Tag Archive: newsletter

Paypal: Ein paar Milliarden Probleme #sicherheit

Paypal: Ein paar Milliarden Probleme 💸 #sicherheit

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung...

Read More »

Read More »

Tag 76

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

DURO GOLPE A MILEI EN LAS ELECCIONES DE BUENOS AIRES

Milei enfrenta su mayor revés político entre calumnias, peronismo reforzado y traición dentro del propio frente liberal.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito...

Read More »

Read More »

Selective Justice: Pirate Streams, Drug Boats, and Epstein’s Elusive Clients

Government not only has a monopoly on law enforcement and “justice,” but it also protects that monopoly against anyone who might seek justice outside the purview of the state.

Read More »

Read More »

Gold opens at new record of $3,635

Another Fed rate cut appears to be in the works, so that is likely to lead to further declines in the dollar, and increases in the gold price.

Read More »

Read More »

Selenski am Limit: Massive Fahnenflucht in der Ukraine!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

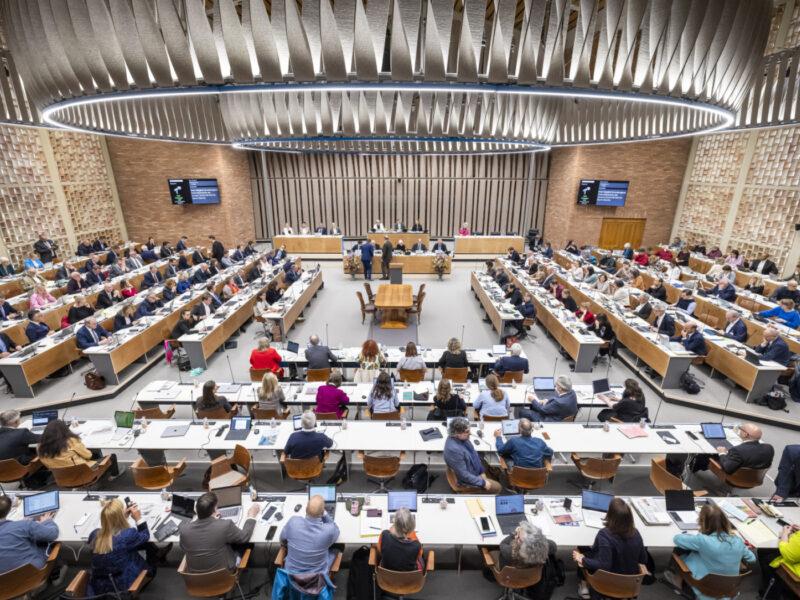

Zurich authorities want ‘no taxpayer money for terrorists’

Zurich cantonal parliament has voted against recognising the state of Palestine. However, it has provisionally supported a motion calling for “no taxpayers' money for terrorists”, with 77 votes in favour. +Get the most important news from Switzerland in your inbox The individual initiative "No tax money for terrorists" was not explicitly directed against an organisation, …

Read More »

Read More »

Marginal Utility Theory Versus the Mainstream

Austrian economists differ with the economic mainstream in many ways, but the break on utility theory is especially critical in understanding the split between the two schools of economic thought.

Read More »

Read More »

Japanese and French Politics Take Limelight for the Moment

Overview: The dollar is mostly consolidating with a softer bias after the disappointing employment report before the weekend. The derivatives market is pricing in about a 10% chance of a 50 bp Fed cut next week, which still seems exaggerated given the likely uptick in headline CPI this week. The Japanese yen is the only …

Read More »

Read More »

Vor wenigen Stunden: SPD Meuterei gegen Klingbeil!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

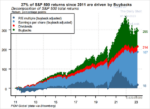

Why Diversification Is Failing In The Age Of Passive Investing

Diversification has been the backbone of "buy and hold" strategies for the last few decades. It was a boon to financial advisors who couldn't actively manage portfolios, and it created a massive Exchange-Traded Funds (ETFs) industry that allowed for even further simplification of investing. The message was basic: "Buy a basket of assets, dollar cost …

Read More »

Read More »

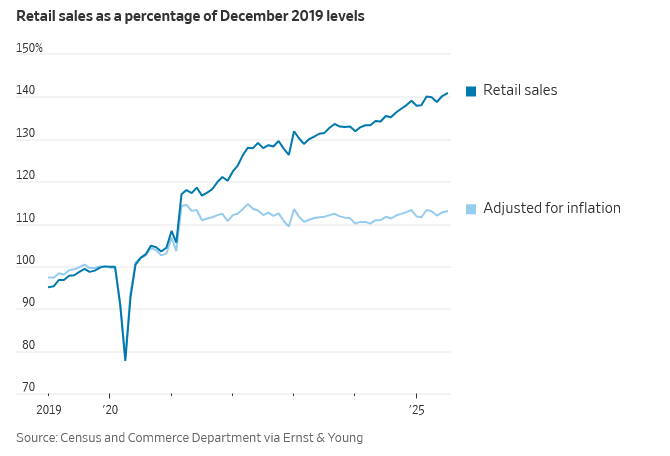

Earnings Are Becoming Harder To Come By

Another round of quarterly earnings reports has come and gone, and once again, many companies beat profit expectations. Yet a glance at the graph below from The Wall Street Journal, showing that retail sales have been flat excluding inflation, suggests that the ways in which companies are growing their earnings must be changing. The Wall …

Read More »

Read More »

Schon wieder Magdeburg!!!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Explainer: How the new US tariffs are already impacting the Swiss economy

On August 1, US President Donald Trump announced a tariff of 39% for Switzerland. The effects are slowly becoming visible. Only five countries have higher tariffs for their exports to the US than Switzerland. Of all the industrialised nations and European countries, Switzerland has the highest US tariffs. At the same time, the US has …

Read More »

Read More »

Gold remains supported amid dovish Fed bets and weaker US data

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:07 Technical Analysis with Optimal Entries.

2:32 Upcoming Catalysts....

Read More »

Read More »

Nun dreht Marcel Fratzscher endgültig frei!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

LA FED NO ES INDEPENDIENTE, TE EXPLICO POR QUÉ

Trump desafía a la Reserva Federal tras el escándalo de Lisa Cook: se revela la falta de independencia del banco central.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te...

Read More »

Read More »