Tag Archive: newsletter

The morning forex technical report for October 24, 2022

A quick look at the EURUSD, USDJPY, GBPUSD and USDCAD to start the trading week.

The EURUSD is finding support near the 100 hour MA keeping the bias in the favor of the buyers despite the declines from Friday's trade and the early Asian session run to the upside.

The USDJPY moved sharply lower on BOJ intervention. The price moved down to a low of 145.45 before snapping back higher toward the 200 and 100 hour MA. The pair trades between those MAs...

Read More »

Read More »

Can Markets Muster Continuation of the Rally? | 3:00 on Markets & Money

(10/24/22) Markets rallied sharply off the 20-DMA on Friday to deliver a 90% upside day for stocks. Futures are pointing higher this morning, begging the question, can markets muster a continuation of the rally over the next few days as we put the wraps on October? 45% of the S&P companies will report earnings this week; the buyback blackout window ends on Friday, and the Fed is set to meet next week, with hopes that talk of ending rate hikes...

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 24 octobre 2022, SMART BOURSE reçoit Thomas Costerg (Économiste senior US, Pictet WM)

Read More »

Read More »

The Difference Between Inflation and the Cost of Living

(10/24/22) Comcast Cable outage coincides with Astro's weekend watch parties as the home team advances to the World Series. Again. Market Commentary: Setting up for some nice action to end the month, with a possible change in Fed stance on interest rates. The top concerns this election season: Inflation and the economy. The problems from un-educated voters; Nancy-nomics, Inflation, and the cost of living. Is the Fed thinking about talking about a...

Read More »

Read More »

Info not fearmongering. Swaps not Swiss. Dealers not Fed. The data and evidence are conclusive.

A negative swap spread sounds like total nonsense - at first. But in a ledger money, fictive currency system what matters is the capacities of those who collectively keep track of the distributed ledger. This is where that nonsense isn't just useful, it is extremely valuable. Swaps are the ledger and they are saying there is a very real and worsening problem on it. Global (euro)Dollar Shortage.

Read More »

Read More »

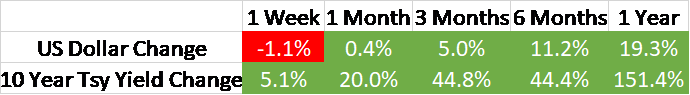

Weekly Market Pulse: Did Powell Just Blink?

Did Jerome Powell blink last Friday? It was just before the market open Friday and interest rates were jumping higher, as they had all week. The 10-year Treasury yield was up to 4.33%, another 11 basis points higher than the previous close and 32 basis points higher than the previous week’s close.

Read More »

Read More »

Aktienmärkte setzten die Rallye fort | Blick auf die Woche | KW 43

In den vergangenen Handelswochen lagen wir mit unserer Short-Ausrichtung im Trading goldrichtig und selbst jetzt, wo die Indizes ein wenig an Boden gutmachen konnten, stehen die meisten Short-Aktien aus dem Screeningdienst weiterhin gut da. Und dennoch:

Ein großer Vorteil als Trader ist es, wesentlich flexibler und schneller reagieren zu können. Herausragend stark sind die US-Indizes und unser DAX zwar noch nicht und dennoch agiere ich als Trader...

Read More »

Read More »

Dr. Andreas Beck: “Bitcoin ist noch viel schlimmer als Gold”

Warum Dr. Andreas Beck einen Bitcoin besitzt, aber dennoch von Bitcoin nicht überzeugt ist, verrät er in diesem kurzen Clip.

Der Clip ist aus dem folgenden Interview mit Andreas Beck entnommen:

? PODCAST:

➤ Spotify: https://open.spotify.com/show/5JLxnfT5AGUfXexXDPbldo?si=IrOTqIWbR22VUf3DOtz4qA

➤ Amazon: https://amzn.eu/d/3VEEaOA

➤ Deezer: https://deezer.page.link/i5ys5tyYrDXnrMhBA

➤ Google Podcast:...

Read More »

Read More »

BOJ Injects More Volatility, while UK’s Tory Party Leadership Contest may be Over Today

Overview: Japanese efforts to curb the weakness of the yen provided drama today. What many suspect was intervention before the weekend was wearing off and officials may have sold dollars again today in front of JPY150.

Read More »

Read More »

Energy crisis ‘will last many years’, says economics minister

Swiss Economics Minister Guy Parmelin assumes the energy crisis will last several years. It is important, he says, not only to think about the winter, but to do everything to ensure that Switzerland produces more energy – that means more renewable energies and greater efficiency.

Read More »

Read More »

SPIEGEL-Abonnenten fragen Ökonom Marcel Fratzscher: »Wir werden einen Verlust von Wohlstand haben«

Deutschland muss in den nächsten Jahren riesige Herausforderungen bewältigen, sagt Ökonom Marcel Fratzscher in einer digitalen Veranstaltung für SPIEGEL-Abonnenten. Doch er macht auch Hoffnung.

Read More »

Read More »

So findest du heraus, ob eine Aktie kaufenswert ist

? bis zu 2 Gratisaktien bei Depotempfehlung für ETFs & Aktien ► http://link.aktienmitkopf.de/Depot *

20 € in Bitcoin bei Bison-App ► https://link.aktienmitkopf.de/Bison *

*Affiliate Link

Read More »

Read More »

Endlich meine eigene Chefin

Was muss man vorkehren, was beachten?

Mehr zum Thema erfahren? Besuchen Sie uns auf https://www.fintool.ch

?? Auf diesen Kanälen könnt ihr uns erreichen:

–––––––––––––––––––––––––––––––––––––––––––––

►Unsere Website: https://www.fintool.ch

►Unser FACEBOOK: https://www.facebook.com/fintool

►Unser LinkedIn: https://www.linkedin.com/company/fint...

►Unser INSTAGRAM: https://www.instagram.com/fintool.ch/...

Read More »

Read More »

Keine Zeit für den Bärenmarkt!

? bis zu 2 Gratisaktien bei Depotempfehlung für ETFs & Aktien ► http://link.aktienmitkopf.de/Depot *

20 € in Bitcoin bei Bison-App ► https://link.aktienmitkopf.de/Bison *

*Affiliate Link

Read More »

Read More »

Wealth Managers Reluctant to Invest in Crypto

Wealth managers around the world are still reluctant to invest in cryptocurrency on behalf of their clients amid concerns over the lack of regulation, the lack of education as well as high volatility, a new study by American asset management company Mercer found.

Read More »

Read More »

Man convicted for fraudulently claiming massive Covid loan

A 48-year-old businessman in Geneva has been given a two-year suspended prison sentence for making a fraudulent claim for a Covid loan that was 100 times the correct amount. He was found guilty of fraud and forgery of documents.

Read More »

Read More »

The Recession in the Productive Sector Is Here

Governments and central banks have become the lender of first resort instead of the last resort, and this is immensely dangerous. Global debt soars, inflation creeps in, and many of the so-called supply chain disruptions are the result of zombification after years of subsidizing low productivity and penalizing high productivity with increased taxes.

Read More »

Read More »

Swiss companies ‘trapped’ in Russia

Leading Swiss brands have withdrawn from Russia because of the war in Ukraine. However, research by a Swiss newspaper shows that while a company can leave a country, its products often remain on shelves.

Read More »

Read More »

Ernst – Thomas Andreas Beck (Originalvideo Konzert TAG Wien 22.10.2022)

Album »Ernst« Präsentation im wiener TAG - Theater an der Gumpendorfer Straße

Das 6. Album „Ernst“ von Thomas Andreas Beck ist textlich wieder eine Mischung aus brandaktuellen politischen Ereignissen, verdrängter Geschichte und starken Emotionen, die dem/r Hörer/in direkt ins Nervengeflecht fahren. Gewidmet ist es Beck´s langjährigem und kürzlich verstorbenen Mentor, dem Sozialforscher Prof. Ernst Gehmacher.

Musikalisch fühlt man sich in den...

Read More »

Read More »