Tag Archive: newsletter

Das System bricht zusammen | Im Gespräch mit Dimitri Speck

Der Edelmetallexperte und Marktanalyst Dimitri Speck spricht in diesem Interview mit Helmut Reinhardt über das Platzen der größten Finanzblase aller Zeiten. In seinem gerade erschienenen neuen Buch vergleicht er den heutigen jetzt stattfindenden Crash mit früheren Zusammenbrüchen in der Geschichte.

Read More »

Read More »

Why Americans’ Savings Rates Have Fallen Off a Cliff

(10/26/22) October historically marks the markets' low point for the year; we're looking to hold on at 3,800, and "softer" language from the Fed next will help. Microsoft's guidance is a disappointment, and Amazon's AWS will, too.

Read More »

Read More »

KOMMT DER VOLATILSTE NOVEMBER ÜBERHAUPT?

Im heutigen Live gehen wir durch, warum Bitcoin gepumpt hat, sowie was der November bringt. Pump? Dump? Volatilität? Das alles erfährst du in diesem Video.

Read More »

Read More »

Dein Trading-TURBO, wenn …

Hebelprodukte – Dein Trading-Turbo? Du möchtest auf die schnellste Art Dein Vermögen aufbauen, hast aber kein hohes Startkapital? Jetzt denkst Du vielleicht, dass ein Hebelprodukt für Dich die perfekte Methode ist, um Dein Kapital schnell und effektiv zu erhöhen.

Read More »

Read More »

DIE GRÜNDE FÜR DAS SCHEITERN DES FINANZSYSTEMS! MARKUS KRALL KLÄRT AUF!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren? Wie funktioniert die Wirtschaft?

Read More »

Read More »

Dollar Slumps, Yuan Rallies by Most this Year amid Intervention Talk

Overview: The US dollar is having one of toughest days of the year. It has been sold across the board and taken out key levels like parity in the euro, $1.15 in sterling, and CAD1.36. The Chinese yuan surged over 1%. Chinese officials promised healthy bond and stock markets.

Read More »

Read More »

Credit Suisse to settle tax probe in France

Credit Suisse Group and the French financial prosecution office have agreed to settle a tax fraud and money laundering case in France with a €238 million (CH234 million) payment to the state, a French court heard on Monday.

Read More »

Read More »

neon’s Crowdfunding Campaign Reaches CHF 5 Million on Its First Day

Swiss neobank neon’s crowdfunding campaign reached CHF 5 million of its CHF 10 million target with more than 2,000 investors participating on the first day of the campaign.

The campaign, which runs from October 25 to 31, is offering two to 250 non-voting shares priced at CHF 200.00 per share. The company aims to sell a total of 50,000 shares.

According to the campaign page, neon’s recent milestones include hitting 130,000 users, generating CHF 3.5...

Read More »

Read More »

N26 Launches New Cryptocurrency Trading Feature With Bitpanda

German neobank N26 has launched its cryptocurrency product in Austria to enable customers to buy and sell 194 cryptocurrencies in their app.

The N26 Crypto feature will be made available progressively to eligible customers in Austria over the coming weeks, as well as in other key markets over the next six months.

The launch addresses strong local demand, where internal research showed that 40% of N26 users are either actively trading, or have...

Read More »

Read More »

Neues Buch von Jens Rabe. Kostenloses Exemplar für Dich!

Es ist endlich so weit: Mein neues Buch "Börse ist ein Business" wurde veröffentlicht.

Was euch im Buch erwartet und warum es gerade jetzt riesige Relevanz für alle hat, die an der Börse aktiv sind, erfährst du hier in diesem Video.

Read More »

Read More »

Deutschland muss seine Arglosigkeit gegenüber China ablegen

Ein Bild sagt mehr als tausend Worte: Chinas Staatspräsident Xi Jinping ließ den früheren Staatschef und innerparteilichen Gegner Hu Jintao vom 20. Parteitag der KP buchstäblich abführen.

Read More »

Read More »

Der Schmerz ist Proportional zur Rendite (Dran Bleiben!)

Der Schmerz ist Proportional zur Rendite (Dran Bleiben!) ?

Bei den derzeitigen Turbulenzen auf dem Aktienmarkt trifft man öfters voreilig Entschlüsse auszusteigen. In Krisenzeiten, auch wenn es schmerzt, sollte man langfristig dranbleiben und dies

#rendite #geduld #Finanzrudel

Read More »

Read More »

Myth versus Ideology: Why Free Market Thinking Is Nonideological

I’ll begin with a provocative thesis: socialism is ideological and free market thinking, while involving myth, is nonideological. I will show why socialism is ideological and why free market thinking involves myth but is nonideological by defining the terms myth and ideology and distinguishing them from each other.

Read More »

Read More »

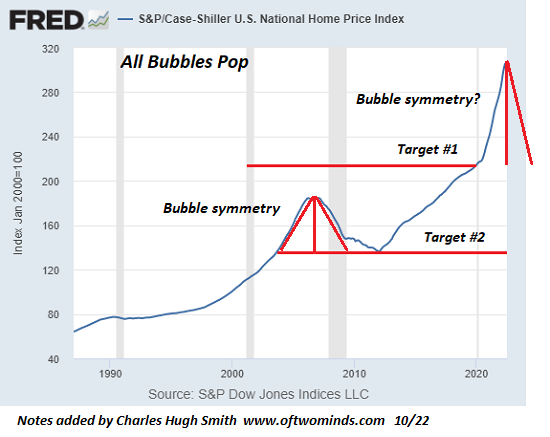

Now That Housing Is Rolling Over, Is That Fixer-Upper a Deal?

So-called "cosmetic work" can cost tens of thousands of dollars.Now that housing is finally rolling over due to rising mortgage rates and bubble valuations, many of those who have been priced out of the market are hoping to take advantage of lower prices.

Read More »

Read More »

Russia pushes dirty bomb claims, submits formal letter to UN | Latest World News | WION

After a series of accusations, Russia has submitted a formal letter to the United Nations, the latter discussed the claims in a closed-door meeting. The start of this week saw a blame game that roped the United Nations and the West, Moscow has accused Kyiv of planning to deploy a dirty bomb on its own land in return Ukraine has counter accused the Kremlin of planning a false flag operation.

Read More »

Read More »