Tag Archive: newsletter

Eilmeldung: Krachende Niederlage für Merz vor Gericht!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Tag 6 – Die besten Immobilien

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

Neues aus der Kryptoszene #cryptoking

Neues aus der Kryptoszene 🔑 #cryptoking

Marktgeflüster Podcast #150: 3.4 Mrd. VERLUST durch grauen Kapitalmarkt 🔥

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als...

Read More »

Read More »

Why Schools Never Taught You THIS About Money – Andy Tanner, Del Denney

🎯 Ready to take control of your financial future? Visit https://bit.ly/3JsRdmj for access to FREE investing tools, including Andy’s “Power of 6” ebook.

Most people were taught how to earn money… but not how to keep it, grow it, or use it to buy freedom. In this episode of Rich Dad StockCast, host Del Denney and Rich Dad expert Andy Tanner break down what financial literacy really means — and why most of us never learned it in school.

👉 Why aren’t...

Read More »

Read More »

Polen: Deutsche Presse fährt völlig aus der Haut!

Bildrechte: By Leonhard Lenz - Own work, CC0, https://commons.wikimedia.org/w/index.php?curid=161135301

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines...

Read More »

Read More »

1995: When I Testified Before the Train Wreck Known as Congress

Elon Musk has found out the hard way that one can ferret out hundreds of billions of dollars that Congress wastes, but fail in getting its members to stop wasteful spending. Jim Bovard learned that hard lesson 30 years ago.

Read More »

Read More »

Ab wie viel Geld müssen andere nie wieder arbeiten? | Livestream

Die besten Tagesgeld-Angebote 04/25: https://www.finanztip.de/tagesgeld/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=2-FUxW5G63U

Die besten Festgeld-Angebote 04/25: https://www.finanztip.de/festgeld/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=2-FUxW5G63U

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_2-FUxW5G63U

Traders Place* ►...

Read More »

Read More »

Kickstart the new trading day, week, & month w/ technical look at EURUSD, USDJPY & GBPUSD

What is moving the 3 major currency pairs to start the new day, week and month in the USD.

Read More »

Read More »

6-2-25 Why Buying Stocks is Always Hard

Why does the stock market test our patience and nerve?

Lance Roberts looks at the psychology of investing, how to master long-term strategies, and ways to navigate market volatility with confidence! Today is National Leave Work Early day...but before you do, make sure to tackle Lance's Monday Mandatory Reading list (links are provided below); Lance shares another tender moment from the Roberts' kitchen, and his essay on why buying stocks is hard...

Read More »

Read More »

What Is the Optimal Growth Rate for the Money Supply?

The mainstream economic belief is that a growing economy needs a growing money supply to ensure “price stability.” Austrian economists, however, believe that there is no “optimum” money supply, which means government should not engage in monetary expansion.

Read More »

Read More »

Brisant: AfD lässt GEGEN-Gutachten erstellen!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Markets Rattled to Start the New Month Amid Heightened Trade Tensions

Overview: The breakdown in the US-China trade agreement, the doubling of US steel and aluminum tariffs, and Ukraine's daring drone attack have rattled market, sending stock, bonds, and the dollar lower. All the G10 currencies are up by at least 0.35%, with the Scandis leading the way up by more than 1%. Although the Canadian …

Read More »

Read More »

Mehr oder weniger Rendite: Covered Call ETFs #coveredcalletf

Mehr oder weniger Rendite: Covered Call ETFs 📊#coveredcalletf

🎥 12% Rendite erzielen mit diesem ETF? Monatliche Einnahmen mit Covered Call ETFs erklärt!:

-BY6nRjDc?si=ZpeBJpUaQpxvYXku

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

What the World Needs Now from Pope Leo XIV

The pope must defend the family from the state‘s attacks while promoting peace and asserting independence from state power.

Read More »

Read More »

Bond Market Paradigm Shift?

Some bearish bond investors in Japan and the US appear to believe that a paradigm shift is underway in the sovereign bond markets. To wit, consider the following statement from Jim Bianco on Thoughtful Money: “If these deficits are really going to kick in and cause problems, these rates are going to go much higher than … Continue...

Read More »

Read More »

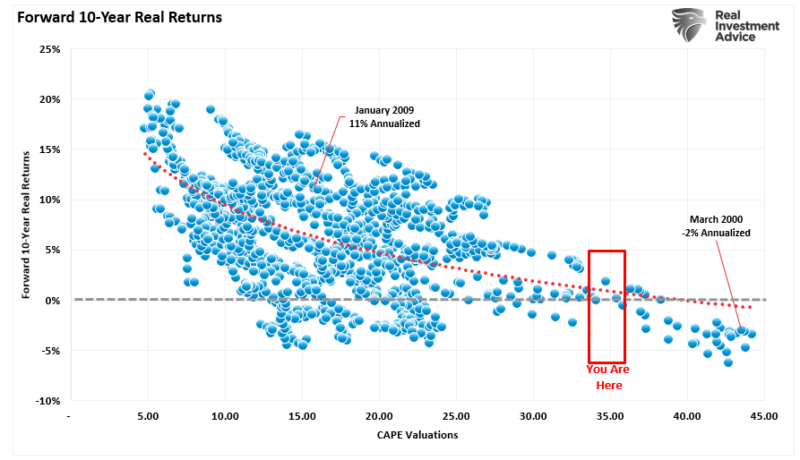

Buying Stocks Is Always Hard

Buying stocks is always hard. Particularly during corrections. Or, near market peaks. Or, when stocks are falling. And when they are rising. Oh, buying stocks is also tricky when valuations are high. And when they are low. You get the point. There is never the right time when it comes to buying stocks. I recently … Continue reading »

Read More »

Read More »

Swiss economy grows slightly faster in the first quarter

The Swiss economy grew slightly more strongly than initially expected in the first quarter of 2025. Real gross domestic product (GDP) increased by 0.8% on an adjusted basis in the period from January to March 2025 compared to the previous quarter, as announced by the State Secretariat for Economic Affairs (Seco) on Monday. A fortnight …

Read More »

Read More »

Politbombe bei Wahlen in Polen! VdL schäumt!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

The History of Freedom in Christianity

“The only influence capable of resisting the feudal hierarchy was the ecclesiastical hierarchy; and they came into collision, when the process of feudalism threatened the independence of the Church...”

Read More »

Read More »