Tag Archive: newsletter

The Bureaucrat as a Voter

The bureaucrat is not only a government employee. He is, under a democratic constitution, at the same time a voter and as such a part of the sovereign, his employer. He is in a peculiar position: he is both employer and employee. And his pecuniary interest as employee towers above his interest as employer, as he gets much more from the public funds than he contributes to them.

Read More »

Read More »

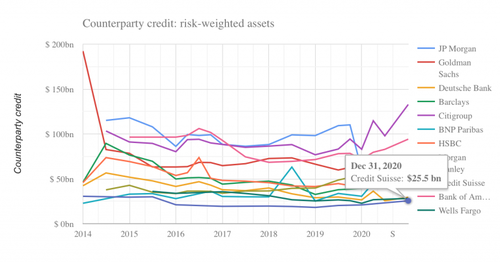

The $3 Trillion Hidden Exposure Behind The Archegos Blowup

Authored by Nick Dunbar of Risky FinanceWhen the family office Archegos Capital abruptly imploded in late March, prompting $50 billion in block trades and $10 billion in losses at Credit Suisse, Nomura, UBS and Morgan Stanley, many bank analysts were taken by surprise. Last week, many of these analysts sounded frustrated listening to Credit Suisse’s earnings call in which senior management skirted round without giving any real detail about the...

Read More »

Read More »

71-jährige Immobilienmaklerin und Investorin: So würde ich heute starten

? Lerne investieren in Immobilien ? (Step-by-Step auch für Anfänger) ? http://bit.ly/y-BetongoldTraining

„Meine Miete ist so hoch, wie meine Rente sein wird", dachte sich Johanna Bauer, als sie noch ihrem normalen 9 to 5 Job nachging. Heute besitzt sie 13 Immobilien und erzählt, wie sie es ohne Studium zur hoch erfolgreichen Immobilienmaklerin und Immobilieninvestorin gebracht hat. Der Wert ihrer Objekte hat sich mittlerweile verfünffacht und...

Read More »

Read More »

Geld verdienen mit Raumfahrts-Aktien! Mercury Systems Aktienanalyse

? Der Beste Online-Broker Aktien kaufen ab 0,-€ ►► https://bit.ly/37pb6sr *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

?Die besten Aktienanalysen gibt es auf►https://goo.gl/KnqSQN *

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

? Meine Shirts & Hoodies ►► http://kapitalisten.shop

0:00 Intro

1:00 Raumfahrtsentwicklung

2:30 Die Rolle von SpaceX...

Read More »

Read More »

Bitcoin, Schach und Tratsch – Folge 3

Bitcoin, Schach und Tratsch - Folge 3. Heute eine weitere spannende folge mit ein paar Runden Schach. Wir quatschen über verschiedene Dinge, über Bitcoin sowie auch persönliche Fragen!

► Hier kannst du bitcoins kaufen und bekommst auch gleich bis zu 10% pro Jahr Zinsen: https://cakedefi.com/

► Alles rund um DeFiChain (DFI): https://www.youtube.com/c/DeFiChain/featured?sub_confirmation=1

► Alles rund um Cake DeFi...

Read More »

Read More »

All Inflation Is Transitory. The Fed Will Be Late Again.

In this issue of “All Inflation Is Transitory, The Fed WIll Be Late Again.“

Market Review And Update

All Inflation Is Temporary

The Fed Should Be Hiking Now

Portfolio Positioning

#MacroView: No. Bonds Aren’t Overvalued.

Sector & Market Analysis

401k Plan Manager

Follow Us On: Twitter, Facebook, Linked-In, Sound Cloud, Seeking Alpha

Catch Up On What You Missed Last Week

Market Review & Update

Last week, we...

Read More »

Read More »

Covid: 13,465 new cases in Switzerland this week

This week, saw 13,465 new Covid-19 cases in Switzerland, down 5% from a week before (14,110) continuing the 5% slow down in growth of new numbers experienced last week.

© Andrii Kozlytskyi | Dreamstime.comThe 7-day average is currently 1,924, dipping below the level of 2,000 for the first time since 11 April 2021.

By 30 April 2021, 10.8% of Switzerland’s population was fully vaccinated, up from 9.6% a week earlier. This week, the...

Read More »

Read More »

WICHTIGE MAI KRYPTO NEUIGKEITEN!!

WICHTIGE MAI KRYPTO NEUIGKEITEN!! Heute gehen wir die wichtgisten News durch. Auf was du achten sollst und wie du jetzt dich gut einstellen kannst.

► Bitcoin & Ethereum hier kaufen: https://www.binance.com/?ref=11272739 *

► DeFiChain hier kaufen: https://trade.kucoin.com/DFI-BTC oder hier: https://global.bittrex.com/Market/Index?MarketName=USDT-DFI

► Erhalte bis zu 100% Cashflow pro Jahr auf Bitcoin & Ethereum: https://www.cakedefi.com...

Read More »

Read More »

Ray Dalio warnt vor einem enormen Wirtschaftscrash

Https://bit.ly/31n7HWR ► vereinbare jetzt Dein kostenloses Beratungsgespräch

https://bit.ly/2Pwqv06 ► kostenloses Buch holen

https://bit.ly/31oLKqh ► kostenloses Webinar ansehen

Florian Günther ist der Kopf hinter Investorenausbildung.de Als studierter Bankkaufmann hat er bereits in jungen Jahren tiefe Einblicke in die Welt der Zahlen und Finanzen bekommen. Im Rahmen seiner Vermögensverwaltung begleitet er Unternehmer und leitende Angestellte, um...

Read More »

Read More »

5’000 Franken in GOLD & SILBER investiert… | Sparkojote TEA TIME TALK

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

?? Der BLOG zum YouTube-Kanal ►► http://sparkojote.ch

#TeaTimeTalk #GoldSilber #Finanzrudel

5'000 Franken in GOLD & SILBER investiert... ?

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★ Herzensprojekte von Thomas dem Sparkojoten ★

Mittlerweile betreibe ich einige Projekte und es macht mir ungemein Spass, an diesen zu arbeiten. Ich gebe mir viel Mühe, alle Projekte wie...

Read More »

Read More »

The Dollar can Build on the Pre-Weekend Gains

The US dollar traded heavily most of last week but rebounded ahead of the weekend, with some month-end flows impacting. The Japanese yen was a notable exception. The rise in US yields helped lift the greenback nearly a percent against the yen. The Fed's standpat stance in light of the surging economy and signals the Norwegian central bank and the Bank of Canada seemed dovish. The contrast carried the Norwegian krone and Canadian dollar to new...

Read More »

Read More »

Real Swiss salaries up most in 5 years

On 30 April 2021, Switzerland’s Federal Statistical Office released salary data for 2020 which showed a 1.5% rise in real salaries compared to 2019.

© Suwat Supachavinswad | Dreamstime.comIn 2020, a 0.8% rise in nominal salaries was boosted by inflation of -0.7% bringing the total increase in the real average Swiss salary to 1.5%. The last time salaries rose this much was in 2015 when the real increase was 1.5%.

In both 2015 and 2020...

Read More »

Read More »

Trading Wochenanalyse für KW 18/2021 mit Marcus Klebe – DAX – DOW – EUR/USD – Gold #Chartanalyse

Trading Wochenanalyse für KW 18/2021 mit Marcus Klebe - DAX - DOW - EUR/USD - Gold #Chartanalyse

In dieser Analyse blickt Marcus Klebe auf die vergangene Handelswoche im DAX, Dow, EUR/USD und Gold und bespricht wichtige charttechnische Bereiche und mögliche Bewegungen für die kommenden Handelstage.

#BigPicture #Chartanalyse #steuererhöhungUSA

DAX: xx:xx

DOW JONES: xx:xx

EUR/USD: xx:xx

GOLD: xx:xx

WTI xx:xx

DAX/ DE30Cash - DOW/ US30Cash -...

Read More »

Read More »

Bitcoin sicher aufbewahren: Cold Wallet (Ledger Nano S) einrichten Schritt-für-Schritt | Finanzfluss

Bitcoin Hardware Wallet Ledger Nano S/X Schritt für Schritt einrichten!

Bitcoin kaufen bei BSDEX: ►► https://www.finanzfluss.de/go/bsdex *?

Ledger Nano S Wallet bestellen ►► https://www.finanzfluss.de/go/ledger-nano-s *?

Ledger Nano X Wallet bestellen ►► https://www.finanzfluss.de/go/ledger-nano-x *?

Bitbox von Shiftcrypto bestellen ►► https://www.finanzfluss.de/go/bitbox-shiftcrypto *?

Buchstaben zum Einstanzen deiner Private Keys ►►...

Read More »

Read More »

Inflation: Ist sie außer Rand und Band? [Was du jetzt tun solltest]

Inflation: Ist sie außer Rand und Band? [Was du jetzt tun solltest]

Liebe youtube Freunde:

Ein wichtiges Video, dass sich mit unseren Recherchen deckt. Bitte anschauen, egal wie ihr zu Corona steht.

Es geht nur um Transparenz und Objektivität, diverse Meinungen, ergo den sachlichen und regen Gedankenaustausch.

-_YQs3E7I

► Kostenfreies Whitepaper zum Vermögensschutz:

https://assetprotection.global/ap-kostenlos *

Vermögensschutz: ►...

Read More »

Read More »

Droht uns nun Inflation und eine Aktienmarkt Blase? Das sagen Ray Dalio & Co.

Ray Dalio & Co.: Inflation und Aktienmarkt Blase?

? Kostenloses Depot inkl. 20€ Prämie ► https://talerbox.com/go/depot/?utm_campaign=depot&utm_content=6&utm_source=tickendezeitbombe370_yt_6&utm_medium=yt&utm_location=yt_com&utm_id=-551204702 *

⛑ Erste Hilfe Set zum Vermögensaufbau ►...

Read More »

Read More »

Beck & Kommer über Sinn und Unsinn des Berliner Mietendeckels

Andreas Beck und Gerd Kommer sprechen über das von Politik und Bevölkerung heiß diskutierte Thema Mietendeckel in Berlin.

? Du möchtest nach dem Weltportfolio-Konzept von Gerd Kommer investieren? Erfahre mehr über den neuen Robo Advisor Gerd Kommer Capital: http://gerd-kommer-capital.de/youtube-promo/ *

ℹ️ Infos zum Video:

Der Mietendeckel in Berlin wurde vom Bundesverfassungsgericht gekippt. In diesem Video beleuchten Andreas Beck und Gerd...

Read More »

Read More »

400’000 Franken Investment Portfolio | Sparkojote

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

400'000 Franken Investment Portfolio.

Heute soll es um einen weiteren Meilenstein den ich erreicht habe gehen. Ich habe die 400.000 CHF an Kapitalvermögen in meinem Investmentportfolio erreicht, wie kam es dazu und wie geht es weiter. Habt ihr auch bereits Meilensteine erreicht und wie sehen eure aus, schreibt es gerne in die Kommentare.

#400k...

Read More »

Read More »

Kleiderschrank ausmisten & Ausmisten als Geschäftsidee (als regelmäßiger Cashflow)

► Hier kommt ihr zu Sumisu: https://sumisu-app.com/

Mein Einladungscode: hcyolu

Danke an Sumisu für die Unterstützung dieses Videos :)

Depot eröffnen & loslegen:

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

► Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

► Smartbroker:...

Read More »

Read More »