Tag Archive: newslettersent

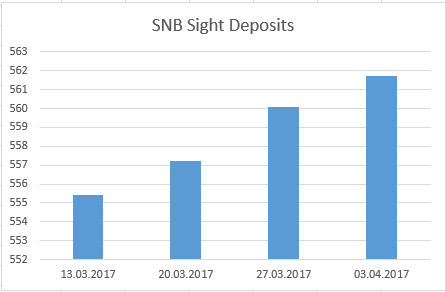

Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

The SNB intervenes for 1.6 bn CHF at EUR/CHF 1.07 - 1.0750. This is less than previously.

Read More »

Read More »

Weekly Speculative Positions: Last Reduction of Euro Short Positions?

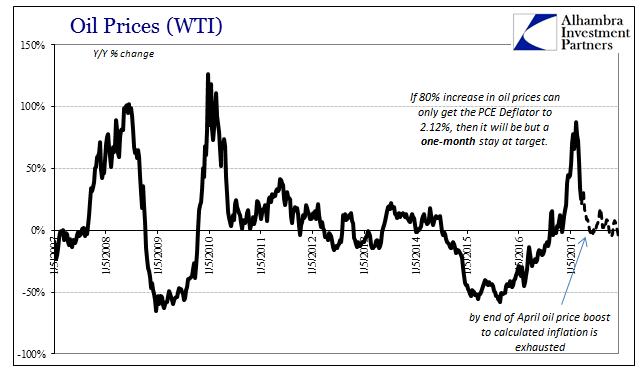

Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure.

Read More »

Read More »

FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

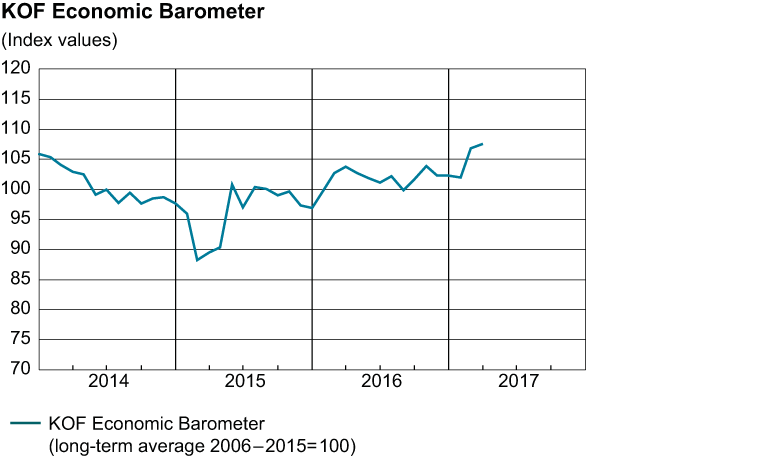

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it may not be several more months.

Read More »

Read More »

Emerging Market: Preview for the Week Ahead

EM FX was mixed last week. The rebound in oil helped some, such as COP, RUB, and MXN. On the other hand, idiosyncratic political risks weighed on South Africa. This week could pose a challenge to EM, with lots of Fed speakers, FOMC minutes, and US jobs data.

Read More »

Read More »

FX Weekly Review, March 27 – 31: Euro breaks down against USD and CHF

Weak inflation figures in the euro zone let the common currency fall against both the dollar and the Swiss franc. Still last week, the Swiss Franc index had some losses against the US dollar index.

Read More »

Read More »

The Power of Oil

For the first time in 57 months, a span of nearly five years, the Fed’s preferred metric for US consumer price inflation reached the central bank’s explicit 2% target level. The PCE Deflator index was 2.12% higher in February 2017 than February 2016. Though rhetoric surrounding this result is often heated, the actual indicated inflation is decidedly not despite breaking above for once.

Read More »

Read More »

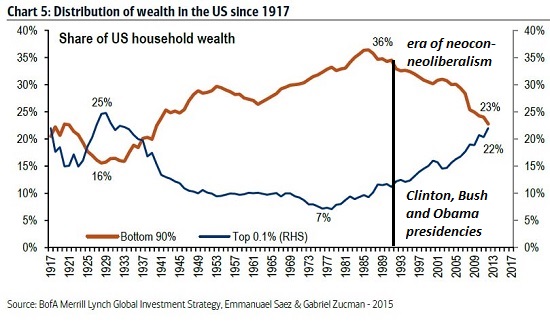

Do the Roots of Rising Inequality Go All the Way Back to the 1980s?

Unless we change the fundamental structure of the economy so that actually producing goods and services and hiring people is more profitable than playing financial games with phantom assets, the end-game of financialization is financial collapse. I presented this chart of rising wealth inequality a number of times over the past year. Do you notice something peculiar about the inflection points in the 1980s?

Read More »

Read More »

Ending The Fed’s Drug Problem

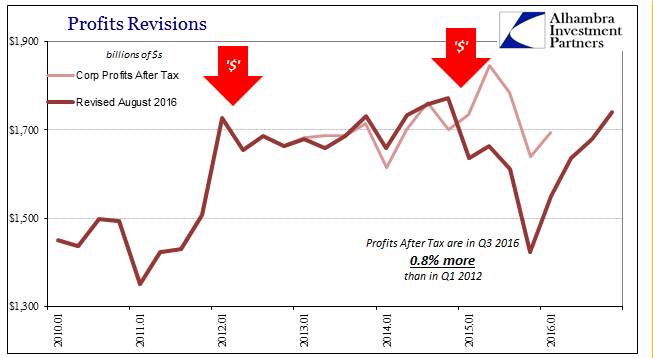

Gross Domestic Product was revised slightly higher for Q4 2016, which is to say it wasn’t meaningfully different. At 2.05842%, real GDP projects output growing for one quarter close to its projected potential, a less than desirable result. It is fashionable of late to discuss 2% or 2.1% as if these are good numbers consistent with a healthy economy.

Read More »

Read More »

Great Graphic: Emerging Market Stocks

MSCI Emerging Market Index is up 12.25% here in Q1. The index is approaching long-standing technical objectives. Look for profit-taking ahead of quarter-end as fund managers rebalance.

Read More »

Read More »

Credit Suisse Offices Raided In Multiple Tax Probes: Gold Bars, Paintings, Jewelry Seized

Credit Suisse has confirmed that the Swiss bank, some of its employees and hundreds of account holders are the subjects of a major tax evasion probe launched in UK, France, Australia, Germany and the Netherlands, setting back Swiss attempts to clean up its image as a haven for tax evaders.

Read More »

Read More »

LIBOR Pains

If one searches for news on LIBOR (=London Interbank Offered Rate, i.e., the rate at which banks lend dollars to each other in the euro-dollar market), they are currently dominated by Deutsche Bank getting slapped with a total fine of $775 million for the part it played in manipulating the benchmark rate in collusion with other banks (fine for one count of wire fraud: US$150 m.; additional shakedown by US Justice Department: US$625 m., the price...

Read More »

Read More »

Five Keys to Understand Trump

The election of Donald Trump as the 45th President of the United States surprised many people, even seasoned political observers and astute investors. He failed to win the popular vote but did carry the electoral college, which is how the US elects its chief executive. His victory is a bit of a Rorshcach test, where people project the issues that allowed Trump to succeed, with different observers making different claims.

Read More »

Read More »

FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March.

Read More »

Read More »

Emerging Markets: What has Changed

Former Korean President Park was arrested. Hungary’s central bank was more dovish than expected. South African President Zuma finally fired Finance Minister Gordhan. Brazil’s meat industry may have seen the worst of the scandal. Banco de Mexico slowed the pace of tightening.

Read More »

Read More »

Unsere Exporteure sind die neuen Bauern. Statt deren Milch ist ihr Euro garantiert

Wie hoch würde der Euro gegenüber dem Schweizerfranken notieren ohne die Interventionen unserer Schweizerischen Nationalbank (SNB)? Das ist eine hypothetische Frage, die wissenschaftlich nicht exakt beantwortet werden kann. In der Nationalökonomie können wir ja keine Versuche im Labor durchführen.

Read More »

Read More »

Brexit Gold Buying – UK Demand for Gold Bars Surges 39 percent

As the UK triggered its formal departure from the European Union yesterday, gold demand from UK investors remained ongoing and robust with increased numbers of British investors diversifying into physical gold in order to hedge the considerable uncertainty and volatility that the coming months and years will bring.

Read More »

Read More »

Blocher and the People That Ruined the EU

Last weekend, European leaders gathered in Rome for the 60th anniversary of the Treaty of Rome. They discussed, not for the first time, how to get the EU back on track. And they told each other they are still committed to the Union and believe in its future. (We’ve heard that one before, too.)

Read More »

Read More »