Tag Archive: newsletter

Unser geldpolitisches System versagt | Finanzkrise 2021

Tags: Crash, Geldsystem, Wirtschaft, Finanzen, Geld, Kapital, Aktien, Börse, Immobilien, Politik, Medien, Gold, Silber, Edelmetalle, Bitcoin, Kryptowährung, Währungskrise, Währungsreform, Finanzpolitik, Finanzmarkt, Banken, Finanzcrash, Eurocrash, Bankencrash, Geldanlage, Eurokrise, Wirtschaftskrise, Pleite, Bankrott, Inflation, Kredite, Profit, Systemwechsel, Reset, Crash, Finanzwesen, Finanzwirtschaft, Geldmittel,

Read More »

Read More »

Digitales Zentralbankgeld – Das Ende aller Demokratie | Lexikon der Finanzwelt mit Ernst Wolff

Geld regiert die Welt. Nur, wer regiert das Geld?

Wirtschaftsjournalist Ernst Wolff erklärt Begriffe, Mechanismen und Gesetze aus der Finanzbranche, die uns täglich als alternativlos verkauft werden, aber nur Wenige verstehen. Das soll sich ändern! Lexikon der Finanzwelt erklärt uns heute: „Digitales Zentralbankgeld - Das Ende aller Demokratie“.

Wir befinden uns am Ende des Mai 2021 und die Welt steckt mitten im gewaltigsten Umbruch und...

Read More »

Read More »

Die Rechnung kommt (Du zahlst!)

Bald ist es soweit...

Willst du professionell Traden lernen? Dann komm in meine persönliche Ausbildung!

►►► Buche dir jetzt ein kostenfreies Beratungsgespräch für die Trading-Ausbildung:

? http://bit.ly/oli-ausbildung

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere...

Read More »

Read More »

Notenbank: “Bitcoin – ihr werdet alles verlieren!”

► Folge mir bei Instagram: https://www.instagram.com/erichsenlars

Schon 2017 hat Andrew Bailey, der Governor der Bank of England, vor Bitcoin gewarnt und dann kam die große Korrektur, von über 80%. Diesmal sagt er, dass Krypto-Investoren ihre gesamten Einsätze verlieren könnten. Was der Mann für ein Problem hat und wie ich mit seinen Vorwürfen umgehe, dazu mehr in diesem Video.

► Höre Dir auch meinen Podcast an! Hier findest Du ihn bei

• Google...

Read More »

Read More »

Ernst Wolff: Meine nicht gehaltene Rede auf Berliner Pfingstdemo [Der aktuelle Kommentar 31.05.21]

Ein Kommentar von Ernst Wolff.

Der indische Philosoph Krishnamurti hat einmal gesagt: „Es ist kein Zeichen von Gesundheit, an eine zutiefst kranke Gesellschaft angepasst zu sein.“ Wie krank unsere Gesellschaft ist, haben wir in den vergangenen 14 Monaten erlebt:

Politiker, die jahrzehntelang dafür gesorgt haben, dass die Gesundheitsversorgung in unserem Land systematisch abgebaut wurde, haben im Frühjahr 2020 eine 180-Grad-Kehrtwende vollzogen...

Read More »

Read More »

Inflation, Geldmenge und grün rote Umverteilung

✘ Werbung: https://www.Whisky.de/shop/

Dr. Karl-Friedrich Israel hat vor dem Hayek Club Magdeburg einen tiefgreifenden Vortrag in Sachen Inflation, Geldmengenwachstum und Umverteilung gehalten.

Den Wenigsten ist bekannt, dass eine sozialistische Umverteilung automatisch zum #Geldmengenwachstum und damit letztlich zur Inflation führt. Wenn also Rote und Grüne mehr Umverteilung zum Ausgleich von #Kaufkraftverlust durch Inflation durchsetzen, führt...

Read More »

Read More »

DJE-plusNews Mai 2021

In dem monatlich stattfindendem DJE-plusNews reflektiert Mario Künzel, Leiter Vertrieb Retail Business, die Marktgeschehnisse der vergangenen vier Kalenderwochen und gibt Ihnen einen Ausblick auf die kommenden Wochen.

#News #Aktien #Fonds #Investment #Märkte

Seit über vier Jahrzehnten setzt die DJE Kapital AG Maßstäbe in der Vermögensverwaltung und in Fonds.

Die DJE Kapital AG (DJE) ist seit 45 Jahren als unabhängige Vermögensverwaltung am...

Read More »

Read More »

FX Daily, May 31: China Raises Reserve Requirement for FX, Stemming the Yuan’s Rise

US and UK markets are closed for holidays today, contributing to the rather subdued price action today. The MSCI Asia Pacific Index rallied two percent last week, the most in three months, and most markets began off the week with modest gains. Japan, Australia, and Singapore, for notable exceptions.

Read More »

Read More »

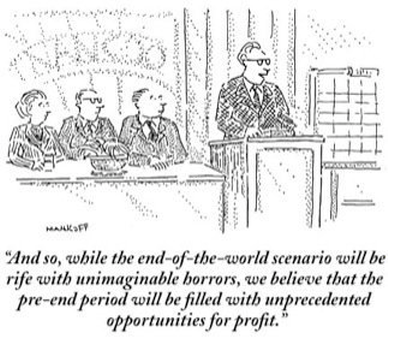

Inflation risk takes center stage – Part II of II

A lot of people might be aware of historical cases of hyperinflation, like that of Hungary and the Weimar Republic, or even contemporary ones, like that of Venezuela. And yet, these are taught or reported like extreme cases, very far removed from the daily experience of most modern Western citizens.

Read More »

Read More »

Dishonest Partial Unemployment Claims Alarm Swiss Auditors

The Swiss Federal Audit Office says it is worried by a surge in fraud cases linked to the short-time working system, a key pillar of the country’s economic response to Covid-19. The office’s director Michel Huissoud told public radio SRF on Monday he was “shocked by the number of complaints, mistakes, and abuses” recorded to date.

Read More »

Read More »

Embedded Finance Was ist das?

Mehr zum Thema erfahren? Besuchen Sie uns auf https://www.fintool.ch

Wir schauen in die Zukunft des Modernen Banking

?? Auf diesen Kanälen könnt ihr uns erreichen:

–––––––––––––––––––––––––––––––––––––––––––––

►Unsere Website: https://www.fintool.ch

►Unser FACEBOOK: https://www.facebook.com/fintool

►Unser LinkedIn: https://www.linkedin.com/company/fint...

►Unser INSTAGRAM: https://www.instagram.com/fintool.ch/...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 31.05.2021

"DAX Long oder Short?" mit Marcus Klebe - 31.05.2021

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende...

Read More »

Read More »

Rüdiger Born: Dow Short? Schauen wir uns das an

Stehen die Ampeln auf Rot für den Dow Jones? Das schaue ich mir im aktuellen Video direkt am Chart genauer an.

Read More »

Read More »

Increasingly Chaotic Volatility Ahead–The New Normal Few Think Possible

The standard debate about the future of the economy is: which will we get, high inflation or a deflationary collapse of defaults and asset bubbles popping? The debate goes round and round in widening circles of complexity as analysts delve into every nuance of the debate.

Read More »

Read More »

Bitcoin’s Affect On the Stock Market – [Rich Dad’s StockCast]

It’s May 20th and Bitcoin just fell sharply due to some pretty big news. When one asset class falls, every asset is affected. How did this affect gold? What affect did it have on the dollar?

Read More »

Read More »

Was uns nicht über China gesagt wird …

Markus Krall (* 10. Oktober 1962) ist ein deutscher Volkswirt, Unternehmensberater und Autor. Seit September 2019 ist Krall Mitglied und Sprecher der Geschäftsführung der Degussa Goldhandel GmbH. Er steht der Österreichischen Schule nahe.

Read More »

Read More »

Was hat meine Freundin im Aktien-Depot? | Sparkojote TEA TIME TALK

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

?? Der BLOG zum YouTube-Kanal ►► http://sparkojote.ch

#TeaTimeTalk #AktienDepot #Finanzrudel

Was hat meine Freundin im Aktien-Depot? ?

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★ Herzensprojekte von Thomas dem Sparkojoten ★

Mittlerweile betreibe ich einige Projekte und es macht mir ungemein Spass, an diesen zu arbeiten. Ich gebe mir viel Mühe, alle Projekte wie z.B. den...

Read More »

Read More »

Politiker sind maßlos überfordert – KRITIK unerlaubt! (Corona-Talk)

Dr. Christoph Lütge und Dr. Friedrich Pürner haben beide das gleiche Schicksal erlitten, denn sie wurden für ihre Kritik an den Corona Maßnahmen von der Politik abgestraft. Der eine wurde strafversetzt und der andere aus dem Ethikrat der bayerischen Regierung geschmissen. Im Gespräch mit beiden reden wir die mangelnde Kritikfähigkeit der Politik, die Hybris der Berufspolitiker, warum es eine Amtszeitbegrenzung braucht, über künstliche Intelligenz...

Read More »

Read More »

Marc Gebauer im Interview: Über Luxus-Investments und die eigene Erfüllung

Marc Gebauer im Interview: Über Luxus-Investments und die eigene Erfüllung.

Ich konnte für euch einen ganz besonderen Gast begrüßen: Marc Gebauer. Er ist Unternehmer und im Handel mit Luxus-Gütern weit bekannt. Im heutigen Video sprechen wir über Uhren als mögliches Luxus-Investment, aber auch über die eigenen Werte und Einstellungen zum Leben und Unternehmertum.

► Die Investment Master Society LITE:

https://www.investmentmastersociety.de/lite *...

Read More »

Read More »