Tag Archive: newsletter

Über die Golden Twenties zum globalen Währungs-Reset

Der „Cocktail“ aus expansiver Fiskalpolitik, stark steigenden Energiepreisen, Rohstoffmangel und gestörten Lieferketten ist der Wirtschaft – wenig überraschend – nicht bekommen und äußert sich nun in einer aufziehenden Stagflation.

Read More »

Read More »

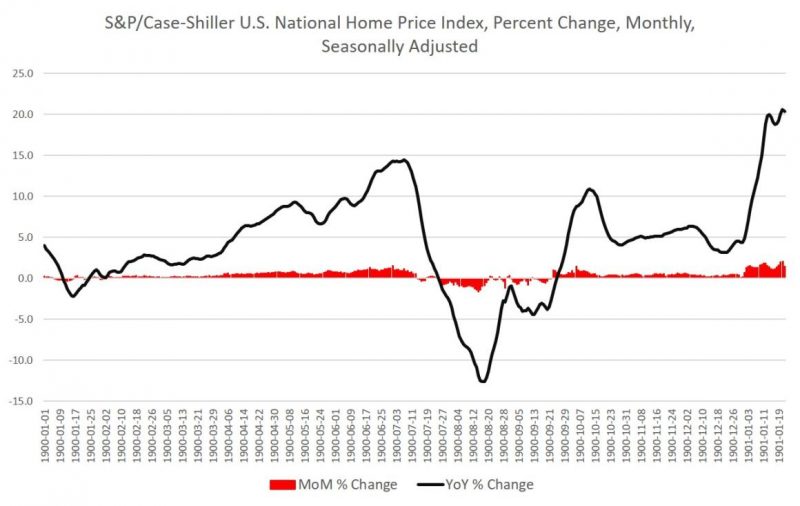

What Will It Take to End Rampant Home-Price Inflation?

Real wages are falling, inflation is at a 40-year high, and the Atlanta Fed predicts we'll find GDP growth at zero for the second quarter. Meanwhile, both the yield curve and money-supply growth point to recession. But when it comes to the latest data on home prices, there's still no sign of any deflation or even moderation.

Read More »

Read More »

‘Hidden’ costs of transport total CHF14 billion

Negative costs on third parties caused by transport in Switzerland amounted to CHF14 billion ($14.7 billion) in 2019. The damage mainly affects the environment and climate, but also health.

Read More »

Read More »

Charlie Munger: You Don’t Have to Have Perfect Wisdom to Get Rich. #Shorts

He was born Warren Edward Buffett on August 30,1930, in Omaha, Nebraska. Warren Buffett is an investor, American businessman and a Philanthropist. He is currently the chairman and CEO of Berkshire Hathaway.

Read More »

Read More »

Economic Winter Has Arrived

The average card-carrying Austrian would say that the Federal Reserve is creating money by the bale, with evidence being Consumer Price Index prints of 8.6 percent per the Bureau of Labor Statistics or over 15 percent per John Williams’s shadowstats.com computation based on the way the government calculated CPI back in 1980.

Read More »

Read More »

Sind die Notenbanken machtlos?

► Hier kannst Du Dich für das Webinar anmelden: https://onlineseminar.lars-erichsen.de/

Notenbanken stehen derzeit vor extremen Herausforderungen. So heißt es offiziell und tatsächlich sind es schier unlösbare Probleme, die FED und EZB, selbstverständlich auch die chinesische Notenbank und die Bank of Japan, beschäftigen. Meines Erachtens ist das aber etwas das uns nicht nur jetzt, sondern über Jahre hinaus als Anleger beschäftigen wird. Sprechen...

Read More »

Read More »

Alasdair Macleod speech about recession, bank credit and inflation

On Twitter Alasdair Macleod tells "When you read about recession, it's about contracting bank credit". In this interview Macleod explains inflation, rissing interest rates and stock market crash.

Alasdair Macleod started his career as a stockbroker in 1970 on the London Stock Exchange. He is an educator and advocates for sound money thru demystifying finance and economics. Regarded as one of the country's greatest short story writers....

Read More »

Read More »

Marc exklusiv live! „Wir erleben Historisches“ (Krise, Krieg, Inflation, Crash)

„Herr Friedrich, das war ihr wichtigster und bester Vortrag“ so ein Zuschauer.

Auf der Deutschen Rohstoffnacht 2022 geht es rund:

- Sind Rohstoffe in Zukunft King?

- Scheitert der Euro?

- Stehen wir vor einer Zeitenwende und erleben wahrhaftig Geschichte?

- Kommt ein Crash?

Warum Inflation erst der Anfang ist, die Politik aufzeigt, wo viele unserer Schwächen liegen und ob wir jemals wieder Zinsen sehen, erfahrt ihr in meinem Vortrag zum...

Read More »

Read More »

Faktor Zeit: wichtige Hilfe bei der Chartanalyse – BORN Akademie vom 29.06.2022

0:00 Intro

1:37 Rüdiger Born

4:20 DAX ?https://bnpp.lk/dax

6:25 Fibonacci auf Zeitachse

48:00 Dow Jones ?https://bnpp.lk/dowjones

59:15 Tesla ?https://bnpp.lk/tesla

1:02:00 K+S ?https://bnpp.lk/K+S

Das man auf Unterstützungen und Widerstände im Chart schauen kann, ist klar: die Preislevels sind für viele Marktteilnehmer eine wichtige Hilfe bei der Einschätzung der Situation. Aber wie sieht es mit der Zeit aus? Kann auch der Zeitablauf sinnvoll...

Read More »

Read More »

Can Recession Be Avoided?

(6/29/22) Does LeBron James' $170M salary make him inflation proof? Why the rich are weathering the weakening economy better than the rest of us; rising wages vs the rise of robots in the workplace. Inflation hits July 4th groceries; American side-hustles; can recession be avoided? Inflation & the savings gap: $6k/yr in debt to maintain standard of living.

[NOTE: Today's livestream was fraught with technical issues between Wirecast and...

Read More »

Read More »

1.000.000

1.000.000!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=504&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=504&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

• Unser Zweitkanal Überfluss:...

Read More »

Read More »

Ausmisten und verkaufen (Wie viel Geld habe ich damit verdient?)

Zur Monkee App: https://minimalfrugal.com/monkee

Zur Monkee Webseite: https://monkee.rocks/

0:00 Einleitung

2:00 Cashback für's Ausmisten (monkee)

Depot eröffnen & loslegen:

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

► Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

►...

Read More »

Read More »

Inflation, Geopolitik, Zinsanstieg – und die Börse? Kapitalmarktausblick von Dr. Jens Ehrhardt

Inflation, steigende Zinsen und Geopolitik als unberechenbarer Faktor: Es gab schon einfachere Zeiten für Investoren an der Börse. Welche Lehren gelten noch, was ist heute anders und was müssen Anleger jetzt wissen? Ein Kapitalmarktausblick von Dr. Jens Ehrhardt.

0:00 - Intro

1:25 - Börsenentwicklung 2022 - Historische Einordnung

6:05 - Aktuelle Gefahren für die Börse

11:08 - Barquoten - Historische Einordnung

12:21 - Gründe für die aktuell...

Read More »

Read More »

Alasdair MacLeod: Euro On Brink Of Collapse | Gold & Silver Market Close

▶︎1000x – Enter your Email ▶︎ https://bit.ly/3QALTQj

▶︎ Subscribe to this YouTube channel ▶︎ https://bit.ly/CompactSilverNews_subscribe

▶︎ Keep your financial education strong with our CompactClub ▶︎ http://bit.ly/CompactClub

Alasdair has been a celebrated stockbroker and Member of the London Stock Exchange for over four decades. His experience encompasses equity and bond markets, fund management, corporate finance and investment strategy. After...

Read More »

Read More »

Will June’s End Provide Lift to Markets? | 3:00 on Markets & Money

(6/29/22) Poorer than expected economic data triggered a market sell-off on Tuesday: The Richmond Fed Survey reported a big drop in all components, suggesting a recession is becoming a much higher probability. Similarly, the Philly Fed Manufacturing Index, the Dallas Fed indicators show pervasive economic slowing, thanks to tighter monetary policy, higher inflation, and higher interest rates. The Census Board's Consumer Confidence survey revealed...

Read More »

Read More »

Erster Lichtblick in Richtung besserer Inflationsdaten – US Opening Bell mit Marcus Klebe – 29.06.22

Erster Lichtblick in Richtung besserer Inflationsdaten - US Opening Bell mit Marcus Klebe - 29.06.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DowJones #Trading #MarcusKlebe

ÜBER JFD:...

Read More »

Read More »

Warum GELD spirituell ist

In diesem Video betrachten wir Geld mal aus einer etwas spirituelleren Sichtweise. Dazu empfehle ich euch auch ein Buch, das mich sehr fasziniert.

Read More »

Read More »

Wir trauern um Markus Gärtner Ein Nachruf von Prof. Max Otte

Völlig überraschend ist Markus Gärtner verstorben.

Es gab eine Zeit des Umbruchs, da haben Journalisten des "alten Schlages" unseren Weg begleitet... Jürgen Engert...Ruprecht Eser... Joachim Jauer... Klaus Bednarz.... Fritz Pleitgen... Dirk Sager...

Wir leben heute in der Zeit, da begleiten uns mutige Berichterstatter des "neuen Schlages"....Boris Reitschuster (reitschuster.de)... Roland Tichy (Tichys Einblick)... Michael Mross...

Read More »

Read More »