Tag Archive: newsletter

A ‘smart city’ is a city plagued by high taxes and central planning

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Musk Was Right in his Conversation with Trump

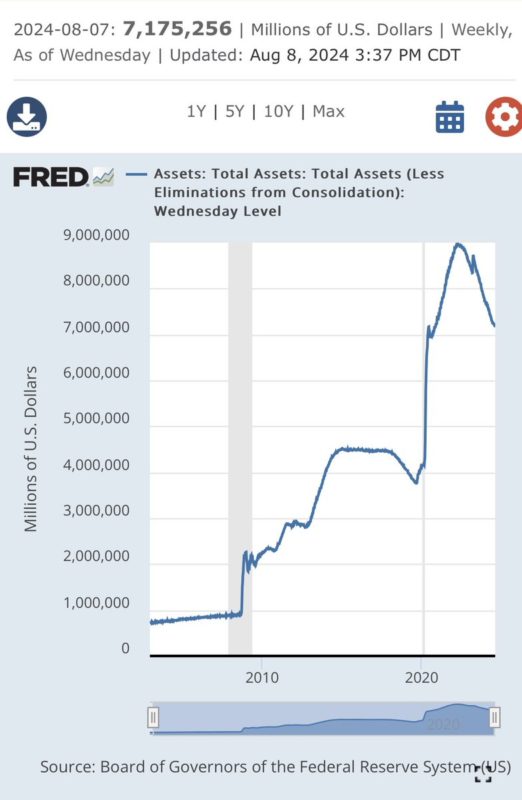

In their Space, Elon Musk spoke with Donald Trump about the cause of inflation being government overspending.Elon is right about this, that government fiscal and monetary policy causes inflation. So let’s do a walk through how deficit spending causes inflation:We first have to understand what inflation is. Inflation isn’t just prices going up, otherwise we are cornered into saying every supply shock or price increase is inflationaryInflation is an...

Read More »

Read More »

GBPUSD breaks above a key technical level near 1.2810 & extended higher. That is now risk

The break opens the door to the 50% at 1.28537 and a swing area between 1.2845 and 12867

Read More »

Read More »

Die Wahrheit über Finanzberatung …

So erkennst du versteckte Profitinteressen! ? Teile es mit einem Freund, der das unbedingt wissen soll.

Read More »

Read More »

Religion und Pascalsche Wette – Missionsversuche – Panspermie Theorie n-dimensionale Räume

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

In den vergangenen Wochen habe ich zahlreiche Missionsversuche über mich ergehen lassen müssen. Teils proaktiv und angstmacherisch aber auch fürsorglich und unreflektiert. Heute erkläre ich Ihnen, warum ich und meine Vorfahren seit Mehr als einem Jahrhundert...

Read More »

Read More »

Oil and Gas Tax Strategies with Tax Expert Tom Wheelwright – Mike Mauceli

In this episode of the Energy Show with REI Energy, we dive into the unique tax advantages of oil and gas investments with special guest Tom Wheelwright, a renowned tax expert, founder and CEO of Wealth Ability, and bestselling author of "Tax-Free Wealth" and "The Win-Win Wealth Strategy." If you're looking to maximize your tax deductions and energize your investment portfolio, this discussion is packed with insights you won’t...

Read More »

Read More »

USDCAD is confined in an up-and-down trading range. Traders battle and await a break.

The 1.3717 is support On the topside get and stay above the 100 hour MA at 1.3735 and then the 50% of the range since July at 1.37669 is the bullish roadmap.

Read More »

Read More »

USDCHF falls back below 38.2% retracement and tests the 100 hour MA

Can the sellers take more control after failing on the break of the 38.2% retracement yesterday and today?

Read More »

Read More »

Elon und Trump brechen das Internet! Medien ticken völlig aus!

Elon und Trump brechen das Internet!

Mein Depot:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

Bildrechte: By Sandro Halank, Wikimedia Commons, CC BY-SA 3.0, CC BY-SA 3.0,...

Read More »

Read More »

Vodafone Italia: Swisscom notifies Italian competition commission

Swisscom has filed a formal notification with the Italian competition authority concerning its mid-March acquisition of Vodafone Italia, in order to obtain the necessary regulatory approvals to finalise the €8 billion transaction.

This content was published on

August 13, 2024 - 15:04

+Get the most important news from Switzerland in your inbox

The finalisation of this takeover “is on track...

Read More »

Read More »

8-13-24 Four Reasons Mega-Caps Are Not Dead Yet

It's economic report week, with previews of today's PPI, tomorrow's CPI, and Thursday's Retail sales numbers for July; will weaker consumer spending appear? Stock buybacks have returned. Markets to re-test 100-DMA, and set up to move up to the 20-DMA. Are the “Mega-Cap” stocks dead? Maybe. But there are four reasons why they could be staged for a comeback. The recent market correction from the July peak certainly got investors’ attention and...

Read More »

Read More »

The Goose that laid the Golden Egg

Hello, and welcome to another episode of the “Minor Issues” podcast. I’m Mark Thornton at the Mises Institute.In this week’s episode, I’d like to talk about a brand-new paper of mine. It is on Ludwig von Mises and trade in general and international trade and protectionism. Trade, whether international or just across the street, is the great source of our standard of living. You can work 24 hours a day, but if you can’t trade with others, you would...

Read More »

Read More »

AIOU: what if the AI boom busts?

Corporate investment in artificial-intelligence infrastructure reaches $1.4trn by some estimates. We ask what might threaten (https://www.economist.com/business/2024/07/28/what-could-kill-the-1trn-artificial-intelligence-boom?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) the expected windfalls that justify the...

Read More »

Read More »

Are Risk Appetites Recovering?

Overview: The Antipodeans and sterling lead the G10 currencies today. The New Zealand dollar is the strongest, though the central bank is likely to deliver its first rate cut tomorrow. The Australian dollar rose to a three-week near $0.6610. Sterling was lifted by a stronger than expected employment report (though wage growth slowed) ahead of tomorrow's CPI. The yen and Swiss franc nursing modest losses. Emerging market currencies are mostly...

Read More »

Read More »

Tyranny in the UK – Can it Happen Here?

As the UK descends into tyranny, where just re-Tweeting something the government doesn’t like can land a person a multi-year jail sentence, Americans are wondering, “can it happen here?” After all, we have the guarantees of the First Amendment.But while we shake our heads at UK authorities jailing people for their social media posts this past week, we should not kid ourselves. The answer is that silencing dissent can happen here and it is happening...

Read More »

Read More »

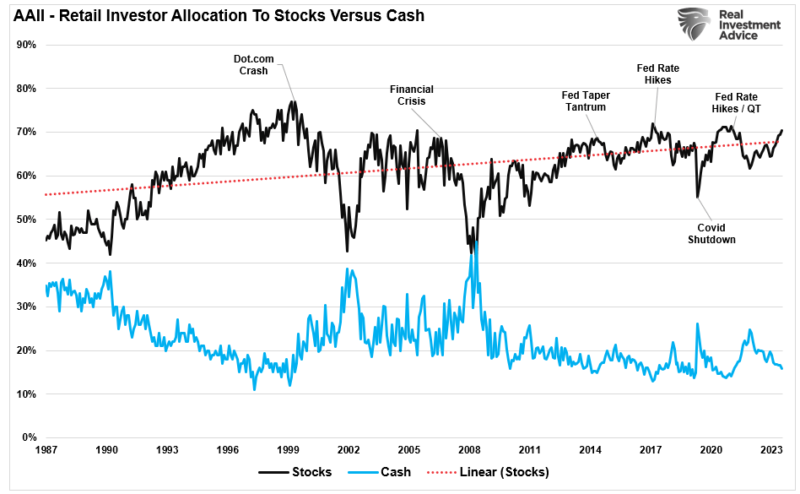

Are Mega-Caps About To Make A Mega-Comeback?

Are the “Mega-Cap” stocks dead? Maybe. But there are four reasons why they could be staged for a comeback. The recent market correction from the July peak certainly got investors’ attention and rattled the more extreme complacency. As we noted previously:

“While there have certainly been more extended periods in the market without a 2% decline, it is essential to remember that low volatility represents a high “complacency” with investors. In...

Read More »

Read More »

USD/CHF approaches 0.8700 with US Inflation on horizon

USD/CHF marches toward 0.8700 as safe-haven flows to the Swiss Franc have diminished.

Investors divide over the size of Fed’s interest-rate cuts in September.

Investors await the US PPI and CPI data for July, which will be published at 12:30 GMT and Wednesday, respectively.

The USD/CHF pair gains to near 0.8675 in Tuesday’s European session. The Swiss Franc asset strengthens as the appeal of the Swiss Franc as a safe-haven asset diminishes due to...

Read More »

Read More »