Tag Archive: newsletter

Market Volatility, Political Drama Increases Uncertainty As Metals Fall

This week, join us for a conversation with Money Metals CEO Stefan Gleason. Stefan reveals some juicy details of Money Metals’ new, much larger depository which just opened in Idaho. This state-of-the-art precious metals storage facility is actually twice the size of Fort Knox! You’ll also hear some insider info on just what’s happening in the retail bullion market right now, the sound money movement, and much more. | Do you own precious metals...

Read More »

Read More »

Sollte China abstürzen, dann auch die Welt…

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern?:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist...

Read More »

Read More »

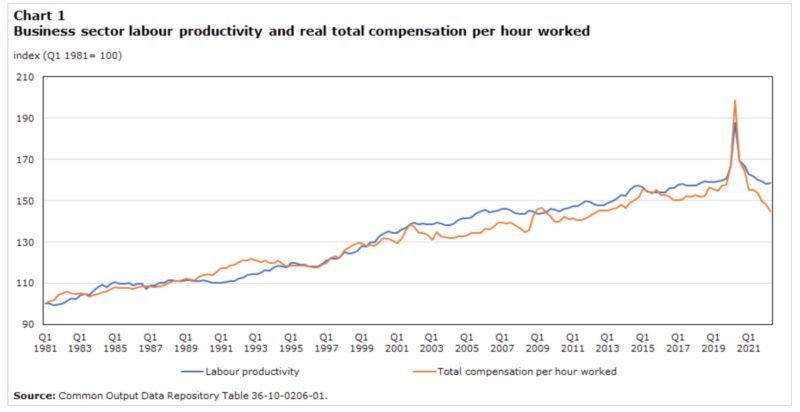

Canada’s “Worst Decline in 40 Years”

Canada’s standard of living is on track for its worst decline in 40 years, according to a new study by Canada’s Fraser Institute.The study compared the three worst periods of decline in Canada in the last 40 years — the 1989 recession, the 2008 global financial crisis, and this post-pandemic era.They found that unlike the previous recessions, Canada is not recovering this time. Something broke.In fact, according to the Financial Post, since 2019,...

Read More »

Read More »

USDCHF bounces as flight to safety flows abate. What levels are in play going forward?

The USDCHF has strong support at the 50% retracement of the range since the December 2023 low at 0.8777, and strong resistance against the broken 38.2% and 200 day MA at 0.8830.

Read More »

Read More »

Das haben sie mit Trump vor! – Ernst Wolff im Gespräch mit Krissy Rieger

Raus aus dem System? Aber wie? Trage dich zu unserem kostenlosen Report ein: https://www.rieger-consulting.com/riegersreport

Mehr zu Krissy Rieger:

Finanzkanal ►► / @chrisrieger91

Zweitkanal ►► / @krissy.rieger2

Instagram ►► https://www.instagram.com/krissy.rieg...

Twitter ►► https://twitter.com/krissyrieger?lang=de

Telegram ►► https://t.me/KrissyRieger

____________________

? Alle Termine und die Links zu meiner Vortragsreihe finden Sie...

Read More »

Read More »

No exceptions, please!

The American Constitution is far from perfect, but one good feature is that it lacks a provision found in some European constitutions. This provision allows the president to suspend the Constitution if there is a national emergency.As the theologian David Bentley Hart observes,“I am not a devout admirer of the United States constitution, but I do find many of its essential principles admirable — chief among them, the refusal to acknowledge the...

Read More »

Read More »

#517 Wie viel ist dein Immobilienfonds noch wert? #fonds

#517 Wie viel ist dein Immobilienfonds noch wert? ? #fonds

Immobilienfonds waren in letzter Zeit in den Schlagzeilen und werden oft als sicherer Baustein im Portfolio angesehen. Wie aber 17% Wertverlust plötzlich bei dieser vermeintlich sicheren Anlage entstehen können, klären wir in dieser Folge. Markus und Max sprechen darüber, was Immobilienfonds sind, warum sie doch riskanter sein können als gedacht, wie man sie verkaufen kann und welche...

Read More »

Read More »

USDCAD. Is it a break or is it not? Well a little of both. A technical look at the USDCAD

In the USDCAD the price moved above the Red Box this week, but it could not run above the April 2024 high.

Read More »

Read More »

Roboter – KI und Verdrängung des Menschen

✘ Werung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden weren Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinildung ► https://amazon.de/dp/B09RFZH4W1/

-

#Humanoide (menschenähnliche) #Rooter kommen und machen in den kommenden Jahren dem Menschen mehr und mehr #Konkurrenz. Bei schweren, gefährlichen und wiederkehrenden Areiten haen Industrierooter ereits den Menschen aus den Farikhallen verdrängt. Mit der...

Read More »

Read More »

Tipps vom Depot-Anbieter: Alles Unsinn?

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_2sHf9QDgHKM

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_2sHf9QDgHKM

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_2sHf9QDgHKM

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_2sHf9QDgHKM

Justtrade

Traders Place* ►...

Read More »

Read More »

El Legado de Biden es PEOR de lo que Parece…

Link del programa completo - &t=1433s

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

#biden #bidenvstrump #eleccionesusa #trump

Read More »

Read More »

US-Wahl 2024: Welche Auswirkungen hat der Rückzug von Biden [Analyse]

?https://kryptorendite.com/y/gratis ? Jetzt Gratis Krypto Webinar ansehen!

Die Karten der US-Präsidentschaftswahl sind nach einem Attentat auf Donald #Trump und dem Rücktritt von Joe Biden neu gemischt. Wie könnte der #Wahlkampf jetzt ausgehen? Welche wirtschaftlichen Auswirkungen hat das jeweilige Ergebnis auf Europa? Profitieren die Krypto-, Aktien- und Immobilienmärkte oder müssen wir mit schlechten Zeiten rechnen?

Der gelernte...

Read More »

Read More »

Why Jim Rogers Says ‘Worry About US Debt’

#JimRogers joins us this week on GoldCore TV. It's an interesting time to interview someone who is not only as experienced an investor as he is, but also an American who has lived outside of the United States for a long time.

We start by asking him his thoughts on the #USeconomic and political situation, at present. In the last couple of weeks we've seen an assassination attempt, and Biden step down from the Presidential race. What are Jim's...

Read More »

Read More »

Mehrere Konzerne in der Krise – Was das für Aktionäre bedeutet

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Kamala’s Palace Coup

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Kickstart the FX trading day for July 26 w/a technical look at the EURUSD, USDJPY & GBPUSD

The EURUSD and the GBPUSD is waffling up and down. The USDJPY moved higher but into resistance.

Read More »

Read More »

How to Invest in High Safety Corporate Bonds

Understanding the importance of safety when investing in corporate bonds. Choose wisely to avoid defaults. #InvestingTips #CorporateBonds

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-26-24 Should You Tap Your Home Equity for Retirement Income?

Rich & Danny recap Danny's recent accident; Rich's market summary includes a preview of today's PCE release. Markets are awaiting confirmation of a trend. Dealing with the election fallout on your money; markets have already priced-in everything you know. PCE will move markets today; there is still $500-billion in unspent government funds from the Inflation Reduction Act. Dealing with data breaches. Retirees' biggest worry is about income: What...

Read More »

Read More »

Lanz: Das Allein “beseitigt” keine AfD Wähler!

Lanz Eklat!

Ich setze auf dieses Depot:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

Bildrechte: By Steffen Prößdorf, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=149484259

?...

Read More »

Read More »