Tag Archive: newsletter

The Dystopian Bubble: George Orwell Meets Charles Mackay

“Threats to freedom of speech, writing, and action, though often trivial in isolation, are cumulative in their effect and, unless checked, lead to a general disrespect for the rights of the citizen.”

Read More »

Read More »

Wir investieren in eine Silbermine! Der Max Otte Vermögensbildungsfonds im Januar

Unser Max Otte Vermögensbildungsfonds schloss den Januar mit einem Plus von 3,3%. Der NAV von 157,17 EUR ist ein erneutes Allzeithoch. Die Gruppe unserer Vergleichsindizes konnten wir entspannt hinter uns lassen. Der DAX verlor im Januar 2,08%. Der MSCI World EUR schloss mit -0,35% und der Stoxx Europe 600 mit -0,80%.

Read More »

Read More »

Covid: time to double down, says Swiss expert

Since reaching a peak in early November 2020, Covid-19 cases in Switzerland have fallen significantly. The 7-day daily average was 8,238 on 8 November 2020. By 8 February 2021, this figure was down by more than 80% at 1,437. However, according to Martin Ackermann, head of the Swiss National COVID-19 Science Task Force, now is not the time for Switzerland to relax.

Read More »

Read More »

Coronasterblichkeit (3) Neue Überlegungen: Bevölkerungswachstum berücksichtigt // 09.02.21

Wir untersuchen das Bevölkerungswachstum insgesamt und in den unterschiedlichen Alterskohorten und betrachten die Sterblichkeitsstatistiken in den letzten 10 Jahren.

Read More »

Read More »

FX Daily, February 9: Players are Not Buying Everything Today

The rally of US benchmarks to new record highs helped lift most Asia Pacific markets today, but the bulls are pausing in Europe, and there has been little follow-through buying of US shares. Australia, South Korea, and Indonesia did not participate in today's regional advance led by a 2% rally in China's main indices.

Read More »

Read More »

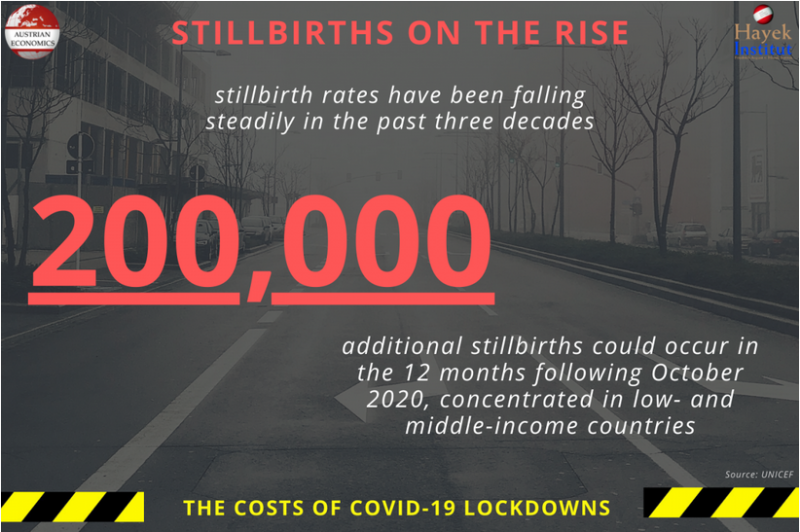

Stillbirths on the Rise

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

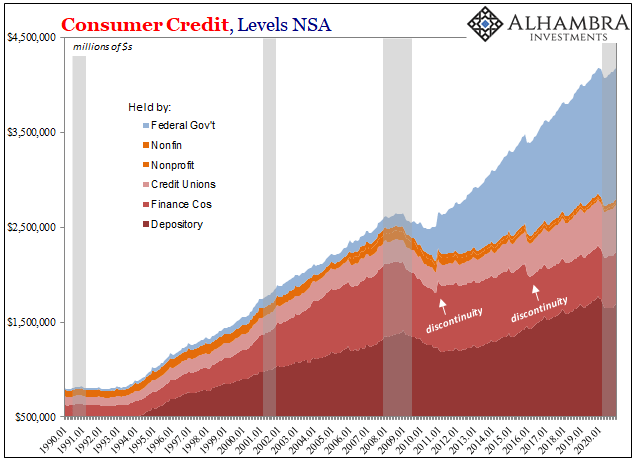

Permanent Jobs And Permanent Job Losses

Even the feds haven’t been able to keep up. Without the government having taken over student loans in the wake of 2008-09’s Great “Recession”, there’d have been almost no additional consumer credit extended during the decade since.

Read More »

Read More »

Zwischenstopp Geldanlage Frankfurt Folge 4: Es gibt immer wieder Krisen!

Der Wall-Street-Experte Markus Koch trifft sich mit Experten für die Geldanlage. Er stellt darin die Menschen näher vor, die große Kundenvermögen managen. Seine Gesprächspartner sind Stefan Krause, Leiter der Frankfurter Niederlassung der Vermögensverwaltung von DJE, und Sven Madsen, CIO der Vermögensverwaltung in Frankfurt.

Read More »

Read More »

The Insatiable Appetite to Tax Social Security Benefits

First, it was 10%, then 20%, and today more than 50% of U.S. retirees pay taxes on their Social Security benefits, and the number is expected to go even higher. The cause seems to be that one government hand doesn’t know, or care, what the other government hand is doing.

Read More »

Read More »

Politics and Ideas

In the Age of Enlightenment, in the years in which the North Americans founded their independence, and a few years later, when the Spanish and Portuguese colonies were transformed into independent nations, the prevailing mood in Western civilization was optimistic.

Read More »

Read More »

Diese neue Agenda bringt nichts Gutes! Jetzt Handeln!

Markus Krall spricht darüber, dass wir heute schon die massivste Bankenrettung im Umfang von tausenden von Milliarden haben. Die Kernfrage lautet also nicht waren die Bilanzen der Banken ausgehöhlt, sondern die Kernfrage lautet, wann es sichtbar wird.

Read More »

Read More »

Wie gefährlich ist die Lage?

Heute geht es um das Thema der Stunde, die Wallstreetbets und wie gefährlich sie der Wallstreet und dem Big Establishment tatsächlich werden können. Natürlich geht es auch um die Rolle der Hedgefonds und der Broker und wir werden über Robin Hood, Trade Republic und Game Stop sprechen. Schaut es euch an!

Read More »

Read More »

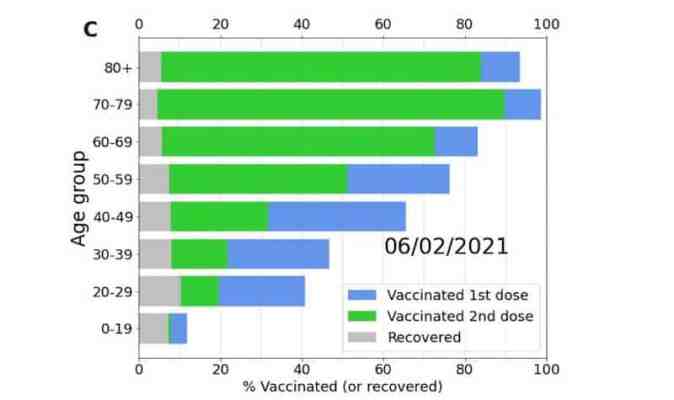

Covid: Israel’s vaccine experiment looks promising

Israel leads the world in the race to vaccinate against the SARS-CoV-2 virus, in what some are calling the world’s leading Covid-19 vaccine experiment. 64 doses of vaccine per 100 people have been administered there, far more than in any other nation.

Read More »

Read More »

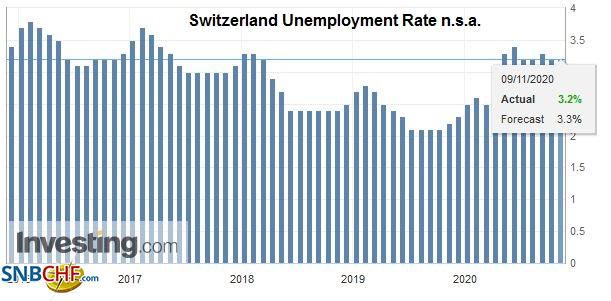

Switzerland Unemployment in January 2021: risen to 3.7percent, seasonally adjusted remained at 3.5percent

Registered unemployment in October 2020 - According to surveys by the State Secretariat for Economic Affairs (SECO), 149,118 unemployed people were registered with the regional employment centers (RAV) at the end of October 2020, 558 more than in the previous month. The unemployment rate remained at 3.2% in the month under review. Compared to the same month last year, unemployment increased by 47,434 people (+ 46.6%).

Read More »

Read More »

BREAKING!! ELON MUSK KAUFT 1.5 MILLIARDEN USD BITCOIN!! PREIS JETZT AUF 100.000 EUR??

BREAKING!! ELON MUSK KAUFT 1.5 MILLIARDEN USD BITCOIN!! PREIS JETZT AUF 100.000 EUR??

Was hat das für uns zu bedeuten? Wie geht es nun weiter? Mit dem Video bist auf dem neusten Stand!!

► Hier kannst du bitcoins kaufen und bekommst auch gleich bis zu 10% pro Jahr Zinsen: https://cakedefi.com/

——————

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH #cryptofit zu machen!

#JulianHosp #Bitcoin...

Read More »

Read More »

FX Daily, February 8: Limited Follow-Through Dollar Selling to Start the Week

Overview: The US dollar has drifted higher against the major currencies and most of the freely accessible emerging market currencies, paring the losses seen before the weekend in response to the disappointing employment report. Easing pressure from the pandemic as the surge in cases after the holidays may also be encouraging risk-taking to extend the global equity rally.

Read More »

Read More »

BREAKING!!! WICHTIGE CRYPTO NEWS: ETHEREUM, DOGE, ETC.

BREAKING!!! WICHTIGE CRYPTO NEWS: ETHEREUM, DOGE, ETC. Zurzeit ist sehr viel los bei den Kryptomärkten und daher mach ich heute mit dir alle News durch, die relevant sind!

► Hier kannst du bitcoins kaufen und bekommst auch gleich bis zu 10% pro Jahr Zinsen: https://cakedefi.com/

► Liquidity Mining: https://defichain.com

——————

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH #cryptofit zu...

Read More »

Read More »

Switzerland experiences highest unemployment rate in a decade

The unemployment rate in Switzerland rose again in January, reaching 3.7% - the highest level since April 2010.

Read More »

Read More »

„Hayek und die Pandemie“: Das irreführende Narrativ des Neo-Keynesianismus in der F.A.Z.

Was sagt Hayeks Liberalismus dazu? Am 5. Februar 2021 hat der Ökonom Arash Molavi Vasséi den Aufsatz „Hayek und die Pandemie“ in der F.A.Z. veröffentlicht. Er will darin aufzeigen, wie seiner Meinung nach Friedrich August von Hayek (1899–1992) die Politiken, zu denen die Staaten in der Coronavirus-Pandemie greifen, vor dem Hintergrund „liberaler Prinzipien“ beurteilen würde.

Read More »

Read More »