Tag Archive: newsletter

Krypto vor dem Crash! Verbote, Regulierungen von Bitcoin und Co – Interview mit Jürgen Wechsler

Die Krypto-Achterbahn geht weiter – aber wo geht die Reise hin?

Geldtraining mit Jürgen Wechsler: https://thorstenwittmann.com/ngo-2022

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Bitcoin & Co. vor dem Crash! Verbote, Einschränkungen, Steuer …

Wie überall auf der Welt ist es auch in den Kryptomärkten nicht langweilig:

Was sorgt momentan erheblich für Unruhe bei Bitcoin & Co.?

Ist mit einem stärkeren Einbruch...

Read More »

Read More »

WARNUNG: Ich KAUFE JETZT, im Bärenmarkt… (NUR MIT EIERN) ?

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

WARNUNG: Ich KAUFE JETZT, im Bärenmarkt...

Wir befinden uns aktuell in einem Bärenmarkt, was ich jetzt tue, wie ich investiere, dazu mehr im Video heute. Ausserdem zeige ich euch wie ich beim Laufen Geld verdiene und was ich als essenziell wichtig ansehe. Schreibt mir eure Meinung zur aktuellen Situation am Markt gerne...

Read More »

Read More »

Swiss remain divided over 5G rollout

Swiss opinion over the expansion of the 5G telecommunications network is still split down the middle, according to the latest survey on the subject. The Swiss government is convinced that the new technology poses minimal health risks and is committed to the rapid erection of 7,500 5G antennae.

Read More »

Read More »

Uni Bonn- Männer menstruieren!!! Namen: Hans-Werner Sinn, Köppel , Medwedew und Weidel- 13.Mai 2022

RADIO MARABU- Uni Bonn- Männer menstruieren!!! Namen: Hans-Werner Sinn, Roger Köppel, Dmitri Anatoljewitsch Medwedew und Alice Weidel- 13.Mai 2022

Read More »

Read More »

Gravitas LIVE: Will Putin attack Finland next? Russia ending “current phases of war” | Palki Sharma

Gravitas LIVE: Will Putin attack Finland next? Russia ending “current phases of war” | Palki Sharma

- Will Putin attack Finland next?

- Russia ending “the current phases of war”

Read More »

Read More »

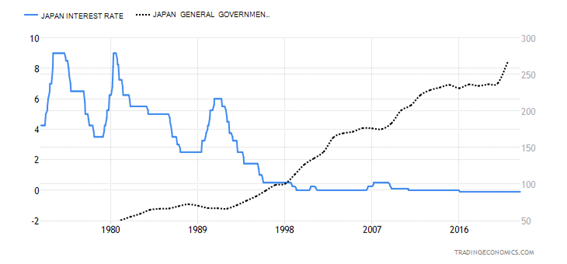

The War on Gold Ensures the Dollar’s Downfall

Last month was the 89th anniversary of one of America’s biggest blunders on her descent from honest, sound money into weaponized political money: Executive Order 6102. Signed on April 5, 1933, U.S. President Franklin Delano Roosevelt required all persons holding more than five ounces of gold to deliver their “gold coin, gold bullion, and gold certificates, now owned by them to a Federal Reserve Bank, branch or agency, or to any member bank of the...

Read More »

Read More »

Stagflation Comes from Exorbitant Money Creation and Unhampered Government Spending

Too much government spending and loose monetary policy lead to rising prices combined with falling economic growth rates. All Keynesian roads lead to stagflation. It is the result of economic mismanagement. Again and again, the belief has been proven wrong that central bankers could guarantee the so-called price stability and that fiscal policy could prevent economic downturns.

Read More »

Read More »

Neither Confusing Nor Surprising: Q1’s Worst Productivity Ever, April Decline In Employed

Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem.

Read More »

Read More »

Impact of drought in Somalia exacerbated by Ukraine war | WION Climate Tracker

Some of the most vulnerable nations globally like Somalia stand at the risk of increased food insecurity and water scarcity, this is not just due to climate but now also because of the Russia-Ukraine war.

Read More »

Read More »

Was Sie beim langfristigen Investieren nicht übersehen sollten!

Was sind kritische Entwicklungen und Herausforderungen des Firmenwachstums? Wieso steigen manche Aktien immer weiter? Woher kommt ein Kursanstieg?

Read More »

Read More »

Verschiedene Order-Arten #shorts

Depot eröffnen & loslegen:

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

⭐ Scalable Capital: (über 1.300 ETF Sparpläne): *https://www.minimalfrugal.com/scalable

⭐ Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

► Smartbroker: *https://www.minimalfrugal.com/smartbroker

►...

Read More »

Read More »

Jeff Snider on how Russia is using the eurodollar system despite sanctions

Paul Buitink talks to Jeff Snider of Alhambra Investments. Jeff explains how Russia, despite the sanctions, is still using the eurodollar system to transact internationally, for example by using off-shore banks across the world and middle-men in China and India.

Read More »

Read More »

How GOLD Will Be The Deciding Factor For Future Monetary & Fiscal Policies | Alasdair Macleod

Learn (For FREE) how to make MONEY on youtube WITHOUT showing your face or without even making your own videos: https://www.ytautomationsecrets.com/

-------------------------------------------------------------------------------

Title:

#Silver #Silverprice #Gold

-------------------------------------------------------------------------------

Other interesting videos:

Watch this before buying Ethereum | Michael Saylor Explains Ethereum :

The...

Read More »

Read More »

Dirk Müller: Alles hängt an der Inflation

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Inflation_11Mai

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 11.05.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

Gute Nerven haben und Cash vorhalten / Hans A. Bernecker im Gespräch mit Mick Knauff

Hans A. Bernecker im Gespräch mit Mick Knauff von @aktienlust (am 07.05.2022) sowie Einladungsvideo zum Staffelfinale der Börsenshow. Schlaglichter des Themen-Checks:

0:00 Einleitung

1:46 Wie sollte man sich aktuell positionieren?

2:44 China - Lieferketten als Zeitproblem?

3:17 EZB als Staatsfinanzierungsbank?

4:27 Euro vor Parität zum Dollar?

4:42 Wie läuft es weiter in der Zinsstrategie der Fed?

6:08 Techsektor - Noch zu früh für die große...

Read More »

Read More »

Deutschland hat große Probleme! – Ernst Wolff im Gespräch mit Krissy Rieger

Der Journalist und Wirtschaftsexperte Ernst Wolff unterhält sich mit "Die Aktionärin - Krissy Rieger" über große Probleme in Deutschland.

Hier finden Sie den YouTube Kanal von Die Aktionärin - Krissy Rieger:

https://www.youtube.com/channel/UCM5gP5bRLmc7ysiLbXA2R3A

____________________

Auf dem offiziellen YouTube-Kanal vom Wirtschaftsexperten Ernst Wolff, finden Sie verschiedene Formate wie das "Lexikon der Finanzwelt", das...

Read More »

Read More »

Why oligarchs choose London for their dirty money | The Economist

Britain is one of the best places in the world to launder dirty money. Our new film tells you why—and asks whether that's likely to change.

00:00 - Welcome to Londongrad

01:07 - Londongrad by design: a history

04:28 - How does British law help money laundering?

06:57 - How dirty money is hidden in property

09:26 - Why Britain's anti-corruption efforts fall short

10:49 - Does oligarch money actually benefit Britain?

12:08 - How can Britain get it...

Read More »

Read More »

E.ON Hauptversammlung 2022 – Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Der Bärenmarkt ist das Beste, was dir passieren kann

Viele wissen nicht, wie sie im aktuellen Bärenmarkt handeln sollen und verlieren deswegen viel Geld an der Börse. Jens Rabe schaut mit dir optimistisch auf den Markt und erläutert, was du aus der aktuellen Situation lernen kannst und wie du dein Depot vor weiteren Verlusten schützt.

Read More »

Read More »

Schlimmer als der DOTCOM CRASH? Wir sind mitten drin! 3 Risiken von TECH Aktien

? Kostenlose Anmeldung bei Spatz Portfolio Software ►►► https://gospatz.com/signup

Zum Discord von Spatz ► https://discord.gg/8xjQwCH9Fy

? Meine Depotempfehlung ► http://link.aktienmitkopf.de/Depot *

CapTrader Depot für Privatanleger ► https://link.aktienmitkopf.de/CapTrader1 *

CapTrader Depot für Firmen ► https://link.aktienmitkopf.de/CapTrader2 *

20 € in Bitcoin bei Bison-App ► https://link.aktienmitkopf.de/Bison *

MyDividends24 App Downloaden ►...

Read More »

Read More »