Tag Archive: newsletter

Alasdair Macleod – What Happens if Russia Wins the Financial War?

Alasdair Macleod, with a background as a stockbroker, banker and is a Senior Fellow at the GoldMoney Foundation shares his thoughts on a possible new world reserve currency.

Read More »

Read More »

Dirk Müller: Wir stürzen ab – gewollt und ungebremst

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Marktupdate220704

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 04.07.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

So baust DU dir EWIGES VERMÖGEN und EINKOMMEN auf

In diesem Video erkläre ich dir, wie du dir ewiges Vermögen und Einkommen aufbauen kannst und gebe dir wertvolle Tipps, was du dabei berücksichtigen solltest. Zusätzlich stelle ich dir einige Unternehmen vor, die teilweise schon Jahrhunderte Dividenden auszahlen.

Read More »

Read More »

The Dollar Remains Bid, while Sterling Shrugs Off Johnson’s Political Woes

Overview: The dollar jumped yesterday making new highs against most of the major currencies, including the euro, sterling, the dollar-bloc and the Scandis. The yen and Swiss franc held in better, but the greenback still closed firmly against the yen despite a six-basis point decline in the 10-year yield.

Read More »

Read More »

Bitcoin Technical Analysis, 6 July, BTCUSD at $20k. Bearish.

Volume of buyers is weak and Bitcoin is hovering around the $20k mark. Weakening momentum and lower price levels of the colume profile hint of a bearish tone, in our view. For those looking for further confirmations, to buy or sell, we offer price levels of doing that for the close of the 4 hour candles.

See the technical analysis here: https://www.forexlive.com/Cryptocurrency/bitcoin-technical-analysis-6-july-bearish-20220706/

See more...

Read More »

Read More »

PRIMA DE RIESGO SUBIENDO: ¿Qué es la ANTI FRAGMENTACIÓN?

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Marc Faber – More Gloom and Doom than Boom in the Current Economy

Prospector News Publisher, Michael Fox talks with The Editor and Publisher of The Gloom Boom and Doom Report, Dr Marc Faber about the Fed, Inflation, Governments and the current outlook for the markets. Spoiler Alert … Not Good

Read More »

Read More »

Norwegian oil and gas workers start strike, cutting output | World Business Watch

Norwegian offshore workers began a strike on Tuesday that will reduce oil and gas output. Workers are demanding wage hikes to compensate for rising inflation.

Read More »

Read More »

Hans-Werner Sinn SEHR BESORGT

#HansWernerSinn #klimaschutz #FinanzTendenz

Was sich wirklich hinter dem Klimawandel verbirgt, verrät uns Hans Werner Sinn! Was erwartet uns in naher Zukunft? Können wir die Erde vor dem Klimawandel retten? Finde es in diesem Video heraus!

Read More »

Read More »

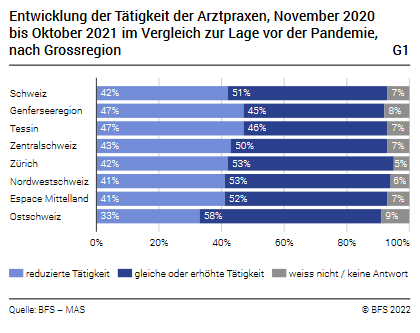

Medical practices played an active part in the vaccination campaign in 2021

In 2021, for the second consecutive year, the activity of medical practices was affected by the COVID-19 pandemic. Despite an improved situation compared with 2020, two out of five medical practices experienced reduced activity and one in five had to resort to short-time work. Three out of five primary care practices participated in the vaccination campaign that began at the end of 2020.

Read More »

Read More »

Die Sache mit der Inflationsbekämpfung

Wie Schulkinder auf die Ferien warten alle gespannt auf den Rückgang der Inflation. Zwar gibt es gute Gründe, dass sie zukünftig etwas nachgibt. Aber um sie auf das Niveau vor Corona und Ukraine-Krieg zu drücken, müsste vor allem die EZB gewaltig über ihren Schatten springen und wieder an die klassische geldpolitische Heilslehre anknüpfen. Aber inwieweit wird sie wirklich ernsthafte Restriktionen durchführen, die mit (finanz-)wirtschaftlichen...

Read More »

Read More »

S&P Futures Analysis, 6th July

Following our tecnical analysis yesterday, ES, despite selling hard on the first half of yesterday, is continuing to show reslience and we maintain our bullish bias. Today's analysis of the S&P Futures shows that it is still creating higher lows and reclaiming higher price levels on the volume profile of the range. We offer some trade ideas for those who want to get a convenient entry and get into the action as a bull that aims to participate...

Read More »

Read More »

Zoo Zürich Aktie 14% Dividendenrendite (Aktie gekauft!)

Zoo Zürich Aktie 14% Dividendenrendite.

Wie du Aktionär werden kannst und so jedes Jahr ein gratis Ticket für den Zoo Zürich bekommst, dazu heute mehr. Habt ihr das gewusst und wie attraktiv findet ihr das? Schreibt es mir gerne in die Kommentare.

Read More »

Read More »

Private property rights under siege – Part II

An astonishing acceleration Even though the downhill trajectory we saw over the last decades in terms of property rights was bad enough, nothing could have ever prepared us for what the covid crisis would bring.

Read More »

Read More »

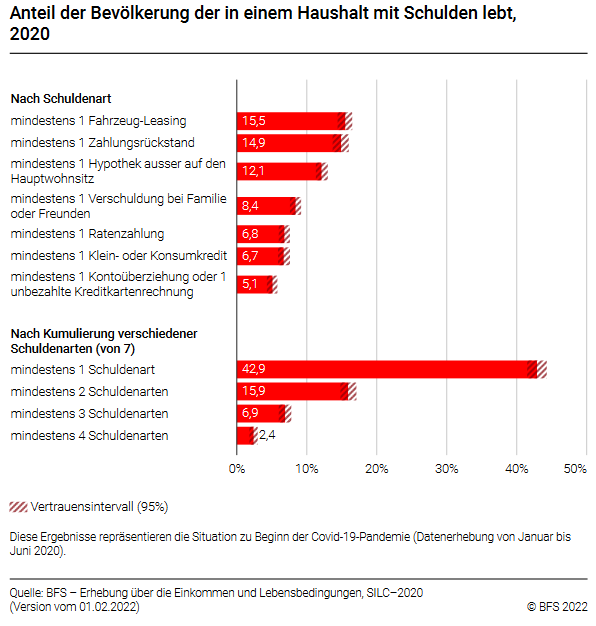

Almost every sixth person lived in a household with arrears in 2020

Vehicle leases and arrears are the most common types of debt in Switzerland. In 2020, 15.5% of the population lived in a household with at least one vehicle lease and 14.9% in a household with at least one arrear in the past 12 months. 6.9% lived in a household with at least three different types of debt.

Read More »

Read More »

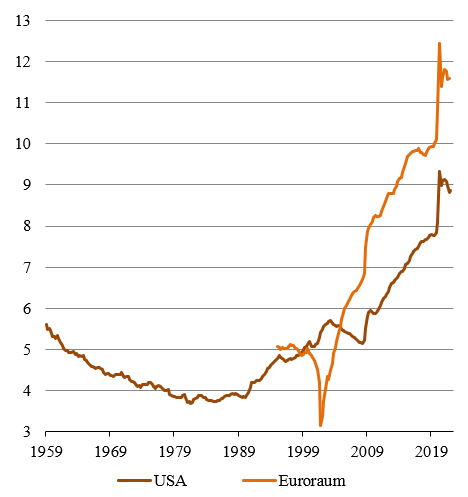

Krugman Is Wrong (Again): Artificially Low Interest Rates Created Bubbles

In his June 21 New York Times article “Is the Era of Cheap Money Over?,” Paul Krugman argues against the view that the Fed has kept interest rates artificially low for the past ten to twenty years.

Read More »

Read More »

Über das Bestreben, Bargeld abzuschaffen und digitales Zentralbankgeld einzuführen

Gleich zu Beginn möchte ich Ihnen die Schlussfolgerungen meiner Überlegungen mitteilen: Das Bargeld zurückzudrängen oder aus dem Verkehr zu ziehen und digitales Zentralbankgeld auszugeben, sind äußerst problematisch, weil.

Read More »

Read More »

The One Solution to All Our Problems

Pick one, America: national security of the essential material foundation of everything, the industrial base, or "global markets," maximizing greed / corporate profits.Sorry about the clickbait title.

Read More »

Read More »