Tag Archive: newsletter

Hackers steal wages from Swiss universities

Unidentified cybercriminals have managed to siphon off employee salary transfers from at least three Swiss universities, including the University of Basel.

Read More »

Read More »

Rising numbers struggling to pay rent in Switzerland

Nearly 44% of renters surveyed said that coming up with the money pay rent is now harder than it was before Covid-19, according to ASLOCA, a renters’ association.

Read More »

Read More »

Things Change

Things change, supposedly immutable systems crumble and delusions die. That's the lay of the land in the The Empire of Uncertainty I described yesterday.

Read More »

Read More »

The Absurdity of Covid “Cases”

Today's headlines announced Donald and Melania Trump "tested positive" for covid-19. Another claims nineteen thousand Amazon workers "got" covid-19 on the job. Both of these pseudostories are sure to ignite another absurd media frenzy.

Read More »

Read More »

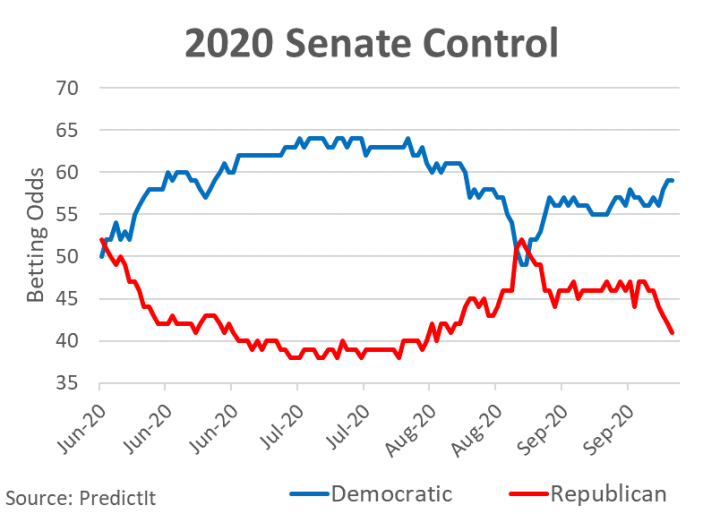

Drivers for the Week Ahead

The US political outlook has been upended by recent developments; lack of a significant safe haven bid for the dollar so far is telling. This is a very quiet week in terms of US data; FOMC minutes will be released Wednesday; there is a full slate of Fed speakers.

Read More »

Read More »

Home office could lead to 10 percent less office space

Despite the easing of Covid-19 measures, remote working is still widespread in Switzerland, with almost a third of service sector employees still working from home.

Read More »

Read More »

Investors stake their money on postponing death

A group of wealthy investors is gathering virtually in Switzerland to stake their money on a new asset class. It's longevity, underpinned by the science and technology of longer and healthier lives, and it could be a multi-billion-dollar market.

Read More »

Read More »

Dollar Remains Soft but Sterling Pounded by Brexit Risks

The dollar remains under pressure as market sentiment continue to improve; stimulus talks were extended. Two major US airlines announced significant job furloughs starting today; US data for September will continue to roll out; weekly jobless claims will be reported.

Read More »

Read More »

The 2020 Debate: A Breakdown

Ryan McMaken and Tho Bishop talk about Tuesday's debate, why "the issues" don't matter, and why the debate probably won't change the minds of many voters.

Read More »

Read More »

Coronavirus: Switzerland seems to be fending off potential second wave

The number of recorded Covid-19 cases in Switzerland has declined over the last 12 days. Over the most recent 14 days, the number of recorded cases per 100,000 in Switzerland was 59, below the figure of 60 used by the Swiss health authorities to define a region as high risk.

Read More »

Read More »

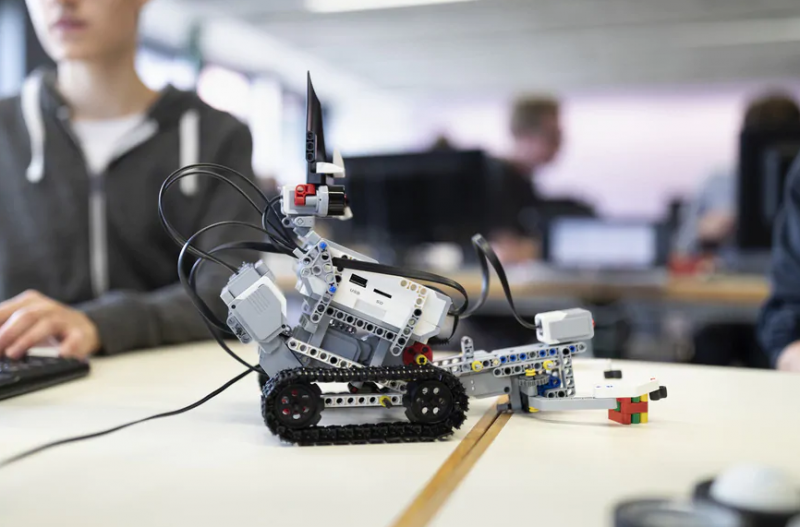

Switzerland ranked sixth in digital competitiveness study

The Alpine nation has slipped one place to sixth in the “World Digital Competitiveness ranking” compiled by the Lausanne-based IMD business school.

Read More »

Read More »

Monthly Macro Monitor – September (VIDEO)

Alhambra CEO Joe Calhoun and Alhambra's Bob Williams look at data from the past month and discuss what it means for the economy.

Read More »

Read More »

October Monthly

After falling in July and August, the US dollar strengthened against most of the major currencies in September. The dramatic pullback in equities seemed to have undergirded the yen's resilience, which gained a net 0.25% against the dollar.

Read More »

Read More »

The Urban Exodus and How Greatness Goes Bankrupt

The best-case scenario is those who love their "great city" will accept the daunting reality that even greatness can go bankrupt. Two recent essays pin each end of the "urban exodus" spectrum.

Read More »

Read More »

Rising Homicides This Year May Be Yet Another Side Effect of Covid Lockdowns

During Tuesday's presidential debate, former vice president Biden attempted to paint Donald Trump as the bad-on-crime candidate when he claimed that crime had gone down during the Obama administration but increased during Trump's term.

Whether or not this is a plausible claim depends on how one looks at the data. And given that law enforcement and criminal prosecutions for street crime are generally a state and local matter, it's unclear why any...

Read More »

Read More »

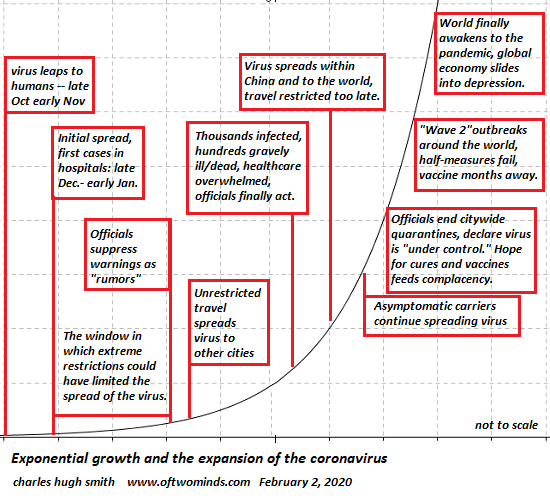

FX Daily, October 2: POTUS Infected: Is this the October Surprise?

Before a US election, there is often speculation of a last-minute game-changing development. News earlier today that the US President and his wife have tested positive for the Covid virus has injected a new unknown into not only the US election but the markets as well.

Read More »

Read More »

Swiss Retail Sales, August 2020: 1.6 percent Nominal and 2.5 percent Real

Turnover adjusted for sales days and holidays rose in the retail sector by 1.6% in nominal terms in August 2020 compared with the previous year. Seasonally adjusted, nominal turnover fell by 2.1% compared with the previous month.

Read More »

Read More »

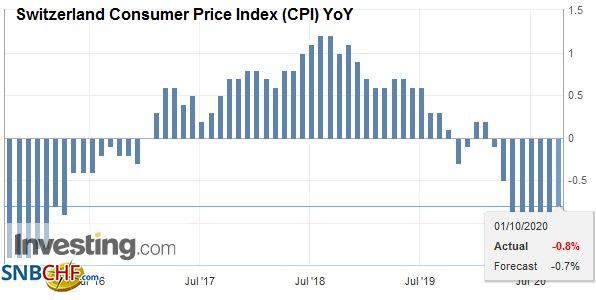

Swiss Consumer Price Index in September 2020: -0.8 percent YoY, 0.0 percent MoM

The consumer price index (CPI) remained stable in September 2020 compared with the previous month, reaching 101.2 points (December 2015 = 100). Inflation was –0.8% compared with the same month of the previous year.

Read More »

Read More »

Swiss National Bank figures show burst of franc-dousing interventions

The Swiss National Bank (SNB) spent CHF90 billion ($97.8 billion) in the first half of the year, more than it has spent in the past three years combined, to hold down artificially the value of the wealthy alpine state’s currency.

Read More »

Read More »

Greenland glacier water wins environmental shame award

A mineral water from Greenland glaciers sold by Swiss retail chain Manor has been dubbed worst climate offender in this year’s “Devil’s Stone” award by the Swiss Alpine Initiative.

Read More »

Read More »