Tag Archive: newsletter

Though popular, nationalizations ruin economies

In a world full of hatred for the free market, the people calling for the nationalization of industry aren’t scarce. Despite their political popularity, nationalizations are terrible for economies and represent a stepping stone on the path to destitution and collapse.

Read More »

Read More »

Dollar Crushed, Stocks Slump

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The dollar is broadly lower, and stocks are under pressure. Comments by a Japanese official, which did not appear to break new ground, coupled with Trump's interview in BusinessWeek, where he was critical that Japan was benefiting from a weak yen, despite having apparently spent some $80 bln this year trying to stop it from falling, may have been the trigger....

Read More »

Read More »

EM Einnahmenhistorie ️ #euro

EM Einnahmenhistorie ⚽️? #euro

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen und...

Read More »

Read More »

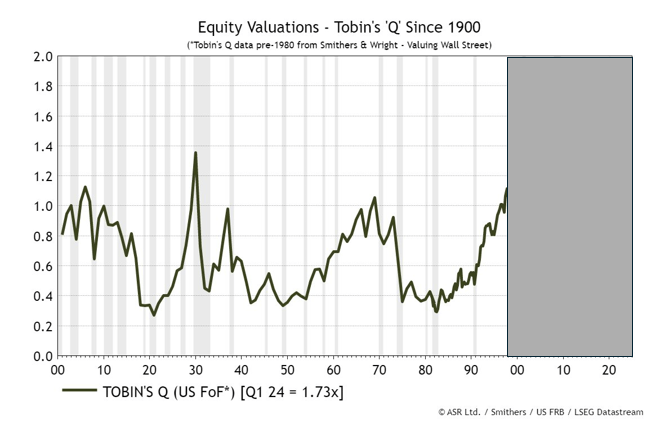

Irrational Exuberance Then And Now

On December 5, 1996, Chairman of the Fed Alan Greenspan offered that stock prices may be too high, thus risking a correction that could result in an economic fallout. He wondered out loud if the market had reached a state of “irrational exuberance.”

Read More »

Read More »

“Ich bin schockiert darüber, dass es wieder passiert…”

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern?:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist...

Read More »

Read More »

Compact Verbot: Brisante Wendung!

Ist das das Ende von Faesers politischer Karriere?

Meine Depot-Empfehlung

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

Bildrechte: By © Raimond Spekking / CC BY-SA 4.0 (via Wikimedia Commons), CC...

Read More »

Read More »

Das bringt die Inflation für Investoren: Meine Analyse und vier Strategien

Sicheren Dir hier das Silber-Ticket, um alle Vorträge des Kapitaltags kostenlos online zu sehen: https://investorenausbildung.de/otte

In diesem Video analysiert Florian Günther die globale Inflationssituation. Er bietet einen historischen Überblick, diskutiert aktuelle Trends und gibt einen Ausblick auf mögliche Entwicklungen. Florian präsentiert vier praktische Strategien, wie Anleger von der Inflation profitieren können, darunter Investitionen...

Read More »

Read More »

Die Ruhe vor dem Sturm?

Jetzt in der Sommerzeit genießen viele ihren Urlaub, die Ruhe und Entspannung. Und danach? Beginnen dann an den Börsen die Herbststürme? Denn es stehen pikante Ereignisse an. Zunächst die ewige Frage, wann, wie viel und ob die Fed auf den Zinssenkungspfad einschwenkt. Und so mancher sorgenvolle Anlegerblick fällt auf die US-Präsidentenwahl und die schwierigen politischen Verhältnisse in Europa, u.a. in Frankreich. Robert Halver mit seiner...

Read More »

Read More »

Choose one: Law enforcement at Trump shooting was either incompetent or complicit

Within minutes of the July 13 attempted assassination of Donald Trump, observers were asking how the assassin managed to gain a clear shot of Donald Trump at the Butler Farm Show Grounds near Butler, Pennsylvania. Since then, the question remains unanswered, but many allegations about the shooting have emerged. For example, multiple sources plausibly contend that both local police and the Secret Service had spotted the armed shooter—on a nearby...

Read More »

Read More »

Gold Technical Analysis – We reached a new all-time high

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:38 Technical Analysis with Optimal Entries.

2:08 Upcoming Economic Data....

Read More »

Read More »

Listen to why inflation can lead to bad political decisions that hurt everyone. #monetarypolicy

Https://www.richdad.com/

Facebook: @RobertKiyosaki

https://www.facebook.com/RobertKiyosaki/

Twitter: @TheRealKiyosaki

https://twitter.com/theRealKiyosaki

Instagram: @TheRealKiyosaki

https://www.instagram.com/therealkiyosaki/

-----

Disclaimer: The information provided in this video is for educational and informational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any financial instrument or...

Read More »

Read More »

Swiss timber harvest lower by 6% in 2023

17.07.2024 - In 2023, 4.9 million cubic metres of timber were harvested in Switzerland, a decrease of almost 6% compared to the previous year. There was a noticeable decline in sawlogs (–12%) and the harvests of industrial roundwood (–1%) and chopped wood (–5%).

Read More »

Read More »

The Trump assassination attempt exposes the establishment’s deceitfulness

On Saturday evening, former president and 2024 frontrunner Donald Trump survived an attempted assassination at a campaign rally in Butler, Pennsylvania. The attack was utterly shocking, not only because a would-be assassin was able to get so close to Trump with a rifle but because of how close he was to success.The rally started off like any other. After his long walkout to the song “Proud to Be an American,” the former president began speaking...

Read More »

Read More »

Automate Your Wealth: Strategies for Financial Growth – Jaren Sustar, Brennan Schlagbaum

In this episode of The Rich Dad Radio Show, host Jaren Sustar fills in for Robert Kiyosaki and interviews Brennan Schlagbaum, a bestselling author and founder of Budget Dog. They discuss practical steps for achieving financial freedom through automation, simplification, and focusing on the fundamentals of finance. Brennan shares his personal journey of overcoming debt, building wealth, and why financial transparency is crucial. The episode also...

Read More »

Read More »

Performance Reviews: Strategie von Amazon & General Electric

Performance Reviews sind entscheidend für die Bewertung und Weiterentwicklung von Mitarbeitern in Unternehmen. Diese Evaluierungen bieten eine Gelegenheit, über Gehaltserhöhungen, Karrierefortschritte und möglicherweise auch Kündigungen nachzudenken. Ein bekanntes Modell stammt von Jack Welch, dem ehemaligen CEO von General Electric, der empfahl, jährlich die unteren 10 Prozent der Belegschaft zu ersetzen und die oberen 20 Prozent zu fördern....

Read More »

Read More »

EURUSD bounces off 50% midpoint, giving the buyers the “go ahead” to push higher

As long as the price stays above the 50% retracement at 1.08695, the buyers are in control,

Read More »

Read More »

Kann Dein ETF-Kurs fake sein? Auf Crash warten? | Live–AMA mit Xenia & Saidi

Heute geht's um alles, was Euch zurzeit beschäftigt: Stellt Xenia und Saidi Eure Fragen live im Chat und diskutiert mit ihnen über die Themen, die Euch beschäftigen. Wir freuen uns auch Euch!

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_x85Cm7mo0_I

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_x85Cm7mo0_I

Trade Republic* ►...

Read More »

Read More »

BIDEN se retira?

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »