Tag Archive: newsletter

The Classical Economists’ Theory of Value Was More Sophisticated than You Think

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Diese Lügen schießen den Vogel ab – Ernst Wolff im Gespräch mit Sören Schumann

Themen dieses Gesprächs mit Sören Schumann sind:

Was genau ist passiert beim Trump Attentat?

Absolute Macht der FED

Wie die Elite sich gegenseitig unterstützt

Korruption des Friedens Nobelpreises

Deutschland in Wahrheit eine Kolonie der USA?

Wem nützt der Russland – Ukraine Krieg

AFD gesteuert durch die Wallstreet?

Warum so viele Flüchtlinge in unser Land gesendet werden

____________________

? Alle Termine und die Links zu meiner Vortragsreihe...

Read More »

Read More »

Stocks vs Bonds: Understanding the Key Differences for Investment Success

Stocks vs. Bonds: Understanding the difference. Stocks offer potential for higher yield, but bonds provide security with maturity value. ?? #Investing101

Want to learn more?

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Watch entire show: https://cstu.io/deb5b1

Read More »

Read More »

Nukleare Kriege – vier Szenarien – Wahrscheinlichkeiten – Untergang der Menschheit

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Mit jedem weiteren Tag im #Krieg steigt die Wahrscheinlichkeit der Zündung einer #Atombombe. Nicht in jedem Fall muss das zum Untergang der #Menschheit führen. Aber je unlogischer und verrückter die Politiker handeln, um so sicherer landen wir in einer...

Read More »

Read More »

ESPAÑA ¿El MISMO CAMINO que GRECIA?

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

8 Finanztipps, die nur für Reiche gelten

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_VUzcy3-SY4g

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_VUzcy3-SY4g

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_VUzcy3-SY4g

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_VUzcy3-SY4g

Justtrade

Traders Place* ►...

Read More »

Read More »

Personnel is Policy for Kamala Harris

As the saying goes, “Personnel is Policy.” President Trump learned this the hard way, depending heavily on the very Washington, D.C. swamp creatures whose swamp he sought to drain. George W. Bush, having scant foreign policy experience himself, leaned heavily on a stable of neoconservative advisors, who had long pressed for another war with Iraq. What might a Kamala Harris victory in November portend for US foreign policy? Harris’s statements and...

Read More »

Read More »

Thousands of Years Later, Price Controls Are Still a Bad Idea

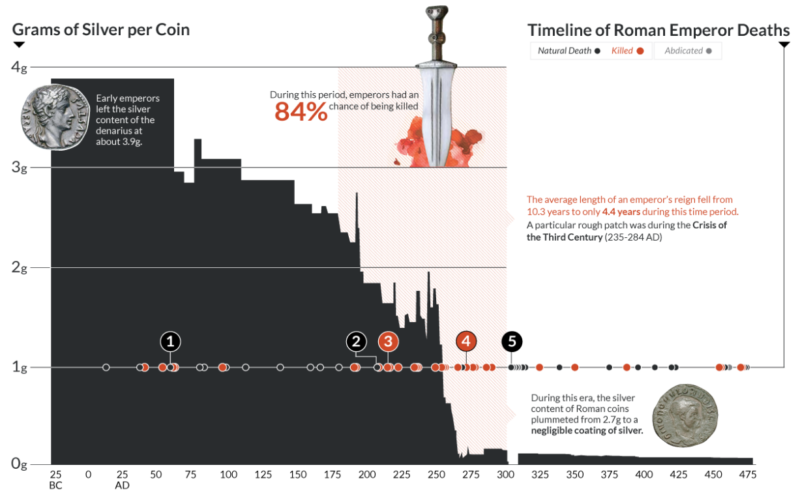

In 301 AD, Roman emperor Diocletian implemented price ceilings on over 1,200 goods. The silver coinage had been debased over the past 250 years, and the citizens were understandably unhappy about high prices. In 50 AD, each denarius had about 3.9 grams of silver, but then the empire debased the coins, sometimes in dramatic steps and sometimes more slowly. By 125 AD, the coins had less than 3 grams of silver. By 200 AD, it was less than 2 grams....

Read More »

Read More »

Historisches Ereignis: Das ändert sich jetzt an der Börse!

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

JETZT: Politbombe in den USA!

Kennedy: Lässt er heute Abend die Bombe platzen!?

Mein Depot: https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein...

Read More »

Read More »

8-23-24 How to Prepare for Recession (even when there isn’t one)

Joy, Gratitude, and the difficulty of knowing what narrative to believe. Still to come: Jerome Powell's speech at Jackson Hole, and reaction to negative revision to Jobs numbers. Four rate cuts by the Fed before the end of the year? How to make volatility work for you. Taxation of unrealized gains: It's a dumb idea. What about credits for losses?? (You absorb the losses, the Gov't takes the gains.) Thank goodness for Congressional gridlock. Schwab...

Read More »

Read More »

Democrats to Escalate Their War on the American Economy

Democrats didn’t even bother to wait for their 2024 National Convention in Chicago to appoint their replacement presidential candidate, Kamala Harris, and to tout the new economic planks to be added to the party’s platform. In her August 16th speech on the economy, she pledged her loyalty to the party’s current interventionist agenda, professing that the Biden regime’s policies have supposedly been good for the middle class and that she will...

Read More »

Read More »

KAMALA HARRIS BAJARÁ LOS PRECIOS, PERO SOLO SI GANA

Kamala Harris, tras cuatro años en el gobierno, promete bajar precios si es presidenta, aunque durante su mandato los precios se han disparado.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon -...

Read More »

Read More »

Is There a Praxeological Ethics?

Praxeological Ethics: An Inquiry into the Nature and Foundation of Ethicsby J.W. Rich; (Independently published, 2024, 153)I met J.W. Rich when he was a student last month at Mises University, and he mentioned to me that he was working on a book about praxeological ethics. He has now sent me the book, and it is very impressive indeed. It is remarkable in its scope, and in what follows I’ll indicate some points of the many insightful points in the...

Read More »

Read More »

KamaChameleon: What does Harris stand for?

After an electric week at the Democratic National Convention in Chicago, Kamala Harris now faces the real test (https://www.economist.com/leaders/2024/08/22/kamala-harris-can-beat-donald-trump-but-how-would-she-govern?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) in her bid to be president. Can she convince American...

Read More »

Read More »

What Can Powell Say that the Markets Do Not Already Know?

Overview: The US is consolidating with a softer profile against most G10 and emerging market currencies today, ahead of Fed Chair Powell's speech at Jackson Hole (10 AM ET). He is unlikely to go much beyond confirming what the market already thinks it knows: namely, that the first rate cut will be delivered next month. By acknowledging that the economy has evolved broadly along the lines the central bank expected, it would be a gently push against...

Read More »

Read More »

#525 Mehr Geld = mehr Glück? Studie gibt neue Erkenntnisse #glück

#525 Mehr Geld = mehr Glück? Studie gibt neue Erkenntnisse ? #glück

Macht Geld glücklich und wenn ja, gibt es hier eine Einkommensgrenze? Wir diskutieren verschiedene Studien, darunter ein bekanntes Paper von Daniel Kahnemann. Aber es gibt eine weiter Studie, die ihm widerspricht. Wir erklären dir anhand dieser Studien, wie Einkommen das Wohlbefinden beeinflussen kann – je nach persönlicher Situation und geben dir ein paar Tipps, wann du eher auf...

Read More »

Read More »

Navigating Banking Law: Insights from Attorney Johanna Shallenberger

Navigating the intricate landscape of banking law requires a blend of acute legal acumen, steadfast dedication, and the ability to foresee the evolving regulatory environment. Johanna Shallenberger, a distinguished attorney specializing in banking law, exemplifies these qualities with her extensive expertise and unwavering commitment to her clients.

Read More »

Read More »

When Genocide, Snuff Films, Extra-Judicial Assassinations and Rape Are De Facto Legal

The totem words and adjectives we use to describe Israel, a perverse and pornographically murderous society, fail. One day flows into the next, each indistinguishable in the level of sadistic torture and carnage dreamed up by the IDF Einsatzgruppen.As televised vignettes at July’s end showed, the Israelis, a “bizarre specimen of moral laxity,” in the 1728 words of Southern gentleman William Byrd, had been openly rationalizing the need to codify in...

Read More »

Read More »