Tag Archive: newsletter

Charlie Munger: This is how you make your first Million dollars (As soon as Possible)

In this video, Charlie Munger explains how you can make your first Million dollar. Watch the video till the end to understand the whole process!

Read More »

Read More »

Quartalsende & Inflation im Fokus – US Opening Bell mit Marcus Klebe – 30.09.22

Quartalsende & Inflation im Fokus - US Opening Bell mit Marcus Klebe - 30.09.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DowJones #Trading #MarcusKlebe

ÜBER JFD:

WER WIR SIND:...

Read More »

Read More »

It is Friday, month end and quarter end. Flow of funds may dominate trading today

It is Friday, month end, quarter end which could cause the flow of funds to dominate trading. That may lead to volatile price action. Technicals may not be the major focus as the needs dominate vs the trader focused risk defining levels. Nevertheless, the technicals tell a story and the video tells the story for the EURUSD, USDJPY, GBPUSD and AUDUSD. Good fortune with your trading.

1:00 EURUSD

4:15 USDJPY

5:42 GBPUSD

7:10 AUDUSD

Read More »

Read More »

Inflation & Energiekrise: Ist jetzt Schluss mit dem Investieren?

Saidi erklärt Dir in diesem Video, ob es sich zu diesen Zeiten von Inflation und Energiekrise noch lohnt zu investieren.

Finanztip Basics ► https://www.finanztip.de/youtube/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=4qaF-j6Y6Xc

Hier geht's zu den Videos:

Gas-Krise: Wie teuer wird es? Was Du jetzt tun kannst ►

So bekommst Du mehr Geld im Monat ►

700% Preiserhöhung: Was tun? | Kein Geld mehr zum Investieren? |...

Read More »

Read More »

Publication on the centenary of the Swiss National Bank’s main building in Zurich: The Pfister Building 1922-2022

To mark the centenary of the Swiss National Bank’s main building at Börsenstrasse 15, the SNB is publishing ‘The Swiss National Bank in Zurich: The Pfister Building 1922-2022’ (Verlag Scheidegger & Spiess).

Read More »

Read More »

Stimmung in den Chefetagen verschlechtert sich – Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Rampant Market Mispricing Exposed. Feat. Alasdair Macleod – Live From The Vault 93

In this week’s Live from the Vault, Andrew Maguire sits down with renowned financial expert, Alasdair Macleod, to demystify the major mispricing in the global markets.

The two old friends speak out on the US fighting tooth and nail to retain their world reserve currency status, with the threat of Russia’s gold-based trade currency closing in.

00:00 Start

04:20 Is Russia spurring ‘escalation’ or securing their position?

14:13 A new global payment...

Read More »

Read More »

TESLA NUR PLASTIKSCHROTT? 534 PS Model Y Performance REVIEW!

Seit einem Monat fahre ich ein brandneues Model Y Performance, welches in Grünheide produziert wurde. Heute gibt es für euch ein erstes Fazit-Video und ein Ausblick zur Tesla Aktie im Kontext von Big-Tech Zum Tesla Angebot: https://amk.electric-runner.de

? bis zu 2 Gratisaktien bei Depotempfehlung für ETFs & Aktien ► http://link.aktienmitkopf.de/Depot *

20 € in Bitcoin bei Bison-App ► https://link.aktienmitkopf.de/Bison *

??5 Euro Startbonus...

Read More »

Read More »

Wake Me Up When September Ends

Benchmark 10-year yields are off 6-8 basis points in Europe and the United States. The panic seen at the start of the week in the UK has subsided considerably, as sterling recovered to almost where it was a week ago, while BOE’s hand has help steady the Gilt market. Equities in Asia Pacific suffered after the losses in the US yesterday. Hong Kong and India were notable exceptions.

Read More »

Read More »

$200 million fine for UBS and Credit Suisse

The biggest two Swiss Banks have each been fined $200 million (CHF199 million) as part of a large-scale US investigation into the failure to preserve electronic communications.

Read More »

Read More »

Endet der DAX exakt auf dem Jahrestief? – “DAX Long oder Short?” mit Marcus Klebe – 30.09.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de...

Read More »

Read More »

Marc Faber: Asien gehört die Zukunft

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: https://bit.ly/3N43HQD

MARC FABER ONLINE

▶︎ Marc Fabers Gloom Boom Doom Webseite: https://www.gloomboomdoom.com/

▶︎ Marc Faber auf Twitter: twitter.com/gloomboomdoom

▶︎ Marc Faber auf Facebook: www.facebook.com/gloomboomdoom

#marcfaber #aktien #sachwertfonds

Marc Faber - Jahrgang 1946 - ist ein renommierter Schweizer Börsenexperte,...

Read More »

Read More »

Jetzt CASH halten. Die Zinswende löst den Aktien Crash aus @Erichsen

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Anleger halten große Cash Positionen! Tradermacher Lars Erichsen

Lars Erichsen ist einer der erfolgreichsten Trader Deutschlands und verfügt über eine 25-jährige Börsenerfahrung, und führt den Kanal Tradermacher. In diesem Video diskutieren wir über globale Finanzlage und warum Cash zeitweise evtl. kein Trash ist....

Read More »

Read More »

Flucht aus Kiew “Ich muss sofort hier raus!” (wahre Begebenheit)

„Flucht aus Kiew“ - Florian war in der Ukraine als der Krieg losging

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Thorsten Homepage: https://thorstenwittmann.com/

Florian Homepage: https://www.florianwawrosch.com/

Panzer, Kampfjets und die Flucht aus Kiew - Florian passierte das, wovor sich jeder fürchtet!

Als ich in Estland ankam, holte mich mein guter Freund Florian vom Flughafen ab.Beim Abendessen erzählte er mir von...

Read More »

Read More »

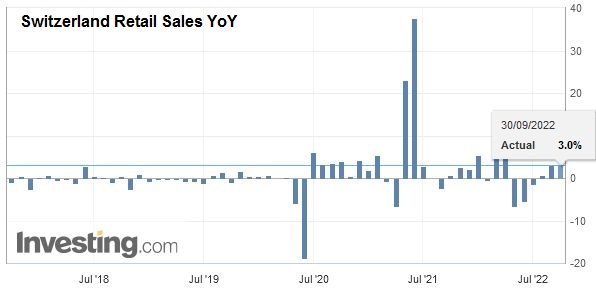

Swiss Retail Sales, August 2022: 5.4 percent Nominal and 3.0 percent Real

Retail trade turnover adjusted for sales days and holidays grew by 5.4% in nominal terms in August 2022 compared with the same month of the previous year, with price increases driving this growth. Seasonally adjusted, nominal turnover rose by 1.5% compared with the previous month.

Read More »

Read More »

Medicare Part B Premiums Will Go Down in 2023

In a world where the price of everything is going up, Medicare recipients get a price cut beginning January 1, 2023. The Centers for Medicare and Medicaid Services (CMS) just announced that the monthly premium for Medicare Part B, which covers doctor visits, diagnostic tests, and other outpatient services, is decreasing $5.20 per month to $164.90.

Read More »

Read More »

Cryptocurrency as Money—Store of Value or Medium of Exchange?

Cryptocurrency enthusiasts generally have a great appreciation for the Austrian school of economics. This is understandable since Austrian economists have always argued for the merit of privately produced money outside government control.

Read More »

Read More »

Das MINDSET und beste UMFELD für ein positives Leben

Einordnung der jetzigen Situation. Mit welcher Einstellung sollte man sein Leben bestreiten. Mindset, Verantwortung, Optimismus und Handeln

Stempel - https://amzn.to/3LHkw4V | https://amzn.to/3rmZu2p

_

https://www.elsaessermarkus.de/

Dr. Markus Elsässer, Investor und Gründer der Value Fonds

„ME Fonds - Special Values“ WKN: 663307

„ME Fonds - PERGAMON“ WKN: 593117

_

1.? "Dieses Buch ist bares Geld wert" *https://amzn.to/3wr2Vq5

Als...

Read More »

Read More »

History Repeats Itself: Abandoning Sound Money Leads to Tyranny and Ruin

Money is one of the most misunderstood topics of our time, and we’re seeing the implications of this play out every day. To understand money, one first must first understand that human beings have always been incentivized to participate in exchange. If humans could not, or did not, trade, most people would die young from starvation, disease, or exposure to the elements.

Read More »

Read More »