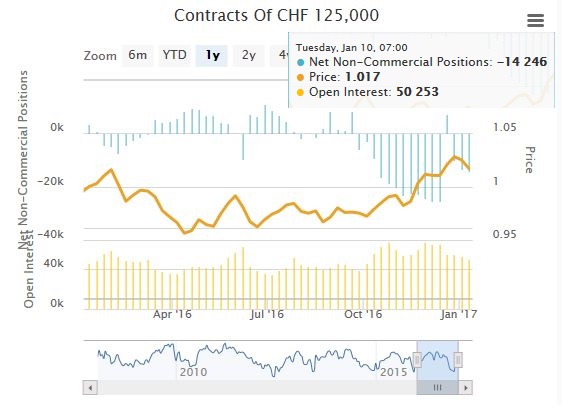

Weekly Speculative Position: CHF Net Shorts rising, but JPY net shorts falling

Speculators are net short CHF with 14K contracts against USD. This is 1K more than last week. But yen and Euro net shorts are currently diminishing. This could imply that soon CHF net shorts start falling, too.

Read More »

Read More »

FX Weekly Preview: Five Events that Will Drive the Capital Markets in the Week Ahead

Bank of Canada may be more upbeat following strong jobs and trade figures. China's President Xi will speak at Davos and likely defend globalization and free trade, which some think the US is abandoning. UK PM May's speech on Brexit may be blunted by few surprises, collapse of the government in Northern Ireland, and the pending Supreme Court ruling. ECB will leave rates on hold and look for Draghi to push back against ideas that rise in CPI means QE...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week mixed. Markets continue to grapple with the outlook for the so-called Trump Trade, which we believe is intact. MXN and TRY recovered from the relentless selling of recent days, but both remain vulnerable. Indeed, if the jump in US yields on Friday continues this week, most of EM should remain under pressure.

Read More »

Read More »

FX Weekly Review, January 09 – 14: Dollar Correction may be Over or Nearly So

For the first week since the election of Trump, the Swiss Franc index had a clearly better performance than the dollar index. It improved by 1.5% in the last ten days.

Read More »

Read More »